Key Highlights

- Money transfers from the USA to India are not taxed by default; tax depends on the source and purpose of funds.

- Transfers for family support, education, medical expenses, personal savings, and gifts from close relatives are generally tax-free.

- The recipient in India is typically responsible for paying taxes, not the sender in the USA.

- Gifts from non-relatives may be taxable if they exceed ₹50,000, and business or investment-related transfers may attract tax.

- Keeping bank statements, transfer receipts, and relationship proof is essential for tax compliance.

- The USA and India have agreements in place to prevent double taxation on cross-border transfers.

- Using platforms like Frex ensures transparency, accurate records, and compliance with tax regulations.

- Understanding reporting requirements and classification rules helps prevent tax-related issues when transferring money.

Transferring money from the USA to India can be a daunting process, especially when it comes to understanding the tax implications. Many people worry about whether their transfer will be taxed, who is responsible for paying the tax, and how to avoid compliance issues.

The confusion often arises because tax liability depends on various factors, including the source of funds, the purpose of the transfer, and the recipient’s residency status. Without a clear understanding of these rules, it’s easy to make costly mistakes that could lead to unexpected tax obligations.

This blog aims to simplify the process by explaining when tax applies to transfers, how to stay compliant with US and Indian tax laws, and what documents are needed to avoid tax-related issues. We’ll help you navigate these complexities and ensure your money transfers are smooth and tax-efficient.

What is US Remittance Tax?

The US remittance tax refers to any potential taxes applied when sending money from the United States to another country. While there is no specific “remittance tax,” certain financial transfers may be subject to reporting requirements under US law.

For instance, if the amount sent exceeds certain thresholds, the sender may need to file forms with the IRS. Additionally, while the remittance itself is not taxable, gifts or income sent abroad may be subject to gift or income tax, depending on the amount and recipient. It’s crucial to consult a tax professional for guidance on compliance.

For more detailed information on US remittance tax, check out this guide on what US remittance tax is and who must pay it.

Who Is Exempt from the US Remittance Tax?

When transferring funds from the USA to India, many individuals may wonder if they are subject to the US remittance tax. Fortunately, not everyone is liable for this tax, and there are certain exemptions. Let’s explore who is exempt from the US remittance tax and how it applies to different situations.

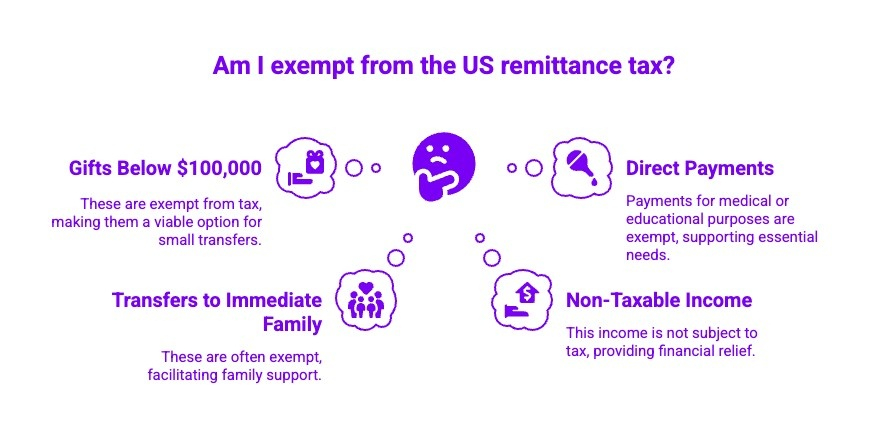

Exemptions from the US Remittance Tax:

- Gifts Below $100,000: If the amount sent is a gift and falls under $100,000, it may be exempt from tax.

- Transfers to Immediate Family: Remittances sent to immediate family members, such as parents, children, and spouses, are generally exempt.

- Non-Taxable Income: Funds that originate from non-taxable sources, such as retirement accounts or personal savings, may not incur remittance tax.

- Direct Payments for Medical or Educational Purposes: Transfers made directly for educational or medical expenses often do not face taxation.

To ensure full compliance and avoid complications, it’s always recommended to seek advice from a tax expert, especially when transferring larger sums or funds that don’t fall within common categories.

How Much Tax Is Involved When Sending Money from the USA to India?

There is no standard tax rate applied to money transfers from the USA to India. The amount of tax, if any, depends on how the transferred funds are classified under Indian income tax laws.

If the funds are considered taxable income, they are taxed according to the recipient’s income tax slab in India. If the transfer is exempt, such as personal savings or eligible gifts, no tax is payable regardless of the amount sent.

For more detailed guidance on transferring money without tax, you can refer to this guide on how to transfer money from USA to India without tax.

Who Is Liable to Pay Tax on Money Sent from USA to India?

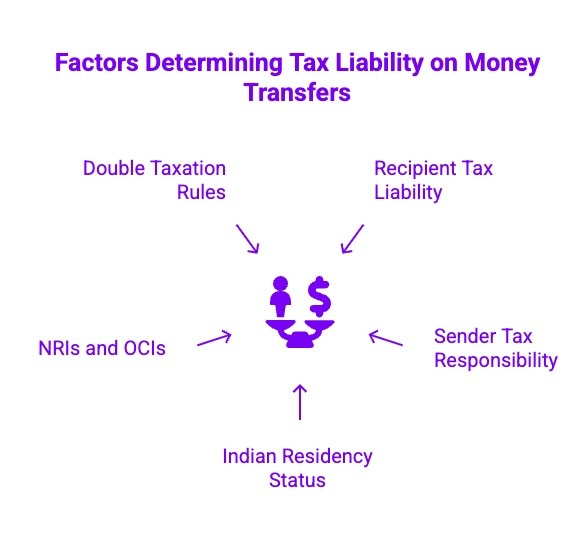

Understanding who carries the tax responsibility helps avoid confusion and ensures compliance when transferring money between countries. The liability depends on who receives the funds, their residency status, and how the money is classified, especially when considering the tax on money sent to India from USA.

Now, let’s explore the specific scenarios where tax liability may apply:

1) Recipient Tax Liability

In most cases, the recipient in India is responsible for paying tax if the money received qualifies as taxable income. Indian tax laws focus on the recipient and the nature of funds, not the act of transferring money itself.

2) Sender Tax Responsibility

The sender in the USA generally does not pay tax in India for sending money. However, the sender must ensure the income has already been declared in the USA, especially for large or recurring overseas transfers.

3) Indian Residency Status

Tax liability depends heavily on the recipient’s residency status in India. Residents are taxed on global income, while non-residents are taxed only on income sourced in India, which can change how received funds are treated.

4) NRIs and OCIs

For NRIs and OCIs, money received from the USA is usually not taxable in India if it represents foreign income or personal savings. Tax applies only when the funds relate to income earned or sourced in India.

5) Double Taxation Rules

India and the USA follow a Double Taxation Avoidance Agreement to prevent the same income from being taxed twice. Proper documentation allows taxpayers to claim relief or tax credits when applicable.

Knowing who is liable for tax helps you plan transfers correctly, avoid compliance issues, and ensure your money moves between the USA and India without unexpected tax consequences.

How Does the Purpose of the Transfer Affect USA to India Money Transfer Tax?

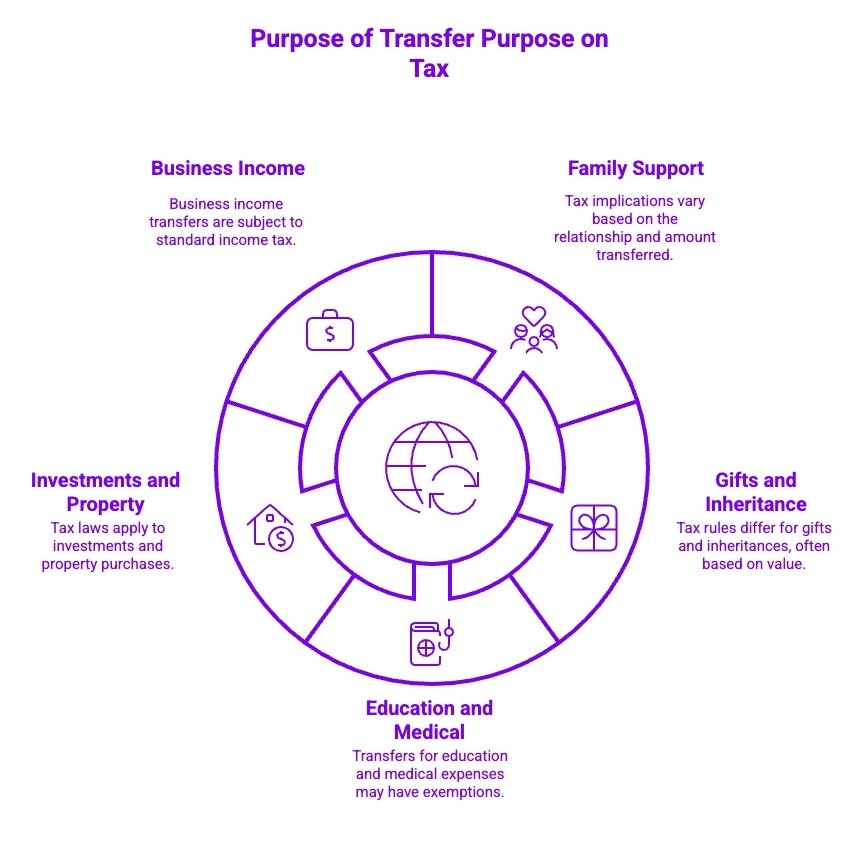

The tax treatment of a transfer is closely linked to why the money is being sent. Understanding the purpose helps determine whether the amount received in India is taxable or exempt under income tax rules. Similarly, if you are wondering how to transfer money from India to USA without tax, the purpose behind the transfer plays an important role.

Now, let’s look at the different scenarios that impact the tax treatment of your transfer:

- Family Support Transfers: Money sent for family maintenance or household expenses is generally not taxable in India, provided it does not represent income earned in India and the source of funds can be clearly established.

- Gifts and Inheritance: Gifts received from close relatives are tax-exempt under Indian tax laws, while gifts from non-relatives above the exemption limit may be taxable in the recipient’s hands.

- Education and Medical Expenses: Funds sent for education or medical treatment are usually not taxed in India, especially when payments are made for legitimate expenses and supported by proper documentation.

- Investments and Property Purchases: Money transferred for investments or property purchases may not be taxed at receipt but can trigger tax liability on returns, capital gains, or rental income in India.

- Business and Professional Income: Transfers linked to business profits or professional services are typically taxable in India, depending on where the income is earned and applicable tax residency rules.

Clearly identifying the purpose of your USA to India money transfer ensures correct tax treatment, reduces compliance risks, and helps you avoid unexpected tax liabilities later.

What Gifts Sent from USA to India Are Taxable in India?

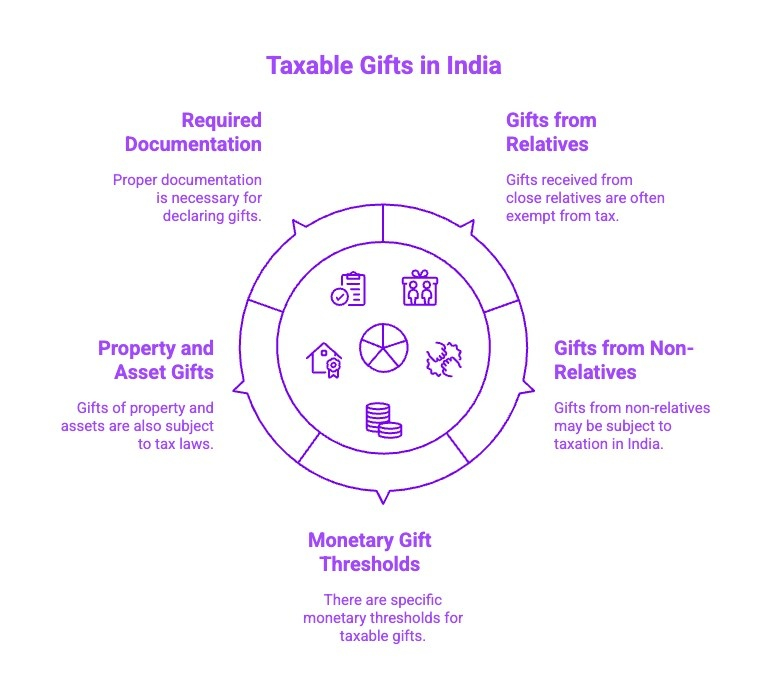

Gift transfers are treated differently under Indian tax laws depending on who sends the money and what form the gift takes. Understanding these distinctions helps prevent unintended tax liabilities, especially when asking how much tax to send money from USA to India.

Here are the key points to consider regarding taxable gifts:

- Gifts from Close Relatives: Gifts received from close relatives such as parents, siblings, spouse, children, or lineal ascendants are fully tax-exempt in India, regardless of the amount transferred from the USA.

- Gifts from Non-Relatives: Gifts received from non-relatives may be taxable if the total value exceeds the exemption limit of ₹50,000. In such cases, the amount is treated as income and taxed in the recipient’s hands.

- Monetary Gift Thresholds: If monetary gifts from non-relatives exceed the prescribed threshold in a financial year, the entire amount becomes taxable under Indian income tax rules.

- Property and Asset Gifts: Gifts in the form of property, shares, or other assets may attract tax based on stamp duty value or fair market value, depending on the type of asset received.

Knowing which gifts sent from the USA to India are taxable ensures proper reporting, protects tax exemptions, and helps recipients stay fully compliant with Indian income tax regulations.

Can You Send Money from USA to India Without Tax Legally?

Certain types of transfers are legally exempt from tax in India, provided the source and purpose of funds are clear. Knowing which scenarios qualify helps you send money confidently without triggering unnecessary tax liability.

- Personal Savings Transfers: Money sent from the USA that comes from personal savings is generally not taxable in India, as it does not represent income earned or accrued within the country.

- Already Taxed Income: Funds that have already been taxed in the USA can be transferred to India without additional Indian tax, as long as the source of income is properly documented.

- Gifts from Close Relatives: Gifts received from close relatives are exempt from tax under Indian income tax laws, regardless of the amount, when the relationship can be clearly established.

- Proper Source Documentation: Maintaining bank statements, income proofs, and transfer records is essential to demonstrate that the funds qualify for tax exemption if questioned by authorities.

- Compliance with Tax Laws: Following both US and Indian tax reporting requirements ensures your transfer remains legal and avoids penalties, audits, or compliance issues later.

By understanding tax-exempt scenarios and keeping proper documentation, you can legally send money from the USA to India without tax while staying fully compliant with both countries’ tax laws.

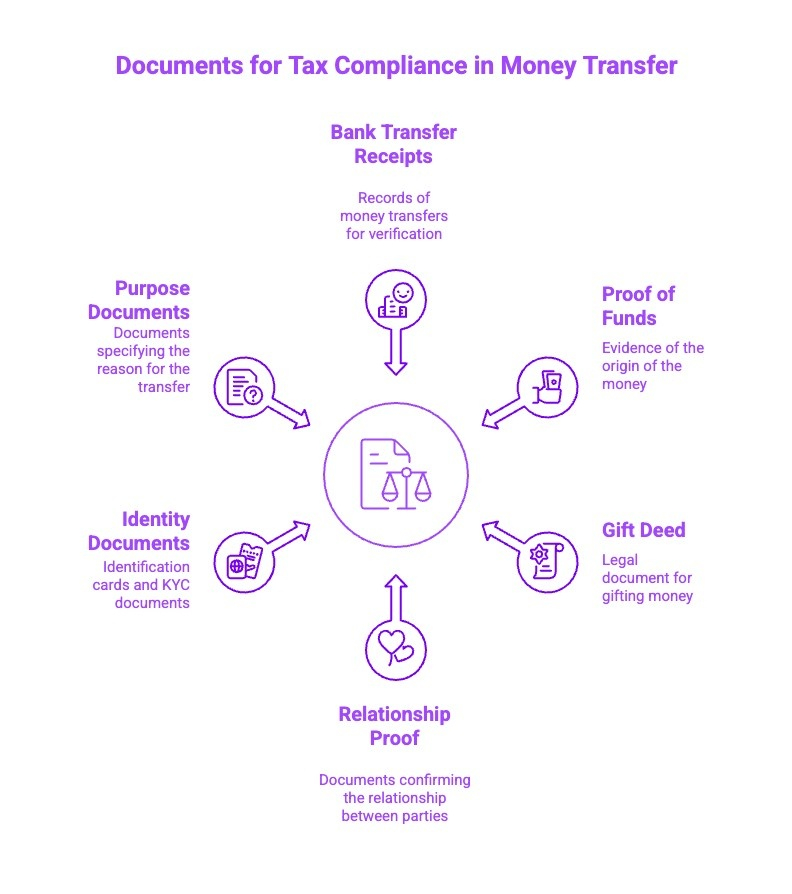

What Documents Are Required to Stay Tax Compliant When Transferring Money?

Proper documentation plays a critical role in proving the source, purpose, and tax treatment of cross-border money transfers. Keeping the right records helps you stay compliant and respond confidently to any tax or regulatory queries.

- Bank Transfer Receipts: Transaction confirmations and bank statements serve as primary proof of the amount transferred, date, and recipient details for both US and Indian authorities.

- Proof of Source of Funds: Income slips, tax returns, or savings statements help establish whether the money transferred is personal savings, already taxed income, or taxable earnings.

- Gift Deed or Declaration: For gift transfers, a written gift deed or declaration helps confirm the nature of the transfer and supports tax exemption claims in India.

- Relationship Proof: Documents showing the relationship between sender and recipient, such as birth certificates or family records, are important for claiming tax-free gift exemptions.

- Identity and KYC Documents: Valid identification documents ensure compliance with banking, AML, and KYC regulations during international money transfers.

- Purpose-Specific Documents: Invoices, admission letters, or medical bills may be required when funds are sent for education, medical treatment, or specific expenses.

Maintaining clear and complete documentation ensures your money transfers remain tax compliant, reduces the risk of scrutiny, and helps you avoid delays or penalties during audits or assessments.

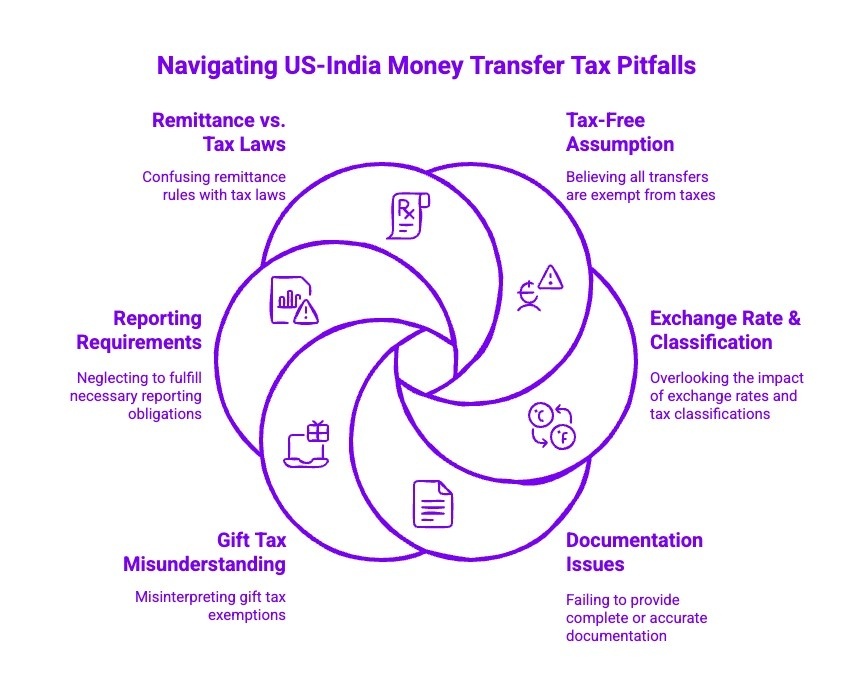

What Are Common Tax Mistakes to Avoid When Transferring Money Between USA and India?

Cross-border transfers often seem straightforward, but small misunderstandings around tax rules can lead to compliance issues. Being aware of common mistakes helps you avoid penalties, delays, and unnecessary scrutiny from tax authorities.

1) Assuming All Transfers Are Tax-Free

Many people believe sending money itself is never taxable. While transfers are not taxed by default, the nature and purpose of the funds can create tax liability for the recipient in India.

2) Ignoring Exchange Rate and Classification Rules

Exchange rates and how funds are classified can affect tax treatment. Misclassifying income, gifts, or reimbursements may lead to incorrect tax reporting or underpayment of tax.

3) Incomplete or Missing Documentation

Lack of proper records such as transfer receipts, income proofs, or gift documentation can make it difficult to justify tax exemptions during assessments or audits.

4) Misunderstanding Gift Tax Exemptions

Not all gifts are tax-free. Assuming gifts from non-relatives are exempt or failing to meet exemption conditions can result in unexpected tax liability for the recipient.

5) Overlooking Reporting Requirements

Even tax-free transfers may require disclosure in certain cases. Ignoring reporting obligations under Indian or US regulations can trigger compliance issues later.

6) Confusing Remittance Rules with Tax Laws

Many confuse money transfer regulations with tax laws. Compliance with remittance limits does not automatically mean the transfer is tax-exempt under income tax rules.

Avoiding these common mistakes ensures your money transfers between the USA and India remain compliant, transparent, and free from unnecessary tax complications.

What Some Expert Tips for NRIs Sending Money to India?

For Non-Resident Indians (NRIs), navigating the process of transferring funds back to India requires careful consideration. There are various ways to make the transfer efficient and compliant with tax laws. Here are some expert tips that can help make the process more seamless and cost-effective.

Tips for NRIs:

- Choose a Reliable Transfer Service: Opt for services with low fees and competitive exchange rates, like Frex or Wise.

- Be Mindful of Timing: Select the best time for transfers to take advantage of favorable exchange rates.

- Minimize Intermediary Costs: Direct bank transfers or transfers through trusted platforms often eliminate additional fees from middlemen.

- Seek Professional Tax Advice: Consulting with a tax expert can ensure you comply with tax regulations both in the US and India.

By following these expert tips, NRIs can make informed decisions, ensuring their remittance process is smooth, cost-effective, and compliant with both US and Indian tax laws.

How Can Frex Help You Transfer Money from the USA to India While Staying Tax Compliant?

Frex simplifies cross-border transfers by offering a transparent, well-documented way to send money from the USA to India. The platform provides clear transaction records, upfront fees, and real-time confirmations, which are essential for maintaining tax compliance. By using a regulated service like Frex, you can easily track transfers, maintain proper documentation, and ensure your money moves quickly without unnecessary tax or reporting complications.

Looking for a fast and compliant way to send money? Download the Frex app today and transfer money from the USA to India with clarity, confidence, and complete transparency.

Conclusion

Understanding the tax implications of transferring money from the USA to India helps you move funds confidently and legally. While the transfer itself is not taxed, the source, purpose, and recipient determine whether tax applies. By keeping proper documentation, knowing gift exemptions, and following reporting rules, you can avoid unnecessary tax issues and ensure smooth, compliant cross-border transfers.

Frequently Asked Questions

Is there a maximum amount you can send from the USA to India without paying extra taxes?

There is no fixed maximum amount that triggers tax on money transfer from USA to India. Taxes depend on the source and purpose of funds, not the amount sent, provided the money represents personal savings or already taxed income.

What paperwork do I need for transferring money to India?

On the US side, no paperwork is needed for transfers under $19,000 per person annually. For amounts exceeding this, you must file IRS Form 709. In India, the recipient’s bank will issue a Foreign Inward Remittance Certificate (FIRC) as proof of the transfer, which is important documentation for their records.

Does sending money for family support have different tax implications compared to gifts?

From the US sender’s view, both are treated as gifts and fall under gift tax rules. For the recipient in India, the purpose matters. Funds from close family members are tax-free. However, if the money comes from a non-relative, amounts over ₹50,000 in a calendar year are taxable under the Income Tax Act.

Do NRIs need to pay any taxes when sending money from the USA to India?

NRIs usually have no tax for money transfer from USA to India when sending personal savings through a money transfer service. Tax applies only if the Indian resident recipient receives taxable income, not on the transfer of money itself.

How does the recent 1% US remittance tax impact transfers to India?

The proposed new remittance tax under the one big beautiful bill may apply to certain foreign remittance transactions. However, good news is that it does not currently impact most debit card or bank-based transfers to India.

Can I send large amounts from the USA to India without facing additional taxes?

Yes, large sums can be sent without extra tax if funds are personal savings or already taxed income. Financial institutions may request additional information for compliance with international wire transfer rules.

What are the current tax rates for transferring money from the USA to India?

There is no direct tax rate on foreign currency transfers. Tax depends on the recipient’s status and purpose of funds under Indian law, not on wire transfers or money transfer providers themselves.

Are there any proposed changes to US remittance tax rates for transfers to India?

Some proposals mention a new remittance tax linked to foreign assets reporting, but nothing is final. For informational purposes only, consult a financial advisor or follow updates from the Internal Revenue Service.

Leave a Reply