Key Highlights

- HDFC Bank offers secure and efficient methods to transfer money from the USA to India.

- HDFC Remit and Frex provide fast and cost-effective options for international transfers.

- Ensure the recipient’s details are accurate to avoid transfer delays.

- Stay informed by tracking your transfer via HDFC Bank’s online platform or mobile app.

- Competitive exchange rates can impact the final amount received by the recipient.

- Be mindful of transfer limits imposed by HDFC Bank and the US bank.

- Always check the fees and exchange rates before initiating your transfer to maximize value.

- Ensure sufficient funds in your US bank account to cover the transfer amount and fees.

Transferring money from the USA to India can feel overwhelming, especially with the complexities of exchange rates, fees, and transfer methods. Whether you’re sending money to family, paying for business expenses, or handling other remittances, it’s crucial to choose a method that is both secure and cost-effective.

The process of transferring money from the USA to India with HDFC Bank can be simplified, but understanding the steps and considerations involved is key. Issues like transfer limits, accurate recipient details, and fluctuating exchange rates can cause unnecessary delays or unexpected fees.

This blog will guide you through the process of making secure, efficient, and hassle-free transfers using HDFC Bank, while ensuring that you understand the essential factors to consider before initiating your transfer.

Why Should You Choose HDFC Bank for Transfers from USA to India?

Transferring money from the USA to India can feel complex, especially when compliance, timing, and costs are involved. HDFC Bank is often chosen by NRIs because it offers structure, predictability, and familiarity in cross-border transfers.

Here is why that actually matters to you:

1) Trusted and Reliable for Cross-Border Transfers

When you are sending money to family or moving larger amounts, reliability matters more than convenience alone. HDFC Bank’s established remittance processes reduce the risk of failed transfers, reversals, or compliance issues. Using regulated partners like Frex also helps ensure NRI remittance tax and reporting requirements are handled correctly.

2) Secure Transfers With Clear Routing

Security is not just about encryption, but about knowing where your money is at every stage. Transfers routed through HDFC-supported channels follow defined banking workflows, which reduces the chances of funds being held or delayed unexpectedly when sending money from the USA to India.

3) Fees and Exchange Rates You Can Evaluate Upfront

Exchange rate margins often cost more than transfer fees. HDFC Bank’s pricing structure makes it easier to estimate the total cost before confirming a transfer, rather than discovering deductions after the money has already been sent.

4) Easy Access for the Recipient in India

Once funds are credited to an HDFC Bank account, they are immediately usable for withdrawals, bill payments, or savings. There is no additional waiting period or conversion step for the recipient, which keeps the process straightforward.

For NRIs who prioritize predictable outcomes, compliance, and established banking workflows, HDFC Bank offers a structured way to transfer money from the USA to India without unnecessary friction.

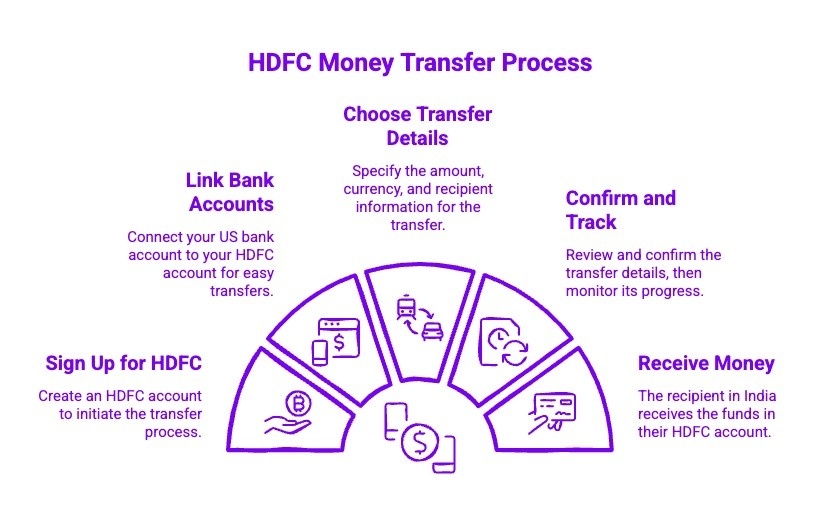

How Do You Transfer Money from USA to India via HDFC Bank?

Transferring money from the USA to India through HDFC Bank is a straightforward process. Below are the steps to follow:

- Sign Up for HDFC: Sign up for HDFC Remit or another regulated digital remittance service. These platforms securely collect funds from your US bank account and deliver them to the recipient’s HDFC Bank account in India.

- Link Your US Bank Account to Your HDFC Account: Add your US bank account to the regulated remittance platform you are using. The platform pulls funds from your US bank and routes them securely to the recipient’s HDFC Bank account in India.

- Choose Transfer Details: Select the amount, recipient’s details, and currency. You can transfer funds to any HDFC Bank account in India. Ensure the recipient’s name and account number are accurate to avoid delays.

- Confirm Transfer and Track Status: Once the details are entered, review and confirm your transfer. You can track the status of your transfer online or via the mobile app, providing real-time updates on your money transfer from USA to India HDFC.

- Receive Money in India: Once the transfer is processed, funds are credited to the recipient’s HDFC Bank account typically within one to three business days, depending on the transfer method, cut-off times, and whether any intermediary banks are involved.

This simple process ensures that transferring money from the USA to India with HDFC Bank is both easy and secure.

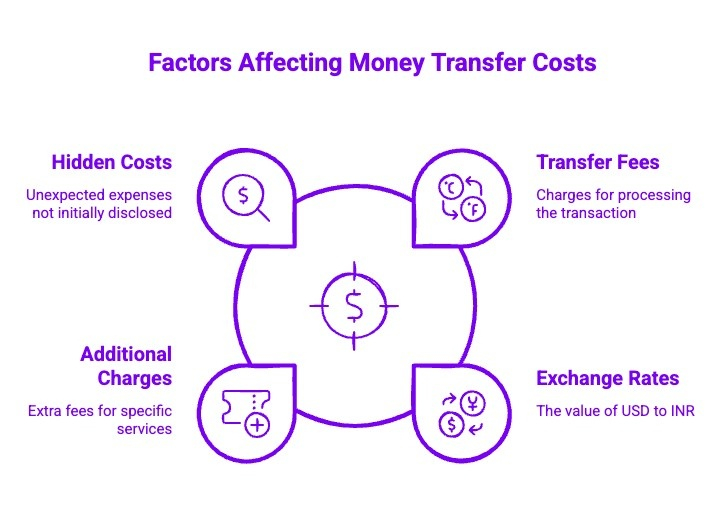

How Much Will It Cost to Transfer Money from USA to India with HDFC?

The cost to transfer money from the USA to India with HDFC Bank depends on the transfer method, amount, and how the funds are routed. Here is a practical breakdown with real-world ranges:

Transfer Fees

For most bank-initiated international transfers:

- USD 15 to USD 40 per transfer

- Online platforms like HDFC Remit are typically at the lower end of this range

- Branch or wire-based transfers usually cost more

Fees are flat in many cases, so larger transfers lower the effective percentage cost.

Exchange Rate Margin

Banks rarely use the mid-market rate. The difference is your FX cost:

- Typical spread: 1.5% to 3%

- On USD 5,000, that is USD 75 to USD 150

In most cases, the exchange rate margin is the biggest cost driver.

Additional Charges

Depending on the path and account details, you may see:

- Handling or service fees: USD 0 to USD 10

- Receiving bank charges in India (sometimes): INR 0 to INR 500

These are smaller costs, but they add up on frequent transfers.

Hidden Costs

These are the charges people miss because they do not always show clearly at checkout:

- Intermediary or correspondent bank deductions: USD 10 to USD 30

- Unexpected routing fees if SWIFT details are incomplete: USD 5 to USD 15

- “Rate padding” beyond the visible spread on some routes: 0.5% to 1% extra

Hidden costs show up most often with SWIFT wire routing, not streamlined online remittance flows.

Example Cost Scenario

Sending USD 2,000 from the USA to India:

- Transfer fee: USD 20

- FX margin at 2 percent: USD 40

- Possible intermediary fee: USD 15

- Total estimated cost: USD 75

The recipient may receive the equivalent of about USD 1,925 after all charges.

Final Cost Takeaway

- Small transfers feel expensive due to flat fees

- Larger transfers are mainly impacted by exchange rate margins

- Online remittance routes are usually cheaper than wires

Always check both the fee and the applied exchange rate before confirming the transfer.

How Can You Ensure a Smooth Money Transfer from USA to India?

To make sure your transfer from the USA to India via HDFC Bank goes smoothly, follow these essential steps:

- Double-Check Recipient Details: Ensure the recipient’s name, account number, and bank details are entered correctly. A small mistake can delay the transfer money from USA to India HDFC Bank or cause it to be rejected.

- Choose the Right Transfer Method: Use the most efficient and cost-effective transfer method, such as HDFC Remit or Frex, to ensure the funds reach the recipient quickly and securely when you transfer money from USA to India HDFC Bank.

- Be Aware of Transfer Limits: Nothing is more frustrating than a transfer that stops halfway because of an unseen limit. Both your US bank and HDFC Bank apply caps based on the transfer type and account setup. Checking these limits upfront helps you plan larger transfers smoothly. This guide breaks down the maximum money transfer limits from the USA to India, with practical examples you can actually use.

- Track Your Transfer: Use HDFC Bank’s online or mobile banking platform to monitor the progress of your transfer. Many platforms offer real-time tracking, so you can stay informed about the status of your transfer money from USA to India HDFC Bank.

- Check Exchange Rates: Pay attention to the exchange rate offered by HDFC Bank. Rates can fluctuate, so check the rate before initiating the transfer money from USA to India HDFC Bank to ensure you get the best value for your money.

- Ensure Sufficient Balance: Verify that your US bank account has enough funds to cover both the transfer amount and any fees associated with the transaction.

By following these simple tips, you can ensure your money transfer from the USA to India with HDFC Bank is smooth, secure, and efficient.

What Are Foreign Currency Cheques and Demand Drafts?

Foreign currency cheques and demand drafts are traditional cross-border banking instruments that existed long before digital remittance platforms. Banks such as HDFC Bank still support them, mainly for legacy, institutional, or compliance-driven transactions.

In simple terms, these are physical, paper-based instruments that move through correspondent banking networks rather than instant payment systems.

They remain valid, but they are no longer built for speed or cost efficiency.

Foreign Currency Cheques

A foreign currency cheque is issued in USD or another overseas currency and deposited into an Indian bank account for collection.

In practice, the process looks like this:

- The cheque is sent for foreign collection through correspondent banks

- Funds are credited only after overseas clearance

- Currency conversion happens after settlement, not at deposit

What this results in:

- Processing timelines of two to four weeks

- Multiple handling and intermediary charges

- Exchange rates that are often less predictable

Foreign currency cheques work, but they are slow and inefficient for regular remittances.

Demand Drafts (DD)

A demand draft is a prepaid, bank-issued instrument where funds are collected upfront from the sender.

At a process level:

- The issuing bank guarantees payment

- The draft is physically sent to India

- The receiving bank verifies and clears it

- Funds are credited after foreign exchange conversion

What this means for the sender:

- Higher payment certainty than cheques

- Manual verification and physical handling

- Slower settlement compared to digital methods

Demand drafts prioritize certainty, not speed.

Key Realities to Keep in Mind

From an operational standpoint:

- Multiple intermediaries are involved

- Fees are higher and less transparent

- Settlement timelines vary significantly

- Exchange rates are applied later, not locked upfront

These delays and costs are inherent to the instrument itself.

Why These Methods Are Rarely Used Today?

Foreign currency cheques and demand drafts continue mainly to support older banking workflows and specific institutional requirements.

As a result:

- Most individuals now prefer digital remittance options

- Transfers are faster and easier to track

- Fees and exchange rates are clearer upfront

These instruments still exist, but they are no longer practical for everyday cross-border money transfers.

While these methods are still available, for faster, more secure, and cost-effective transfers, it’s recommended to use HDFC Bank’s online services like HDFC Remit or Frex for seamless transactions.

How Does Direct Remittance from Foreign Banks/Exchange Houses Work?

Direct remittance through foreign banks or exchange houses is an efficient way to transfer funds internationally. Here’s a breakdown of how this process works:

1) Initiating the Transfer

You initiate the transfer through a foreign bank or exchange house by providing the recipient’s details, including their HDFC Bank account information in India. The transfer is typically done via wire or electronic funds transfer (EFT).

2) Conversion of Currency

Foreign banks and exchange houses convert your USD (or other foreign currency) into Indian Rupees (INR) at the prevailing exchange rate. This process is typically handled by the bank or exchange house, but you can request the rate before proceeding.

3) Transfer to HDFC Bank

Once the currency is converted, the funds are transferred to the recipient’s HDFC Bank account. This can take anywhere from a few hours to a few days, depending on the remittance service and method used.

4) Confirmation and Tracking

You can track the status of your remittance through the foreign bank or exchange house’s tracking system. After the transaction is completed, the recipient will be notified and can access the funds in their HDFC account.

Key Considerations for Direct Remittance:

- Transfer Speed: Direct remittance is often faster than traditional methods like cheques or demand drafts.

- Fees: While the process is efficient, there may be fees charged by both the foreign bank and HDFC Bank for processing the transaction.

- Exchange Rates: Ensure you understand the exchange rate applied during the transaction, as it can affect the final amount received by the recipient.

Direct remittance from foreign banks or exchange houses is a popular choice for quick and secure transfers. However, it’s essential to weigh the fees and exchange rates before proceeding to ensure it meets your needs.

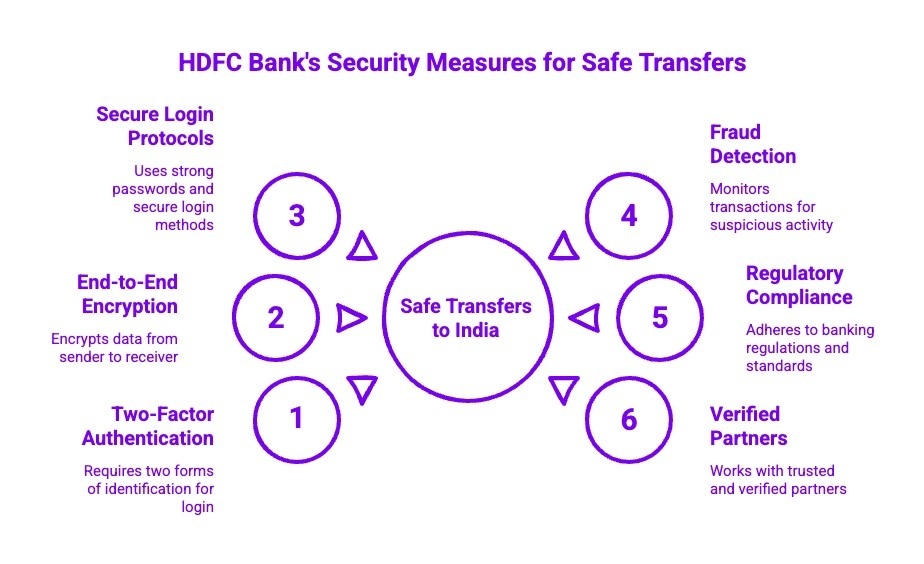

What Security Measures Does HDFC Bank Have for Safe Transfers to India?

When transferring money from the USA to India through HDFC Bank, security is a top priority. Here are the key security measures HDFC Bank employs to ensure safe and secure transactions:

1. Two-Factor Authentication (2FA)

HDFC Bank uses two-factor authentication to ensure that only authorized users can initiate transfers. This additional layer of security requires both a password and a unique one-time password (OTP) sent to your mobile device.

2. End-to-End Encryption

All transactions processed by HDFC Bank are encrypted end-to-end, meaning your data is protected throughout the entire transfer process. This ensures that sensitive information, such as bank account numbers and personal details, remains secure from unauthorized access.

3. Secure Login Protocols

HDFC Bank uses secure login protocols such as SSL encryption and multi-layered security systems to safeguard your login credentials and prevent unauthorized access to your account.

4. Fraud Detection and Monitoring

HDFC Bank continuously monitors all transactions for suspicious activity. If any unusual behavior is detected, the bank takes immediate action to block the transfer and contact the account holder for verification, ensuring your funds are protected.

5. Regulatory Compliance

HDFC Bank adheres to international security regulations and compliance standards, including those set by the Reserve Bank of India (RBI) and FATF (Financial Action Task Force). This ensures that the bank follows global best practices in money transfer security.

6. Verified and Trusted Partners

When using digital remittance services like Frex, HDFC Bank partners with trusted and verified financial institutions to ensure that your money is transferred securely, with minimal risk of fraud or loss.

By employing these robust security measures, HDFC Bank ensures that your money transfers to India are secure, fast, and reliable.

Why Should You Choose Frex for Secure Transfers to India via HDFC Bank?

Frex is a highly secure and efficient digital remittance service that makes transferring money from the USA to India through HDFC Bank simple and hassle-free. Here’s why Frex stands out:

- Fast Transfers: Frex ensures your money reaches the recipient quickly, often within hours.

- Competitive Exchange Rates: Get the best value for your transfer with Frex’s competitive exchange rates.

- Secure and Easy to Use: Frex uses advanced security protocols, keeping your transfer safe and user-friendly.

- Low Fees: Enjoy low processing fees, making it a cost-effective choice for sending money to India.

Frex offers an efficient, transparent, and secure method for sending money from the USA to India, making it an ideal partner with HDFC Bank for your remittance needs.

Have questions? Our team is ready to assist you. Contact us now.

Start transferring with ease. Download the app today.

Conclusion

Transferring money from the USA to India with HDFC Bank is a convenient and secure option for NRIs. With a range of reliable transfer methods available, including HDFC Remit, the bank ensures that your funds reach their destination quickly and securely. By offering competitive exchange rates, low fees, and a commitment to robust security, HDFC Bank makes it easier to send money to your loved ones in India.

Whether for personal or business reasons, choosing HDFC Bank for your international transfers ensures a smooth, reliable, and cost-effective experience.

Frequently Asked Questions

Do I need to provide any specific documents for transferring money to HDFC Bank in India from the US?

Yes, for foreign outward remittance to HDFC Bank, you will typically need to provide a valid passport, beneficiary details, and possibly a letter of instruction. You may also be asked for a bank statement or proof of business transactions if relevant.

What are the differences between using HDFC Bank and services like Western Union or Wise for money transfers to India?

HDFC Bank offers direct ACH transfers and competitive foreign exchange transactions with attractive rates. Unlike services like Wise, HDFC provides access to HDFC Bank branches for in-person assistance, while Western Union relies on its network of agents.

Is the HDFC Bank NRI account required for transferring funds from the USA to India?

No, an HDFC Bank NRI account is not required for foreign outward remittance. You can use the mode of transfer such as telegraphic transfer or netbanking, as long as the account details of the beneficiary are correct.

What exchange rates does HDFC Bank offer for international transfers from the USA to India?

HDFC Bank offers forex rates for outward remittances that are typically competitive, depending on various currencies. You can check the exact rate on their pricing page or inquire at HDFC Bank branches to get attractive rates for your transfer.

Are there any limits on how much money I can send to India using HDFC Bank from the USA?

Yes, limits may apply depending on the payment method. For foreign outward remittance, the terms of use typically set an annual cap for personal transfers. For business transactions, larger sums may require additional documentation and approval.

How do I initiate an international wire transfer to HDFC Bank in India from the USA?

To initiate a transfer, use netbanking or visit your local HDFC Bank branches. You will need to provide account details of the beneficiary, select a mode of transfer, and complete the transaction by confirming the terms of use.

What are the differences between using HDFC Bank and services like Western Union or Wise for money transfers to India?

HDFC Bank provides a professional advice approach with more secure and regulated options such as telegraphic transfer and direct ACH transfers, while services like Wise may offer wise fees but without the local presence of HDFC Bank branches.

Is the HDFC Bank NRI account required for transferring funds from the USA to India?

No, you do not need an NRI account to send funds from the USA. You can make outward remittances via telegraphic transfer or through platforms like RemitNow, as long as you have the correct beneficiary information.

How long does a wire transfer take from USA to India HDFC?

Typically, telegraphic transfers from the USA to India via HDFC Bank take business days to process. Depending on the payment method and time of day, transfers can be completed within 2-4 business days or even faster in certain cases.

Leave a Reply