Key Highlights

- You can transfer money from the U.S. to India tax-free if it’s a personal gift or self-remittance.

- The annual US gift-tax exclusion for 2025 is $19,000 per recipient.

- The lifetime gift and estate tax exemption stands at $13.99 million per individual.

- Starting January 1, 2026, a 1% remittance tax will apply only to cash-funded transfers.

- Electronic transfers through bank accounts, debit cards, credit cards or via apps like Frex remain tax-free.

- In India, gifts from relatives are fully exempt, while non-relative gifts above INR 50,000 are taxable.

- Always maintain records showing the transfer’s purpose, source of funds, and recipient details.

- Using regulated money transfer providers helps avoid hidden charges and ensures compliance.

Sending money home should not feel cumbersome or confusing. Many people still struggle to understand how much actually reaches their family after accounting for transfer fees and potential taxes when sending money from the US to India. It’s frustrating to send a generous amount, only to see it shrink by the time it lands in India.

Between US gift tax limits and India’s income tax rules, things can get complicated fast. Many people aren’t sure if money sent to relatives counts as income or how the IRS views such transfers. With both countries having their own reporting requirements, it’s easy to feel unsure about what’s really tax-free.

The truth is, most personal transfers can be completely tax-free when you know the right steps. This guide explains how to transfer money from the USA to India without tax with clear limits, simple methods, and practical tips that help you send funds confidently and legally.

What Are The Tax Implications Of International Money Transfers?

Whenever you move money across borders, it’s natural to wonder if taxes apply. A common question that comes up is, “Is money transferred from the US to India taxable?” In most cases, it’s not.

What you usually pay are transfer fees: the small charges that financial institutions or money transfer service providers collect for processing the transaction. These fees can vary depending on exchange rates, payment methods, and the amount of money sent. Understanding transfer money from the USA to India tax implications can help you plan better and avoid mistakes.

Taxes usually apply only when the transfer is considered:

- Income

- A business payment

- A gift

In such cases, the Internal Revenue Service in the United States checks whether you’ve exceeded the annual exclusion limit of $19,000, while Indian authorities assess how the inward remittance is classified. The tax outcome depends on whether it’s a foreign inward remittance, personal transfer, or business payment.

What Should US Senders Know About Taxes When Transferring Money To India?

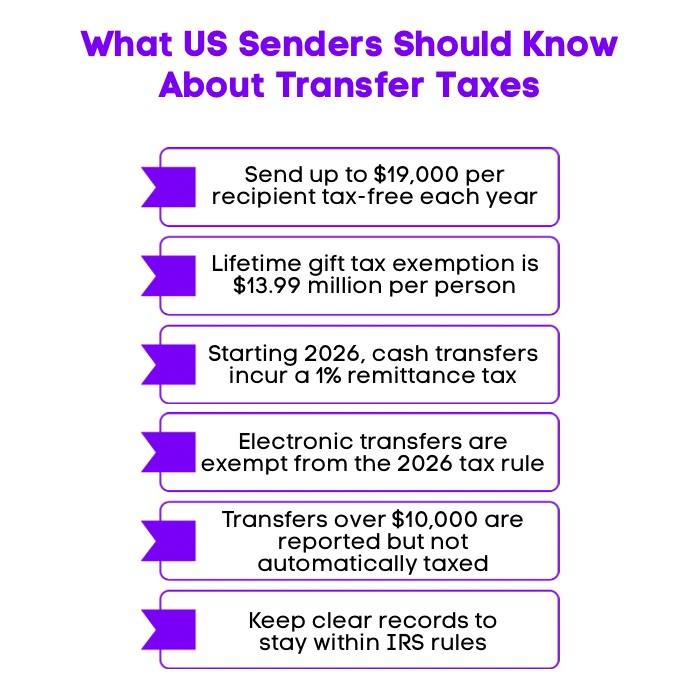

If you’re transferring money from the United States to India, understanding how the IRS treats these transactions can help you avoid unnecessary stress. Here’s a quick breakdown of the main rules for 2025–2026.

1. Annual Gift-Tax Exclusion

For 2025, you can send up to $19,000 per recipient without filing Form 709. This limit resets each calendar year and applies mainly to personal gifts such as family support or medical expenses.

2. Lifetime Gift And Estate Tax Exemption

The lifetime limit for 2025 is $13.99 million per individual. Most people never reach this lifetime gift tax exemption, so large family transfers typically remain tax-free. Keeping proper documentation helps ensure your transfers stay within federal gift tax compliance.

3. Electronic Transfers vs. Cash Transfers (2026 Rule)

Starting January 1, 2026, a new 1 percent remittance tax will apply only to cash-funded transfers. The rule targets transactions funded by cash payment, money order, or similar instruments. Electronic transfers through a bank account, debit card, or credit card are exempt from this new tax.

4. Reporting Requirements

Any transfer of more than $10,000 is reported by financial institutions under the Bank Secrecy Act. This reporting is routine and does not mean you owe tax. The Internal Revenue Service uses this data to monitor large transfers, but it is separate from the gift tax system and income tax filings.

In short, staying under the annual limits, choosing electronic transfers, and keeping clear records are the simplest ways to transfer money from the U.S. to India without running into tax trouble.

What Should Indian Recipients Know About Taxes On Money Received From The US?

When money arrives in India, the tax treatment depends on who sends it and why it’s sent. Understanding these rules helps ensure that your inward remittance stays compliant and free of unnecessary taxes.

1. Gifts From Relatives

Gifts from close family members are completely tax-free under the Income Tax Act. This includes money received from parents, siblings, children, or a spouse. Whether you receive a small sum or large amounts of money, there’s no tax liability if it comes from a specified relative.

2. Gifts From Non-Relatives

If you receive money from someone who isn’t a relative and it’s given purely as a gift without any exchange of goods or services, the total received from all such people in a financial year is tax-free up to INR 50,000 (or about $560). Once this limit is crossed, the entire amount becomes taxable in India as income from other sources.

3. Transfers To Your Own NRE or NRO Account

When you transfer funds to your own NRI account, such as an NRE or NRO account, the money isn’t taxable in India because it represents your foreign post-tax income. Interest earned on an NRE account is also exempt while you maintain a non-resident status.

However, interest on an NRO account is taxable, and you can claim a foreign tax credit if applicable.

4. Purpose Of Transfer Matters

The reason for the transfer determines how it’s treated under Indian tax law. Money sent for family support, household needs, or medical expenses is usually treated as personal remittance, not taxable income. However, payments for services or business purposes are considered income and taxed accordingly.

Tip: Always keep a clear trail of your transfers by noting the source of funds and maintaining receipts or bank statements. Proper documentation makes it easy to prove that the money is a gift or personal transfer, not taxable income.

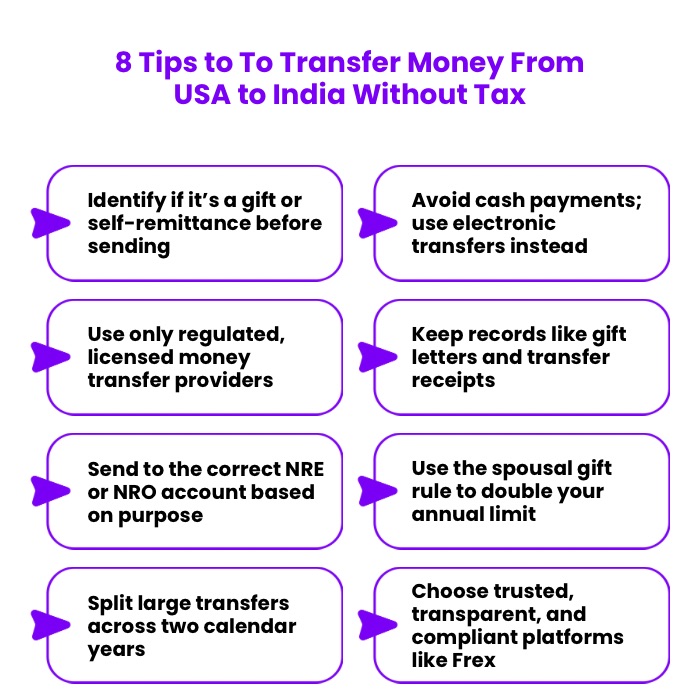

How Can You Transfer Money From the USA To India Without Tax? 8 Expert Tips

Transferring money from the U.S. to India can be simple and tax-free when you follow the right approach. Here are 8 expert tips to help you stay compliant while keeping more of your money where it belongs.

1. Confirm The Purpose Of Your Transfer

Decide if the transfer is a gift or self-remittance. For gifts, stay within the $19,000 annual exclusion limit per recipient for 2025 to avoid filing a gift tax return. If it’s a self-remittance, you’re just moving your own post-tax funds, which are not taxable in India.

2. Choose Electronic Transfers Over Cash

Starting January 1, 2026, cash-funded transfers will attract a 1% U.S. remittance tax. Avoid cash payment or money order, and use electronic options like a bank account, debit card, or credit card instead. These methods are faster, safer, and exempt from the new tax.

3. Use A Regulated Money Transfer Provider

Select a licensed money transfer provider that offers transparent transfer fees and competitive exchange rates. Compare online money transfer services, banks, and fintech platforms to find one that best suits your needs.

4. Keep Documentation Ready

Maintain records such as a simple gift letter for family transfers, proof of relationship, bank receipts, and wire confirmations. Documenting the source of funds ensures you can justify the transfer if questioned by tax authorities in either country.

5. Verify The Recipient’s Account Type

If you’re sending funds to yourself, use an NRE account to keep the transfer tax-free. If the money goes to a relative, confirm their NRO account or bank account number is correct to avoid delays. Interest earned on an NRE account is tax-exempt, while NRO interest is taxable under the Income Tax Act.

6. Leverage The Spousal Gift Rule

Married couples can combine their exclusions to double the gift limit for the same recipient in a single year. This allows you to send a larger tax-free amount while remaining within IRS guidelines.

7. Split Transfers Across Calendar Years

If you want to send a larger amount without crossing the annual limit, divide the transfer across two tax years (for example, December and January). This helps maximize your tax-free allowance legally and efficiently.

8. Use Reputable Transfer Services

Choose trusted platforms that offer transparency, better rates, no hidden fees, and regulatory compliance. Frex is licensed and compliant with FinCEN (USA), FEMA (India), and FIU India, making it a secure choice for NRIs who want hassle-free, tax-efficient transfers.

Clarify your purpose, go digital, choose a trusted provider, keep your paperwork organized, verify account details, and that’s how to transfer money from the USA to India without tax safely and efficiently.

What Happens If You Exceed the Thresholds?

Exceeding the U.S. gift-tax annual limit simply means you must file Form 709, but you typically won’t owe any tax unless your total lifetime gifts surpass the $13.99 million exemption. On the Indian side, receiving more than $563 from non-relatives in a financial year makes the entire amount taxable as income, while gifts from relatives remain fully exempt regardless of size.

Issues arise mainly when transfers are misclassified, documentation is missing, or cash transfers trigger extra charges starting in 2026. Staying organized, keeping proof of the transfer’s purpose, and using regulated electronic channels ensure your transfers remain compliant even when thresholds are crossed.

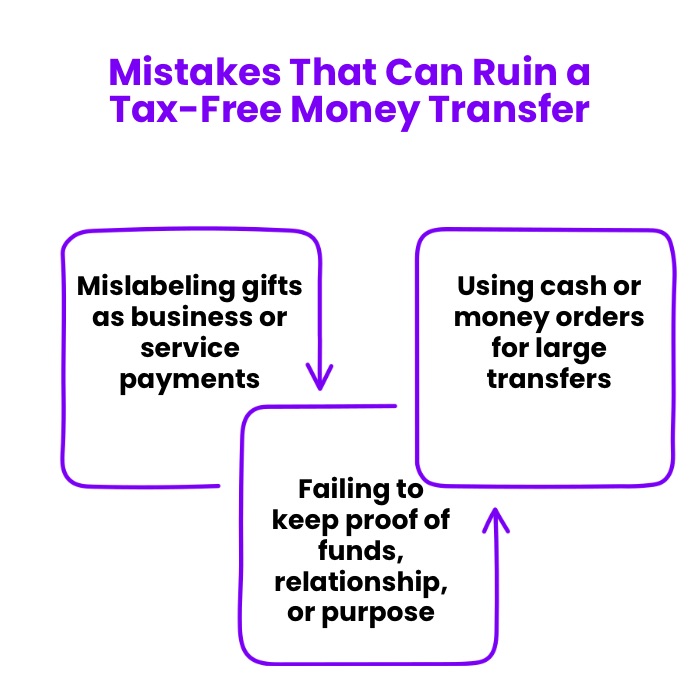

What Mistakes Can Ruin A Tax-Free Money Transfer From The US To India?

Even small errors can turn a simple, tax-free transfer into a taxable one. Here are the most common mistakes people make, and how to avoid them.

1. Mislabeling Transfers

Avoid calling a business payment or service fee a “gift.” The IRS and Indian tax authorities treat such payments as taxable income, not personal remittance. Always use the correct reason for the transfer and keep your paperwork consistent.

2. Using Cash For Large Transfers

Since cash and money-order transfers will come with extra charges starting in 2026, it’s smarter to use safer, traceable options like a bank account, debit card, or credit card.

3. Ignoring Documentation

Always keep proof of the source of funds, the relationship with the recipient, and the reason for the transfer. These records help confirm that your transfer qualifies as a gift or self-remittance and protect you from being taxed later.

Being clear about your transfer’s purpose, keeping electronic records, and using legitimate banking channels are the easiest ways to maintain a truly tax-free money transfer from the U.S. to India.

Why Frex Is The Smarter Way To Send Money From The US To India?

If you want a faster, cheaper, and more transparent way to send money home, Frex is built for you. It combines modern technology with real-world convenience to make cross-border transfers simple and secure.

Here’s why Frex stands out:

- Better exchange rates that beat traditional money transfer platforms.

- Zero hidden fees with complete pricing transparency.

- Direct transfers from your U.S. bank account to India.

- Transfers made via Frex are free of any remittance tax.

- Instant settlements powered by regulated stablecoins technology.

- Licensed and compliant with FinCEN (USA), FATF (Global), and FIU (India).

- Designed for NRIs who want reliable, tax-efficient transfers.

- No minimum transaction limit, so you can send any amount with ease.

Frex brings transparency, speed, and savings together, making it the easiest way to move money from the U.S. to India without unnecessary costs or complications.

Download the Frex app today and experience borderless money transfers.

Final Thoughts: Making Your US To India Transfers Truly Tax-Free

Transferring money from the US to India can be simple when you understand the basics. Stay within the $19,000 gift limit, choose electronic transfers, and maintain clear records to ensure no tax on money sent from the USA to India. Using a regulated provider with transparent fees ensures your money moves safely and efficiently.

If you’re wondering whether you can send money tax-free, the answer is yes when you follow the rules and document your transfers properly. In the end, tax-free transfers are all about being informed, organized, and choosing the right method.

Frequently Asked Questions

Can I send money from the USA to India without tax?

You generally don’t pay tax when sending personal funds or gifts to India. However, US to India money transfer tax applies when the amount exceeds $19,000 per person in 2025. In such cases, you may have to file a gift tax return in the U.S., even though there’s no actual tax on transferring money from the USA to India.

How to transfer money from the USA to India without charges?

Use online money transfer platforms or fintech apps offering zero-fee transfers and competitive exchange rates. Compare service providers, choose electronic payments, and avoid cash-based transactions that often include higher processing or remittance costs.

Can I use my NRI account to transfer funds from the USA to India without incurring taxes?

Yes. Sending money to your own NRE account is tax-free because it’s considered remittance of post-tax income earned abroad. Ensure you use licensed channels, keep transaction records, and verify your NRI status to maintain compliance.

Which money transfer method from the USA to India has the lowest or no tax charges?

Electronic transfers via bank accounts or regulated money transfer services have the lowest costs and no tax charges. These methods also ensure faster processing, transparent fees, and compliance with both U.S. and Indian tax regulations. Understanding the tax rules for sending money to India from the USA can help you choose the best method.

Is money transferred from the US to India taxable?

Money sent as a personal remittance or a family gift is not taxable in India. However, gifts from non-relatives above $563 a year may attract tax on money transfer from the USA to India under the Income Tax Act, so keep proof of the sender and transfer purpose.

Leave a Reply