Key Highlights

- Western Union is one of the oldest money transfer services with a massive global network of physical agent locations.

- Xoom, a PayPal service, is a digital-first platform known for its user-friendly app and integration with PayPal accounts.

- Frex is a value-focused money transfer app offering live exchange rates, zero fees, and instant USA–India transfers.

- All three platforms are regulated, secure, and compliant with global KYC and AML standards.

- Generally, Xoom offers a lower transfer fee for many online transactions compared to Western Union.

- Both services provide multiple payment methods, including bank account, debit/credit card, and options for cash pickup.

- Frex emerges as a strong alternative, often providing better exchange rates and lower fees for international money transfers.

- Personal money transfers from the USA to India are generally tax-free across all three services.

Are you sending money home every month and wondering where your dollars lose value along the way? Not sure whether high fees, slow delivery, or weak exchange rates are quietly eating into what your family receives in India? For many NRIs, choosing the right money transfer service can feel confusing and frustrating.

When it comes to reliable international transfers, Xoom and Western Union are two top contenders. Both platforms offer different features, fees, and exchange rates that could make a huge difference in the amount your loved ones receive. But how do you know which one is the best for your needs?

This guide will help you compare Western Union vs Xoom in detail, focusing on the aspects that matter most to NRIs, fees, speed, and exchange rates, so you can make an informed decision for your next money transfer to India from the USA.

At a Glance: Xoom vs Western Union Comparison 2026

To select the best service for your transfer needs, it’s crucial to examine how Xoom and Western Union handle exchange rates, fees, and transfer speeds. Each platform has its own perks, which can significantly impact the final amount your recipient receives.

Below, we’ve compared the two services to make it easier for you to find the right fit.

| Factor | Xoom | Western Union |

|---|---|---|

| Exchange Rate | 1 USD = ₹88.98 INR Includes a markup over the mid-market rate | 1 USD = ₹90.59 INR Adds 1-3% margin over mid-market |

| Fees | $0 to $15, depending on the payment method and transfer speed, Higher fees for card payments | $0–$100 depending on the amount and method |

| Speed | UPI & Cash Pickup: Instant (minutes)Bank Deposits: minutes to 2 hours Larger Transfers: 2-3 business days | Cash Pickup/Wallet: Instant (minutes)Bank Deposits: minutes to a few hours,Standard Bank Transfers: 1-5 business days |

| Tax | Personal transfers are typically tax-freeLarge transfers may need verification | Personal transfers are tax-free |

| Transaction Limits | Up to $50,000 for verified accounts | $3,000 (unverified) to $50,000 (verified) |

| Security | Regulated with PayPal PCI compliant | Licensed globallyAML & KYC compliance |

| Delivery Options | Supports bank, cash pickup, and mobile wallets | Wide network of cash pickup locations |

| Support | 24/7 support via chat, email, phoneEasy-to-use app | 24/7 support via phone, email, and in-personMobile app available |

* Disclaimer: Exchange rates, transfer fees, and transaction limits mentioned above may change based on market conditions, payment methods, and platform policies. Always verify the latest rates and applicable fees on the official Xoom and Western Union websites before initiating a transfer.

| Looking for a Smarter Way to Send Money? Choose Frex for Better Value. Xoom and Western Union offer reliability, but fees and exchange rate margins can reduce how much your family receives. Frex takes a different approach with zero transfer fees, competitive live exchange rates, and instant USA to India transfers, helping you keep more of your money where it belongs. Download the Frex app for iOS today! |

|---|

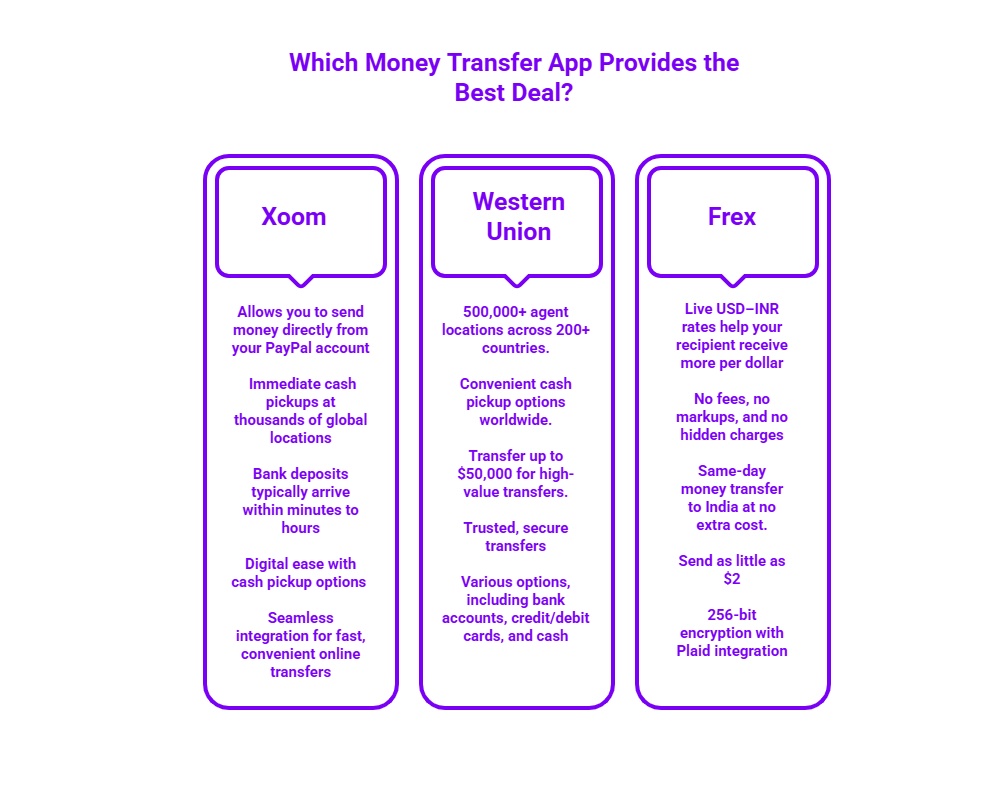

Xoom vs Western Union vs Frex: Which Money Transfer App Is Right for You?

While Xoom and Western Union are popular choices, they aren’t the only options available for your international payments. A third contender, Frex, is making waves by focusing on value.

Choosing the best app to send money to India from USA often comes down to what you prioritize most: convenience, cost, or a massive physical footprint. Each online platform has its own strengths. So, let’s dive deeper into how Xoom, Western Union, and Frex measure up in key areas that matter to you.

Exchange Rate: Xoom vs Western Union vs Frex

Xoom Exchange Rate

Xoom offers a competitive exchange rate for USD to INR, typically around ₹88.98 per USD. It’s close to the mid-market rate but includes a small markup. This ensures a reliable rate, though not the absolute best in the market, making it a solid option for Xoom USD to INR transfers.

Western Union Exchange Rate

Western Union offers an exchange rate close to the mid-market rate, typically around ₹90.59 INR for 1 USD. However, the platform tends to add a 1–3% markup, meaning the recipient receives a slightly lower amount. The rate can vary depending on the payment method and transfer destination.

Frex Exchange Rate

Frex offers one of the most competitive exchange rates, providing ₹90.54 INR for every 1 USD. This rate is updated in real-time to ensure accuracy.

Which Service Delivers the Best Exchange Rate: Xoom, Western Union, or Frex?

Frex provides the best exchange rates at ₹90.54 INR per USD, with real-time updates and transparent pricing.

Fees: Xoom vs Western Union vs Frex

Xoom Transfer Fees

Xoom charges fees ranging from $0 to $15, depending on the payment method and transfer speed. For credit card payments or expedited transfers, fees are typically higher. If you’re using a bank account for a standard transfer, fees tend to be on the lower end of the range.

Western Union Transfer Fees

Western Union charges $0 to $100, depending on the transfer amount and the chosen payment method. Cash pickups and credit card payments typically incur higher fees, whereas bank transfers or online payments are generally more affordable.

Frex Transfer Fees

Frex offers zero transfer fees, ensuring complete transparency. There are no hidden costs or currency markups, allowing you to send money without worrying about extra fees or unexpected charges.

Which Transfer Service Has the Lowest Fees: Xoom, Western Union, or Frex?

Frex stands out with zero fees and full transparency, making it the most cost-effective option.

Speed: Xoom vs Western Union vs Frex

Xoom Transfer Speed

Xoom offers instant transfers for UPI & cash pickup, typically completing within minutes. Bank deposits can take anywhere from minutes to 2 hours, depending on the method chosen. For larger transfers, it may take 2-3 business days to complete, depending on the payment method and destination.

Western Union Transfer Speed

Western Union also provides instant transfers for cash pickups and mobile wallets, which are completed within minutes. For bank deposits, transfers typically arrive in minutes to a few hours, while standard bank transfers can take anywhere from 1 to 5 business days, depending on the payment method and destination country.

Frex Transfer Speed

Frex stands out by offering instant transfers, typically completing within minutes or the same day at no extra charge, ensuring a fast and reliable transfer experience. Whether you’re using bank deposits or mobile wallets, Frex ensures your recipient gets the money as quickly as possible.

Which One Gets Your Money There Fastest – Xoom, Western Union, or Frex?

Frex is the fastest with instant transfers that complete within minutes or the same day at no extra cost.

Tax: Xoom vs Western Union vs Frex

Xoom Tax Fees

Xoom’s personal transfers are typically tax-free. However, for large transfers, you may need to provide additional verification or documentation to comply with regulatory requirements. Business-related transfers could be subject to tax, depending on local rules.

Western Union Tax Fees

Western Union’s personal transfers are generally tax-free, but for large transfers (typically over $10,000), they may require reporting to comply with tax regulations. High-value transfers may also trigger tax inquiries depending on the amount and destination.

Frex Tax Fees

Frex offers no tax for personal remittances from the USA to India, ensuring a straightforward and tax-free experience for individual transfers. There are no hidden taxes or charges for regular personal remittances, making it a simple process.

Which Platform Handles Taxes Best: Xoom, Western Union, or Frex?

Frex offers the most straightforward, tax-free transfers with no US remittance tax for personal remittances from the USA to India.

Security Compliance: Xoom vs Western Union vs Frex

Xoom Security Compliance

Xoom is fully regulated with PayPal’s PCI-compliant security, adhering to global KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines. This ensures your money transfer without tax is both secure and compliant with international financial standards.

Western Union Security Compliance

Western Union is licensed globally and follows strict AML and KYC regulations. They also provide data encryption and fraud prevention to safeguard your personal and financial information during the transfer process.

Frex Security Compliance

Frex is compliant with FinCEN USA, FIU India, and global FATF guidelines, ensuring 256-bit encryption to keep your transfers secure. This makes Frex an incredibly reliable and secure option for sending money internationally.

Which Money Transfer Service Is the Most Secure: Xoom, Western Union, or Frex?

Xoom, Western Union, and Frex all offer robust security, but Frex stands out with 256-bit encryption and global compliance with top security standards.

Customer Support: Xoom vs Western Union vs Frex

Xoom Customer Support

Xoom provides 24/7 support through chat, email, and phone, ensuring that users can easily access assistance at any time, whether they’re looking for help with a transfer or tracking their funds. Additionally, the platform features a user-friendly app that makes it easy for users to send money to India from USA, monitor transactions, and receive updates on the status of their transfers, offering a seamless experience for busy senders.

Western Union Customer Support

Western Union also delivers 24/7 support via phone, email, and in-person at over 500,000 agent locations globally, ensuring that users have access to help no matter where they are. Their mobile app offers a comprehensive tool for managing transfers, finding agent locations, and receiving updates, making it a convenient option for both first-time and regular users.

Frex Customer Support

Frex provides in-app chat and human support during business hours, offering personalized assistance for any issues, such as failed or delayed transfers. This customer service approach ensures that users get quick help and can resolve any problems swiftly, contributing to an overall smooth user experience that stands out in the money transfer industry.

Which Platform Provides the Best Assistance: Xoom, Western Union, or Frex?

Frex stands out with personalized in-app chat and human support during business hours. While all three excel in customer support, Frex offers a more tailored experience for quick resolutions.

Verdict: Xoom and Western Union Are Good, But Frex Wins on Value

Now that we’ve highlighted how each service compares in terms of fees, speed, and exchange rates, it’s important to understand when each one is the best option for your transfer needs.

Let’s explore when Frex should be your first choice, and why Xoom and Western Union might still be better suited for certain scenarios.

When to Choose Frex?

Here’s why Frex might be the best option for your next money transfer to India from the United States:

- Best Exchange Rates: Live USD–INR rates that help your recipient receive more per dollar sent.

- Zero Transfer Fees: No fees, no markups, and no hidden charges on any transfer.

- Instant Delivery: Same-day or instant transfers to India at no extra cost.

- Low Minimum Send: Send as little as $2, suitable for both small and large remittances.

- Strong Security: 256-bit encryption with Plaid integration and full compliance with FinCEN USA, FEMA India, and FIU India.

Get started with the Frex app today and experience faster, more affordable money transfers with zero fees!

When to Choose Xoom?

Here’s when you should consider Xoom:

- PayPal Integration: Send money directly from your PayPal account for fast, seamless transfers.

- Instant Cash Pickup: Access immediate cash pickups at thousands of global locations.

- Fast Bank Transfers: Bank deposits typically arrive within minutes to hours.

- Convenience: Ideal for users seeking digital ease with cash pickup options.

- Ideal for PayPal Users: Seamless integration for fast, convenient online transfers.

When to Choose Western Union?

Here’s when Western Union is the right fit:

- Unmatched Global Coverage: 500,000+ agent locations in 200+ countries, perfect for remote areas.

- In-Person Transactions: Convenient cash pickup options worldwide.

- Large Transaction Limits: Transfer up to $50,000 for high-value transfers.

- Reliable and Established: Trusted, secure transfers with a long history.

- Multiple Payment Methods: Offers various options, including bank accounts, credit/debit cards, and cash.

In short, Xoom excels with PayPal integration and convenience, Western Union dominates with unmatched global reach, but Frex takes the crown for the best exchange rates, zero fees, and instant transfers.

Want to keep more of your money? Download the Frex app today and start sending faster, fee-free transfers that save you more!

Choosing the Right Money Transfer App: Maximize Value, Speed, and Security

When it comes to sending money, the service you choose can make or break the experience. Whether you’re sending funds to family or handling business payments, finding the right service means unlocking the best value. From zero fees to instant transfers, choosing a service that matches your priorities ensures your money reaches its destination faster and without hidden charges.

With the right exchange rates, you can make sure your hard-earned dollars work harder for you. Don’t let high fees or slow transfers hold you back. Compare services today, choose the one that best suits your needs, and start saving more with every transfer. Make your next transfer seamless, affordable, and stress-free because every penny counts.

Frequently Asked Questions

Can I send cash for pickup with both Xoom and Western Union?

Yes, both Xoom and Western Union offer cash pickup. Western Union boasts a vast network of 500,000+ agent locations worldwide, while Xoom partners with thousands of locations, allowing for easy cash collection globally.

Is there a maximum limit to how much I can transfer with Xoom or Western Union?

Yes, both services Xoom to Western Union, have transfer limits. Xoom allows up to $50,000 for verified accounts, while Western Union limits vary between $3,000 to $50,000, depending on the payment method and country-specific regulations or verification levels.

Which service is faster for sending money abroad?

Xoom and Western Union both offer instant cash pickup, but Frex leads with instant transfers and same-day deposits. With Frex, your money reaches its destination faster, making it the quickest option.

Xoom Money Transfer vs Western Union: What’s the Difference?

Xoom money transfer is a digital-first platform offering lower fees and fast online transfers for bank-to-bank or cash pickup. Western Union, on the other hand, stands out with its extensive global network of physical locations for cash pickups.

Which service is more widely available in different countries, Xoom or Western Union?

Western Union has a broader presence with over 500,000 agent locations across 200+ countries, making it ideal for remote areas. Xoom operates in over 160 countries, though it’s not as widely accessible for cash pickup as Western Union.

How do I transfer money from United States to India?

To transfer money from the United States to India, you can use Xoom, Western Union, or Frex. Each platform offers different fees, transfer speeds, and exchange rates, so choose based on your priorities, like cost-effectiveness or speed.

Is Xoom better than Western Union?

Xoom may be better than Western Union for those seeking lower fees and faster digital transfers. Xoom offers competitive exchange rates and quicker online transactions, while Western Union excels in physical cash pickup locations.

What are the fees for transferring money to India from the USA?

The fees vary depending on the payment method and transfer speed. Xoom charges between $0 and $15, while Western Union fees range from $0 to $100 based on the transfer amount and method. Frex charges zero fees for personal transfers.

What is the exchange rate for the US Dollar to Indian Rupee on Xoom and Frex?

Xoom offers competitive rates, typically around ₹88.98 per USD, with a small markup. Frex provides one of the best rates, offering ₹90.54 INR per USD, updated in real-time for accuracy.

How secure are my money transfers with Xoom, Western Union, and Frex?

Xoom, Western Union, and Frex all prioritize security. Xoom uses PayPal-level protection, Western Union is globally licensed, and Frex stands out with 256-bit encryption and full compliance with FinCEN and FATF guidelines for maximum security.

Leave a Reply