Key Highlights

- The US remittance tax introduces a 1% fee on specific international money transfers, set to take effect from Jan 1 2026.

- It applies mainly to cash-based or paper transactions such as money orders and cashier’s checks.

- Most digital transfers, including Frex, made through banks or verified platforms are to be exempted.

- The tax aims to improve transparency and generate revenue for the US government.

- Families and expats sending regular remittances will see a small increase in overall costs.

- Penalties apply for non-payment or underreporting, including fines and possible audits.

- Smart planning and digital tools can help offset the extra cost and simplify compliance.

- Platforms like Frex offer better rates and zero fees, helping users save despite the new rule.

If you’ve ever sent money abroad from the US, you know the mix of relief and frustration that comes with it. Relief because you’re helping loved ones back home, and frustration because fees and exchange rates always seem to take more than expected.

Now there’s something new to think about: the US remittance tax. A small fee on money sent overseas might not seem significant, but for families who transfer funds regularly, every dollar matters. Combined with existing service fees, the cost of sending money abroad can quickly add up.

The good news is that by understanding how this tax works, you can make smarter, more cost-efficient choices. This blog explains what the US remittance tax means, who it affects, and how to reduce its impact with solutions that help you keep more of your money.

What is the US Remittance Tax?

If you’re curious about what is the US remittance tax, it refers to a government fee on certain types of money sent from the US to other countries. It was introduced under the One Big Beautiful Bill Act and is part of a new law passed by the House of Representatives in July 2025, aimed at improving oversight and transparency in cross-border payments.

The proposed US remittance tax mainly applies to non-digital transactions rather than online or app-based transfers. It’s an excise tax that the remittance transfer provider or other authorized financial institution collects when you make a payment.

Here’s a quick breakdown:

- It generally applies to paper-based transfers, such as a money order or cashier’s check.

- The imposition of the excise tax occurs at the time of the transfer of funds.

- The remittance provider is responsible for collecting and sending the tax to the authorities.

- The amount of tax depends on the total value of the remittance.

This new law aims to make money transfers more transparent while generating additional government revenue and ensuring compliance with existing financial regulations.

How Much Is The Tax, And When Will It Apply?

The US remittance tax bill outlines a small government fee on certain transfers sent abroad from the US. According to current reports, the US remittance tax proposal percentage, 2025 is expected to be around 1%, much lower than earlier suggestions of up to 5%.

The US remittance tax effective date is expected after December 31, 2025, meaning the charge could start applying to transfers in 2026. However, this may change depending on how the US remittance tax bill progresses in Congress and any guidance the IRS releases in the coming months.

Here’s how the new tax works:

- Tax Rate: 1% fee on eligible transfers from the US to other countries.

- Collection: The remittance provider or another financial institution collects it during the transaction.

- Applies To: Paper-based remittances or physical transactions like cash or checks.

- Possible Exemptions: Some digital platforms handling electronic transfers may be excluded.

The tax bill clarifies that the imposition of the excise tax applies to each eligible transaction, with the remittance transfer provider or money transmitter responsible for collection. Some taxpayers may qualify for a tax credit when filing their federal income tax or income tax return, depending on future IRS rules.

In short, once the new remittance tax takes effect, anyone transferring funds through a US bank or other approved channel may see a small additional charge on international transfers.

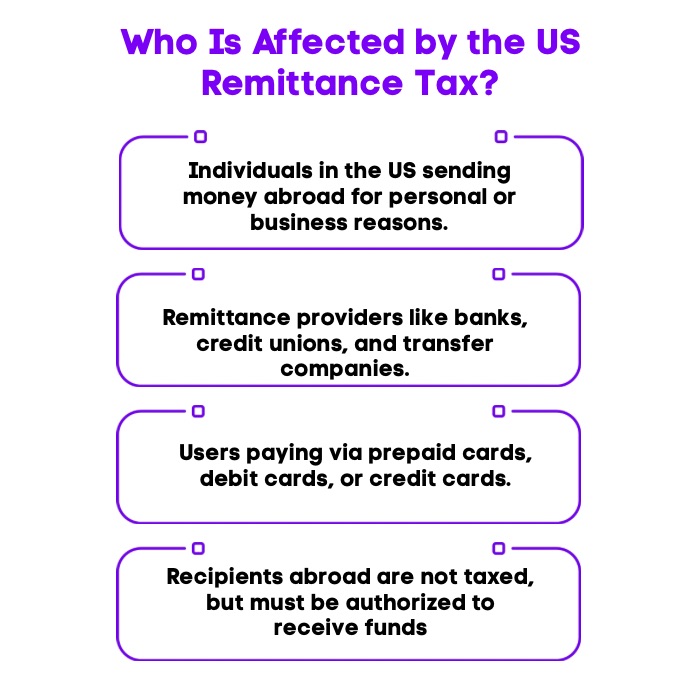

Who Does The US Remittance Tax Affect?

The proposed US remittance tax affects a wide range of people and institutions involved in cross-border transfers. Its impact depends largely on the type of transaction and the channel used rather than the sender’s profile alone.

Here’s a closer look at who’s most affected:

1. Individuals Sending Money Abroad

People in the US who send money to a foreign country for family, education, or business purposes are directly affected. This includes US nationals, green card holders, and non-citizens using a US account to transfer funds abroad. Regular senders may see slightly higher costs once the rule takes effect.

2. Remittance Providers

Banks, credit unions, and companies like Western Union that handle money transfer services or electronic transfers are responsible for collecting and submitting the tax to the government.

3. Payment Methods

Users of prepaid cards, debit cards, or credit cards may also fall under this rule depending on how their electronic fund transfer is processed.

4. Authorized Recipient Of A Remittance Transfer

The designated recipient abroad doesn’t pay the tax; the sender does. Responsibility lies with the sender and the financial institution managing the transaction.

So, does the US tax remittances for everyone? Not quite. The rule mainly targets active senders and registered money transmitters.

Why Did The US Introduce The Remittance Tax?

The US government introduced the proposed US remittance tax to improve financial transparency and generate stable revenue from outbound transfers. It was added to the One Big Beautiful Bill Act, a reform package aimed at modernizing the federal tax system.

The US tax on remittance collects small fees from the billions of dollars sent abroad each year. Even a 1% amount of tax on these transfers can help fund national programs without raising broader taxes.

Key reasons behind this new law include:

- Revenue Generation: Capture modest income from high remittance volumes leaving the US.

- Transparency: Track and regulate international money transfers more effectively.

- Fairness: Ensure both citizens and non-citizens contribute under a unified tax policy.

- Modernization: Promote secure digital payments through licensed financial institutions and remittance transfer providers.

Overall, the US remittance tax bill reflects a policy shift, encouraging formal, traceable money transfers while helping the government fund domestic priorities through a fair and predictable new remittance tax.

The Remittance Tax Debate: Who Wins And Who Loses?

The proposed US remittance tax has sparked a heated debate across the country. Supporters believe it strengthens oversight and raises needed revenue, while critics see it as an extra financial strain on those sending money abroad.

So, who gains and who feels the pressure under this new system? Here’s a quick look:

| Who Benefits | Who Loses Out |

|---|---|

| The US government gains a predictable income stream from outbound remittances. | Migrant workers and low-income families who feel the pinch of added fees. |

| Regulated financial institutions and remittance providers see more formal use. | Recipients abroad may receive less due to increased transfer costs. |

| Tax authorities benefit from improved compliance and fraud prevention. | Smaller money transfer services, facing higher compliance and reporting burdens. |

The US remittance tax may boost revenue and transparency for the government and institutions, but it adds pressure on everyday senders and recipients. Its real impact will depend on how the rule is applied in 2025.

Can You Deduct Or Claim The US Remittance Tax?

As the US remittance tax bill moves closer to implementation, one key question arises: can people deduct this new fee or claim it on their tax filings? The answer isn’t fully clear yet, but early discussions suggest the new remittance tax may not qualify as a direct deduction for most individuals. Still, there could be limited ways to offset it through existing tax provisions.

Here’s what to know for now:

- Tax Credit Possibilities: Depending on how the IRS defines the rule, some taxpayers could qualify for a small tax credit when filing their federal income tax or income tax return, especially those who make frequent or large transfers.

- Business Transactions: Companies or small businesses that send cross-border payments for legitimate expenses may be able to include the fee as a deductible business cost.

- Documentation: Always keep receipts and proof of payment for each remittance transfer made through a remittance provider or financial institution.

The US remittance tax bill status, 2025 will determine whether these credits or deductions become available. Until then, it’s best to view the charge as a minor, non-refundable cost tied to the imposition of the excise tax on outgoing payments.

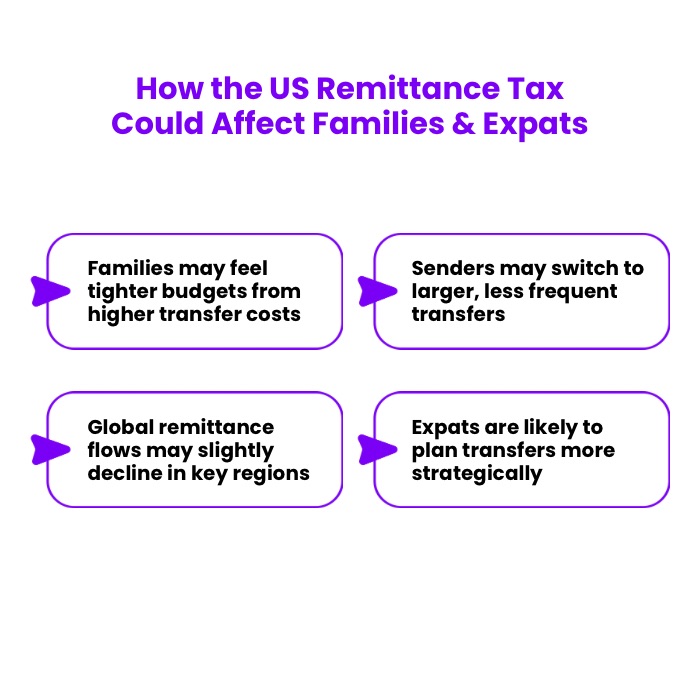

How Will The US Remittance Tax Impact Families And Expats?

For many families and expats, sending money abroad is a part of life. While the US remittance tax bill aims to boost transparency and revenue, it’s also reshaping everyday money habits.

Here’s what this could mean for real people and communities:

1. Tighter Family Budgets

Families who regularly send money from the US to a foreign country may start feeling the pinch once the new remittance tax takes effect. Even a small rise in transfer costs can impact those relying on monthly remittances for essentials such as school fees, rent, and groceries.

2. Changing Money Habits

Some senders may adjust their transfer patterns. Instead of smaller, frequent payments, they might send larger amounts less often to save on fees. Others could shift to digital platforms or licensed money transfer services that offer lower costs and better exchange rates.

3. Ripple Effects On Global Economies

Countries that receive significant funds from the US, like India, Mexico, and the Philippines, could experience a modest decline in remittance inflows. Even a small dip can influence local spending, small businesses, and household stability.

4. Smarter Planning For Expats

For expats, the amount of tax encourages more deliberate financial planning. Comparing providers, fees, and transfer times helps reduce costs. Working with trusted financial institutions or remittance providers ensures transactions remain secure and compliant.

In short, while the new rule might slightly raise costs, it’s also driving families and expats to make more thoughtful, cost-efficient choices about global transfers.

How Can You Minimize Costs Under The US Remittance Tax? 5 Expert Tips

Even with the proposed US remittance tax adding a small fee to transfers abroad, there are simple ways to keep your overall costs low. A little planning goes a long way in helping you save money while still supporting your loved ones.

Here’s how you can make every transfer smarter and more cost-efficient:

1. Compare Transfer Platforms

Before sending funds, compare exchange rates and service fees across different money transfer services. Some platforms charge lower rates or waive certain fees for new users. Always check total costs instead of just the advertised rate to find the best deal.

2. Send Larger Transfers Less Often

If you send money regularly, consider combining smaller transfers into one larger payment. This helps minimize per-transaction fees and the total amount of tax paid. Just make sure you use a trusted remittance provider or financial institution to process the transaction securely.

3. Choose Digital Transfers

Apps like Frex offer a simple way to send money directly from your US bank account to India with low fees and competitive rates. Digital platforms also help cut costs compared to in-person methods and allow for fast, secure online transfers using your bank account or prepaid card.

4. Avoid Hidden Charges

Be cautious of currency conversion fees or extra service charges tied to online bill payments or credit card-funded transfers. Reading the fine print before confirming your transaction helps prevent unexpected deductions.

5. Select Reliable Transfer Partners

Stick with well-established companies like your local US bank or licensed global services such as Western Union that clearly disclose rates and timelines. Transparent providers make it easier to track your transfer and ensure that the authorized recipient of a remittance transfer receives the correct amount on time.

If you frequently send money from the USA to India, compare platforms that specialize in low-cost, secure transfers. Choosing wisely helps you save on fees and stay connected without overspending.

From The US To India, Make Every Dollar Count With Frex

The new US remittance tax may add a small fee to every transfer, but that doesn’t mean you should lose more of your hard-earned money. With Frex, you get more INR for every USD you send, without worrying about hidden fees or unfair exchange rates.

Frex makes cross-border transfers simple, fast, and transparent, so your family receives more while you spend less.

Here’s what makes Frex different:

- Zero Fees: No extra charges or deductions.

- Remittance tax compliant: Remittances made via Frex are free of any taxes

- Better Rates: 2-3% higher than Google, Wise, or Xoom.

- Instant Transfers: Send money from your US bank account to your India bank account within minutes.

- No Minimum Amount: Send as little as $2 anytime, anywhere.

- Safe And Compliant: Licensed under FinCEN USA, FATF Global, and FIU India, with 256-bit encryption for total security.

With Frex, you don’t just transfer money, you transfer value. It’s modern banking built for a borderless world.

Download the Frex app today and start sending money smarter!

Conclusion: Stay Smart About Global Money Transfers

The proposed US remittance tax may seem small, but it changes how people manage international payments. Understanding how the US remittance tax bill works helps you choose better transfer options, compare fees, and plan more efficiently.

This rule is not meant to stop global support. It’s designed to bring structure and transparency to cross-border transactions. Staying informed ensures your money moves safely, cost-effectively, and with confidence, no matter where you send it.

Frequently Asked Questions

What are the penalties if the remittance tax is not paid or reported?

Failure to pay or report the US remittance tax can result in fines, penalties, and interest charges. Repeated non-compliance may also trigger additional scrutiny from the IRS, potentially leading to audits or restrictions on future international transfers.

How does the US remittance tax compare to similar taxes in other countries?

The US remittance tax is relatively low at 1% compared to other nations. For example, some countries charge up to 5% on outbound remittances, making the US outward remittance tax less burdensome for frequent international senders.

Who collects the US remittance tax, and how is it enforced?

The tax is collected by authorized remittance providers, financial institutions, or money transmitters when funds are sent abroad. These entities report and remit the collected amount to the IRS, ensuring compliance through regulatory audits and transaction tracking.

What paperwork or reporting is required for the US remittance tax?

Senders typically do not need to file special forms. The remittance provider or bank includes the transaction details in standard IRS reports, while individuals should retain receipts or digital confirmations for personal recordkeeping and potential tax-related documentation.

Are there any exceptions or exemptions to the US remittance tax?

Certain electronic transfers or bank-to-bank payments may be exempt if they meet specific IRS guidelines. Exemptions can also apply to transfers for business purposes or education payments, provided documentation and verification requirements are satisfied.

Is US tax on remittance on US citizens?

Once the remittance tax takes effect after December 2025, people in the US sending money abroad for family, education, or business purposes, including citizens, green card holders, and non-citizens, will be directly affected, with regular senders likely facing slightly higher costs.

Leave a Reply