Key Highlights

- Money sent to an NRE account from the US must originate from a foreign source, such as a US bank account.

- NRIs can fund NRE accounts using bank wires or digital bank-to-bank transfer services.

- NRE accounts are meant for foreign income and generally offer tax-free interest and full repatriation.

- Accurate beneficiary details, including the IFSC code, are essential for a successful transfer.

- Digital transfers often complete faster and provide clearer exchange rate visibility than traditional wires.

- Choosing between NRE and NRO accounts depends on whether the income is earned abroad or in India.

- Understanding documentation and compliance rules helps avoid delays, rejections, or unexpected costs.

Sending money from the US to India sounds simple, but it often becomes confusing when NRE accounts are involved. Many NRIs know they need to move money from a US bank account, yet questions quickly come up around eligibility, transfer methods, timelines, and compliance rules.

A common challenge is understanding whether an NRE account can receive money directly from the US and what steps must be followed to ensure the transfer goes through smoothly. Choosing the wrong account type or transfer method can lead to delays, rejected transactions, or unexpected costs.

NRE accounts are specifically designed for foreign income, but they must be funded in the right way. This guide explains how to send money from the US to an Indian NRE account, breaks down the transfer process step by step, and clarifies the difference between NRE and NRO accounts. It also highlights key rules and checks to know before confirming a transfer, helping NRIs move money with clarity and confidence.

What Is an NRE Account and Who Can Use It?

An NRE account is designed for Indians living outside India who want to keep their foreign income in an Indian bank account. It allows money earned abroad, such as income from the United States, to be transferred to India and held in Indian rupees in a compliant way.

This type of account is available only to NRIs, OCIs, and PIOs. One important rule to remember is that money credited to an NRE account must come from outside India. The funds are first sent in foreign currency and then converted to INR before being credited to the account.

NRIs commonly use NRE accounts for savings, investments, or regular expenses in India. A key benefit is that both the principal amount and the interest earned are generally tax-free in India, subject to current tax rules.

When sending money from the US, particularly for international remittances, the transfer must happen through approved banking channels. This means the money needs to come from a US bank account or an authorised digital remittance service. Cash deposits and informal transfer methods are not permitted for funding an NRE account.

Also Read: Which Is the Best App for Sending Money to India from USA?

Is It Possible to Transfer Money to an NRE or NRO Account?

NRIs can send money to both NRE and NRO accounts, but the account you choose should match the source of the funds. This distinction is important because each account follows different rules for deposits, taxation, and repatriation.

At a basic level, both accounts fall under the category of NRI banking accounts, created to help Indians living abroad manage money linked to India.

- An NRE account is meant for income earned outside India, such as salary or savings from the US.

- An NRO account is used to manage income earned in India, such as rent, pension, or other local receipts.

While both accounts allow deposits from abroad, they serve different financial purposes. Understanding this difference before initiating a transfer helps NRIs choose the right account and avoid complications later.

How to Transfer Money from US Bank to NRE Account?

Transferring money from a US bank to an NRE account is allowed only through formal banking and authorized remittance channels, which are essential NRI services. This is a core rule highlighted across NRI guides published by Wise and Indian banks. The transfer must originate from outside India and be sent in foreign currency before conversion to INR.

Most NRIs use either a traditional bank wire or a digital remittance platform to complete this process. In both cases, the money moves directly from the US bank account to the Indian NRE account, with no involvement of cash pickup or third-party handling. This method ensures compliance with FEMA guidelines, as explained in ICICI Bank and Arthgyaan NRI resources.

To understand how to transfer money from US to India NRI account, the sender must provide accurate beneficiary details when sending money from a US bank to an NRE account, including the NRE account number, bank name, branch, and IFSC code.

From a technical perspective, the transfer involves three stages.

- First, funds are debited from the US bank account.

- Second, the amount is converted from USD to INR at the applied exchange rate.

- Finally, the INR amount is credited to the NRE account.

Many modern digital transfers now complete this process within the same day, especially for smaller amounts, which is why NRIs increasingly prefer bank-to-bank digital transfers for funding NRE accounts.

How to Transfer Money from the US to an NRE Account Using Frex?

Once the basics of NRE accounts are clear, the next step is to choose a simple, compliant way to send money to India from USA.

Step 1: Download the Frex App and Create an Account

Start by downloading the Frex mobile app and creating an account using your email address and basic personal details. New users can benefit from best exchange rates and are guided through a simple onboarding process designed for NRIs in the US.

Step 2: Complete Identity Verification

Before sending money, users must complete identity verification. This is a standard requirement for regulated money transfer services in the US and India. The process usually involves uploading an identity document and confirming personal details.

This step helps ensure the transfer remains secure and compliant with financial regulations.

Step 3: Link Your US Bank Account Securely

Next, link your US bank account to Frex. This connection lets you transfer money directly from your bank account without using cards or manual wire transfers. The linking process is handled through a secure banking connection.

Once linked, your bank account can be reused for future transfers.

Step 4: Enter the Transfer Amount

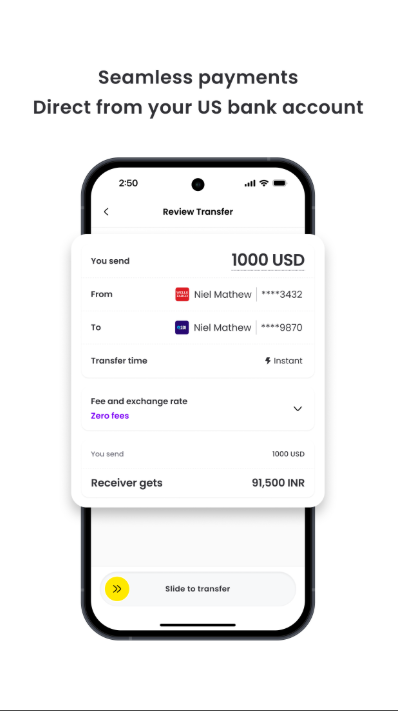

After your bank account is linked, enter the amount you want to send. Users can choose to send small or large amounts depending on their needs. The app clearly shows the amount being sent from the US and the corresponding amount that will be credited in India.

This step helps users plan transfers without committing blindly.

Step 5: Add the NRE Account Details

Now, add the beneficiary’s Indian NRE account details. This includes the account holder’s name, phone number, NRE account number, bank name, and IFSC code. These details must match the bank’s records exactly to avoid delays.

The money is sent directly to the NRE account through formal banking channels.

Step 6: Review Exchange Rate and Confirm the Transfer

Before confirming, Frex displays the applicable exchange rate and the final INR amount to be credited to the NRE account. This review step allows users to understand the full transfer outcome upfront.

Once confirmed, the transfer is processed without requiring any further action.

Step 7: Track the Transfer Status

After confirmation, users can track the transfer status within the app, providing peace of mind. Updates are provided until the money is credited to the NRE account. Many transfers are completed quickly, depending on banking hours and processing timelines.

By following these steps, NRIs can understand how to send money to NRE account from US using online money transfer services to move funds from a US bank account to an Indian NRE account in a structured and predictable way. This process removes much of the uncertainty often associated with international transfers and helps first-time users complete transactions with confidence.

How to Transfer Money to an NRO Account: Step-by-Step

Sending money to an NRO account is a straightforward process, especially when the funds are meant to manage income earned in India. NRO accounts function as India-based bank accounts for managing income earned in India, but they come with specific tax treatment and repatriation restrictions that do not apply to standard resident accounts.

Here’s how the process typically works:

- Choose the transfer method: Decide whether the money will be sent through online banking, a digital money transfer service, or another authorised banking channel.

- Enter the NRO account details: Provide the account holder’s name, NRO account number, bank name, and IFSC code. These details must match bank records to avoid delays.

- Select the transfer amount: Choose how much money you want to send, keeping in mind the purpose of the funds and any applicable limits.

- Submit documents if requested: In some cases, banks or transfer services may ask for supporting documents, especially for larger amounts or specific income types.

- Confirm and complete the transfer: Review the details and confirm the transaction. Once processed, the money is credited to the NRO account.

Funds held in an NRO account can be repatriated abroad, subject to applicable rules and limits. Currently, repatriation is allowed up to USD 1 million per financial year for permitted purposes, provided the tax and documentation requirements are met.

What is The Difference Between NRE and NRO Accounts for US-Based NRIs?

With NRE and NRO account differences in mind, it becomes easier to decide how to transfer money to NRO account from US.

| Aspect | NRE Account | NRO Account |

|---|---|---|

| Purpose | To hold income earned outside India | To manage income earned within India |

| Typical use | Salary, savings, or transfers from the US | Rent, pension, dividends, or other India-based income |

| Source of funds | Foreign income only | Indian income and foreign transfers |

| Currency | Maintained in Indian rupees | Maintained in Indian rupees |

| Funding from US | Allowed through US bank or authorised remittance channels | Allowed through US bank or authorised remittance channels |

| Tax on interest | Generally tax-free in India | Interest is taxable in India |

| Repatriation | Fully repatriable | Limited repatriation, subject to rules and taxes |

| Suitability for NRIs | Preferred for sending money from the US | Used mainly for managing India-side income |

| Compliance focus | Designed for foreign inward remittance | Requires additional tax compliance for outward transfers |

Choosing the right account helps NRIs avoid tax issues and ensures transfers from the US are credited correctly. Foreign income is usually routed to an NRE account, while India-based income is managed through an NRO account. Understanding this difference makes cross-border money management simpler and more predictable.

What Documents Are Required for Transferring Money to NRE and NRO Accounts?

For most simple digital transfers from the US to an NRE or NRO account, documents are usually not required for every transaction. In many cases, users only need to select the transfer purpose and complete identity verification during onboarding.

However, regulated digital payment platforms may require a government-issued ID for one-time identity checks. This helps ensure the transfer complies with financial regulations in both the US and India.

If you are specifically transferring funds from an NRO account to an NRE account, additional documentation is required. In such cases, you may need to provide proof of tax payment to confirm that applicable Indian taxes have been paid before the transfer.

If you are opening an NRE or NRO account, banks may ask for the following documents along with the application:

- Proof of NRI status

- Proof of tax residency

- Proof of identity

- Current overseas address proof

- Permanent Indian address proof

Document requirements can vary from bank to bank. In some cases, banks may also request proof of overseas income or a cancelled cheque for account setup.

Also Read: How to Transfer Money from USA to India Without Tax?

What Are the Important Rules to Know When Sending Money from the US to India?

Before sending money from US bank account to India NRO account, it is important to understand a few key rules governing international digital transfers. Knowing these upfront helps avoid delays, rejected transfers, or compliance issues.

- Funds must originate outside India: Money sent to an NRE account must come from a foreign source, such as a US bank account. Transfers from Indian accounts or cash deposits are not permitted for funding NRE accounts.

- The purpose of the transfer matters: The reason for sending money determines whether it should be sent to an NRE or an NRO account. Foreign income is usually credited to NRE accounts, while income earned in India is managed through NRO accounts. Selecting the correct purpose helps ensure proper account credit.

- Accurate beneficiary details are essential: Digital transfers rely on exact bank details. The account holder’s name, account number, and IFSC code must match bank records. Even minor errors can delay or fail the transfer.

- Exchange rates impact the final amount received: The exchange rate applied at the time of transfer directly affects how much money is credited in India. Reviewing the rate before confirming the transfer helps avoid unexpected differences.

- Tax and repatriation rules differ by account type: NRE accounts generally offer tax-free interest and full repatriation, while NRO accounts are subject to Indian taxes and repatriation limits. Understanding this difference is important for long-term planning.

Why Choose Frex for US to India NRE Transfers?

When sending money from the US to an NRE account in India, clarity and reliability matter as much as speed. Frex offers a simple way to fund NRE accounts from US bank accounts without dealing with complex transfer fees or unclear exchange rates.

Frex shows the exact transfer amount, exchange rate, and final credited value before you confirm the transfer. This upfront visibility helps NRIs understand the true cost of sending money to India and avoid last-minute surprises. With fast processing and direct bank-to-bank transfers, funds can be deposited into Indian NRE accounts quickly and securely.

Designed for a mobile-first experience, Frex keeps the transfer process straightforward with easy setup, secure verification, and real-time tracking. This makes managing US-to-India transfers easier, whether you send money occasionally or regularly.

Ready to move money with more confidence? Download the Frex app and experience a clearer way to send money from the US to India.

Conclusion

Transferring money to NRE account US to India becomes much simpler when the correct account type and transfer method are chosen. By understanding the rules, preparing the proper details, and using digital bank-to-bank transfers, NRIs can avoid delays and unexpected costs.

As a next step, review your NRE or NRO account type, keep your bank details handy, and compare exchange rates before confirming a transfer. If you plan to send money regularly, using a digital transfer option with upfront rate visibility can make the process easier to manage.

Frequently Asked Questions

Can I send money directly from a US bank account to an NRE account in India?

Yes. Money can be sent directly from a US bank account to an NRE account through authorised banking or digital remittance channels that offer various payment methods. The funds must originate outside India and are converted to INR before being credited.

How long does it take to transfer money from the US to an NRE account?

Transfer time depends on the method used. Traditional bank wires may take one to five business days, while digital bank-to-bank transfers are often completed on the same day or within one business day, making it the best option for faster transactions.

Is there a minimum amount required to send money to an NRE account from the US

Most digital money transfer services do not require a minimum transfer amount. This allows NRIs to send small or large amounts based on their needs, making NRE account funding more flexible.

Can I send money from the US to an NRO account instead of an NRE account?

Yes. Sending money from a US bank account to an NRO account in India is allowed. However, NRO accounts are primarily used for income from India and are subject to Indian tax and repatriation rules.

Do I need to convert USD to INR before sending money to an NRE account?

No. You send money in USD, and the transfer service handles the currency conversion automatically, every step of the way. The funds are converted to INR at the applicable exchange rate before being credited to the NRE account.

How to transfer money to an NRO account from the US?

To transfer money to an NRO account from the US, NRIs can send funds from a US bank account through authorised banking or digital remittance channels. The process is similar to NRE transfers, but NRO accounts are subject to Indian tax and repatriation rules.

Are there any fees when using Frex to send money from the US to India?

Frex focuses on transparent pricing and shows the full transfer details before confirmation. Users can see the exchange rate and final credited amount clearly, helping them understand the actual cost of the transfer upfront.

Is Frex safe for sending money from the US to India?

Yes. Frex follows regulatory requirements in both the US and India and uses secure banking connections and encryption. These measures help protect user data and ensure that various payment options for money transfers are processed safely and reliably.

Which US banks allow transfers directly to NRE accounts in India?

Most major US banks support sending funds to Indian bank accounts, including NRE accounts, via their international wire services. The transfer must be routed through authorised banking channels, and you should provide accurate account details to avoid delays.

Do I need to convert USD to INR before sending money to an NRE account?

No. You send money in USD. The receiving bank or transfer service converts it to INR during processing. The conversion occurs during the transfer, so you do not need to convert the currency yourself before sending.

Leave a Reply