Key Highlights

- Banks can reject wire transfers due to incorrect details, compliance checks, transfer limits, or intermediary bank issues, even when funds are available.

- International wire transfers carry higher rejection risk because they involve multiple banks, stricter regulations, and additional review layers.

- Rejected wire transfers are usually reversed to the sender, but refunds may take days, and fees can still be deducted.

- Traditional bank wires fail more often due to manual processing, limited tracking, and rigid compliance systems.

- Non-wire remittance platforms reduce rejection risk through pre-validation, fewer intermediaries, and real-time tracking.

- Careful preparation, accurate details, and choosing the right transfer method help prevent avoidable wire transfer failures.

Sending a wire transfer is often time sensitive, yet many people experience unexpected rejections that delay payments and create uncertainty. When money does not reach the recipient as planned, it can disrupt personal commitments, business transactions, and urgent financial needs.

Wire transfer failures are more common than expected, especially for international payments. Small errors, strict compliance checks, and multiple banks involved in the process increase the risk of delays or outright rejection. These issues often leave senders confused about what went wrong and how to fix it.

This blog explains why banks reject wire transfers, what happens after a rejection, and how different transfer methods affect reliability. It aims to help you understand the risks and make informed decisions when sending money internationally.

What Does It Mean When a Bank Rejects a Wire Transfer?

If your bank says a wire transfer was rejected, it does not mean your money is gone. It means the payment could not move forward and was stopped somewhere in the banking process before reaching the recipient.

A wire transfer rejection occurs when the bank is unable to process the payment as instructed. This can happen before funds leave your account or after the transfer enters processing. Common reasons include incorrect recipient details, compliance checks, insufficient funds, or internal bank issues.

A rejected wire transfer is not the same as a delay. Once rejected, the funds are usually returned to the sender, although this can take several business days. For international wires, the process may take longer due to intermediary banks, and wire fees may still apply even if the transfer fails.

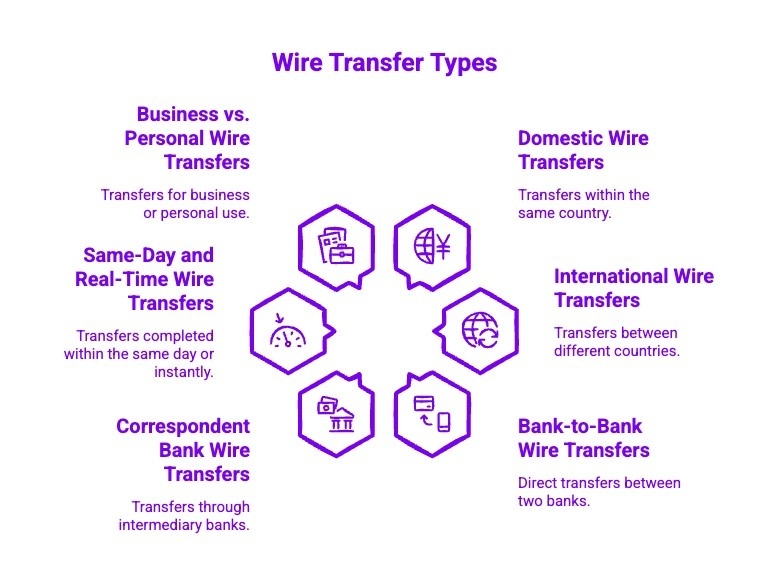

What Are the Different Types of Wire Transfers?

Wire transfers are not all processed the same way. The type of wire you use affects speed, fees, and rejection risk.

Below are the most common types of wire transfers and how each works in real-world banking scenarios:

1) Domestic Wire Transfers

Domestic wire transfers move funds between banks within the same country. They are usually faster and involve fewer compliance checks than international wires. Because only local banking systems are involved, rejection risk is lower, though errors in account or routing numbers can still cause failures. They are often used for urgent payments. Overall, domestic wires are relatively straightforward.

2) International Wire Transfers

International wire transfers send money across borders and currencies, making them more complex. These transfers involve additional compliance checks, foreign exchange processing, and intermediary banks. Errors, sanctions screening, or mismatched recipient details increase the likelihood of rejection. Processing times are longer, and fees are higher. This makes international wires more prone to issues.

3) Bank-to-Bank Wire Transfers

Bank-to-bank wire transfers occur directly between two banks that have an established relationship. Fewer intermediaries usually mean faster processing and reduced risk of errors. However, banks still perform strict compliance checks before releasing funds. If details are incorrect or flagged, the transfer can still be rejected. Direct does not always mean guaranteed.

4) Correspondent Bank Wire Transfers

Correspondent bank wire transfers rely on intermediary banks to complete the transaction, especially for international payments. Each intermediary adds another layer of review, fees, and potential delay. Rejections often occur at this stage due to compliance concerns or missing information. This structure significantly increases rejection risk. More steps mean more failure points.

5) Same-Day and Real-Time Wire Transfers

Same-day and real-time wire transfers are designed for speed, but they come with strict cutoff times and limits. Missing a cutoff or submitting incomplete details can cause immediate rejection. These wires leave little room for correction once initiated. Speed increases pressure on accuracy. Fast processing also means faster failure if something is wrong.

6) Business vs. Personal Wire Transfers

Business wire transfers often involve larger amounts and stricter compliance checks than personal wires. Banks may request additional documentation to verify the purpose of funds. Personal wire transfers are usually simpler but still subject to limits and monitoring. Business wires face higher scrutiny. The use case directly affects approval likelihood.

Understanding wire transfer types helps you choose the safest option and avoid unnecessary rejections.

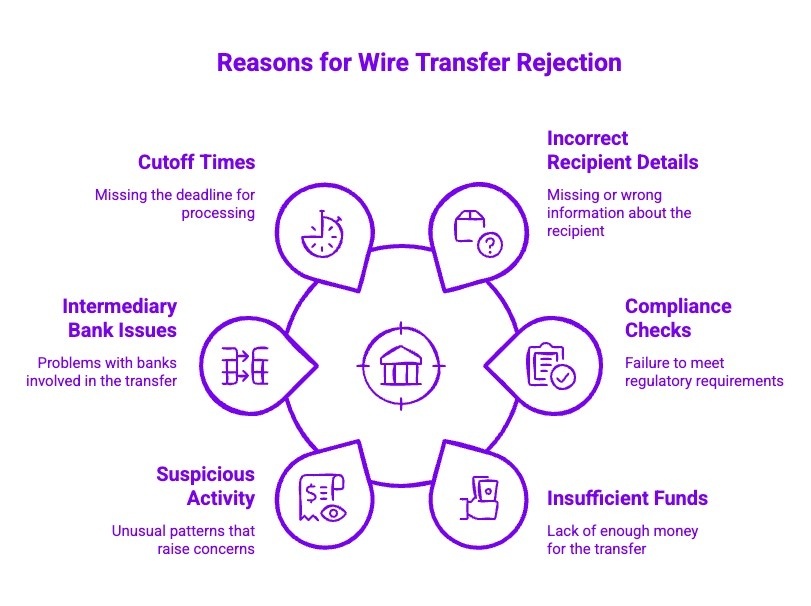

Why Would a Bank Reject a Wire Transfer?

1) Incorrect or Incomplete Recipient Details

Even a small mistake in the recipient’s name, account number, routing number, or SWIFT code can trigger a rejection. Banks require exact matches, especially for international wires. Formatting differences, missing fields, or outdated bank details are among the most frequent causes of failed wire transfers. As a result, payments are often returned only after several days, sometimes with additional return or repair fees.

2) Failed Compliance or Regulatory Checks

Banks must comply with strict anti money laundering and know your customer regulations. If a transfer is flagged during screening, it may be rejected without warning. This often happens when transactions involve high risk countries, restricted entities, or unclear payment purposes. In such cases, funds can be held during review, leaving the sender unable to access or resend the money immediately.

3) Insufficient Funds or Transfer Limits

A wire transfer can be rejected if your account balance does not fully cover the transfer amount and related fees. Banks also enforce daily and transaction level limits. When these limits are exceeded, the transfer is often stopped automatically, forcing senders to wait for limit resets or submit additional documentation, which delays time sensitive payments.

4) Suspicious or Unusual Transaction Activity

Wire transfers that fall outside normal account behavior may trigger fraud prevention systems. Large amounts, first time international wires, or sudden changes in frequency often raise alerts. When this happens, the transfer may be rejected and the account temporarily restricted until verification is completed, preventing further transactions in the meantime.

5) Intermediary or Correspondent Bank Issues

International wire transfers frequently pass through intermediary banks. Any of these institutions can reject the transfer due to missing information, compliance concerns, or internal policies. Because multiple banks are involved, tracking the funds becomes more complex and resolution can take weeks, even when the sender did nothing wrong.

6) Cutoff Times and Processing Errors

Banks operate under strict cutoff times for wire transfers. Submitting a transfer after these windows, during holidays, or outside business hours can lead to rejection. System outages or manual processing errors may also interrupt the transfer, causing missed deadlines, penalties, or strained business and personal relationships.

Understanding these rejection triggers helps reduce avoidable delays and makes it easier to choose transfer methods that offer clearer tracking and fewer disruptions.

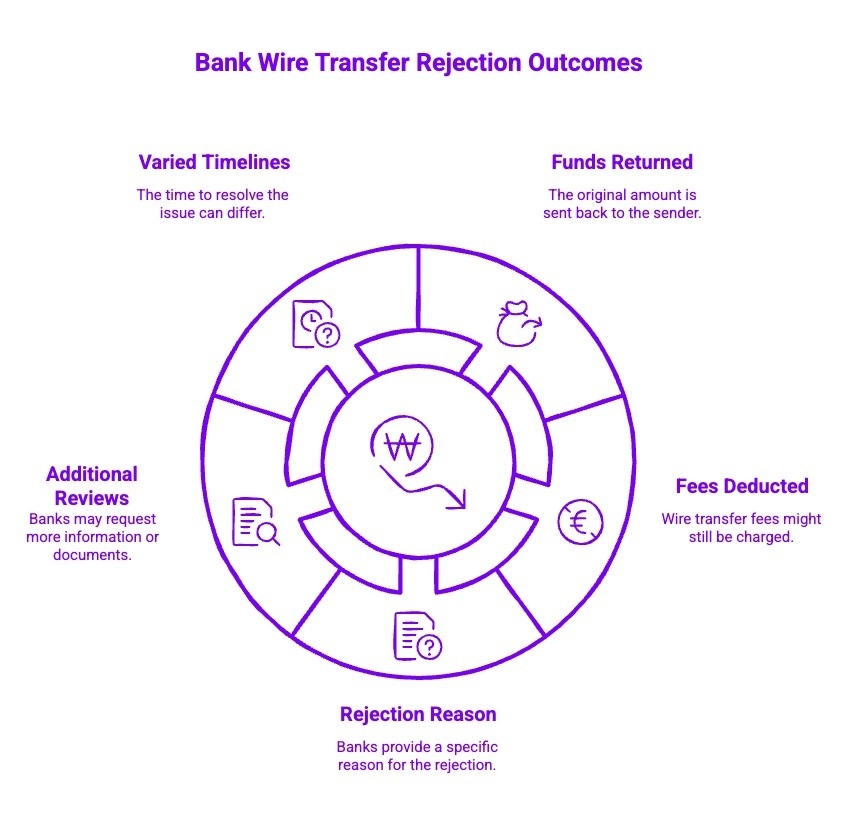

What Happens After a Bank Rejected Wire Transfer?

A rejected wire transfer can create uncertainty about where your money is and what comes next. Knowing the post-rejection process helps reduce stress and delays.

Below are the key things that usually happen after a bank rejects a wire transfer:

- Funds Are Returned to the Sender: The money is typically reversed back to the sender’s account. This process can take a few business days and may take longer for international wires involving intermediary banks.

- Wire Fees May Still Be Deducted: Banks often charge wire fees even if the transfer is rejected. In some cases, intermediary banks may also deduct handling fees before the funds are returned.

- Banks Provide a Rejection Reason or Code: The sending bank usually shares a rejection reason or reference code. This helps identify whether the issue was due to incorrect details, compliance checks, or processing errors.

- Additional Reviews or Documentation May Be Requested: If the rejection was compliance-related, the bank may ask for supporting documents before allowing a new transfer to be sent.

- Resolution Timelines Can Vary: Domestic wires resolve faster, while international wires may take longer due to multiple banks being involved.

Understanding what happens after a rejection helps you recover funds faster and avoid repeat issues.

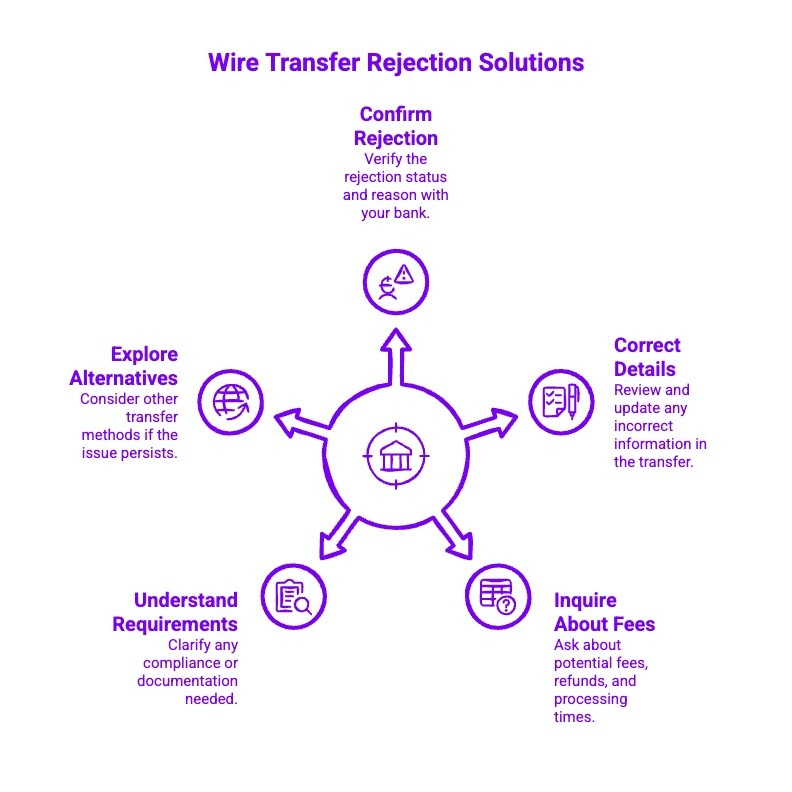

What Should You Do If Your Bank Rejected a Wire Transfer?

When a wire transfer is rejected, the first reaction is uncertainty. Questions about where the money is and how long recovery will take arise immediately. While stressful, most rejected wires are recoverable.

Taking the right steps early helps regain control and avoid delays:

1) Confirm the Rejection Status With Your Bank

Start by verifying whether the wire transfer was officially rejected or simply delayed. Ask your bank for the rejection reason and any reference or error codes. This information helps determine whether the issue was caused by incorrect details, compliance checks, or processing errors, and guides your next steps.

2) Review and Correct Transfer Details

Carefully recheck the recipient’s name, account number, routing number, and SWIFT code. Even small formatting differences can cause rejections. Make sure all details match the receiving bank’s records exactly before resubmitting the wire. Accurate information significantly reduces the risk of another rejection.

3) Ask About Fees, Refunds, and Timelines

Confirm when the rejected funds will be returned to your account and whether any wire fees were deducted. International wires may take several business days to reverse, especially if intermediary banks were involved. Knowing the timeline helps you plan your next transfer more effectively.

4) Understand Any Compliance or Documentation Requirements

If the rejection was compliance related, your bank may request additional documentation. This could include proof of identity, source of funds, or payment purpose. Responding promptly and providing clear information can help resolve issues faster and prevent repeat rejections.

5) Consider an Alternative Transfer Method

If wire transfers continue to fail or cause delays, consider using a non-wire remittance platform. These services often validate details in advance, reduce intermediary involvement, and offer better tracking. Choosing a more streamlined option can help ensure your funds reach the recipient without repeated issues.

Taking the right steps after a rejected wire transfer helps you recover faster and avoid future problems.

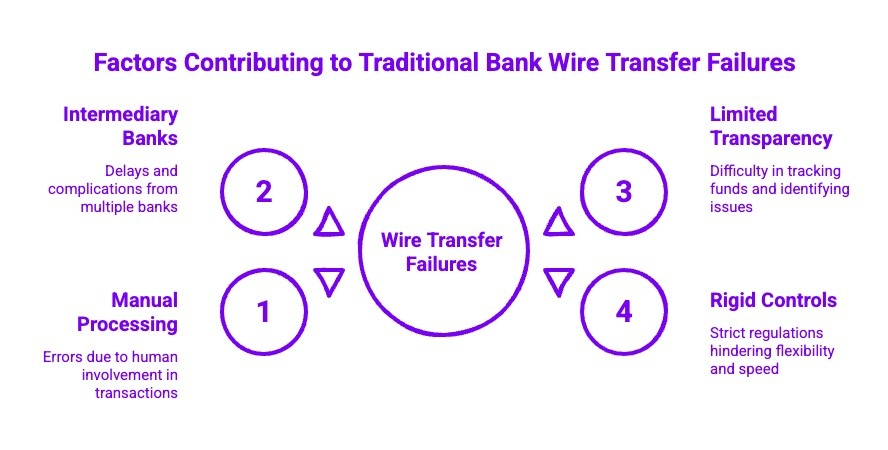

Why Do Traditional Bank Wire Transfers Fail More Often Than Expected?

Bank wire transfers are often seen as reliable, yet failures are more common than many expect. Complex processes and strict controls increase the chance of errors.

Below are the main reasons traditional bank wire transfers fail so frequently:

1) Manual Processing and Human Error

Traditional wire transfers rely heavily on manual data entry and review. Small mistakes in names, numbers, or formatting can cause rejections. Human involvement at multiple stages increases the likelihood of errors, especially for international wires that require additional verification and handling.

2) Multiple Intermediary Banks

Many international wire transfers pass through several intermediary or correspondent banks. Each institution applies its own checks, fees, and policies. Every additional handoff increases processing time and creates another opportunity for delays or rejection beyond the sender’s control.

3) Limited Transparency and Tracking

Banks often provide minimal visibility once a wire is sent. Senders may not know where the transfer is held or why it failed until days later. This lack of real-time tracking makes it harder to resolve issues quickly and increases frustration.

4) Rigid Compliance and Security Controls

Banks must follow strict regulatory requirements, including anti-money laundering and fraud prevention rules. Transactions that appear unusual or unclear may be automatically rejected. These rigid systems prioritize risk avoidance, sometimes at the expense of successful transfer completion.

Understanding these weaknesses explains why wire transfers fail and highlights the value of more streamlined alternatives.

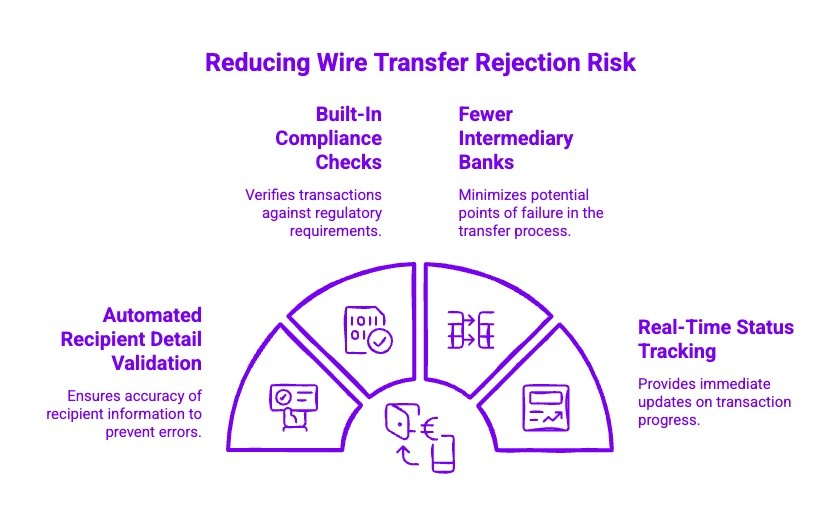

How Do Non-Wire Remittance Platforms Reduce Wire Transfer Rejection Risk?

Wire transfer rejections often happen due to manual errors and complex banking chains. Non-wire remittance platforms are designed to reduce these friction points, but they still operate fully within financial and regulatory frameworks such as KYC, AML, and cross-border reporting requirements.

Below are the key ways these platforms reduce rejection risk while remaining compliant with financial regulations:

1) Automated Recipient Detail Validation

Non-wire remittance platforms validate recipient details before a transfer is initiated. Account numbers, bank codes, and beneficiary information are automatically checked against banking rules and formats. This reduces human error while ensuring details meet regulatory and banking standards, preventing rejections common in traditional wires.

2) Built-In Compliance Checks Before Sending

These platforms perform identity verification, sanctions screening, and purpose-of-transfer checks upfront, in line with regulatory requirements. By resolving compliance requirements before funds move, they reduce the risk of transfers being flagged, paused, or rejected later during downstream bank reviews.

3) Fewer Intermediary Banks, Not Fewer Rules

While non-wire platforms often rely on direct settlement networks or local banking partners, they still route funds through regulated financial institutions. Fewer intermediaries reduce operational handoffs, but regulatory checks are embedded at each required stage, improving consistency without compromising compliance.

4) Real-Time Status Tracking and Regulatory Transparency

Real-time tracking and alerts do not replace regulatory oversight. Instead, they provide transparency into compliance stages, verification checks, and settlement progress. This visibility allows users to respond quickly to required actions, reducing failed or returned transfers.

By automating validation, embedding compliance early, and reducing operational complexity, non-wire remittance platforms lower rejection risk while continuing to operate squarely within financial regulations.

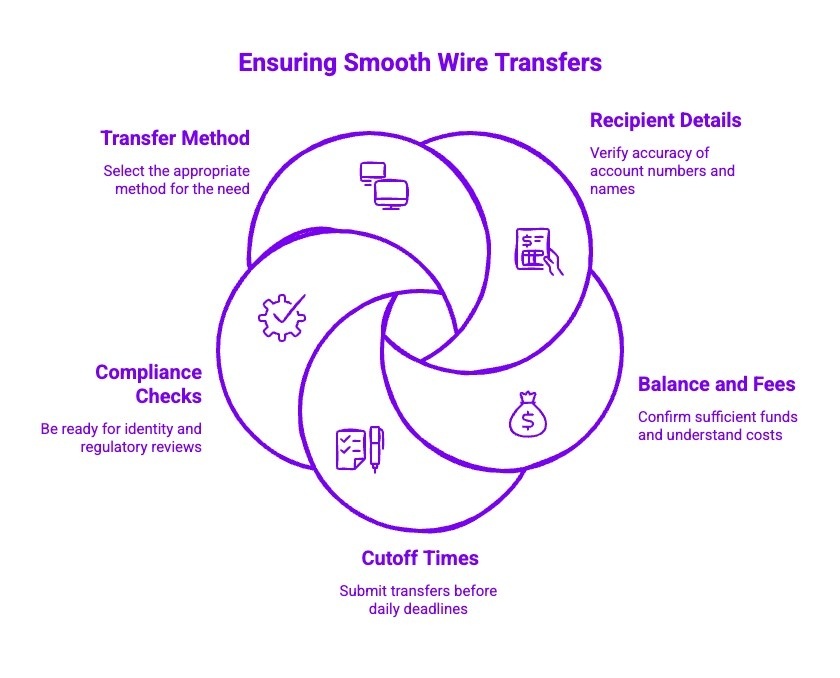

How Can You Prevent a Bank From Rejecting a Wire Transfer?

Preventing a wire transfer rejection starts before you click submit. Small checks can make a big difference in approval success.

Below are practical steps you can take to reduce the risk of a bank rejecting your wire transfer:

1) Double-Check All Recipient Details

Always verify the recipient’s full name, account number, routing number, and SWIFT code exactly as provided by the receiving bank. Even minor spelling differences or formatting issues can trigger a rejection. Avoid abbreviations and confirm details directly with the recipient before initiating the transfer to reduce avoidable errors.

2) Confirm Available Balance, Fees, and Transfer Limits

Ensure your account has enough funds to cover both the transfer amount and wire fees. Check daily and transaction limits in advance, especially for international wires. Transfers that exceed limits or leave insufficient balances are commonly rejected automatically during processing.

3) Submit the Wire Before Cutoff Times

Banks enforce strict cutoff times for wire transfers. Submitting a wire after the cutoff, on weekends, or during holidays can result in delays or rejection. Initiating the transfer early in the business day allows time for reviews and corrections if issues arise.

4) Prepare for Compliance and Verification Checks

Be ready to explain the purpose of the transfer and provide documentation if requested. Clear transaction descriptions, consistent transfer patterns, and up-to-date account information help prevent compliance-related rejections. Respond promptly if your bank contacts you for verification.

5) Choose the Right Transfer Method for the Situation

Wire transfers are not always the best option, especially for international payments. When reliability matters, consider alternatives that validate details in advance and reduce intermediary involvement. Selecting the appropriate method based on amount, urgency, and destination can significantly lower rejection risk.

Careful preparation and the right transfer choice greatly improve your chances of a successful wire transfer.

Are Bank Wires or Digital Remittance Platforms Better for International Transfers?

When comparing bank wires and digital remittance platforms for international transfers, the key differences come down to reliability, speed, and transparency. Bank wires rely on multiple banks and manual processing, which increases the risk of delays, fees, and rejection. Tracking is often limited, leaving senders unsure of a transfer’s status.

Digital remittance platforms are built specifically for cross-border payments. They typically validate recipient details in advance, use fewer intermediaries, and provide real-time tracking. This reduces rejection risk and improves delivery times. Costs are also more predictable, with clearer exchange rates and fees. For individuals sending money internationally, especially on a regular basis, digital remittance platforms often offer a smoother and more dependable transfer experience.

How Does Frex Help Minimize Transfer Rejections Compared to Bank Wires?

Frex helps minimize transfer rejections by removing many of the common failure points associated with traditional bank wires. Unlike bank wires that rely on manual entry and multiple intermediary banks, Frex uses automated recipient detail validation before a transfer is initiated. This significantly reduces errors related to account numbers, bank codes, and beneficiary information.

Frex also runs compliance and verification checks upfront, rather than after funds are sent. By addressing regulatory requirements early, transfers are less likely to be flagged or rejected later in the process. With optimized transfer corridors and fewer intermediaries, payments move faster and more predictably, especially for international transfers.

Real-time tracking keeps users informed at every stage, reducing uncertainty and delays. If you want a more reliable way to send money internationally, contact us to learn how Frex works, or download the Frex app today to get started with faster, lower-risk transfers.

Conclusion

Wire transfer rejections are more common than many people expect, especially with international payments. Strict compliance rules, manual processing, and multiple intermediary banks all increase the risk of delays and failures. Understanding how wire transfers work, why banks reject them, and what happens after a rejection helps you make better decisions when sending money.

Choosing the right transfer type, checking details carefully, and knowing when alternatives may be more suitable can reduce frustration and financial uncertainty. With the right preparation and awareness, you can avoid common mistakes and ensure your international transfers are completed more smoothly and with greater confidence.

Frequently Asked Questions

Are there ways to dispute or reverse a rejected wire transfer?

In most cases, a rejected money transfer is automatically returned to the originator. You can dispute fees or delays by contacting your bank with the receipt. For rare cases, seek professional advice, as reversals depend on bank policies and due diligence.

Is it possible for a recipient bank to refuse an incoming wire transfer, and why?

Yes, a recipient bank can refuse an incoming wire transfer due to a wrong account number, name mismatch, or issues with third parties. Banks in specific countries may also reject transfers that do not meet local compliance rules.

Do wire transfers ever get blocked because of suspected fraud or money laundering?

Yes, wire transfers can be blocked due to wire transfer fraud concerns or money laundering checks. Banks monitor activity to protect customers from fraudsters and may stop transfers that appear unusual, especially across the United States, Europe, or high-risk regions.

Can sanctions or legal restrictions lead to a wire transfer being rejected?

Sanctions enforced by OFAC can cause wire transfers to be rejected. Transfers involving Iran or other restricted regions may be blocked. Banks must comply with legal restrictions and cannot act as a substitute for sanctioned transactions.

What information do I need to check before initiating a wire transfer to avoid rejection?

Always confirm the bank account number, recipient name, amount limits, and destination country. Review the terms of use carefully and verify whether additional documents like a letter of credit are required for international money transfer requests.

If my wire transfer is lost or missing, what should I do?

Contact your bank immediately and request a trace using the receipt details. The originator bank can track the transfer through affiliates or intermediaries. Resolution may take until the next business day or longer for international transfers.

Are there ways to dispute or reverse a rejected wire transfer?

Disputes are usually limited once a wire is rejected. Funds are returned automatically, though fees may apply. Banks provide general information purposes only, so consult a financial advisor if you believe the rejection was incorrect.

Can limits on the amount I send cause a bank to refuse my wire transfer?

Yes, exceeding daily or transaction limits can cause rejection. Banks enforce limits to manage risk and compliance. This applies to both domestic and international transfers, especially when sending large amounts through multiple third parties.

Why did my wire transfer get returned?

A wire transfer may be returned due to incorrect details, compliance checks, suspected fraud, or restrictions tied to specific countries. Returned transfers are common safeguards and do not always indicate wrongdoing by the sender.

Leave a Reply