Key Highlights

- Wire transfers from the USA to India are secure and reliable for both personal and business transactions, typically processed within 2-5 business days.

- Frex offers faster ACH-based transfers with low fees, ideal for both small and large amounts.

- Wire transfer charges from USA to India can vary based on the service provider, with potential hidden fees or exchange rate markups.

- Transfers require essential details like the recipient’s name, bank account number, IFSC, and SWIFT/BIC code for accurate processing.

- Wire transfer methods provide enhanced security with encryption and fraud protection, ensuring safe transactions.

- Choosing the right transfer method can reduce fees and processing times while ensuring a reliable, cost-effective transaction.

- Direct bank account transfers in India ensure competitive exchange rates and low fees, especially with services like Frex.

Sending money from the USA to India often involves high fees, long processing times, and concerns over security. Finding an affordable and reliable method for transferring funds is essential for personal and business transactions.

Traditional wire transfers can be slow and expensive and often come with hidden charges, making them less suitable for time-sensitive transfers. These challenges can create frustration for senders looking for a quicker and more transparent solution.

This blog will explore different options for transferring money from the USA to India, highlighting the benefits of choosing an efficient, cost-effective, and secure method.

What is Wire Transfer from USA to India?

A wire transfer from the USA to India is a method of electronically sending money between banks or financial institutions across international borders. It is a secure and reliable way to transfer funds quickly, often used for both personal and business transactions. The process involves the sender providing details like the recipient’s name, bank account number, IFSC code (for Indian banks), and the SWIFT/BIC code to ensure the money is directed to the correct account.

Wire transfers are commonly used for large amounts, as they can be processed within a few days, depending on the service provider and the transfer method chosen. While they may come with higher fees compared to other methods like ACH or online transfers, wire transfers offer added security and direct bank-to-bank transfers. This makes the international wire transfer from USA to India a trusted option for sending money internationally, especially for urgent or high-value transactions.

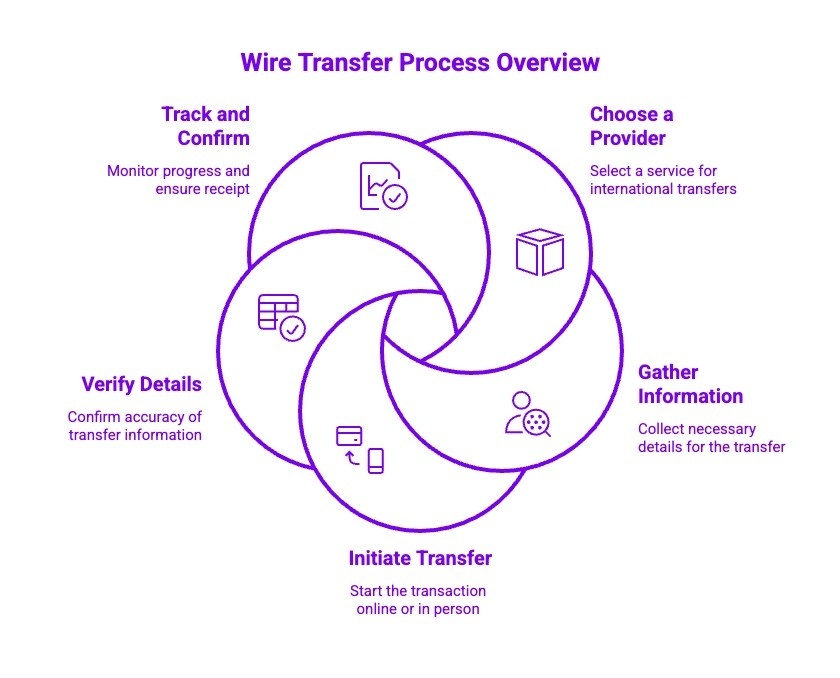

How Do You Do a Wire Transfer from USA to India?

Wire transfers from the USA to India use the international banking network, typically SWIFT, to move funds securely between banks. Following the correct process helps avoid delays, rejections, or compliance issues.

Step 1: Choose a Bank-Based Wire Transfer Provider

Wire transfers from the USA to India must be initiated through a US bank or a financial institution that sends funds over the SWIFT network. These providers route money directly to Indian banks, sometimes using intermediary banks. Review fees, exchange rates, and processing timelines before proceeding.

Note: ACH-funded remittance platforms operate on a different payment rail and are alternatives, not wire transfers.

Step 2: Gather the Required Wire Transfer Details

Banks require accurate recipient information to process a wire transfer. This typically includes the recipient’s full name, bank account number, IFSC code, SWIFT or BIC code, and sometimes the bank branch address. Larger transfers may also require a stated purpose of remittance.

Step 3: Initiate the Wire Transfer Through the Bank

Wire transfers are initiated via a bank’s online portal or at a physical branch. Once submitted, the bank sends funds through the SWIFT network, often passing through correspondent or intermediary banks before reaching India.

Step 4: Review and Confirm All Transaction Details

Before final confirmation, carefully verify recipient details, transfer amount, and routing codes. Errors in account numbers or SWIFT codes are a common reason for delays or rejected wire transfers, especially for high-value transactions.

Step 5: Track the Wire Transfer and Confirm Receipt

After the transfer is sent, the bank provides a reference number or SWIFT tracking code. This allows you to track the transaction through the banking network and confirm when the receiving bank credits the funds in India.

Wire transfers remain a reliable option for large or formal transactions, though they usually involve higher fees and longer processing times compared to non-wire alternatives.

Also Read: Looking to avoid high wire transfer fees and delays? Learn how ACH funded remittance platforms help NRIs transfer money from the USA to India without fees, while still ensuring speed, transparency, and compliance.

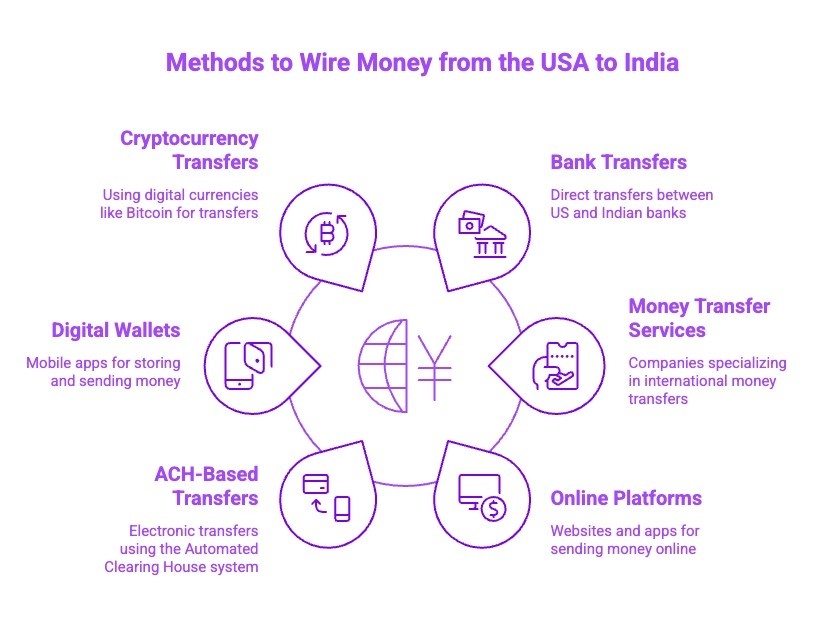

What Are the Key Methods to Wire Money from the USA to India?

Wiring money from the USA to India refers specifically to bank-to-bank transfers routed through the international wire network, usually using SWIFT. These methods differ from ACH, wallets, or app-based remittances, which are separate payment rails.

Here are the legitimate wire transfer methods NRIs can use.

1) Bank-Initiated International Wire Transfers (SWIFT)

This is the most traditional form of wire transfer. The sender instructs their US bank to send funds directly to an Indian bank via the SWIFT network, using details such as the recipient’s account number, IFSC code, and SWIFT or BIC code.

These transfers typically take two to five business days and are commonly used for high-value transactions, property payments, or formal remittances where documentation and traceability matter.

2) Branch-Based Wire Transfers via Global Money Services

Some global money service providers offer true wire transfers by routing funds through partnered banks rather than alternative rails. These services still rely on SWIFT messaging and correspondent banking relationships, even if initiated online or at a physical location.

They can be faster than traditional banks but often come with higher fees or wider exchange rate spreads.

3) Bank-to-Bank Wires Using Intermediary Banks

In certain cases, especially when smaller US banks are involved, wire transfers are routed through one or more intermediary or correspondent banks before reaching India. This is still a genuine wire transfer, but it may involve additional fees or processing time.

Intermediary routing is common for large amounts or less common banking corridors.

What Is Not a Wire Transfer?

ACH transfers, remittance apps, digital wallets, and cryptocurrency transactions do not qualify as wire transfers. These use different settlement systems, even if the end result is money credited to an Indian bank account. While they may be faster or cheaper, they should be discussed separately as non-wire alternatives.

Understanding the distinction between wire transfers and other payment methods helps NRIs choose the right option based on value, compliance needs, and transfer purpose without confusion or misleading comparisons.

What Details Are Required for Wire Transfer from USA to India?

To complete a wire transfer from the USA to India, banks require accurate sender and recipient details for routing and compliance. Missing or incorrect information is a common reason for transfer delays or rejected transactions.

Below are the key details typically required:

- Recipient’s Full Name: Must exactly match the name on the recipient’s bank account.

- Recipient’s Bank Account Number: Used to credit funds to the correct account in India.

- Recipient’s Bank Name: The official name of the receiving bank is often required.

- Bank Branch Name and Address: Some banks request branch level details for verification.

- IFSC Code: Required to route funds correctly within the Indian banking system.

- SWIFT or BIC Code: Identifies the recipient’s bank for international wire routing.

- Intermediary Bank Details: Certain US banks use intermediary banks, which may require an additional SWIFT code.

- Purpose of Transfer: Often required for large amounts or regulatory reporting.

- Sender’s Details: Your full name, bank account information, and contact details.

- Source of Funds Declaration: May be requested for higher value transfers to meet compliance checks.

Ensuring all details are accurate helps avoid delays, reduces compliance queries, and ensures a smooth wire transfer from the USA to India.

What Are the Benefits of Choosing the Right Wire Transfer Method?

Choosing the right wire transfer method for sending money from the USA to India can significantly impact the cost, speed, and security of your transaction. Here are the key benefits of selecting the appropriate method:

1) Cost-Effectiveness

Selecting the right wire transfer method helps reduce unnecessary fees. Some methods, such as online services like Frex, offer lower transaction costs and competitive exchange rates compared to traditional bank transfers. This ensures that more of your money reaches the recipient, making it ideal for regular or large transfers.

2) Faster Processing Time

Certain methods offer faster processing times. For example, services like Frex enable quick transfers, often within the same day, whereas traditional bank wire transfers may take 2-5 business days. Understanding the USA to India wire transfer time is essential to ensure funds are available to the recipient promptly when needed. Choosing the right method ensures timely delivery and reduces any potential delays.

3) Security and Reliability

Wire transfers are among the most secure ways to send money internationally. By choosing a trusted provider like Frex, you benefit from reliable encryption, fraud protection, and tracking features. This minimizes the risk of fraud or errors, ensuring peace of mind for both the sender and the recipient.

4) Convenience and Accessibility

The right method provides flexibility and convenience. Services like Frex allow users to send money directly from their bank account to the recipient’s account, or even through mobile wallets, providing multiple transfer options. The ability to access services online means you can send money anytime, anywhere.

Choosing the right wire transfer method ensures a secure, cost-effective, and efficient way to send money from the USA to India, providing benefits for both the sender and recipient.

How Much Time Wire Transfer Take from USA to India?

The time it takes for a wire transfer from the USA to India can vary depending on several factors. Here’s a general breakdown:

- Standard Transfers: Typically, wire transfers from the USA to India take between 2 to 5 business days. This is the usual timeframe for bank-to-bank transfers using SWIFT.

- Same-Day or Next-Day Transfers: Some services offer faster transfers that can be completed within 24 hours. These options are available for an additional fee and can be useful for urgent transfers.

- Delays: Delays can occur due to weekends, holidays, or additional verification checks. Transfers may take longer if there’s a time zone difference or if the recipient’s bank requires extra processing.

To ensure the quickest transfer, you can opt for services like Frex, which uses ACH-based transfers to streamline the process, reducing delays and improving speed. This answers the common question of how long does wire transfer take from USA to India.

Wire Transfers vs. Other Cross-Border Methods: Which is Best for Sending Money from the USA to India?

When sending money from the USA to India, it’s important to choose the right method based on speed, fees, and security. While wire transfers are a traditional option, several alternative methods may better suit your needs depending on the amount and urgency.

Below are the key comparisons between wire transfers and other popular cross-border transfer methods:

| Method | Speed | Fees | Security | Transfer Limit | Best For |

|---|---|---|---|---|---|

| Wire Transfers | 2-5 Business Days | $10-$50 (sender) + possible receiver fees | Very secure (bank-to-bank) | High-value transactions | Large or urgent transactions |

| Online Transfer Service | Same Day to 1 Day | Low fees (flat-rate or percentage) | Secure (encryption and fraud prevention) | Medium to high value | Cost-effective for small to medium transfers |

| Money Transfer Services | Minutes to 1 Day | Higher fees (varies by method) | Secure (regulated service) | Low to medium value | Sending money quickly for cash pickup |

| Digital Wallets | Minutes to Hours | Fees vary by payment method | Secure (encryption) | Medium value | Quick transfers for personal use |

| P2P Transfers | Minutes to Hours | Low fees, but can be higher for credit card use | Secure (via platform security) | Low to medium value | Small personal transactions |

| Cryptocurrency Transfers | Minutes to Hours | Low transaction fees | Secure (blockchain technology) | High value | High-value transfers, cost-effective but volatile |

Each method offers unique advantages depending on your needs, whether it’s the speed, cost, or security of the transaction. By understanding the differences, you can choose the best wire transfer or alternative method that meets your requirements for sending money from the USA to India.

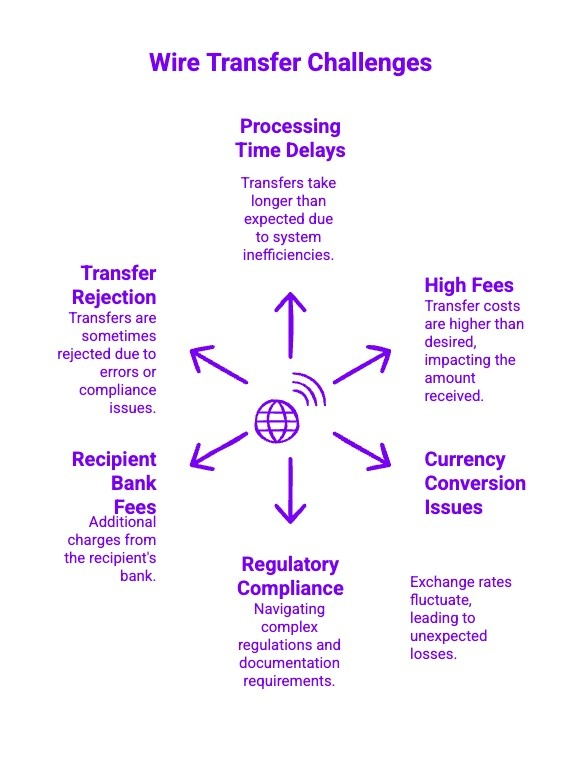

What Are the Common Challenges of Wire Money Transfers from the USA to India?

Sending money from the USA to India via wire transfers can come with its own set of challenges. Understanding these obstacles can help you navigate the process smoothly. Here are some of the most common challenges encountered during wire transfers:

1) Processing Time Delays

One of the main challenges with wire transfers is the processing time. International transfers can take 2-5 business days, and weekends or holidays can extend the wait time. Sometimes, intermediary banks also add to the delay.

2) High Fees and Charges

Wire transfers often come with high fees, which can add up quickly. Banks typically charge fees for both sending and receiving funds, and hidden charges can arise from conversion rates or intermediary banks. These wire transfer charges from USA to India can vary depending on the service provider, affecting the overall cost of the transfer.

3) Currency Conversion Issues

When transferring money internationally, the exchange rate plays a significant role in how much the recipient will receive. Fluctuations in exchange rates, hidden margins applied by banks, and delays in conversion can affect the final amount transferred.

4) Regulatory Compliance and Documentation

Regulatory requirements in both the USA and India can cause complications during the transfer process. Strict documentation may be required for large amounts, including the purpose of the transfer or proof of source of funds.

5) Recipient Bank Fees

While the sender is usually responsible for fees, recipient banks in India may also charge for incoming wire transfers. Fees may vary depending on the recipient’s bank and the transfer amount, potentially reducing the final amount received.

6) Transfer Rejection or Delays

Occasionally, wire transfers may face rejection or delays due to technical or regulatory issues. Incorrect recipient details, discrepancies in account information, or issues with intermediary banks can halt or delay the transfer process.

Being aware of these common challenges allows you to take the necessary precautions and make informed decisions when sending money from the USA to India via wire transfer.

Why Choose Frex for Your USA to India Wire Transfers?

Sending money from the USA to India has never been easier with Frex. Offering low fees, competitive exchange rates, and fast ACH-based transfers, you can enjoy a seamless and cost-effective experience.

Unlike traditional wire transfers, Frex ensures funds are transferred quickly, often within the same day, and with no hidden fees. The platform is transparent, so you always know the cost upfront.

With enhanced security measures such as encryption and fraud protection, your money and personal information are safe throughout the transfer process. Whether it’s for family support, tuition payments, or business transactions, Frex simplifies the process while ensuring your funds arrive securely.

Start using a reliable, efficient, and affordable method to send money to India.

Download the Frex app now and begin your hassle-free transfer today!

Conclusion

Selecting the right wire transfer method from the USA to India can greatly impact the cost, speed, and security of your transaction. Whether you need a quick transfer for personal expenses or a reliable option for business payments, understanding the different options available ensures that you make an informed choice.

By considering factors like fees, transfer speed, and security features, you can streamline the process and avoid unnecessary delays or charges. With the right service, sending money internationally can be hassle-free, efficient, and cost-effective, helping you achieve smooth cross-border transactions every time.

Frequently Asked Questions

How do I wire transfer money from the USA to India securely?

To wire transfer money securely from the USA to India, use trusted providers like banks or online services with encryption and fraud protection. For a cost-effective and secure option, Frex offers ACH-based transfers with competitive fees and fast processing times.

Are there any limits on the amount I can wire transfer to India from the USA?

Yes, there are limits on wire transfers to India. The Reserve Bank of India (RBI) sets annual limits for personal remittances, typically up to $250,000 USD per person per year under the Liberalized Remittance Scheme.

Can I use online banking or mobile apps to wire transfer money from the USA to India?

Yes, many banks and money transfer services allow you to wire transfer money to India via online banking or mobile apps. Frex provides a seamless option for sending money via its online platform, making it easy to transfer funds securely.

Are there any tax implications for transferring large sums from the USA to India?

Yes, there may be tax implications when transferring large sums. Indian tax laws require individuals to report gifts or transfers exceeding a certain limit, and the sender may need to comply with US reporting requirements.

How does wire transfer differ from other money transfer methods from the USA to India?

Wire transfers move funds directly between banks, offering strong security and reliability. While online or P2P services may be faster or cheaper, wire transfers suit high value transfers. Frex simplifies the process with fast delivery, low fees, and dependable security.

What happens if you wire transfer more than $10,000?

When you wire transfer more than $10,000, the transaction is subject to reporting under the Bank Secrecy Act in the USA. Both the sender and recipient may face additional documentation and verification for compliance purposes.

What information is required for wire transfer to India?

To wire transfer money to India, you need the recipient’s name, bank account number, IFSC code, SWIFT or BIC code, and bank details. Double checking accuracy helps avoid delays, while using Frex supports faster, smoother, and low cost transfers.

What Exchange Rates Apply When Sending a Wire Transfer from the USA to India?

Banks apply their own exchange rates for wire transfers, usually with a margin over interbank rates. The final rate depends on market conditions, the sending bank’s pricing, and whether intermediary banks are involved.

Leave a Reply