Key Highlights

- NRIs in the USA have multiple ways to send money to India, including online transfer services, bank wires, bank-led remittance options, and emerging digital platforms.

- Understanding how remittances work helps reduce delays, avoid failed transactions, and ensure funds reach the recipient’s bank account securely.

- Choosing the right transfer method depends on factors like speed, fees, exchange rate transparency, transfer limits, and ease of use.

- Most money sent by NRIs to India is not taxable, but gift rules, reporting requirements, and compliance checks still apply.

- Keeping accurate recipient details and completing verification early helps prevent common transfer issues.

- Digital platforms such as Frex simplify cross-border transfers by offering fast processing, transparent pricing, and app-based convenience.

Sending money to India often feels more complicated than it should for NRIs living in the USA. Whether you are supporting parents, covering household expenses, or helping family during an emergency, comparing exchange rates, worrying about fees, and waiting for confirmation can turn a routine transfer into a stressful task.

The challenge is not a lack of options, but too many of them. Banks, apps, and wire transfers all work differently, with varying costs, speeds, and limits. Without clear guidance, it is easy to feel unsure about which method actually makes sense for your situation.

This blog explains NRI sending money to India in a simple, practical way. It covers how transfers work, what impacts cost and speed, and how to choose the right option so your money reaches home smoothly and without confusion.

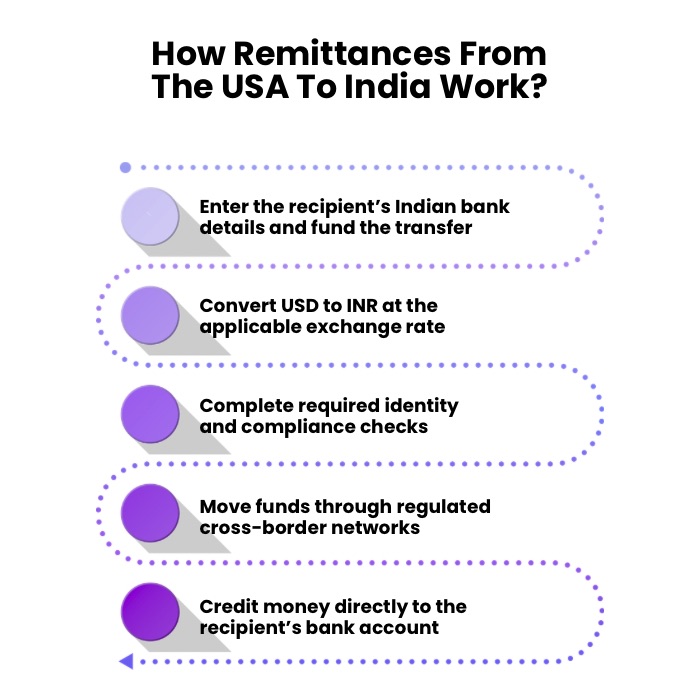

How Remittances From The USA To India Work?

When an NRI sends money from the USA to India, the funds do not move directly from one bank account to another. Instead, the transfer passes through a series of checks, conversions, and banking networks that determine how fast the money arrives and how much the recipient finally receives.

Here’s how the process typically works:

- Initiating The Transfer: You start by choosing a bank or online money transfer service and entering the recipient’s Indian bank details. The transfer is funded using a US bank account, debit card, or another supported payment method.

- Currency Conversion: The service converts your US dollars into Indian rupees using the applicable exchange rate. This rate, along with any transfer fees, determines the final amount your recipient receives.

- Compliance And Verification Checks: The transfer goes through mandatory identity and security checks to meet US and Indian regulatory requirements. First-time transfers may take slightly longer due to verification.

- Cross-Border Processing: Regulated banking networks and payment partners move the funds from the USA to India. Processing time depends on the service used, as well as weekends and bank holidays.

- Final Credit In India: Once cleared, the money is credited directly to the recipient’s Indian bank account. Depending on the provider, this can happen within minutes or take up to a few business days.

Understanding these steps helps NRIs make better decisions when sending money to India. It allows you to balance speed, cost, and convenience while choosing the most reliable remittance option for your needs.

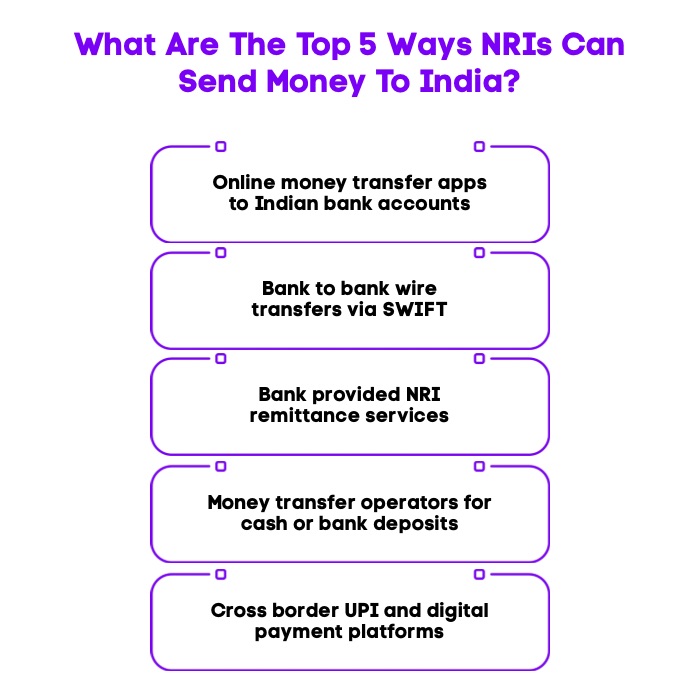

What Are The Top 5 Ways NRIs Can Send Money To India?

NRIs in the USA have several reliable options for sending money to India, each designed to meet different needs around speed, cost, and convenience. Understanding how these methods work helps you avoid unnecessary fees and choose a transfer option that fits your situation.

Here are the 5 best ways to send money to India from the USA:

1. Online Money Transfer Services

Online money transfer services are digital platforms that let NRIs in the USA send money to India using a mobile app or website. Platforms like Frex are designed specifically for cross-border remittances, offering a simple way to transfer funds directly to Indian bank accounts with clear exchange rates and fast processing.

How It Works

- Create an account and complete a basic identity verification

- Enter the recipient’s Indian bank account details

- Choose a funding method such as a US bank account or debit card

- The platform converts USD to INR and transfers the money to India

When Is It The Best Option?

This option is ideal for NRIs who send money to India regularly and want a fast, app-based experience. It works well for small to medium transfers where convenience, speed, and exchange rate transparency matter most.

2. Bank-To-Bank Wire Transfers (SWIFT)

Bank-to-bank wire transfers use the SWIFT network to move money directly from a US bank account to an Indian bank account. This is one of the most traditional and widely accepted methods for international remittances.

How It Works

- You initiate a wire transfer through your US bank

- Provide the recipient’s Indian bank details and SWIFT code

- The US bank sends funds through the SWIFT network

- The recipient’s bank credits the amount in INR after processing

When Is It The Best Option?

This method is best suited for large value transfers, such as property-related payments or long-term financial support. It is preferred when transfer limits and institutional reliability matter more than speed or cost.

3. Bank-Provided Remittance Services

Many Indian and international banks offer dedicated remittance services designed specifically for NRIs. These services are often linked to NRI banking products and offer a more integrated experience.

How It Works

- You log in to your bank’s remittance platform or NRI banking portal

- Select the recipient account in India, often an NRE or NRO account

- Initiate the transfer from your overseas bank account

- The bank handles conversion and credit to the Indian account

When Is It The Best Option?

This option works well for NRIs who already maintain NRI bank accounts and prefer managing remittances within a single banking relationship. It is suitable for users who value familiarity, compliance, and bank-backed processes.

4. Money Transfer Operators (MTOs)

Money transfer operators offer both digital and offline options for sending money to India. They are known for their wide reach and flexible payout methods.

How It Works

- You initiate a transfer online or at a physical agent location

- Choose whether the recipient receives cash or a bank deposit

- Funds are sent through the operator’s global network

- The recipient collects cash or receives a bank credit in India

When Is It The Best Option?

This method is useful in urgent situations or when the recipient does not have easy access to banking services. It is commonly used for emergency transfers or one-time needs.

5. Cross-Border UPI And Emerging Digital Options

New digital payment innovations are gradually reshaping how NRIs send money to India. Some platforms now support transfers that connect directly with India’s UPI ecosystem.

How It Works

- You initiate a cross-border transfer through a supported digital platform

- Funds are converted from USD to INR

- The amount is credited to a UPI-linked Indian bank account

- The recipient receives money almost instantly

When Is It The Best Option?

This option is ideal for frequent, smaller transfers where speed and ease of access are key. It works well for supporting day-to-day expenses and quick family needs in India.

A Quick Comparison Of The Top Ways NRIs Send Money To India

| Transfer Method | Speed | Typical Costs | Best For | Key Consideration |

|---|---|---|---|---|

| Online Money Transfer Services | Minutes to 1 business day | Low fees, transparent rates | Regular personal transfers | Exchange rate transparency matters |

| Bank To Bank Wire Transfers (SWIFT) | 2–5 business days | Higher bank and intermediary fees | Large value transfers | Slower and less cost efficient |

| Bank Provided Remittance Services | 1–3 business days | Moderate fees | NRIs using NRE or NRO accounts | Tied to banking relationship |

| Money Transfer Operators (MTOs) | Same day to 2 days | Higher fees for cash pickup | Emergencies or unbanked recipients | Convenience over cost |

| Cross Border UPI And Digital Options | Minutes | Low or minimal fees | Small, frequent transfers | Availability depends on provider |

Want more clarity on choosing the right method? Read What Is the Best Way to Send Money to India From USA?

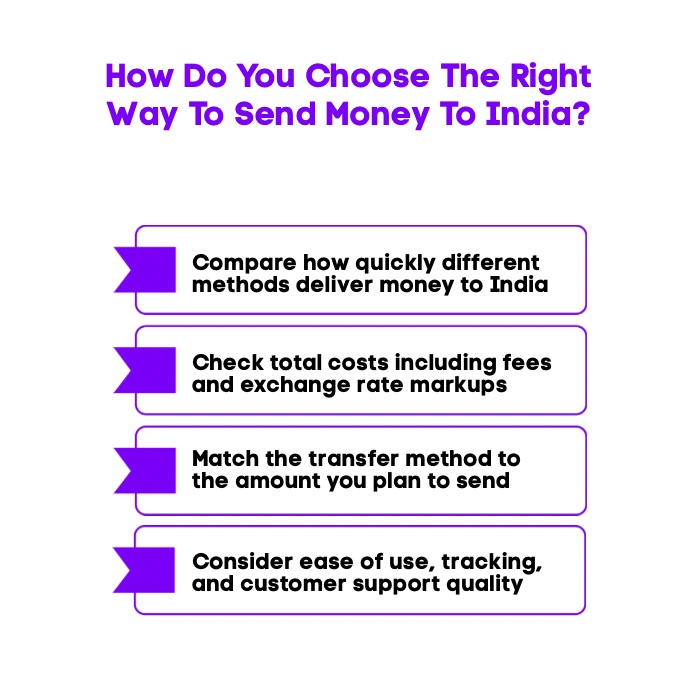

How Do You Choose The Right Way To Send Money To India?

Not every remittance method works the same way for every NRI. The right choice depends on how quickly you need the money delivered, how much you are sending, and how simple you want the process to be.

Here are the key factors to consider before choosing a transfer method.

1. Transfer Speed

Some transfers reach India within minutes, while others may take a few business days. App-based digital services usually offer faster delivery, while bank wire transfers can take longer due to additional processing and intermediary checks. Speed becomes especially important for urgent family needs or time-sensitive payments.

2. Fees And Exchange Rate Markups

Low fees do not always mean better value. Some services charge minimal upfront fees but add hidden margins to the exchange rate. Others offer transparent rates with clearly shown costs. Always look at the final amount your recipient receives rather than focusing only on transfer fees.

3. Transfer Limits And Typical Use Cases

Different methods suit different amounts. Online money transfer services work well for small to medium transfers, while bank wire transfers are often better for large sums like property payments or long-term financial support. Understanding limits helps you avoid failed or delayed transfers.

4. Ease Of Use And Customer Support

A smooth user experience matters, especially for frequent transfers. Mobile apps and digital platforms usually offer better tracking, notifications, and support. Reliable customer service becomes important if a transfer is delayed or requires verification.

Choosing the right method helps you balance speed, cost, and convenience while ensuring your money reaches India safely and without unnecessary complications.

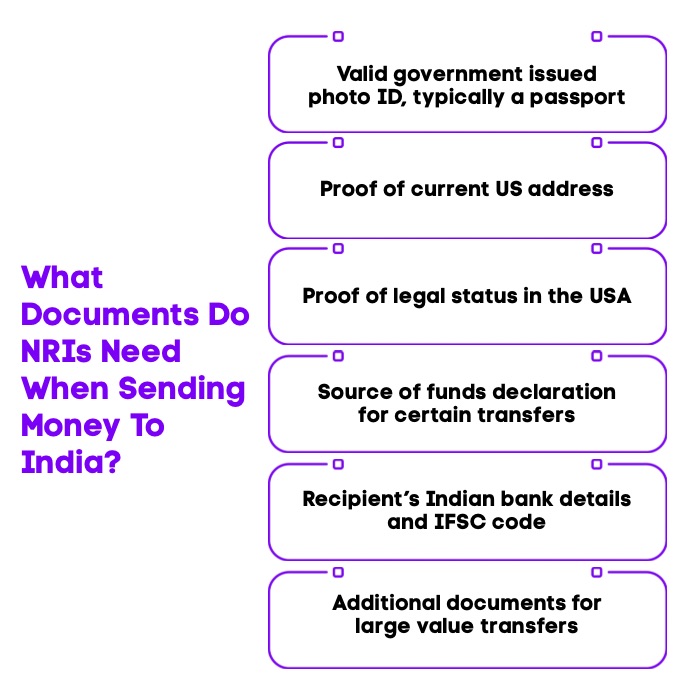

What Documents Does An NRI Need To Provide When Sending Money To India?

Most remittance providers require basic documentation to verify identity and comply with financial regulations in the USA and India. The exact documents may vary by service and transfer amount, but the overall requirements are fairly standard.

Here are the common documents NRIs are usually asked to provide.

- Valid Government Issued ID: A passport is the most commonly accepted form of identification. Some providers may also accept other US-issued photo IDs for verification.

- Proof Of Address: Documents such as utility bills, bank statements, or lease agreements are used to confirm your current US address.

- Proof Of Legal Status In The USA: A valid visa, Green Card, or work authorization are required to confirm residency status for US based NRIs.

- Source Of Funds Details: In some cases, you may need to declare where the money is coming from, such as salary, savings, or business income, especially for higher-value transfers.

- Recipient Bank Details: This includes the recipient’s full name, bank name, account number, and IFSC code to ensure accurate credit in India.

- Additional Verification For Large Transfers: For higher amounts, providers may request extra documentation or clarification to meet regulatory and compliance checks.

Having these documents ready helps avoid delays and ensures your money reaches India smoothly. Clear documentation also makes repeat transfers faster and easier over time.

Are There Any Tax Implications For NRIs Transferring Money From The USA To India?

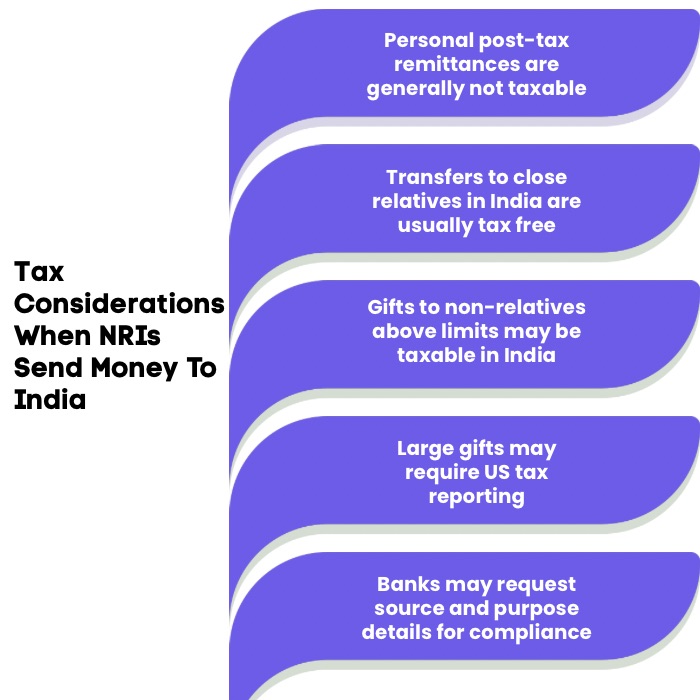

In most cases, sending money from the USA to India does not attract tax simply because a transfer is made. However, tax implications and reporting obligations can depend on the source of funds, the recipient, and the purpose of the transfer. Understanding these basics helps avoid confusion and compliance issues.

Here are the key points NRIs should keep in mind.

- No Tax On Personal Remittances: Sending your own post-tax income or savings from the USA to India is generally not considered a taxable event in either country. The act of transferring money itself does not create a tax liability.

- Tax Treatment For Recipients In India: Money received by close relatives such as parents, spouse, or children is usually not taxable in India. Transfers received as income or from non-relatives may be subject to Indian income tax rules if they cross specified limits.

- Gift Related Considerations: India does not have a separate gift tax, but gifts from non-relatives above certain thresholds can be taxable for the recipient. Gifts to immediate family members are typically exempt.

- US Reporting Requirements: While sending money abroad does not usually result in US tax, large transfers classified as gifts may require reporting to the IRS. Filing a report does not always mean tax is owed, but records should be maintained.

- Source And Purpose Of Funds: Banks and remittance providers may ask for details about where the money comes from and why it is being sent. These checks are part of standard compliance and are not taxes.

- When Professional Advice Is Helpful: For large transfers or complex situations, speaking with a qualified tax professional can help ensure compliance with both US and Indian regulations.

Understanding these tax considerations allows NRIs to send money to India with clarity, confidence, and proper financial planning.

Want a deeper breakdown of tax-free transfers? Read our guide on How to Transfer Money from USA to India Without Tax to understand smart, compliant ways to send money home.

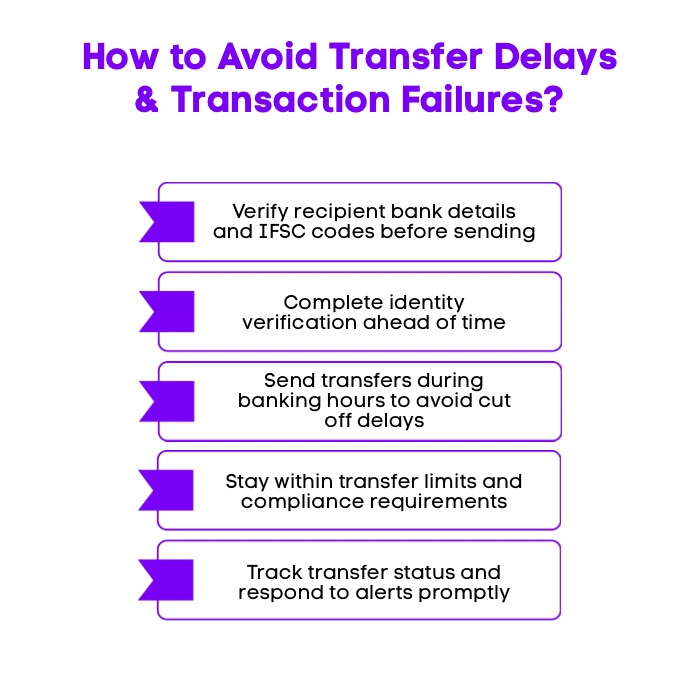

How Can You Avoid Transfer Delays And Transaction Failures?

Transfer delays and failed transactions can be frustrating, especially when money is needed urgently. Most issues happen due to small oversights that can be easily avoided with the right preparation.

Here are the key steps to help ensure your money reaches India without unnecessary delays.

1. Double Check Recipient Bank Details

One of the most frequent reasons transfers fail is incorrect bank information. Simple errors like a wrong IFSC code, mismatched account name, or an extra digit in the account number can cause the transfer to bounce or get stuck in review. Always cross-check details before confirming.

2. Complete Identity Verification Early

Many NRIs try to send money before completing identity checks, assuming verification can be done later. This often results in transfers being paused mid-process. Completing verification in advance prevents last-minute holds, especially for first-time or higher-value transfers.

3. Be Aware Of Banking Cut-Off Times

Transfers are commonly delayed because they are initiated late at night, on weekends, or during Indian or US bank holidays. Even fast digital services rely on banking windows. Sending money during business hours reduces processing delays.

4. Understand Transfer Limits And Compliance Rules

Transfers can be delayed when the amount exceeds platform limits or triggers additional compliance checks. NRIs often overlook daily or monthly caps and documentation requirements, especially when sending larger sums. Knowing the maximum transfer limits helps avoid unexpected reviews.

5. Monitor Transfer Status And Notifications

Many delays happen because users miss emails or in-app alerts requesting clarification or additional information. Ignoring or delaying responses can stall a transfer. Regularly checking transfer status helps resolve issues quickly.

Paying attention to these details helps reduce the chances of failed transactions and ensures a smoother, more reliable money transfer experience to India.

Why NRIs Choose Frex For Sending Money To India?

When sending money from the USA to India, NRIs often have to juggle speed, cost, and clarity. Frex is built to remove that friction by offering a straightforward, app-based way to transfer money without second-guessing fees, rates, or delivery timelines.

Frex focuses on transparency and ease, so you always know what you are paying and how much your recipient will receive before you confirm the transfer.

Here is what sets Frex apart for NRIs in the USA.

- Competitive Exchange Rates With No Hidden Fees: Frex uses live mid-market rates with clear pricing, helping you get more value per dollar without unexpected deductions.

- Fast Transfers To Indian Bank Accounts: Funds are sent directly to Indian bank accounts, often reaching recipients within minutes, without added charges for speed.

- No Minimum Transfer Amount: You can send small amounts without waiting to bundle transfers, which makes it easier to support regular household expenses.

- Secure And Reliable Infrastructure: The platform uses advanced encryption and trusted financial partners to ensure secure transfers and stable settlements.

- Fully Compliant And Regulated: Frex follows regulatory requirements in both the USA and India, offering peace of mind for compliant international transfers.

- Built With NRI Needs In Mind: Designed by NRIs, Frex focuses on clarity, control, and predictability rather than complex banking processes.

With Frex, you can send money directly from your US bank account to any Indian bank account and see the final INR amount before completing the transfer.

How To Send Money With Frex From The USA To India?

Getting started with Frex is simple and fully app-driven.

- Step 1: Download the Frex app from the App Store or Google Play Store.

- Step 2: Complete the one-time setup by verifying your identity, adding recipient bank details, and securely linking your US bank account.

- Step 3: Enter the amount in USD, review the INR amount your recipient will receive, and confirm the transfer. Funds are typically credited within minutes.

Everything is handled within the app, without paperwork, delays, or unclear steps. Frex is designed to make sending money to India feel as simple and predictable as it should be.

Download the Frex app now and start sending money smarter, faster, and safer.

Conclusion

Sending money home does not have to be complicated when you understand how the process works. For NRIs living in the United States, knowing how international money transfers function makes it easier to choose the right service, avoid delays, and ensure funds reach the recipient’s bank account securely and on time.

With various options available today, you can compare transfer options based on speed, fees, and competitive exchange rates. Whether you are sending a small or large amount of money, focusing on transparency, reliability, and the best exchange rates helps make every transfer of money to India smoother and more cost-effective.

Frequently Asked Questions

Can an NRI transfer money to a resident Indian account?

Yes, an NRI can transfer money to a resident Indian savings or current account. These transfers are commonly used to support family expenses, education, or emergencies. The recipient can receive funds directly in INR without needing an NRI account.

Can an NRI transfer money to a savings account in India?

NRIs can send money directly to any valid savings account in India. The recipient only needs an active bank account with the correct details, such as account number and IFSC code. Most remittance services support direct bank credits across India.

How much money can an NRI repatriate from India?

NRIs can generally repatriate up to USD 1 million per financial year from India, subject to applicable rules and documentation. This includes proceeds from assets, income, or balances held in certain accounts, provided compliance requirements are met.

How much money can an NRI send to India?

There is no fixed upper limit on how much money an NRI can send to India. However, individual transfer limits may apply based on the remittance service, bank policies, and regulatory checks, especially for large or frequent transactions.

How can an NRI transfer money from the USA to an NRI account in India?

An NRI can transfer money from the USA to an NRI account using online money transfer services, bank wire transfers, or bank-provided remittance platforms. These methods allow funds to be credited to NRE or NRO accounts in Indian rupees.

How to transfer money from the US to India NRI account?

The process usually involves choosing a remittance provider, entering the recipient’s NRI account details, funding the transfer from a US bank account, and confirming the transaction. Most platforms offer tracking so you can monitor delivery status.

Is NRI sending money to India taxable?

In most cases, sending money from the USA to India is not taxable for the NRI if it comes from post-tax income. Tax implications, if any, usually depend on how the recipient classifies the funds under Indian tax rules.

How do I choose between NRE and NRO accounts for transferring money to India as an NRI?

NRE accounts are ideal for transferring overseas income to India with full repatriation benefits, while NRO accounts are used for managing income earned in India. The choice depends on whether the funds originate abroad or within India.

What limits or regulations should NRIs know about when sending money to India?

There is no fixed limit on inward remittances to India, but service providers may impose transaction caps. Large transfers may trigger compliance checks, and documentation may be required to confirm the source and purpose of funds.

How long does it usually take for money transferred by an NRI to reach an Indian account?

Transfer timelines vary by method. Online money transfer services can credit funds within minutes or a few hours, while bank wire transfers may take two to five business days depending on banks, holidays, and verification requirements.

Leave a Reply