Key Highlights

- Wise offers transparent mid-market pricing and predictable costs for every transfer.

- Remitly provides flexible speed options with promotional benefits for new users.

- Western Union delivers wide cash pickup access and strong global reach.

- Frex stands out with real-time rates, zero fees, and instant or same-day delivery.

- Exchange rates vary across platforms and directly affect how much your recipient receives.

- Transfer fees and payment choices can significantly change the final amount delivered.

- Each provider supports secure, tax-free personal transfers with reliable compliance measures.

- Frex often gives the best overall value through speed, transparency, and no additional charges.

Sending money home should feel simple, yet many people end up comparing apps, double checking fees, and refreshing exchange rates just to figure out what they will actually pay. The process often feels more confusing than it should be.

The challenge grows once you notice how differently each service handles pricing, delivery timelines, and rate markups. What looks like a great deal at first can turn into a smaller payout after transfer fees or currency margins are applied.

This blog breaks down these differences clearly so you can choose the right service with confidence. By comparing Wise, Remitly, and Western Union side by side, you will see which platform gives you the smoothest experience and the best overall value.

How Do Wise, Remitly, And Western Union Compare In 2026?

Choosing the right platform can feel overwhelming when the features look similar on the surface. Comparing Wise vs Western Union vs Remitly side by side helps you clearly understand how each service handles pricing, speed, and reliability.

Here is a simple comparison to help you evaluate them at a glance.

| Factor | Wise | Remitly | Western Union |

|---|---|---|---|

| Exchange Rate | • ₹89.75 with no markup • Based on real market rate | • ₹90.54 for the first 6000 USD of your transfer. • ₹90.27 applies to the rest of the transfer.• Includes a small markup for regular transfers | • Around ₹90.53 per USD, depending on the day • Rate adjusts with market conditions |

| Fees | • Wise fees start around $7.33 via ACH • Higher fees apply for debit card or card payments | • Free on the first transfer • $3.99 for transfers below $1,000, and after that, it’s zero fees. | • $0–$100 depending on payment method and delivery type • Fees may rise for instant or card-funded transfers |

| Speed | • Typically 1–2 business days • Timing depends on payment method and bank processing | • Express transfers can arrive in minutes • Economy transfers take 3–5 business days | • Cash pickup often within minutes • Bank deposits usually take 1–5 business days |

| Tax | • Personal transfers are generally tax-free • Large transfers may require reporting under US gift tax rules | • Personal remittances are generally tax-free • Check tax implications if sending large amounts | • Personal transfers are typically tax-free • Verification may be required for larger transfers |

| Transfer Limits | • Up to $1,000,000 via wire (with verification) • Higher maximum limits for verified users | • Up to $100,000 per transfer (with verification) | • $3,000 for unverified users • Up to $50,000 for verified users |

| Security | • Globally regulated and monitored • Strong encryption and fraud prevention | • Licensed and regulated in the United States • Uses KYC and AML compliance protocols | • Long track record of global compliance with KYC and AML • Secure infrastructure for online and cash pickup transfers |

| Delivery Options | • Bank transfer only • No cash pickup or wallet options | • Bank deposit, cash pickup, mobile wallets • Delivery options vary by country and payout method | • Bank deposit or cash pickup at many locations across India • Wide network of cash pickup locations |

| Support | • Help center and live chat support • No phone support | • 24/7 chat and email support via the Remitly app or website • Response times may vary | • Phone and live chat support available for help with transfers and account issues. |

*Disclaimer: Exchange rates, fees, and delivery timelines are subject to change based on market conditions and provider updates. Always review the latest pricing details and terms of use on each platform before completing your transfer.

| Why Frex Stands Out Among Leading Transfer ServicesSending money shouldn’t feel confusing or expensive, yet most platforms make you deal with hidden fees, slow delivery, and unpredictable exchange rates. Frex solves this by giving you real-time rates, zero fees, and fast, reliable transfers that ensure your recipient gets the full amount every time.With real-time rates and an easy process from start to finish, Frex focuses on speed, transparency, and reliability for every transfer.Download the Frex app on your iPhone today |

|---|

Wise vs Remitly vs Western Union vs Frex: Which Money Transfer App Offers the Best Value in 2026?

When you compare these platforms more closely, the differences in cost, speed, and overall experience become much clearer. This breakdown helps you understand which service offers the strongest value when you need to transfer money from the United States to India and want a reliable provider.

Here is how each one performs across the most important factors.

Exchange Rate Comparison: Wise vs Remitly vs Western Union vs Frex

Wise Exchange Rate

Wise offers around ₹89.75 per USD, following the real market rate with no markup. This helps you know the exact value of your transfer before sending it.

Remitly Exchange Rate

Remitly provides a promotional rate of ₹90.59 per USD for new customers. After the first transfer, the rate shifts to its standard pricing, which includes a small markup.

Western Union Exchange Rate

Western Union currently offers about ₹90.53 per USD. The Western Union USD to INR currency exchange rate updates throughout the day and may include a minor margin depending on timing and payment method.

Frex Exchange Rate

Frex offers the best exchange rate for USD to INR with ₹91.49 per USD, updated in real time with no added margin. This helps maximize the amount your recipient receives.

Which Service Stands Out With the Best Exchange Rate: Frex, Wise, Remitly, or Western Union?

Frex clearly offers the best exchange rate at ₹91.49 per USD, giving users the highest value for every transfer compared to Wise, Remitly, and Western Union.

Looking for the simplest way to transfer money home? Check out our guide on How to Send Money to India from USA Without Hassle.

Fee Comparison: Wise vs Remitly vs Western Union vs Frex

Wise Fees

Wise fees vary based on the payment method. For a $1,000 transfer, ACH costs about $7.33, wire transfers cost $11.72, and card payments are higher. Wise shows all fees clearly before you confirm your transfer.

Remitly Fees

Remitly usually charges around $3.99 for transfers below $1,000, and the fee is waived for your first transfer. Costs vary based on whether you choose Economy or Express.

Western Union Fees

Western Union fees range from $0 to $100, depending on how you fund the transfer and how the recipient receives the money. Fees are generally higher for card-funded transactions.

Frex Fees

Frex keeps it simple with zero fees when you send money to India from the USA, regardless of payment method or delivery time.

Which App Offers the Lowest Transfer Fees: Frex, Wise, Western Union, or Remitly?

Frex takes the lead with no fees at all. Wise, Remitly, and Western Union each charge variable fees based on payment type and transfer details.

Speed Comparison: Wise vs Remitly vs Western Union vs Frex

Wise Transfer Speed

Wise usually completes transfers within 1-2 business days, depending on your payment method and the receiving bank.

Remitly Transfer Speed

Remitly delivers Express transfers in minutes, while Economy transfers typically arrive in 3-5 business days.

Western Union Transfer Speed

Western Union offers near-instant cash pickup in most cases, and bank deposits generally take 1-5 business days.

Frex Transfer Speed

Frex provides instant transfers or completion within the same day, making it one of the fastest ways to send money to India from the USA.

Which Is the Fastest Way to Transfer Money: Wise, Remitly, Western Union, or Frex?

Frex is the fastest option, offering instant or same-day delivery for most transfers, making it quicker than Wise, Remitly, and Western Union.

Tax: Wise vs Remitly vs Western Union vs Frex

Wise Tax Policy

Wise treats personal transfers as tax-free. Larger amounts may require additional verification depending on regulations.

Remitly Tax Policy

Remitly generally supports tax-free personal transfers. High-value transactions may need extra documentation based on local rules.

Western Union Tax Policy

Western Union transfers are typically tax-free for personal use. Verification steps may apply for higher amounts.

Frex Tax Policy

Frex processes personal remittances without tax deductions. Compliance checks apply when sending larger transfers.

Which Platform Handles Taxes Best: Wise, Remitly, Western Union, or Frex?

Frex handles taxes best by offering the clearest, most straightforward guidance during the transfer process, even though all four services support tax-free personal transfers.

Want to avoid unnecessary tax confusion while sending money home? Read our guide on How to Transfer Money from the USA to India Without Tax.

Security Comparison: Wise vs Remitly vs Western Union vs Frex

Wise Security Compliance

Wise follows strict global financial regulations and uses advanced encryption to safeguard customer data. Identity verification is required for higher-value transfers, and every international money transfer is monitored to ensure it remains secure and traceable.

Remitly Security Compliance

Remitly is licensed in the United States and uses Know Your Customer and Anti-Money Laundering checks to confirm user identity. Its system constantly reviews transfers to detect unusual activity and protect users from potential risks.

Western Union Security Compliance

Western Union operates under long-established global regulatory standards and maintains strong KYC and AML procedures across its network. Its security framework is designed to verify users, protect personal information, and support secure transfers across a wide range of countries.

Frex Security Compliance

Frex uses 256-bit encryption along with verified banking connections to protect every transfer. It complies with major regulatory bodies, including FinCEN and FIU guidelines, and applies continuous monitoring to keep high-value transfers safe.

Which is the Most Secure Platform: Wise, Remitly, Western Union, or Frex?

Frex is the most secure platform, combining modern encryption with strict multi-jurisdiction compliance to offer stronger protection and reliability than Wise, Remitly, or Western Union.

Customer Support: Wise vs Remitly vs Western Union vs Frex

Wise Customer Support

Wise provides support through live chat and its online help center. Users can find guidance for common questions such as transfer delays, fee information, and account-related issues directly within the platform.

Remitly Customer Support

Remitly offers 24/7 chat and email support to help users with account verification, delivery updates, and payment concerns. Response times are generally quick for both new and returning customers.

Western Union Customer Support

Western Union gives users multiple ways to get help, including online chat and country-specific phone numbers for regions such as the USA and Canada. Its support team can assist with issues like delays or declined transfers, and users can report app or website errors by sharing screenshots and error codes for faster troubleshooting.

Frex Customer Support

Frex provides direct in-app support with access to live human assistance during business hours. Its integrated chat helps users resolve transfer details or account issues quickly without needing to leave the mobile app.

Which Platform Offers the Best Customer Support: Wise, Remitly, Western Union, or Frex?

Frex clearly wins by offering the best customer support thanks to its fast, in-app human assistance and simplified issue resolution.

Want to know how Frex compares to Wise? Check out our comparison on Remitly vs Wise vs Frex to know more.

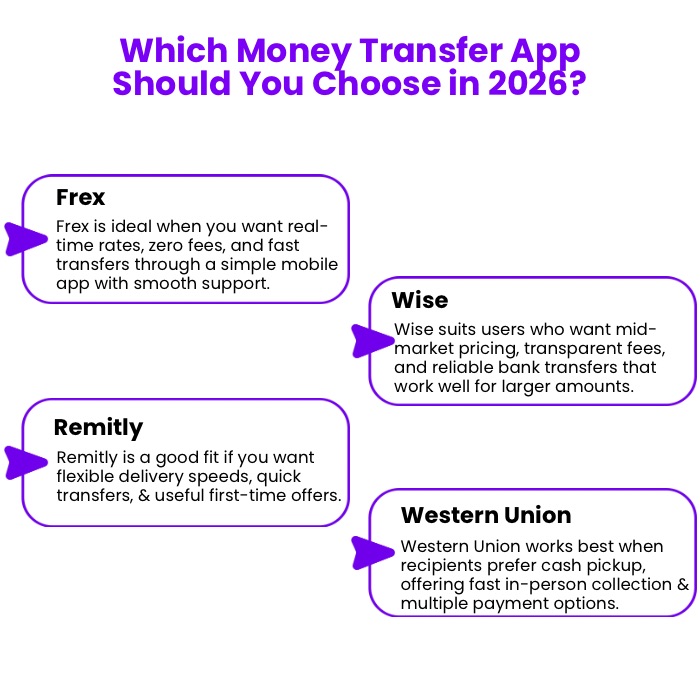

Wise vs Remitly vs Western Union vs Frex: Which App Should You Choose in 2026?

Choosing the right platform depends on what you value most. Each service has its strengths, whether you prioritize low costs, fast delivery, or flexible delivery options. Understanding how they differ makes it easier to decide which one works best for your needs, especially when you are looking for the best app to send money to India from the USA.

When To Choose Frex?

Frex works well if you want a smooth experience with real-time rates and no surprises. Frex is the best choice when you want:

- Zero fees with transparent rate updates

- Offers the highest exchange rate and security

- Instant or same-day transfers

- Easy money transfers through a simple mobile app

- Strong support with clear guidance when needed

- Ideal for users who want predictable results from start to finish

Download the Frex app on the App Store now.

When To Choose Wise?

Wise is a great fit for users who value accuracy and clarity in every transaction. Choose Wise for:

- Mid-market pricing without hidden fees

- Clear fees shown before you confirm

- Reliable bank transfers with strong visibility

- Great for large transfers that need precision

When To Choose Remitly?

Remitly is a good choice if you prefer flexibility in delivery time and cost. Choose Remitly when you want:

- Express transfers that arrive within minutes

- Economy transfers that cost less

- Clean and intuitive Remitly app experience

- Useful promotions for your first transfer

- Helps users who want control over both speed and pricing

When To Choose Western Union?

Western Union is practical when your recipient prefers collecting funds in person. Choose Western Union if you are looking for:

- Large network of cash pickup locations across India

- Cash pickup available within minutes

- Multiple payment options for added flexibility

- Good for situations where bank access is limited

- Helpful for users who want both digital and in-person delivery choices

In summary, Wise offers clear pricing, Western Union provides flexible payout options, and Remitly delivers convenient speed choices. Frex outperforms them all with fast delivery, zero fees, and strong overall value.

Download the Frex app now to experience better, zero-fee transfers from the US to India today.

Final Thoughts

Choosing the right money transfer service comes down to how much value you keep after the transfer is complete. Wise delivers clarity, Remitly offers flexible speeds, and Western Union provides broad access through different payout options. Frex brings these strengths together by giving you a simple way to send funds directly to a bank account without an upfront fee or additional fees that reduce the amount of money your recipient receives, making it the best option for many users.

With real-time pricing and strong exchange rates, Frex offers an option worth considering alongside other money transfer providers. Review each platform’s speed, security, and costs to make an informed decision about which service delivers the best value for your needs.

Frequently Asked Questions

What is the best money transfer service for larger amounts?

For higher value transfers, Wise is often preferred because it uses mid-market pricing and gives transparent cost breakdowns. Remitly also supports large transfers with verification, while Western Union allows higher limits for verified users and offers flexible payout methods.

Which is better, Wise or Western Union?

Wise is usually better for users who want transparent pricing and predictable rates, especially for online transfers. Western Union is helpful when you need cash pickup or flexible delivery methods. Frex offers another strong option if you want fast delivery and no fees.

Which app is best to send money internationally?

If you prefer speed, clarity, and strong value, Frex is a strong choice because it provides fast delivery, simple pricing, and reliable rates. Other platforms like Wise, Remitly, and Western Union also work well, depending on your preferred delivery method and budget.

Which is better for sending money internationally: Wise, Remitly, Western Union, or Frex?

Wise offers transparent rates, Remitly provides flexible delivery speeds, and Western Union is ideal for users who need cash pickup. Frex stands out if you want fast transfers, real-time pricing, and a smooth experience across different transfer needs.

Are there hidden charges with Wise, Remitly, Western Union, or Frex?

Wise shows its fees upfront, Remitly’s costs vary based on speed and method, and Western Union may factor some charges into its exchange rates. Frex keeps pricing simple with zero fees and real-time rates, helping you avoid hidden costs and send the full amount with confidence.

Is Remitly safe to send money?

Yes, Remitly is safe to use. It is licensed in the United States, follows strict verification checks, and uses encryption to protect user data. Frex, Wise, and Western Union, also follow regulated security standards to ensure secure and compliant money transfers.

Which money transfer app is easier to use: Wise, Remitly, Western Union, or Frex?

All four apps are user-friendly for international transfers, but Frex offers the simplest experience with fast setup, real-time rates, and quick transfers in a streamlined interface. Wise and Remitly are also easy to navigate, while Western Union includes more steps due to multiple payout options.

Which service offers the best exchange rates: Wise, Remitly, Western Union, or Frex?

Frex typically provides the strongest exchange rates with real-time pricing and no added margins, making it a better option. Remitly may offer promotional rates for new users, Western Union adjusts rates throughout the day, and Wise uses the mid-market rate without hidden markups.

Leave a Reply