Key Highlights

- Instarem offers competitive exchange rates with low visible fees, suited for rate-sensitive transfers.

- Xoom focuses on speed and payout flexibility, including UPI, wallets, and cash pickup.

- Frex emphasizes predictable pricing and a streamlined, app-first experience.

- True transfer value depends on exchange rates, fees, speed, and pricing transparency combined.

- Instarem is ideal for occasional senders who want strong rates on one-off transfers.

- Xoom is ideal for users who prioritize fast delivery and flexible payout options.

- Frex is ideal for frequent or high-value senders seeking consistency and clarity.

International money transfers, especially from the United States to India, are essential, but they are often expensive and confusing. With remittance users losing billions each year to high fees and poor exchange rates, choosing the right platform matters.

The real challenge is not sending money, but avoiding hidden costs, FX markups, and slow settlements. Even small differences in US-INR exchange rates can significantly affect how much the recipient in India finally receives, particularly for frequent or high‑value transfers.

This blog provides a clear, side‑by‑side comparison of Instarem vs Xoom for US-India transfers, covering fees, exchange rates, speed, coverage, and ease of use, so you can choose the service that delivers the most value.

At A Glance: Instarem vs Zoom- Comparison 2026

Choosing between Xoom vs Instarem often comes down to a few core factors such as cost, speed, and reach. The table below provides a quick snapshot of how Instarem and Zoom compare.

| Factors | Instarem | Xoom |

|---|---|---|

| Exchange Rate | • ₹89.30–₹89.50 per USD• 0.6–0.8% markup over mid-market | • ₹87.80–₹88.30 per USD• 1.9–2.4% markup over mid-market |

| Fees, Charges or Costs | • $0–$5 for bank transfers (often promotional)• No hidden fees | • $4.99–$9.99 for bank transfers• Higher costs for card-funded transfers |

| Speed | • Same day to 1 business day• Depends on the receiving bank’s processing | • Minutes to a few hours• Near-instant for UPI or cash pickup |

| Tax | • No tax charged by the platform• TCS or government taxes may apply separately | • No tax charged by the platform• Government taxes may apply separately |

| Transaction Limits | • Up to ~$50,000 per transfer (route & KYC dependent)• Monthly limits apply | • ~$10,000–$50,000 depending on method• Lower limits for cash pickup |

| Security & Compliance | • Regulated in multiple jurisdictions• KYC, AML, encrypted transactions | • PayPal-backed security framework• Strong fraud monitoring and compliance |

| User Experience & Customer Support | • Clean app and web interface• Email, help center, in-app support | • Simple app with PayPal integration• Email, help center, phone support |

Disclaimer: Exchange rates, fees, transfer speeds, and limits shown above are indicative and may change based on market conditions, payment method, corridor, and platform policies. Always verify the latest details on the official Xoom and Instarem websites before making a transfer.

| Want a Better Value for USD to INR Transfers? Try Frex.Instarem and Xoom are popular choices, but fees and rate markups can add up. Frex offers competitive exchange rates, transparent pricing, and fast transfers, so more money reaches your recipient.Get started with the Frex app today. |

|---|

Instarem vs Xoom vs Frex: Which Money Transfer Platform Is Right for You?

Choosing between Instarem, Xoom, and Frex comes down to trade-offs between pricing, speed, and payout options. Each platform approaches exchange rates, fees, limits, and support differently, which can significantly affect the final outcome of a transfer.

Here’s a clear, side-by-side breakdown to help you decide.

Exchange Rate: Instarem vs Xoom vs Frex

Instarem Exchange Rate:

Instarem generally prices transfers closer to the mid-market rate, with a relatively low FX markup that is shown upfront.

In real-world comparisons, Instarem often lands around 0.5–1% below mid-market, which can materially improve the final amount received, especially on medium to large transfers.

Xoom Exchange Rate

Xoom uses rate-inclusive pricing, where fees are embedded into the exchange rate rather than charged separately. Xoom currently offers effective delivery rates such as ₹90.62 (UPI) and ₹90.52 (bank deposit), with transfers typically completed in minutes. While convenient, these rates can fluctuate by payout method and amount.

Frex Exchange Rate

Frex focuses on rate stability and predictability rather than chasing the tightest spot FX. Its exchange rates are usually competitive but slightly less aggressive than the lowest-cost consumer platforms, making Frex better suited for users who value consistency, transparency, and repeat transfers.

Which platform gives you the most value on exchange rates?

While Instarem can deliver strong spot value and Xoom favors convenience, Frex stands out for consistent, dependable exchange rates that hold up over time, making it the safer choice for repeat and high-value transfers.

Fees: Instarem vs Xoom vs Frex

Instarem Fees

Instarem is known for low and transparent fees, especially for bank-funded transfers. Fees are usually shown separately from the exchange rate and often range from $0 to $5, with frequent promotions that reduce costs further for regular users.

Xoom Fees

Xoom applies variable fees based on payment method and payout option. Bank transfers may cost $4.99–$9.99, while debit or credit card transfers are typically higher. In many cases, part of Xoom’s cost is embedded into the exchange rate, making total fees less visible upfront.

Frex Fees

Frex focuses on clear, predictable pricing, particularly for larger or repeat transfers. Fees are typically flat or contract-based, reducing surprises and making total transfer costs easier to forecast for businesses and high-frequency users.

Which Platform Is Best For Predictable Fees?

Instarem is often the lowest-cost option for one-off transfers, and Xoom prioritizes convenience despite higher variable fees. Frex stands out for fee transparency and consistency, making it the better choice when predictable costs matter more than short-term discounts.

Speed: Instarem vs Xoom vs Frex

Instarem Speed

Instarem typically completes bank transfers within the same day or 1 business day, depending on the receiving bank and local clearing cycles. It offers reliable turnaround times for standard transfers.

Xoom Speed

Xoom is optimized for fast delivery, with UPI and eligible bank deposits often completed within minutes, and most other transfers reaching recipients within a few hours.

Frex Speed

Frex focuses on predictable and dependable settlement timelines. Transfers are usually completed within 1 to 3 business days, with clearly communicated processing windows that help users plan payouts with confidence.

Which Platform Is Best For Transfer Speed?

Frex is the better choice when predictable delivery is more important than instant speed, especially for repeat or high-value transfers where planning and reliability outweigh the need for immediate settlement.

Tax: Instarem vs Xoom vs Frex

Instarem Tax

Instarem does not charge any tax itself on transfers. However, depending on local regulations, users may be subject to government-mandated taxes, such as Tax Collected at Source (TCS) in India on certain outward remittances. These taxes are set by the government and are unrelated to the platform’s fees.

Xoom Tax

Xoom does not impose taxes on transfers either. Like Instarem, Xoom’s users may incur statutory taxes or reporting requirements based on the sending or receiving country’s laws. Xoom does not withhold tax on behalf of governments; regulation-based charges remain external.

Frex Tax

Frex also does not levy taxes on transfers. For users in jurisdictions like India, Frex will comply with local tax regulations, including reporting and any government-mandated taxes such as TCS, where applicable. The platform provides documentation to support compliance, but does not itself add tax charges.

Which Platform Handles Tax Compliance Best?

For users focused on compliance and reporting clarity, Frex offers robust documentation and reporting support that makes navigating tax obligations easier, especially for frequent or business transfers. This can provide peace of mind and reduce administrative burden compared with other services that may offer less detailed tax guidance.

Security & Compliance: Instarem vs Xoom vs Frex

Instarem Security & Compliance

Instarem is regulated across multiple jurisdictions and follows industry-standard security practices. This includes strong encryption, robust Know Your Customer (KYC) procedures, and Anti-Money Laundering (AML) controls to protect user funds and prevent fraud. Regulatory compliance varies by corridor but generally aligns with local financial laws.

Xoom Security & Compliance

Xoom benefits from being part of the PayPal ecosystem, with enterprise-grade security infrastructure. It implements comprehensive fraud monitoring, encryption, and compliance controls. Xoom is regulated in key markets and adheres to financial regulations in both sending and receiving countries.

Frex Security & Compliance

Frex is built with security and compliance as core pillars. It maintains industry-standard encryption, rigorous KYC and AML processes, and operates under relevant financial licenses. Frex also emphasizes corporate-grade compliance, particularly for business use cases that require audit trails and regulatory documentation.

Which platform offers the strongest security and compliance framework?

When it comes to structured compliance and transparency for frequent or business transfers, Frex stands out for its enterprise-oriented approach. Its focus on regulatory documentation, robust onboarding checks, and clear compliance reporting makes it especially reliable for users who value stringent security and adherence to financial regulations.

Customer Support: Instarem vs Xoom vs Frex

Instarem Customer Support

Instarem provides support through email, in-app messaging, and a help center with FAQs and guides. Response times can vary by region, and dedicated phone support may not be available in all countries. Support is generally reliable, but resolution speed depends on issue complexity and local coverage.

Xoom Customer Support

Xoom offers 24/7 online support, email assistance, and phone support in many countries. Its integration with PayPal’s global support network gives it broader coverage, including multilingual options and faster turnaround for urgent issues. Live support availability tends to be stronger than many standalone remittance platforms.

Frex Customer Support

Frex provides high-touch support with direct access to customer service agents via email, chat, and dedicated account support (especially for business users). Frex emphasizes personalized assistance, proactive notifications, and clear escalation paths, which help reduce friction for both individual and corporate transfers.

Which Platform Delivers The Best Support Experience?

For users who value responsive, personalized help and clear guidance throughout the transfer process, Frex stands out for its customer support. Its focus on timely, accessible assistance, particularly for repeat and business users, makes it a strong choice for those who want reliable support alongside competitive pricing and compliance.

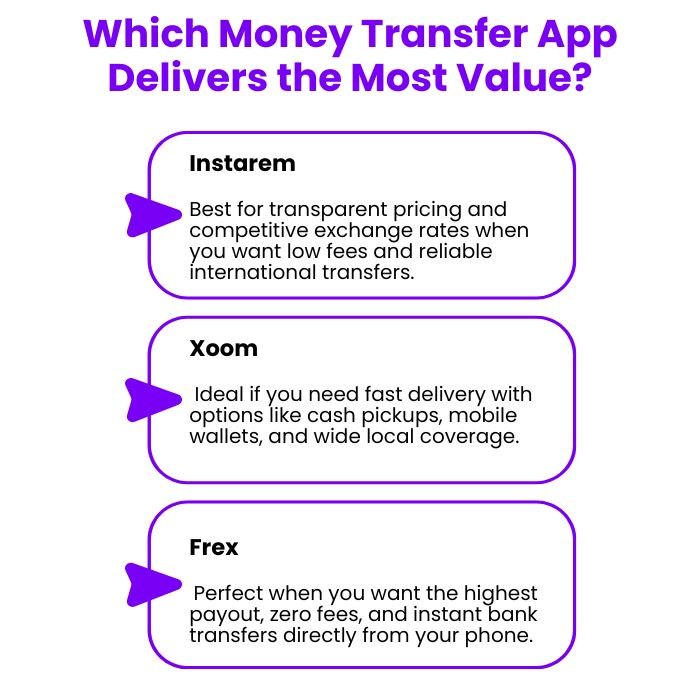

Verdict: Instarem and Xoom Are Good — But Frex Wins on Value

Choosing between Frex, Instarem, and Xoom ultimately depends on what you care about most when sending money. Each platform solves a slightly different problem, so the “best” choice varies by use case.

Below is a simplified way to think about it:

When Frex Is the Best Choice:

Frex stands out if you want a balance that holds up over time:

- You care about overall value, not just a one-time good rate

- You prefer predictable pricing without constantly re-checking spreads

- You send money regularly or in higher amounts

- You want a clean, app-first experience with fewer surprises.

When Instarem Makes Sense:

Instarem is a good fit if:

- You send money occasionally

- You like to compare rates before each transfer

- You are focused on maximizing payout on individual transactions

- Standard bank delivery times work for you

When Xoom Is the Right Pick:

Xoom works best when:

- Speed is critical

- You need UPI, wallet, or cash pickup options

- Convenience matters more than squeezing out the best rate

- Your recipients benefit from flexible payout methods

Make Better Money Transfer Decisions

Choosing a money transfer service is less about finding the cheapest option once and more about finding a solution that consistently works for your needs. Exchange rates, fees, speed, and reliability all play a role, but the real difference comes from how predictable and transparent the experience feels over time.

A platform that offers clear pricing, dependable delivery, and strong support reduces the need for constant comparison and second-guessing. When transfers feel straightforward and outcomes are easy to anticipate, sending money becomes less of a task and more of a routine you can trust.

Frequently Asked Questions

Is Xoom or Instarem safer for sending money online?

Both Instarem and Xoom are regulated and use encryption and fraud monitoring. Frex also adheres to strong compliance standards, providing users with another secure, trustworthy option.

Can I send money from the US to India with Instarem or Xoom, and which is cheaper?

Yes, both Instarem and Xoom support US-to-India transfers. Instarem is often cheaper due to lower fees and better rates, while Frex is also competitive, especially for users focused on predictable pricing and savings.

Which has better customer support and user experience: Instarem or Xoom?

Xoom is known for fast transfers and a simple interface, while Instarem stands out for transparent fees. Frex balances both, offering clear pricing with responsive support, appealing to users who value clarity alongside reliability.

Are there any limits on the amount I can send with Instarem vs Xoom?

Yes, Instarem and Xoom apply transfer limits based on verification, payment method, and destination. Frex also follows regulated limits, clearly outlining caps upfront so users can plan larger or recurring transfers confidently.

Are there special offers or referral bonuses with Instarem and Xoom?

Instarem frequently runs referral bonuses and promotions, while Xoom offers region-specific campaigns. Frex similarly introduces periodic offers and referral incentives, making it attractive for cost-conscious users sending money regularly.

Which service, Instarem or Xoom, has better user reviews for reliability?

Instarem is often praised for value and exchange rates, whereas Xoom earns high marks for speed and global reach. Frex receives positive feedback for consistency, transparent pricing, and dependable US-to-India transfers.

Do Instarem and Xoom offer customer support if something goes wrong with my transfer?

Yes, both provide in-app and online customer support for transfer issues. Frex also offers dedicated assistance and clear escalation channels, ensuring users get timely help if delays or questions arise.

Leave a Reply