Key Highlights

- Exchange rates directly impact how much INR do you receive in the Indian bank account for the USD you send

- Rates can vary between providers due to foreign exchange rate markups, fees, and transfer charges.

- Comparing the final payout is more important than just checking fees.

- Providers may lock exchange rates at different stages of the transfer.

- Watch out for platforms that hide fees in marked-up rates.

- Always verify rates and fees before sending to get the best value.

- Frex offers better-than-Google rates with zero hidden charges. Frex stands out for transparency, zero fees, and same-day delivery.

Have you ever sent money to India only to find that your recipient received less than expected? You double-check the transfer fee, and everything looks fine. But behind the scenes, the exchange rate may have quietly reduced the final amount, and most people don’t even notice.

What many senders overlook is that exchange rates vary significantly across different platforms. Some services apply hidden markups, others lock in rates only at the time of transfer, and a few charge low fees but offer poor conversion rates. With so many variables at play, choosing the right service can be more complex than it seems.

In this blog, we’ll walk you through how exchange rates work, what affects them, and why they matter more than you might think. We’ll also compare top money transfer apps side by side to help you make informed, cost-effective choices when sending money from the USA to India.

What Exchange Rate Means When Transferring Money?

The exchange rate tells you how many Indian rupees your recipient gets for every dollar you send. It is a simple number, yet it has a big impact on how much your loved ones receive in the end. The exchange rate tells you how many Indian rupees your recipient gets for every dollar you send. It’s a simple number, but it can make a big difference in how much your loved ones receive.

Each provider may offer a different rate, and that’s where things get tricky. Some use the mid-market rate, which is the real rate you see on Google or financial news, while others adjust it to include their own markup.

When you understand what the rate really represents, it becomes easier to compare options and pick the one that gives your recipient more value, especially if you’re looking for the best rate to send money to India from the USA.

How Often Do Exchange Rates Change for US to India Transfers?

Exchange rates for US to India transfers can change many times a day as banks and transfer services refresh their pricing. That is why you might notice one rate in the morning and a slightly different one later. You don’t need to track every little change. Just keep an eye on the trend and send when the rate feels right.

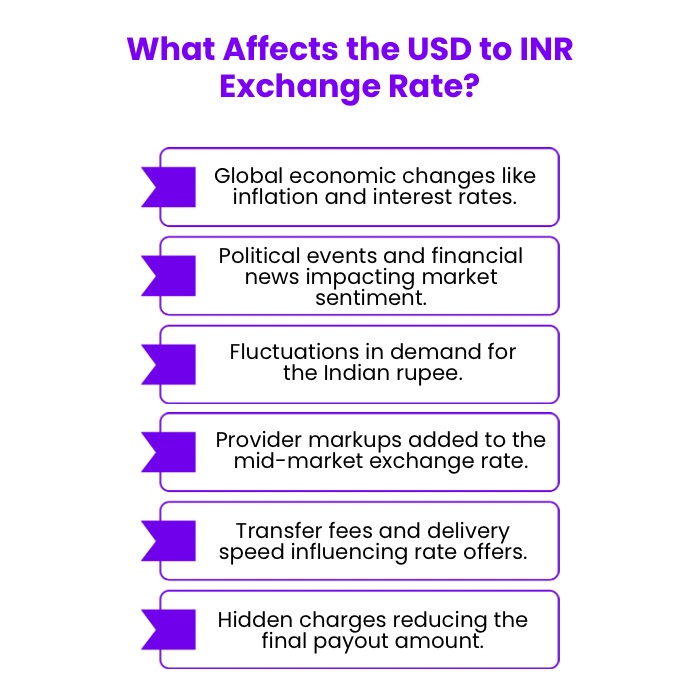

What Factors Influence the USD to INR Exchange Rate?

Several factors shape how many rupees your recipient gets for every dollar you send. Some are driven by global economics, while others depend on the transfer service you choose.

Here are the key factors that can affect the rate you get when sending money to India:

1. Global Economic Conditions

Interest rate changes, inflation levels, and trade flows all play a role. When the US or Indian economy shifts, the value of each currency can change. For example, a rise in US interest rates might strengthen the dollar and give you a better exchange rate.

2. Market Sentiment

Political events, financial news, and global uncertainty can cause currencies to rise or fall quickly. These swings often lead to small but frequent changes in the rate, something worth noting if you’re keeping track of the money transfer rate from the USA to India.

3. Currency Demand

If more people or businesses need rupees, such as during a surge in demand for Indian goods or investments, the INR may strengthen. Lower demand can weaken it.

4. Provider Margins and Markups

Even if the global rate stays steady, the rate you see from a transfer service might be different. Many providers add a markup to the mid-market rate, which is the rate banks use to trade currencies with one another.

5. Transfer Fees and Delivery Speed

Faster transfers or specific delivery methods like instant UPI or cash pickup often come with higher costs. Some services offer slightly lower exchange rates to balance these added expenses.

If you want to transfer money from the USA to India for the best exchange rate, keep an eye on how speed affects your final payout.

6. Hidden Charges

Always check the full cost of a transfer. Things like service fees, minimum amounts, or payout options can affect the final amount your recipient receives.

By keeping these factors in mind, you can better time your transfer and choose a service that gives you more value for every dollar sent.

How Do Top Money Transfer Apps Compare on Exchange Rates?

When you’re sending money from the United States to India, every rupee matters. Even a small change in the exchange rate can make a difference, especially if you are transferring larger amounts or doing so regularly. That’s why comparing live rates across several providers is smart. It helps you find the best exchange rate for money transfer to India from the USA without second-guessing.

Here’s how the USD to INR exchange rates currently compare across the most popular money transfer apps.

1 USD to INR: Current Exchange Rates

| Provider | Exchange Rate (1 USD = INR) |

|---|---|

| Frex | 90.54 |

| Wise | 88.69 |

| Remitly | 89.06 |

| Xoom | 88.82 |

| Western Union | 89.24 |

| Ria | 88.71 |

| Instarem | 88.69 |

| Xe | 88.73 |

Disclaimer: Exchange rates are subject to change based on market conditions and each platform’s policies. Always verify the latest rates, charges, and limits directly on the official website of your chosen money transfer service before making a transaction.

To get the most value from your transfer, compare live rates and fees, then pick the service that offers the best payout, delivery speed, and payout method.

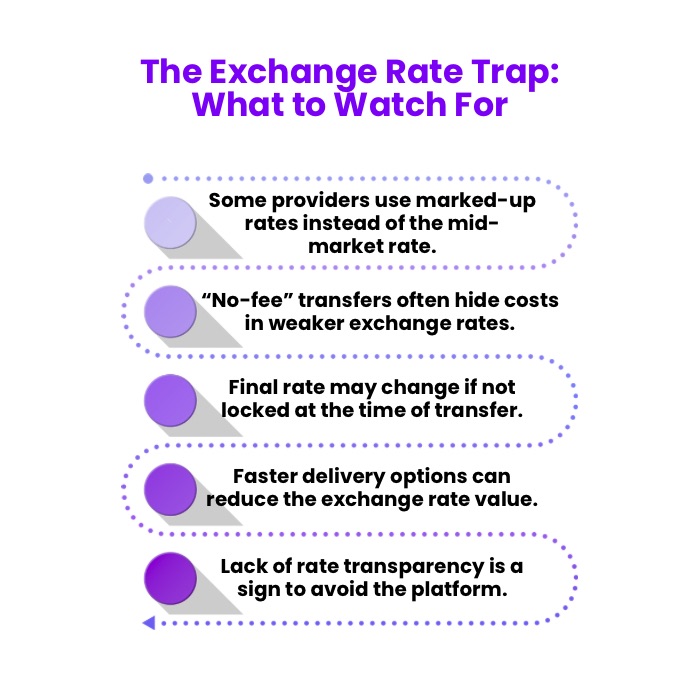

The Exchange Rate Trap: What to Watch Out For

While most money transfer apps seem to offer competitive rates, the number you see isn’t always what it seems. Many platforms quietly adjust the exchange rate to include hidden margins, which means your recipient may receive less than expected, even if the transfer fee looks low or “free.”

Here are a few things to be aware of before you hit send:

1. Marked-Up Rates Instead of Mid-Market Rates

Some services don’t use the mid-market rate (the rate you see on Google or financial news sites). Instead, they apply a marked-up rate that includes their profit margin. This small difference can add up, especially on larger transfers.

2. “No-Fee” Isn’t Always Free

When a provider advertises zero fees, it often makes up the difference by offering a weaker exchange rate. Always compare how much the recipient will actually receive, because that’s the real cost.

3. Rates Can Change After You Start

Some platforms show you an estimate up front, but the actual exchange rate is locked only when you complete the transaction. If there’s a delay, your final rate could be lower than expected.

4. Hidden Costs Behind Delivery Options

Choosing a faster delivery method like instant UPI or cash pickup may come with either added fees or a less favorable rate, especially at cash pickup locations. Slower methods might offer better value, but you need to weigh the trade-offs.

5. Lack of Transparency

If a platform doesn’t clearly show you the current exchange rate and how much your recipient will get, that’s a red flag. Always look for full cost breakdowns before confirming a transfer.

Smart Tip: Before choosing a service, calculate how much your recipient will receive after fees and conversion, and compare that number across apps. That’s the easiest way to avoid overpaying.

Looking for the Best Exchange Rate to Transfer Money from the USA to India? Choose Frex

If you want to make the most of every dollar you send to India, Frex makes it easy. Designed specifically for NRIs, Frex offers one of the best exchange rates to transfer money from the USA to India with zero hidden fees and complete transparency.

Frex shows you exactly how much your recipient will receive before you send, with no guesswork. You get full visibility into the exchange rate, fees, and delivery time upfront.

Why Frex Stands Out:

- No fees, even for fast or instant transfers

- Better exchange rates than most apps

- No minimum transfer requirement

- Same-day delivery available

- 256-bit encryption and bank-level security

- Licensed in both the US and India

Whether you’re sending a little or a lot, Frex helps you do it with confidence, speed, and maximum value.

Download the Frex app on Google Play or the App Store and start sending smarter today.

Conclusion

Understanding how exchange rates work and how they vary across platforms is key to sending smarter. From fees to transfer speed to payout method, every detail impacts the final amount of money your recipient receives in their bank account.

Before making any international money transfer, take a moment to compare the money transfer from the USA to India rates across trusted services. Look beyond the headline currency exchange number and focus on the actual value delivered to your recipient’s bank account.

Whether you’re sending a small gift or a large payment, knowing when and how to transfer can help you make the most of your money today.

Frequently Asked Questions

Can I send money to India from the USA with the Google exchange rate?

Most providers do not offer the exact rate shown on Google. However, some apps provide rates that closely match it. Always check the final amount your recipient receives before confirming your transfer to ensure the best value.

How to transfer money to India from the USA for the best rate?

To get the best rate, compare live exchange rates across multiple apps, review fees carefully, and check the final payout amount. Transfers made during stable market conditions usually offer better value, so monitoring rate trends can also help improve your results.

Can I lock in an exchange rate when sending money from the USA to India?

Some money transfer apps allow you to lock in a rate for a short period so your transfer is not affected by market changes. Always check each provider’s policy to see if rate guarantees are available before completing your transaction.

What is the best way to send money to India from the USA?

The best way is to compare trusted apps like Frex that offer real-time exchange rates, low fees, and fast delivery to your recipient’s bank account. Choosing a service with full rate visibility helps you make more informed transfers.

Which money transfer app gives the best rates to India?

Apps like Frex stand out by offering better currency exchange rates with no hidden markups. To transfer money to India from the USA, compare rates, always look at the final amount the recipient receives rather than just the listed rate.

What is the cheapest way to transfer money from the US to INR?

Look for providers that offer low fees and flexible payment options such as credit card, debit card, or direct bank transfers. Frex supports these methods and also accepts Mastercard, making it both affordable and easy to use.

What documents do I need to transfer money from the USA to India?

You’ll typically need your bank account information, the recipient’s name and account number, and a valid phone number and email address. Some services may ask for additional information to verify your identity and comply with regulations.

Leave a Reply