Key Highlights

- Western Union boasts a massive global network with over 500,000 agent locations, making cash pickup widely available.

- Remitly offers a user-friendly mobile app with two options for the speed of the transfer: a faster Express service and a cheaper Economy option.

- Frex provides competitive exchange rates with low, transparent transfer fees, often making it the best value for a bank deposit.

- All three services, Remitly, Western Union, and Frex, ensure secure transfers with KYC and AML compliance.

- Remitly is perfect for users looking for fast, mobile-friendly transfers.

- Western Union supports high-value transfers up to $50,000 with agent assistance.

- Frex is ideal for instant digital transfers with no additional fees.

- The best service for you depends on factors like transfer speed, cost, and whether your recipient needs cash pickup or a bank deposit.

Sending money internationally can often feel like a daunting task. With so many transfer services available, it’s hard to know which one will provide the best experience. You want a service that’s fast, reliable, and affordable, one that ensures your recipient gets the most out of the transfer. But choosing the right provider can leave you questioning whether you’re getting the best deal.

For transfers specifically from the USA to India, the priorities shift even more. You’re not just comparing services, you’re looking for the best USD to INR exchange rate, low fees, and a delivery time that fits your urgency. Since both Remitly and Western Union operate differently in this corridor, the service you choose can directly affect how much money actually reaches your recipient.

In this blog, we’ll compare Remitly vs Western Union to help you make an informed decision. From fees and exchange rates to transfer speeds and customer support, we’ll break down everything you need to know to choose the best service for your next transfer.

At a Glance: Remitly vs Western Union

Looking to send money to India from USA without hassle? Here’s a quick comparison to help you decide which is better, Western Union or Remitly, for a seamless and cost-effective transfer.

Below is a side-by-side breakdown of their key features:

| Factors | Remitly | Western Union |

|---|---|---|

| Exchange Rate | ₹90.50 per USD (only valid for new users)₹90.27 applies to the rest of the transfer.Includes a markup over the mid-market rate. | ₹90.59 INR per USDRate adjusts with market conditions |

| Fees | $3.99 fee for transfers under $1,000 | $0–$100 depending on the amount and delivery method |

| Speed | Express service for instant transfersEconomy service takes 3-5 days | Cash pickup: instantBank transfers: 1-5 business days |

| Tax | Tax-free for personal transfers | Tax-free for personal transfers |

| Transaction Limits | Approximately $100,000 per transfer | $3,000 (unverified) to $50,000 (verified) |

| Security | • Account verification • Encrypted server connection • KYC compliance • FCA regulated in the UKRegistered with HMRC | Encryption PCI DSS compliantIdentity verificationFraud hotlineFCA regulated |

| Delivery Options | Supports bank, cash pickup, and mobile walletsSome methods may not be instant | Bank deposit or cash pickup at many locations across IndiaWide network of cash pickup locations |

| Support | 24/7 live chat Email support | Agent network and in-person support Phone and email support |

* Disclaimer: Exchange rates, fees, and transfer limits mentioned above are subject to change frequently depending on market conditions and platform policies. Always check the latest rates and fees on the official Remitly and Western Union websites before making a transfer.

| Seeking a Better Alternative? Choose Frex for Top Rates and No Fees. While Remitly and Western Union come with added fees and rate markups, Frex offers live market rates, zero fees, and instant transfers, making it the ideal alternative for sending money to India. Download the Frex app for iOS today! |

|---|

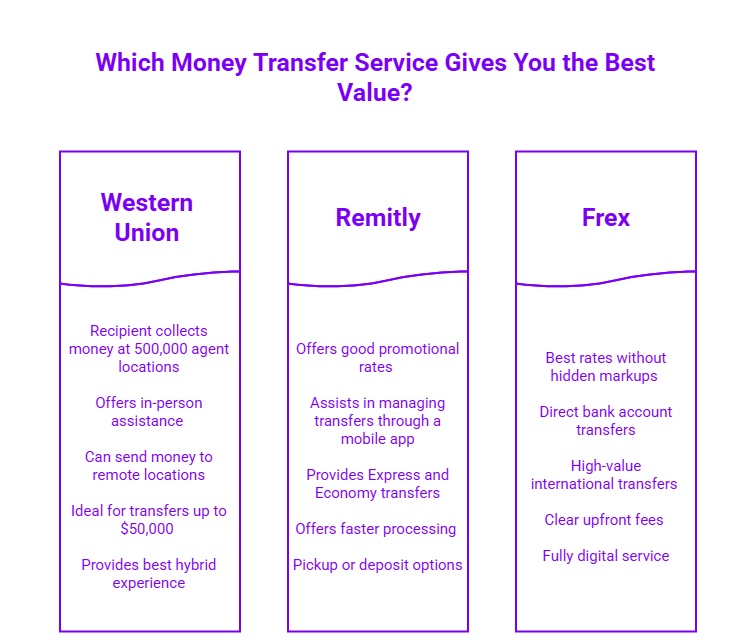

Remitly vs Western Union vs Frex: Which One Offers the Best Value for Global Transfers?

When evaluating the best value for global transfers, it’s important to consider all available options. Let’s explore how Frex, with its focus on transparency and low costs, compares to Remitly and Western Union in delivering the most value for your money.

Exchange Rate: Remitly vs Western Union vs Frex

Remitly Exchange Rate

Remitly offers competitive exchange rates, often starting at ₹90.50 per USD for new users. The rates are real-time, allowing you to get the most up-to-date conversion at the time of your transfer. However, Remitly adds a small markup to the exchange rate, which may increase the cost of the transfer.

Western Union Exchange Rate

Western Union provides exchange rates that start at ₹90.59 per USD, but these can fluctuate based on factors like payment method and transfer type. Their rates often include a markup, which can affect the final amount received by your recipient. It’s important to check the live rate, as it may differ when you make the transfer.

Frex Exchange Rate

Frex offers the live exchange rate, ensuring the most accurate and competitive conversion without any hidden markups. For example, you could get ₹90.54 per USD, close to the actual market rate. This transparency ensures you know exactly what you’re paying without surprises.

Which Transfer Service Offers the Best Exchange Rate: Remitly, Western Union, or Frex?

When it comes to exchange rates, Frex stands out by offering the live mid-market rate with no markup, providing the best value for the amount of money and ensuring the best exchange rate for USD to INR.

Fees: Remitly vs Western Union vs Frex

Remitly Transfer Fees

Remitly charges a flat $3.99 fee for transfers under $1,000. The fees can increase depending on the transfer method, such as using a debit or credit card. For larger transfers or expedited service, fees may also rise, making it important to choose the service that matches your budget and transfer speed needs.

Western Union Transfer Fees

Western Unionfees are more variable, ranging from $0 to $100 depending on the payment method and delivery option selected. Transfers to cash pickup locations typically have higher fees, while bank transfers are generally more affordable. The total cost can be influenced by the transfer amount, so it’s a good idea to check Western Union’s fee calculator for an accurate estimate.

Frex Transfer Fees

Frexoffers zero (0%) extra fees, making it the most transparent and cost-effective option.

Which App Delivers the Lowest Transfer Fees: Remitly, Western Union, or Frex?

When it comes to fees, Frex takes the lead by offering zero extra fees, making it the most affordable choice for international transfers. As the best app to send money to India from USA, it ensures clear, up-front pricing.

Speed: Remitly vs Western Union vs Frex

Remitly Transfer Speed

Remitly offers two primary cash transfer options: Express and Economy. The Express service is ideal for those needing funds quickly, with transfers typically arriving within minutes. However, this option comes at a higher cost. On the other hand, the Economy service is more budget-friendly but takes 3-5 business days to complete the transfer. Remitly gives you the flexibility to choose based on your speed and budget preferences.

Western Union Transfer Speed

Western Union is famous for its instant cash pickups, allowing recipients to collect cash in minutes from any of their global agent locations. However, bank transfers typically take between 1-5 business days, depending on the destination country and payment method. Western Union’s cash pickup option is a fast solution, but if you’re sending money to a bank account, the speed can vary.

Frex Transfer Speed

Frexoffers instant transfers on the same day at no extra charge, making it a great choice for those who need fast digital transfers. Whether you’re sending money to a bank account or mobile wallet, the funds are typically available on the same day, ensuring quick and efficient delivery.

Which Service is the Fastest: Remitly, Western Union, or Frex?

Western Union offers instant cash pickups, allowing recipients to access funds almost immediately. Remitly’s Express service is also fast, with quick transfers, but Frex surpasses both with instant digital transfers at no extra charge, making it the fastest option for online payments.

Tax: Remitly vs Western Union vs Frex

Remitly Tax Fees

When you send money to India from USA, Remitly does not charge any specific tax fees on personal remittances. The transfer fees depend on the payment method, transfer amount, and delivery speed. Remitly ensures that you can send money without worrying about additional tax charges, but keep in mind that regulatory requirements for large transfers may require identity verification.

Western Union Tax Fees

Similarly, Western Union does not levy any tax fees for personal remittances sent from the USA to India. However, Western Union may require additional documentation for large transfers, especially those involving cash pickups or large amounts of money. While no direct tax is charged, you may encounter fees related to compliance checks or identity verification, depending on the nature of the transaction.

Frex Tax Fees

Frexalso follows the same approach, with no tax for personal remittances from the USA to India. This makes Frex a straightforward option for sending money across borders without worrying about hidden tax costs.

Which Service Makes Dealing with Taxes Easier: Remitly, Western Union, or Frex?

All three platforms, Remitly, Western Union, and Frex, offer tax-free personal remittances from the USA to India. However, Frex stands out with its transparency, ensuring no hidden charges or US remittance tax implications, providing the clearest and simplest transfer experience.

Security: Western Union vs Remitly vs Frex

Western Union Security Compliance

Western Union ensures identity verification and uses encryption to protect data. The service is also PCI DSS compliant and offers a fraud hotline for user support. Western Union is FCA regulated, ensuring it meets global standards for secure financial transactions.

Remitly Security Compliance

Remitly ensures account verification for security and trust. It uses encrypted server connections to protect all transactions and is fully KYC compliant for user verification. The service is FCA regulated in the UK and registered with HMRC, ensuring compliance with global financial standards.

Frex Security Compliance

Frex is compliant with FinCEN USA, FIU India, and follows global FATF guidelines. It utilizes 256-bit encryption to safeguard user data and is partnered with Plaid for additional fraud protection. Frex is licensed and fully regulated, offering a safe and secure platform for international transfers.

Which Platform Offers the Best Security Compliance: Remitly, Western Union, or Frex?

Frex stands out with its comprehensive adherence to FinCEN USA, FIU India, and global FATF guidelines.

Customer Support: Remitly vs Western Union vs Frex

Remitly Customer Support

Remitly offers 24/7 live chat and email support, ensuring customers can get assistance at any time. The mobile app is designed to be user-friendly, making it easy to resolve issues quickly. For more complex inquiries, phone support is also available in different languages, including English and Spanish, providing a comprehensive support system.

Western Union Customer Support

Western Union provides a wide range of support options, including 24/7 phone and email support. It also offers in-person assistance at any of their global agent locations, which is a unique feature that digital-only services can’t match. This combination of online and face-to-face support ensures customers can easily resolve issues no matter where they are.

Frex Customer Support

Frex features in-app chat and human support during business hours, providing quick help for failed or delayed transfers. Its efficient digital support system ensures that users can resolve issues quickly through chat or email. Frex offers a responsive and straightforward customer service experience.

Which App Provides the Best Customer Support: Remitly, Western Union, or Frex?

Frex stands out with its fast, responsive in-app chat and human support during business hours.

Verdict: Western Union and Remitly Are Good, But Frex Outperforms on Value

After comparing Remitly, Western Union, and Frex across exchange rates, fees, and speed, the choice is clear. Each platform offers reliable services for sending money from the United States to India, but they cater to different needs.

Here’s how to determine which app is best for your specific transfer requirements.

When to Choose Frex?

Frex is the best choice for users who prioritize value and transparency in their money transfer to India from the USA. Here’s when to pick Frex:

- Competitive Exchange Rates: If you want the best rates without hidden markups, Frex is the top contender.

- Bank Account Transfers: Best for sending money directly to a bank account.

- Instant Transfers: Ideal for users needing to send instant transfers.

- Clear Fees: If you want to see all fees upfront before committing to the transfer.

- Digital-Only: Perfect if you don’t require cash pickup and prefer a fully digital service.

Ready to transfer money from the United States to India? Download the Frex app today and start sending money with the best rates and no hidden fees.

When to Choose Remitly?

If you’re looking for an easy-to-use mobile platform that offers flexible options for your transfer, Remitly is an excellent choice. Here’s when it makes sense:

- Promotional Rates: Ideal if you want to take advantage of new user promotions for your first transfer.

- Mobile Convenience: Perfect for users who prefer managing their transfers through a sleek and simple mobile app.

- Flexible Service: Choose between Express transfers for speed and Economy transfers for lower costs.

- Quick Delivery: Use debit cards to fund your transfer for faster processing.

- Pickup or Deposit: If your recipient can pick up the funds or receive them via a bank deposit at one of Remitly’s partner locations.

When to Choose Western Union?

For those who need the reliability of a traditional service with a huge network, Western Union is the go-to. It’s particularly useful when:

- Cash Pickup: If your recipient needs to collect their money at one of 500,000 agent locations worldwide.

- In-Person Assistance: Perfect for users who prefer setting up transfers in person.

- Remote Destinations: Use the Western Union app for sending money to exotic or remote locations.

- Larger Transfers: Ideal for transfers up to $50,000, especially with agent assistance.

- Hybrid Experience: A blend of a functional money transfer app and a massive agent network gives users flexibility.

In short, Remitly offers flexibility, Western Union excels with its global network, but Frex steals the spotlight with instant transfers and no hidden fees.

Ready to get the most out of your transfers? Download the Frex app today from the App Store for faster, fee-free transfers at the best rates!

Conclusion

When choosing a money transfer service, it all comes down to what matters most to you, whether that’s the best exchange rates, speed, or convenience. If value is key, look for services with clear fees and competitive rates, especially for digital transfers. If you need flexibility, consider services that offer cash pickup or higher transaction limits.

Take the time to understand your options and find a service that fits your needs perfectly. By making an informed choice, you can save both time and money. Start exploring today and make your next transfer as smooth and cost-effective as possible.

Frequently Asked Questions

Which is better, Remitly or Western Union?

Both services are reliable for sending money to India. Remitly offers great exchange rates for bank transfers, while Western Union excels with cash pickup options. Compare rates and transfer speed on the day to determine the best deal.

Are there hidden charges with Remitly, Western Union, or Frex?

Remitly and Western Union may have hidden charges, such as fluctuating exchange rates and extra fees for expedited services. Frex, on the other hand, offers zero fees, ensuring no hidden charges or surprises.

How does Western Union set exchange rates?

Western Union sets exchange rates by analyzing various factors, including market trends, currency fluctuations, and operational costs. They typically offer a rate that includes a markup over the market rate, ensuring profitability while remaining competitive in the remittance sector.

Is Remitly faster than Western Union for transferring money?

Remitly often offers quicker transfer speeds compared to Western Union, especially for online transactions. While some transfers through Western Union can be instant, others may take longer. Ultimately, the speed depends on the chosen service option and destination country.

Do Remitly or Western Union offer better customer support?

Both Remitly and Western Union provide 24/7 support, but Remitly focuses on online chat and email, offering faster responses. Western Union offers phone support and in-person assistance, making it better for users who prefer traditional methods.

Are there differences in how easy it is to use Remitly versus Western Union?

Yes, Remitly offers a user-friendly mobile app for quick, digital transfers, while Western Union uses both its app and physical locations. Choose based on whether you prefer a digital-first experience or in-person support.

Can Remitly send to Western Union?

Remitly cannot send money directly to Western Union. However, you can send funds to a bank account number or pickup location through Remitly. If your recipient prefers cash pickup, you would need to choose Western Union instead for this service.

Is Remitly better than Western Union?

Remitly is better for digital transfers with its competitive exchange rates and simple mobile app, while Western Union is preferable for cash pickups with its extensive agent network. The choice depends on your transfer needs.

Is Frex the fastest for international transfers?

Frex offers instant transfers within minutes at no extra charge, making it an excellent option for those needing quick digital transfers. Unlike Western Union or Remitly, Frex’s speed doesn’t come with hidden fees or complex options.

How do the fees compare between Remitly, Western Union, and Frex?

Remitly typically has lower fees for digital transfers, while Western Union can be more expensive, especially for cash services. Frex, however, offers zero fees, live market exchange rates, and instant transfers, making it the most cost-effective option.

Leave a Reply