Key Highlights

- Multiple options make instant money transfer from the USA to India possible, including banks, instant money transfer apps, digital wallets, online services, P2P platforms, and cash pickup.

- Express transfers funded by debit cards are usually the fastest, while standard bank transfers may take one to four business days to reach India.

- Transfer fees and exchange rates vary by service and payment method, making it important to compare total costs before confirming an instant transfer.

- Instant money transfer services offer added benefits such as predictable delivery times, ease of use, multiple payout options, and 24/7 availability.

- Common limitations include transfer limits, payment method restrictions, exchange rate markups, bank compatibility issues, and verification-related delays.

- Using regulated providers with encryption, fraud monitoring, and strong authentication helps ensure instant transfers from the USA to India remain secure.

Managing urgent payments or supporting family in India from the USA often requires speed and certainty. Delays, unexpected fees, and complex banking processes can quickly turn a simple transfer into a frustrating experience, especially when funds are needed immediately.

With so many transfer options available today, choosing the right one is not always straightforward. Banks, mobile apps, digital wallets, and online transfer services all promise fast delivery, but processing times, exchange rates, and transfer limits can vary widely depending on the method you choose.

This blog explains how to transfer money from the USA to India instantly by breaking down the fastest transfer methods, best apps, fees, benefits, safety measures, and common mistakes. It aims to help you make informed decisions for quick, secure, and cost-effective transfers.

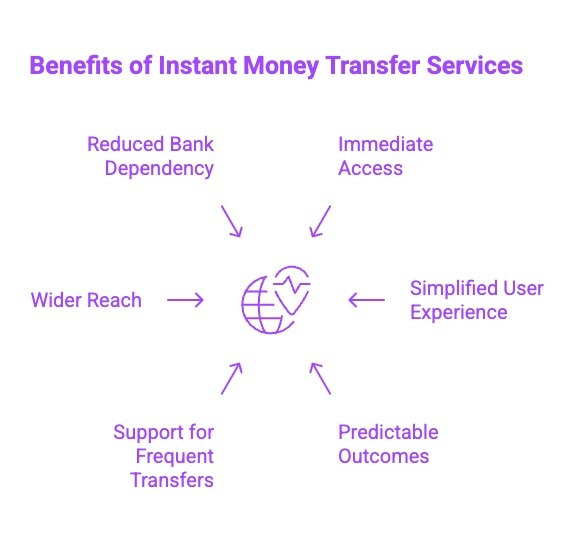

What Are the 6 Benefits of Using Instant Money Transfer Services from the USA to India?

Instant money transfer services go beyond speed. They are designed to improve the overall transfer experience, especially for frequent senders and urgent needs.

1) Immediate Access to Funds

Recipients in India can access money almost instantly, which is critical for emergencies, medical expenses, or time-sensitive payments. There is no waiting period, helping families and businesses act quickly.

2) Simplified User Experience

Most instant money transfer apps are built for ease of use. From onboarding to payment confirmation, the process is intuitive, reducing errors and making cross-border transfers stress-free, even for first-time users.

3) Predictable Transfer Outcomes

Instant services clearly show delivery time, fees, and exchange rates before confirmation. This predictability helps users plan transfers confidently without worrying about delays or unexpected deductions.

4) Better Support for Frequent Transfers

For NRIs and regular senders, instant services offer saved recipients, repeat transfers, and transfer history. This makes recurring payments faster and more efficient compared to traditional methods.

5) Wider Recipient Reach

Instant transfers support multiple payout options such as bank accounts, mobile wallets, and cash pickup. This ensures funds reach recipients regardless of their banking access or location within India.

6) Reduced Dependency on Traditional Banks

By avoiding slow banking channels, instant transfer services eliminate processing bottlenecks. This is especially useful during weekends, holidays, or outside standard banking hours.

Beyond speed, instant money transfer services from the USA to India deliver convenience, predictability, and accessibility, making them a practical choice for both urgent and everyday international payments.

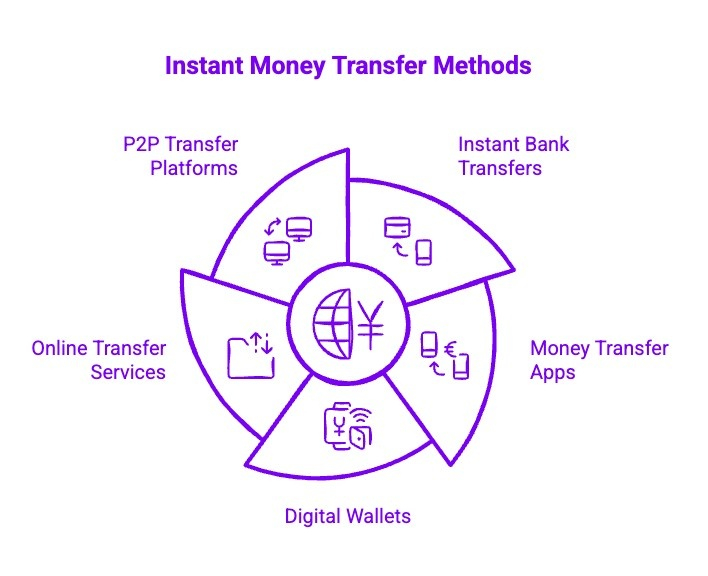

How to Transfer Money from USA to India Instantly?

Sending instant money transfers to India from the USA has become easier than ever. With several fast and secure options available, you can choose the best method depending on your needs.

Let’s explore some of the quickest and best ways to send money:

1) Instant Bank Transfers

Sending money via instant bank transfers ensures that the funds are processed in real-time, allowing the recipient to receive the amount of money within minutes. This method leverages a bank’s real-time payment system, which minimizes delays and ensures a smooth transaction experience.

Process

To initiate an instant bank transfer, the sender typically needs to log into their bank’s online platform or mobile app. After entering the recipient’s bank details and confirming the amount, the transfer is processed immediately, with funds reaching the recipient’s account in real-time.

Once the transfer is complete, the recipient can access the funds in their bank account without delay, making this method ideal for those needing a quick transaction.

Pros and Cons

Now, let’s consider the advantages and potential drawbacks of using instant bank transfers for sending money to India.

| Pros | Cons |

| Quick and reliable | May require the sender and receiver to have accounts with specific banks offering real-time services |

| Secure due to bank protocols | Fees may apply, depending on the bank |

|---|---|

| Suitable for large transfers | – |

2) Money Transfer Apps

Money transfer apps make sending money fast and easy. With many options like Frex, PayPal, Remitly, and Xoom, these apps allow you to send funds almost instantly with just a few taps on your smartphone.

Process

To send money via an app, the sender simply needs to link their bank account or credit card to the app. After entering the recipient’s details, the sender confirms the transaction, and the money is transferred to the recipient’s account or wallet in real-time.

This process is designed to be quick, with minimal setup required, making it a popular choice for those who need to transfer money on the go.

Pros and Cons

Here’s a look at the pros and cons of using money transfer apps for your transactions:

| Pros | Cons |

|---|---|

| Convenient and easy-to-use interface | May involve higher fees for instant transfers |

| Real-time tracking | Currency exchange rates can vary, impacting the final amount received |

| Competitive exchange rates | – |

3) Digital Wallets

Digital wallets like Google Pay, Apple Pay, and Paytm offer an easy way to send money with just a few taps on your phone. These services allow users to transfer funds instantly, making them ideal for people who prefer a quick, tech-savvy solution.

Process

To send money through a digital wallet, the sender links their credit card or bank account to the wallet. The recipient can receive the money either into their wallet or directly to their bank account, depending on the service used. The process is simple and requires only a few steps to complete the transfer.

Once the transaction is confirmed, the funds are transferred instantly, enabling immediate use.

Pros and Cons

Let’s explore the advantages and disadvantages of using digital wallets for instant transfers.

| Pros | Cons |

|---|---|

| Instant transfers | Limited to users with digital wallets |

| User-friendly and secure | May have transaction limits or fees for international transfers |

| Available on most mobile devices | – |

For a deeper understanding of the transaction limits that could affect your transfer, check out our guide on the maximum limit for money transfers from the USA to India.

4) Online Transfer Services

Online transfer services like Wise and Revolut provide an efficient way to send money. With competitive exchange rates and low fees, these services allow near-instant transfers that are often cheaper than traditional methods.

Process

The sender initiates a transfer online by entering the recipient’s details and the amount to be sent. After confirming the transaction, the money is transferred through the platform’s network and reaches the recipient’s bank account or wallet in a matter of minutes.

This method is ideal for individuals who value transparency and speed.

Pros and Cons

Now, let’s review the pros and cons of using online transfer services for sending money to India.

| Pros | Cons |

|---|---|

| Transparent fees and exchange rates | Requires internet access to use the platform |

| Fast processing times | May have limits on transfer amounts for specific countries |

| Available for both small and large transfers | – |

5) P2P Transfer Platforms

Peer-to-peer (P2P) platforms like Venmo and Wise let users send money instantly, often with lower fees. By connecting directly to other users, P2P transfers bypass traditional financial institutions, speeding up the process for faster money delivery.

Process

Using a P2P platform, the sender links their bank account or credit/debit card and initiates the transfer by selecting the recipient from their network. Once the transaction is confirmed, the money is transferred instantly to the recipient’s account or wallet.

This method is often a cost-effective and fast way to send money.

Pros and Cons

Let’s break down the pros and cons of using P2P platforms for instant money transfers.

| Pros | Cons |

|---|---|

| Lower fees compared to traditional methods | Limited to users on the same platform |

| Fast, often near-instant transfers | May not be available in all countries or regions |

| Simple to use | – |

To make sure you’re sending money without any hassle, check out our guide on how to send money to India from the USA without hassle for helpful tips and recommendations on simplifying the process.

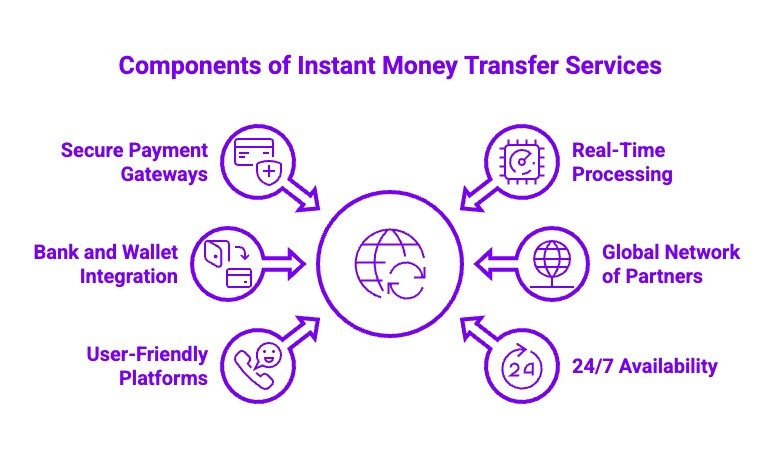

How Do Instant Money Transfer Services Work?

Instant money transfer services make sending funds fast and secure. Here’s how they ensure quick transactions:

- Secure Payment Gateways: These services use encrypted payment gateways to protect your financial and personal details, ensuring secure transactions.

- Real-Time Processing: Transactions are processed in real time, so funds are sent and received within minutes.

- Integration with Banks and Digital Wallets: Instant transfer services integrate with banks and digital wallets to ensure seamless transfers to accounts or mobile wallets.

- Global Network of Partners: A wide network of global partners, such as local banks or agents, helps facilitate quick fund disbursement.

- User-Friendly Platforms: Most services provide easy-to-use platforms or apps to simplify the transfer process with just a few clicks.

- 24/7 Availability: These services are available at any time, ensuring your funds are transferred promptly, day or night.

Instant money transfer services leverage secure systems, real-time processing, and global networks to ensure that your money is sent quickly and safely, no matter when or where you’re transferring.

What Are the Best Apps for Instant Money Transfer from the USA to India?

Several apps are designed to make instant money transfer from the USA to India fast, secure, and convenient. Now, let’s compare Frex with other leading money transfer services to find the best fit for your needs:

| Transfer Fee | Exchange Rate Margin | Additional Fees | Delivery Time | Compliance and Security |

|---|---|---|---|---|

| Frex | Zero fees, Live rate, mid-market rate | No hidden charges | Instant (typically within minutes) | Fully compliant with global regulations. Scured with encryption and fraud prevention. |

| PayPal/Xoom | $2.99 – $4.99 for instant transfers | Slight markup from mid-market rate | Instant (typically within minutes) | Regulated by financial authorities, secure and reliable. |

| Remitly | $0 – $3.99 (depending on payment method) | Competitive rates | Express (Instant, within minutes) or Economy (1-3 business days) | Regulated, complies with financial regulations. |

| Wise | Low fees (typically 0.5% to 1%) | Real-time, mid-market rate | Instant (typically within minutes) | Fully compliant, uses robust security measures. |

| Western Union | $5 – $20 (depending on payment method) | Markup based on transfer amount | Instant (typically within minutes) | Regulated by financial authorities, secure and trusted. |

| Google Pay | Free for linked bank transfers | Slight markup | Instant (typically within minutes) | Compliant with financial regulations and secure. |

The fees for sending money from the USA to India instantly vary depending on the service, payment method, and transfer amount. Always compare these factors to choose the most cost-effective option.

If you’re curious about other options, check out our guide on the best apps for sending money to India from the USA to explore more choices for instant money transfers.

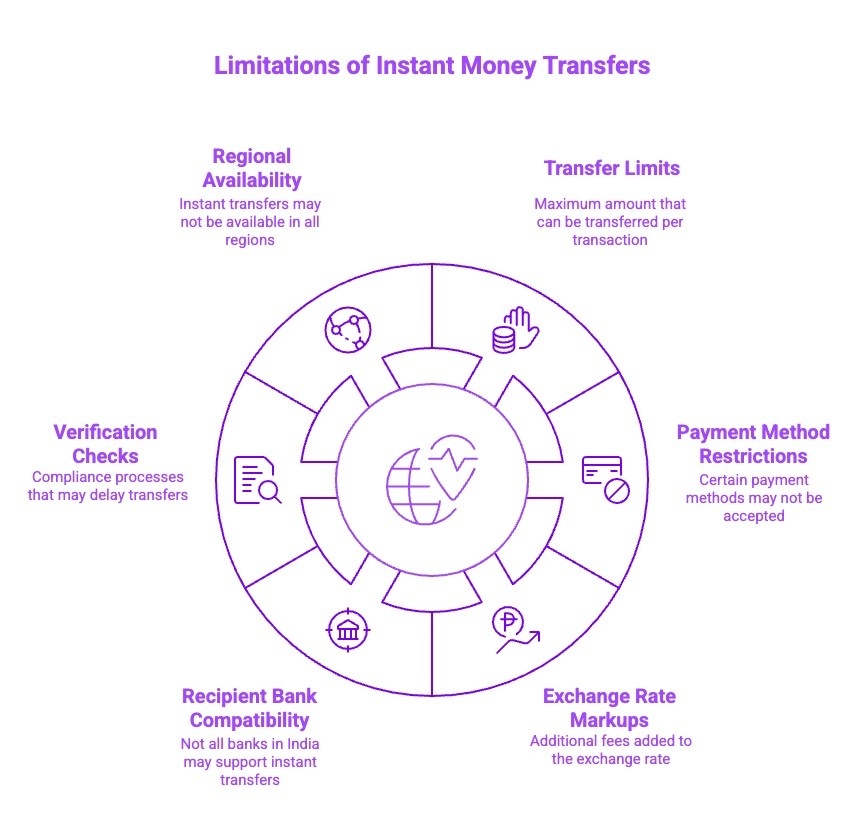

Are There Any Limitations to Instant Money Transfers from the USA to India?

While instant money transfers offer speed and convenience, there are a few limitations users should be aware of before choosing a service.

- Transfer Limits: Most instant transfer services set daily or per-transaction limits, which may restrict sending large amounts at once.

- Payment Method Restrictions: Instant delivery is often limited to debit cards or select payment methods, while bank transfers may take longer.

- Exchange Rate Markups: Some platforms compensate for speed by applying higher exchange rate margins, reducing the final amount received.

- Recipient Bank Compatibility: Not all Indian banks support real-time settlements, which can cause short delays despite choosing an instant option.

- Verification and Compliance Checks: KYC verification or regulatory reviews may temporarily delay transfers, especially for new or high-value transactions.

- Limited Regional Availability: Certain instant money transfer services may not be available in all US states or across all locations in India.

Knowing these limitations helps you choose the most suitable instant money transfer service from the USA to India while avoiding unexpected delays or costs.

What Are the Common Mistakes to Avoid When Sending Money from the USA to India Instantly?

Sending money instantly sounds simple, but small oversights can lead to delays, extra costs, or failed transactions. Being aware of common mistakes helps ensure your transfer from the USA to India goes through smoothly and securely.

- Ignoring Exchange Rate Margins: Focusing only on transfer speed and fees while overlooking exchange rate markups can significantly reduce the amount your recipient receives.

- Choosing the Wrong Payment Method: Some payment options do not support instant transfers. Selecting ACH or standard bank transfers may cause delays despite using an instant platform.

- Entering Incorrect Recipient Details: Small errors in bank account numbers, IFSC codes, or recipient names can lead to failed or delayed transfers.

- Not Checking Transfer Limits: Instant services often have transaction caps. Sending an amount above the allowed limit can result in rejection or processing delays.

- Overlooking Hidden Charges: Some platforms advertise instant transfers but apply extra fees for speed, card payments, or cash pickup.

- Skipping Verification Requirements: Incomplete KYC or identity verification can pause or cancel instant transfers, especially for first-time users.

- Using Unverified Platforms: Choosing lesser-known or unregulated services increases the risk of fraud, data misuse, or failed transactions.

Avoiding these common mistakes helps ensure your instant money transfer from the USA to India is fast, secure, and cost-effective.

Why Is Frex a Smart Choice for Instant Money Transfers from the USA to India?

When sending money from the USA to India, time and transparency are critical. No one wants delays, hidden charges, or complicated processes. Frex is designed for users who value speed, transparency, and simplicity in their international money transfers. With Frex, you can send money instantly to Indian bank accounts with no hidden fees, offering clear pricing, competitive exchange rates, and secure transactions for both urgent and recurring transfers.

Ready to transfer money without delays or surprises? Download the Frex app today and experience seamless transfers with confidence.

Conclusion

Transferring money from the USA to India instantly is now practical and reliable when you choose the right method. Start by deciding how fast the funds are needed, compare fees and exchange rates, and select a trusted instant transfer app or service that fits your payment preferences.

Always double-check recipient details, understand transfer limits, and complete verification steps in advance to avoid delays. For frequent or urgent transfers, using a dedicated instant money transfer app from USA to India can save time and reduce costs. Take action today by choosing a secure provider, setting up your account, and making your next transfer with confidence.

Frequently Asked Questions

What are the limits and fees for instant money transfers from the USA to India?

The limits and transfer fees depend on the service you use. Some platforms allow you to send up to $535,000 USD online. Costs vary based on the transfer amount and payment method, but providers are transparent about any additional fees. Always check the exchange rates, as this impacts the final amount received.

Can I send instant transfers directly from my US bank account to an Indian bank account?

Yes, you can absolutely send a bank transfer from your United States bank account directly to an Indian bank account. To do this, you will need to provide your recipient’s details, including their full name as it appears on their ID, their bank’s name, and their bank account number.

How long does it typically take for an instant transfer to reach India?

To transfer money from the USA to India quickly, the speed depends on the payment method. Frex offers instant transfers with no hidden fees, ensuring fast, secure transactions compared to traditional bank transfers.

Can you send money from the USA to India using digital wallets or cryptocurrencies?

Yes, digital wallets enable easy money transfers using a linked credit card or bank account information. However, cryptocurrencies face regulatory limits, making them less practical for overseas money transfers to a recipient’s bank account in India.

What are the steps to transfer money instantly from the USA to India?

Choose a transaction type, enter the recipient’s name, recipient’s bank account number, Indian Financial System Code, and email address, select currency exchange options, confirm additional information, then authorise payment for instant delivery.

Are there any mobile apps that allow instant money transfers from the USA to India?

Yes, apps like Frex allow instant transfers to Indian banks such as ICICI, Axis, and PNB. It provides fast, secure transfers with no hidden fees, offering a hassle-free experience for users.

Which service offers the best exchange rates for instant transfers from the USA to India?

Services like ICICI Bank and Bank of Baroda offer competitive exchange rates. However, for best exchange rates and no hidden fees, Frex provides live mid-market rates, ensuring you get the best deal.

Can I send money instantly from my US bank account to an Indian bank account?

Yes, you can send money via wire transfer or direct debit to Indian banks like ICICI. For faster transfers, Frex ensures instant transfers at competitive exchange rates with zero hidden fees or charges.

Leave a Reply