Key Highlights

- Transferring money from India to the USA without charges is possible by choosing platforms with no transaction fees and favorable exchange rates.

- Bank-to-bank transfers are the most cost-effective method, reducing the chances of extra charges.

- Compare exchange rates across different providers to ensure you get the lowest rates and the best value.

- Personal transfers are typically tax-free; however, business-related transfers may incur taxes, especially for large amounts.

- Digital wallets and special promotions can significantly reduce transfer costs, offering a transparent pricing experience.

- Consolidating transfers and using loyalty programs can further help reduce transaction fees and maximize savings.

- Always verify recipient details to avoid delays or extra charges during bank wire transfers.

- Frex offers a straightforward, fee-free way to send money internationally, ensuring ease of use and transparency.

Ever wondered why sending money from India to the USA feels like you’re losing more than you’re sending? Hidden fees, high transaction costs, and unpredictable exchange rates can quickly add up, leaving you with far less to transfer. It’s frustrating when all you’re trying to do is help a loved one or cover important expenses, only to watch a large chunk of your money disappear.

But it doesn’t have to be this way. With the right strategy, you can send money efficiently, avoid those dreaded fees, and ensure your loved ones get exactly what you intend. Whether you’re supporting family, paying bills, or covering education costs, there are smart ways to make your transfer hassle-free and cost-effective.

This blog aims to guide you through the steps of transferring money from India to the USA without incurring unnecessary charges or taxes. You’ll discover the best strategies, tips, and options to maximize your savings, ensuring your money reaches its destination with ease and efficiency.

Can You Really Send Money Without Any Charge from USA to India?

Now that you know why fees exist, the next question is whether it’s truly possible to send money from the USA to India without any charges at all. The good news is that it can be done, but with a few important caveats.

Many platforms advertise “zero-fee” or “no-charge” transfers, yet still recover costs through exchange rate markups or specific conditions. Understanding what “fee-free” actually means will help you identify genuine zero-cost options. To understand when a transfer is genuinely free, here are the situations where zero-fee transfers are actually possible:

- Promotional Fee Waivers: Some services offer temporary zero-fee transfers for first-time users or special campaigns.

- Mid-Market Rate Providers: Certain fintech companies provide the real exchange rate with no markup, making transfers nearly cost-free.

- Bank Partnerships: Select U.S. banks collaborate with Indian banks to eliminate remittance fees for eligible customers.

- ACH-Based Transfers: Providers may waive fees when transfers are funded through ACH instead of cards.

- Referral or Reward Credits: Cashback, referral bonuses, or platform credits can offset or eliminate transfer costs.

In short, sending money from the USA to India without charges is possible; you just need to choose the right methods and verify that “zero-fee” truly means what it claims.

What are the 4 Best Ways to Send Money From USA to India Without Charges?

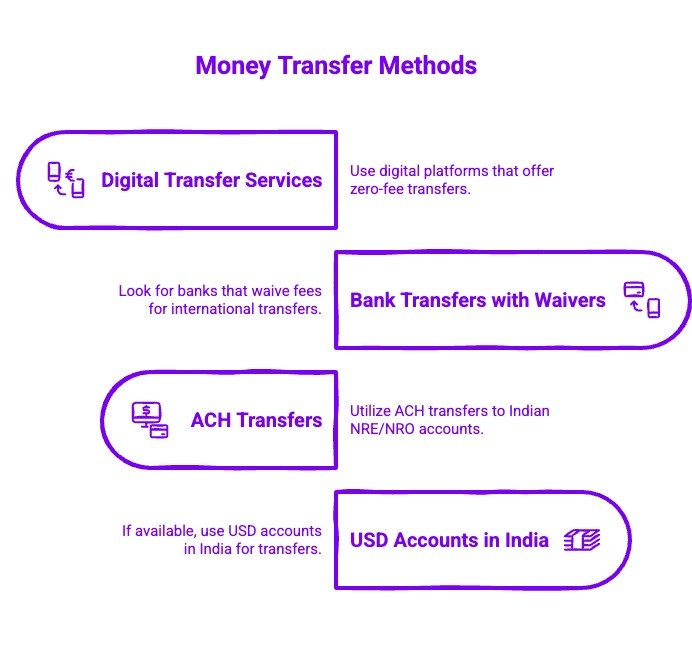

Once you understand what makes a transfer free and where hidden costs typically appear, it becomes much easier to identify the best methods. Below are the four most effective ways to ensure your transfer is genuinely cost-free:

1) Zero-Fee Digital Transfer Services

Sending money internationally can be expensive, but digital platforms like Frex offer zero-fee transfers. These services provide transparent exchange rates, fast processing times, and no hidden charges. Frex ensures that you keep more of your money for the recipient.

2) Bank-to-Bank Transfers with Fee Waivers

Certain banks offer fee-waiver programs for international transfers, especially when partnered with Indian banks. These partnerships can eliminate wire transfer fees for eligible customers. While slightly slower than fintech options, these transfers are secure and cost-effective, ideal for premium accounts.

3) ACH Transfers to Indian NRE/NRO Accounts

ACH transfers are one of the most economical ways to send money to India, particularly for NRIs with NRE or NRO accounts. ACH is often fee-free compared to debit or credit card payments, offering a simple, cost-effective solution with minimal processing time.

4) Using USD Accounts in India (If Applicable)

NRIs with USD-denominated accounts in India can avoid foreign exchange fees and transfer costs. Sending funds in USD directly eliminates conversion charges, offering a cost-effective way to manage large transfers. It’s ideal for those who wish to minimize losses on currency exchange.

By choosing the right method from these four options, you can easily send money from the USA to India without paying unnecessary charges, and keep more of your money where it belongs.

Step-by-Step Guide: How to Send Money to India from USA Without Charges?

If you’re wondering how to send money to India from USA without charges, it’s important to understand the typical charges for sending money from USA to India. By choosing the right method and paying attention to key details, you can eliminate fees and avoid hidden exchange rate costs.

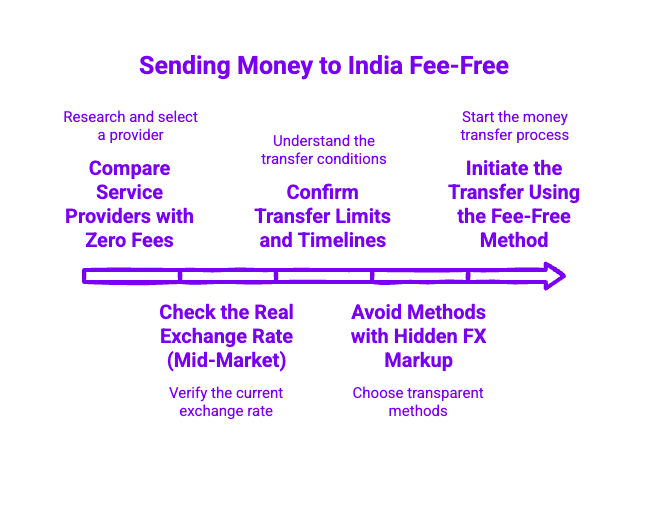

Here’s a practical, step-by-step guide to help you complete a truly fee-free transfer:

1) Compare Service Providers with Zero Fees

Start by identifying reputable platforms that genuinely offer zero-fee transfers and transparent pricing. Services like Frex stand out by offering no hidden fees, competitive exchange rates, and fast processing times. Comparing these factors will help ensure you choose a reliable, cost-effective option, maximizing the amount your recipient receives. With Frex, you can also access first-time user promotions, making your transfer completely fee-free.

2) Check the Real Exchange Rate (Mid-Market)

Before sending money, confirm the platform uses the actual mid-market rate, the fairest rate available. Many providers advertise “no fees,” but offset this through inflated exchange rates. Verifying the mid-market rate ensures you’re not losing value through hidden markups during conversion.

3) Confirm Transfer Limits and Timelines

Different services may place daily or monthly caps on zero-fee transfers, and processing times can vary. Reviewing these details helps you plan your transfer more effectively. Knowing both the limit and expected delivery time prevents delays and ensures your transaction remains fully free.

4) Avoid Methods with Hidden FX Markup

Even fee-free services may embed costs in their exchange rates. Avoid platforms known for weak FX rates, especially during weekends or off-market hours. Choosing providers that publish transparent, real-time rates ensures you don’t unknowingly pay more through poor currency conversion.

5) Initiate the Transfer Using the Fee-Free Method

After confirming the fee structure, exchange rate, and transfer conditions, proceed with the preferred zero-fee option. Double-check recipient details, funding method, and transfer summary before finalizing. This ensures your transaction is secure, accurate, and truly free from unexpected charges or deductions.

By following these steps carefully, you can confidently complete a transfer while avoiding hidden fees, ensuring your recipient receives the full amount. This approach makes it easy to send money from the USA to India without charges every time.

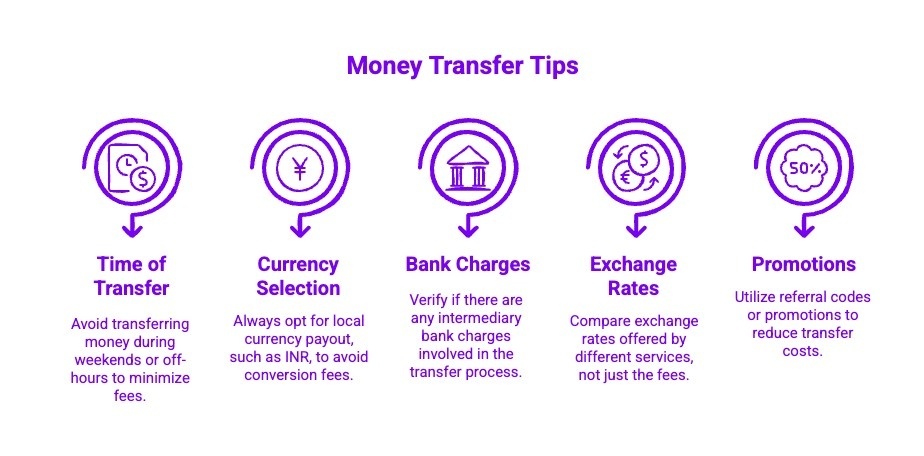

What are Some Tips to Avoid Hidden Fees When Transferring Money?

Even when using fee-free methods, hidden costs can quietly reduce the value of your transfer. Understanding where these fees appear and how to avoid them ensures your recipient gets the full amount.

Here are practical tips to minimize or eliminate hidden charges:

- Avoid Weekend or Off-Hours Transfers: Exchange rates can be less favorable during weekends or off-market hours. Scheduling transfers during standard trading times ensures you benefit from mid-market rates, preventing unnecessary deductions from your transfer.

- Always Choose Local Currency Payout (INR): Sending money in the recipient’s local currency avoids additional conversion fees. Transfers sent in USD may be automatically converted by the recipient’s bank, leading to hidden charges.

- Verify Intermediary Bank Charges: Some international transfers pass through one or more intermediary banks that deduct fees. Check whether your provider uses a direct route to minimize extra costs.

- Compare Exchange Rates, Not Just Fees: A zero-fee transfer isn’t always the cheapest option. Providers may compensate with poor exchange rates, so always compare both fees and FX rates to get maximum value.

- Use Referral Codes or Promotions: Many services offer referral bonuses, promotional codes, or first-time transfer credits. These can help offset costs and reduce hidden fees while keeping your transfers secure and fast.

By following these tips, you can avoid hidden fees and ensure every dollar sent from the USA to India reaches its full value, making your transfers cost-efficient, transparent, and truly fee-free.

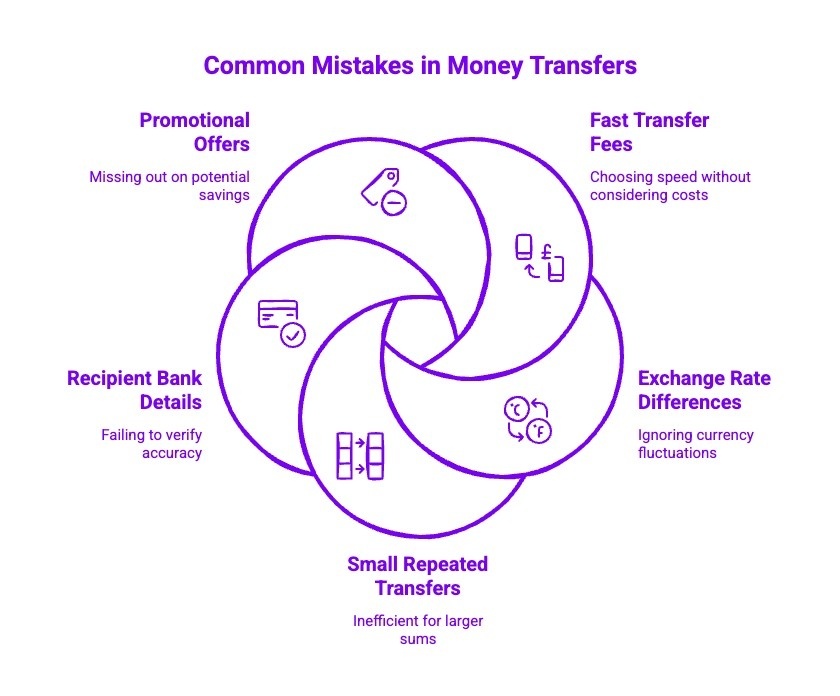

What Are the 5 Common Mistakes to Avoid?

Even when using fee-free methods, many people make simple mistakes that lead to higher costs, delays, or lost money. Being aware of these common pitfalls helps you send money efficiently, safely, and without unnecessary fees:

1) Choosing “Fast Transfer” Options Without Checking Fees

Many providers advertise instant transfers, but speed often comes with hidden costs or higher exchange rate markups. Always compare fees and rates before opting for faster delivery. Sometimes, a slightly slower transfer can save a significant amount in charges.

2) Ignoring Exchange Rate Differences

Even if the transfer fee is zero, poor exchange rates can reduce the money your recipient receives. Check the real mid-market rate and compare providers to ensure you are getting the best value for your money.

3) Sending Small Amounts Repeatedly

Transferring money in very small increments can lead to repeated fees or increased cumulative costs. If possible, batch transfers in larger amounts to minimize per-transfer charges and reduce total costs while staying within provider limits.

4) Not Verifying Recipient Bank Details

Mistyped account numbers or incorrect IFSC codes can lead to delays, rejected transfers, or even loss of funds. Always double-check the recipient’s bank details before sending money to ensure the transfer is smooth and error-free.

5) Overlooking Promotional or Referral Offers

Many users ignore first-time transfer promotions, referral bonuses, or cashback offers. These can often eliminate fees entirely. Always check for available promotions before sending money to maximize savings and reduce hidden costs.

Avoiding these common mistakes ensures your transfers from the USA to India are faster, cheaper, and more secure, helping your recipient receive the full amount without unnecessary delays or hidden charges.

What Are The Exchange Rates Offered By Leading Providers?

Are you wondering how much it really costs to send money from the USA to India? Different providers charge varying fees, offer different exchange rates, and have different transfer speeds. Comparing them carefully helps you find the most cost-effective option.

| Provider | Typical Transfer Fee | Exchange Rate / Markup | Delivery Time | Best For |

|---|---|---|---|---|

| Frex | $0 | Transparent, no markup | Minutes–Hours | Zero-fee transfers with transparent pricing & fast delivery |

| Wise (TransferWise) | ~$2.50–$7.00 (varies by amount) | Close to real mid‑market rate (minimal markup) | ~1–2 business days | Transparent pricing with low total cost |

| Remitly | $0 (Economy) / ~$3.99 (Express) | Slight markup on rate | Minutes (Express) / 3–5 days (Economy) | Zero‑fee economy option & fast delivery choices |

| Western Union | ~$0–$8.99 (online) | Moderate markup | Minutes–3 days | Cash pickup & wide global access |

| Xoom (PayPal) | ~$2.99–$4.99 | Slight markup | Minutes–24 hours | Fast PayPal‑linked transfers |

| XE Money Transfer | ~$0 for >$500 | Mid‑range markup | ~1–4 days | Zero fee on larger transfers |

| MoneyGram | ~$4.99+ | Higher markup | Minutes–Hours | In‑person cash pickup available |

| Traditional Bank Wire | ~$25–$50+ | Higher markup + hidden costs | 3–5 business days | Established bank transfers (often most expensive) |

By answering these questions, you can easily identify the cheapest and most efficient way to send money from the USA to India, ensuring your transfer is secure, fast, and free from unnecessary fees.

Why Choose Frex for Your International Transfers?

Frex offers an easy, fast, and cost-effective way to send money from India to the USA without the hassle of high fees or complicated processes.

With Frex, you can enjoy fee-free transfers, competitive exchange rates, and transparent pricing. Whether you’re sending money for family support, paying hospital bills, or assisting Indian students studying abroad, we ensure your funds reach their destination without hidden charges.

Getting started with Frex is quick and effortless:

- Easy Setup: Download the Frex app from Google Play Store or App Store.

- Quick Identity Verification: Complete a one-time setup by verifying your identity for secure transfers.

- Seamless Bank Linking: Link your bank accounts to enable smooth transfers.

- Instant Currency Conversion: Enter the USD amount, and see the INR equivalent in real time.

- Enhanced Security: Confirm transactions securely with FaceID for added protection.

- Fast Transfers: Funds arrive within minutes in the recipient’s Indian bank account.

- Paperless Process: No paperwork or delays, everything is completed directly within the app.

Download the Frex app now and start sending money smarter, faster, and safer!

Conclusion

Avoiding unnecessary fees and hidden costs is entirely possible if you take a few simple steps. Start by comparing service providers, checking mid-market exchange rates, and confirming transfer limits. Use fee-free digital services, ACH transfers, or USD accounts where applicable. Double-check recipient details, leverage promotions or referral bonuses, and plan your transfers during standard trading hours.

By implementing these strategies, you can confidently send money from the USA to India quickly, securely, and without losing a single dollar to fees.

Frequently Asked Questions

What do I need to send money online to India?

To send money online from the United States to India, you need the recipient’s bank account information, bank account details, Indian financial system code, recipient’s name, mobile number or email address, and a valid payment option like debit card or credit card.

How do I set up my first money transfer from the USA to India?

To set up your first international money transfer, register using your mobile app or online banking, enter your bank account details, recipient’s bank account number, delivery method, amount of money, date of birth, and choose competitive rates with low fees.

Are there any limits to how much money I can send to India at one time?

Limits for sending money to India depend on your account type, country of residence, payment options, and transfer amount. Some providers impose daily or monthly caps, while banks like ICICI Bank or Axis Bank allow higher local bank account transfers.

Is it possible to send money to India from the US without paying currency conversion charges?

Yes, some providers offer competitive rates and great exchange rates for international money transfer. Using local bank account deposits or mobile wallets, you can avoid additional fees and send Indian rupees directly to the recipient’s bank account.

Do first-time users get free transfers when sending money to India from the USA?

Many services, including Xoom accounts or mobile apps, offer first-time users free transfers to India. This promotion applies to bank deposit, cash pickup locations, or mobile wallet options, often limited to a certain transfer amount or delivery method.

How do money transfer services to India from the US compare in terms of fees and charges?

Services differ in fees depending on delivery method, payment options, and transfer amount. Using a debit card, credit card, or Maestro cards may incur additional fees, whereas bank deposits or local bank accounts generally offer low fees and best exchange rates.

Are there any time restrictions or limits for free transfers from the USA to India?

Yes, free transfers often depend on the date, time, and delivery method. Some mobile apps or online banking services limit the transfer amount per day, week, or month. Cash pickup locations or mobile wallets may have additional fees if exceeded.

How to send money from USA to India without fees?

To avoid charges to send money from USA to India, choose platforms offering zero-fee transfers and transparent exchange rates. Many digital services provide fee waivers or promotions, ensuring that your transfer is cost-effective and efficient.

Leave a Reply