Key Highlights

- Remitly offers flexible transfer options with express and economy speeds.

- Xoom provides wide delivery coverage, including cash pickup and PayPal support.

- Both platforms include a markup in their exchange rates, reducing the final payout.

- Remitly usually has slightly lower fees for smaller transfers.

- Xoom charges vary based on payment method and delivery choice.

- Frex delivers instant transfers with zero fees and transparent pricing.

- All three services are secure and compliant with US and Indian regulations.

- The best app depends on your priority: speed, cost, or overall value.

Sending money from the USA to India sounds easy, but the reality often feels confusing. Between varying exchange rates, hidden charges, and unpredictable delivery times, it’s hard to know if your recipient is getting the full amount.

Comparing apps doesn’t always make it better. Some services look cheap but add costs through markups, while others charge more for faster transfers. Choosing between Remitly and Xoom can quickly become frustrating when both seem to promise similar results.

This blog simplifies that decision. We’ll break down Remitly vs Xoom across key factors like fees, exchange rates, transfer speed, and security so you can decide which service gives you the best value when sending money abroad.

At a Glance: Remitly vs Xoom Comparison (2026)

When you’re looking to transfer money from the United States to India, the last thing you want is to scroll endlessly through websites. Whether it’s about fees, exchange rate markups, maximum limits, or how fast your money lands in the recipient’s bank account, knowing what to expect upfront can save you both time and stress.

Here’s a quick side-by-side look at how Remitly and Xoom compare:

| Factor | Remitly | Xoom |

|---|---|---|

| Exchange Rate | • ₹90.54 for the first 6000 USD of your transfer. • ₹90.27 applies to the rest of the transfer.• Includes a markup over the mid-market rate. | • ₹89.35 per USD• Includes a markup over the mid-market rate |

| Fees | • No fee on the first transfer• $3.99 for transfers below $1,000, and after that, it’s zero fees. | • First transfer is free• Fees range from $0 to $45.49, depending on payment method |

| Speed | • Express delivery within minutes• Economy option takes 3 to 5 business days | • Typically instant for bank and UPI transfers• Cash pickup timing varies by partner |

| Tax | • Personal transfers are tax-free | • Personal transfers are usually not taxed |

| Transaction Limits | • Up to $100,000 per transfer | • Varies based on delivery method and verification• Limits increase with account usage |

| Security | • Fully licensed in the US• Follows KYC and AML verification procedures | • Protected by PayPal’s compliance systems• Meets US regulatory standards |

| Delivery Options | • Supports bank, cash pickup, and mobile wallets• Some methods may not be instant | • Offers bank transfers, UPI, mobile wallets, and cash pickup |

| Support | • 24/7 chat and email assistance• May experience peak-time delays | • Assistance via email, phone, and help center• Availability varies by country |

*Disclaimer: Exchange rates, fees, transfer speeds, and delivery options may change over time based on market fluctuations and updated policies. Always check the latest pricing and terms of use before initiating money transfers.

| Want More Than What Remitly or Xoom Offers? Try Frex InsteadTired of markups, fees, or slow transfers? Frex gives you what others don’t: competitive exchange rates, zero fees, and instant delivery. It’s money transfer made simple, fast, and fair.Get the Frex app on your iPhone today |

|---|

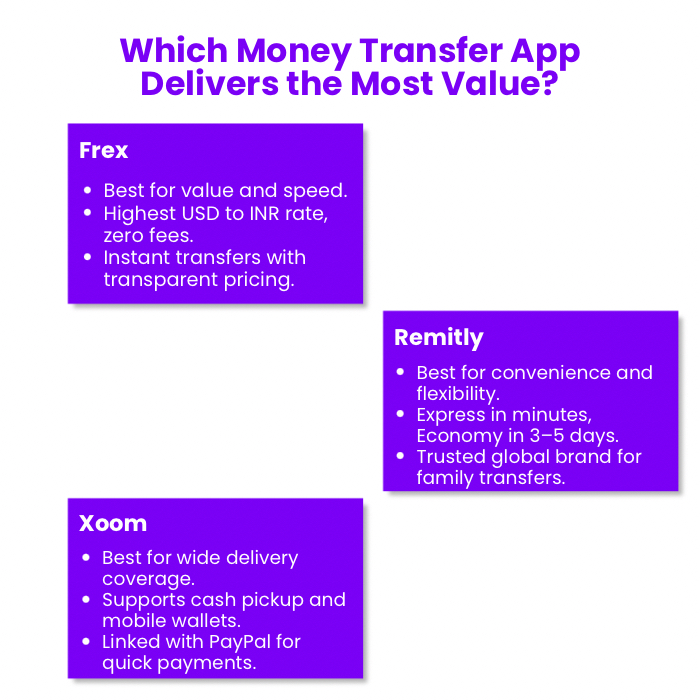

Remitly vs Xoom vs Frex: Which One Truly Delivers More?

Choosing the right money transfer app is about more than just numbers on a screen; it’s about value, convenience, and trust. Whether you’re focused on exchange rates, speed, or overall experience, it’s important to know how each platform performs where it counts.

Let’s break it down category by category and see which app truly delivers more when sending money from the USA to India:

Exchange Rate: Remitly vs Xoom vs Frex

Remitly Exchange Rate

Remitly provides a rate of ₹90.59 for new users. However, the platform also includes a markup in its exchange rate, so the payout is not based on the real mid-market value.

Xoom Exchange Rate

Xoom currently offers around ₹89.35 per USD, but this rate includes a markup, which means the value your recipient receives is slightly reduced compared to mid-market benchmarks.

Frex Exchange Rate

Frex gives the best value at ₹91.49 per USD, according to the latest payout comparison. It uses live market rates with no markup, ensuring your recipient gets more INR for every dollar sent.

Which Has the Best Exchange Rate: Remitly, Xoom, or Frex?

When it comes to the USD to INR exchange rate, Frex clearly leads. Even a small difference of one or two rupees per dollar can add up significantly on larger transfers, giving Frex a distinct advantage for those who want the best exchange rate for USD to INR.

Fees: Remitly vs Xoom vs Frex

Remitly Transfer Fees

Remitly offers free transfers for first-time users, but typically charges $3.99 for transfers under $1,000. Additional fees may apply depending on the chosen delivery method.

Xoom Transfer Fees

Xoom’s fees vary widely depending on the payment method. While first-time transfers may be free, a debit card or credit card payment can cost up to $45.49.

Frex Transfer Fees

Frex doesn’t charge additional fees for personal money transfers from the USA to India. What you send is exactly what your recipient’s bank account receives, with no surprises along the way.

Which App Has the Lowest Transfer Fees: Remitly, Xoom, or Frex?

Frex takes the lead with its zero-fee model. Compared to variable costs on Xoom vs Remitly, Frex offers transparent savings that directly benefit your recipient while sending money to India from the USA.

Speed: Remitly vs Xoom vs Frex

Remitly Transfer Speed

Remitly gives you a choice: Express transfers arrive in minutes, while Economy can take 3–5 business days. Delivery speed depends on your selected payment options.

Xoom Transfer Speed

Most bank transfers and UPI payments on Xoom are instant. However, some cash pickup locations may take longer depending on the provider network.

Frex Transfer Speed

Frex delivers funds instantly or within the same day, using blockchain-backed rails for faster cross-border payments. Instant transfers are built-in, not an upsell.

Which Is the Fastest Money Transfer App: Remitly, Xoom, or Frex?

While Xoom vs Remitly both offer fast options, Frex wins for consistency. Its instant delivery is the default, with no trade-offs between speed and cost.

Tax: Remitly vs Xoom vs Frex

Remitly Tax Fees

Remitly does not charge US remittance tax on personal use transactions. However, it’s always best to consult local policies when sending larger amounts.

Xoom Tax Fees

Most personal transfers through Xoom are tax-free, but business-related transactions may fall under different rules depending on the sender’s location.

Frex Tax Fees

Frex supports tax-free personal remittances and complies with U.S. and Indian regulations. Whether it’s a small or high-value transfer, Frex ensures everything is in line with cross-border rules.

Want to know how to transfer money without tax? Check our guide on how to transfer money from the USA to India without tax.

Which Platform Handles Taxes Best: Remitly, Xoom, or Frex?

All three services support tax-free international transfers for personal use. However, Frex stands out for its proactive compliance with changing global regulations.

Security: Remitly vs Xoom vs Frex

Remitly Security Compliance

Remitly is licensed in the US and follows KYC and AML checks to safeguard each transfer. Users may be required to verify identity and provide a valid email address or phone number.

Xoom Security Compliance

Xoom is backed by PayPal, offering strong encryption, fraud protection, and layered verification. The platform follows US regulatory protocols for international money transfers.

Frex Security Compliance

Frex uses 256-bit encryption and is integrated with Plaid for secure bank account linking. It operates under FinCEN (USA), FIU (India), and FATF standards, providing a secure experience from start to finish.

Which Money Transfer App Is Safest: Remitly, Xoom, or Frex?

All three are compliant and trusted, but Frex’s next-gen infrastructure, stablecoin rails, and global licensing provide added peace of mind for users.

Customer Support: Remitly vs Xoom vs Frex

Remitly Customer Support

Remitly has 24/7 chat and email address support, though some users report slower response times during busy periods.

Xoom Customer Support

Xoom offers help via email, call support, and a help center. Response times can vary by region and support volume.

Frex Customer Support

Frex provides quick, human assistance right inside the app, helping users resolve failed or delayed transactions in real time.

Which App Offers the Best Customer Support: Remitly, Xoom, or Frex?

Frex delivers the most seamless experience by keeping support fully in-app. Compared to Xoom vs Remitly, users get faster resolution without leaving the platform.

Want to see how Frex compares to Wise? Read our Remitly vs Wise vs Frex guide for a clear breakdown.

Verdict: Remitly and Xoom Perform Well, But Frex Offers Better Value

With plenty of options for money transfer to India from the USA, it can be tough to tell which app truly meets your needs. But once you compare rates, fees, speed, and features, Frex stands out as the most balanced choice, giving you full control without hidden surprises.

Here’s a quick guide on when each app makes the most sense based on your goals.

When to Choose Frex?

If you’re after maximum value with minimum friction, Frex is designed to give you more for every USD you send.

Go with Frex when:

- You want the best exchange rate for USD to INR with no markup.

- You prefer zero fees, no matter how or when you send.

- You need instant transfers with same-day delivery at no extra cost.

- You value transparency and predictable payouts.

- You want fast, secure transfers using modern rails that offer better speed and usability.

Get the Frex app today and start sending with confidence.

When to Choose Remitly?

Remitly is ideal if you want a mix of speed and cost control, especially if you’re a new user taking advantage of their Remitly USD to INR intro rate.

Use Remitly when:

- You’re sending your first transfer and want a good introductory rate.

- You want flexibility between Express and Economy speeds.

- You like the option to adjust speed based on urgency and fee.

- You’re comfortable with a transparent fee structure and a moderate markup in exchange rate.

When to Choose Xoom?

Xoom remains a solid option if you’re focused on flexible delivery and a wide network of cash pickup locations.

Choose Xoom if:

- You want cash pickup or support for mobile wallets.

- You’re sending to someone who prefers physical pickup options.

- You rely on PayPal or familiar platforms for quick account linking.

- You prioritize broad delivery options across different cities in India.

- You’re okay with paying slightly more for wider reach and convenience.

To sum it up, Xoom is great for flexible delivery, Remitly suits those who want speed with options, but Frex stands out by combining real-time transfers, no hidden charges, and stronger payout value, making it the best app to send money to India from the USA.

Want to keep more of what you send? Download the Frex app now and experience fast, fee-free transfers that work better for you.

Conclusion: Make Every Transfer Count

Sending money from the USA to India isn’t just about getting it there. It’s about ensuring your recipient receives as much as possible. If you’re wondering which is better, Remitly or Xoom, both perform well in different areas. Xoom USD to INRoffers flexible delivery options with reliable service, while Remitly focuses on convenience and speed.

However, if you want to maximize value, Frex stands out by combining real-time transfers, no hidden fees, and stronger payouts. Think about what matters most: cost, speed, or simplicity, and choose the app that helps you send smarter every time.

For faster and more rewarding transfers, Frex is the way to go.

Frequently Asked Questions

What’s better, Remitly or Xoom?

Both platforms perform well, but the better choice depends on your needs. Remitly works well for lower fees and flexible speed options, while Xoom is ideal for faster delivery. The Xoom vs Remitly exchange rate comparison shows that both include a markup that affects payout value.

What are the disadvantages of Remitly?

Remitly may include a markup on its exchange rate, reducing the amount your recipient receives. It can also charge higher fees for faster transfers, and some payment methods or delivery options are limited depending on your location.

What is better than Remitly?

Frex is a strong alternative to Remitly, offering zero fees, transparent pricing, and faster transfers. It provides competitive rates without hidden costs, making it a better option for users who prioritise maximum payout and efficiency.

What is the disadvantage of Xoom?

Xoom’s main drawback is its variable pricing. Fees change depending on how you pay, and its rate includes a markup. Users also notice a different rate between Xoom and Remitly, especially for larger transfers, which can affect how much your recipient receives.

Which one do users prefer for regular remittances, Remitly, Xoom, or Frex?

Many users prefer Remitly for regular transfers because of predictable costs and an easy-to-use app. Xoom remains popular for its flexibility and cash pickup network, but Frex is gaining attention for faster, zero-fee transfers that make it easier to send money to India from the USA.

Is Remitly, Xoom, or Frex more secure for sending money abroad?

Both services are highly secure and regulated. Xoom benefits from PayPal’s infrastructure, while Remitly uses encryption and identity verification. If you’re asking which is bigger, Xoom or Remitly, Xoom has a wider global reach, but Frex adds advanced encryption and regulatory compliance across both the US and India.

Which service has better exchange rates, Remitly, Xoom, or Frex?

Remitly often offers a slightly stronger rate than Xoom, but both apply a small markup. The USD to INR exchange rate Xoom Remitly comparison shows similar patterns, though Frex outperforms both by offering real-time conversions without hidden costs, giving users the best value for their transfers.

Leave a Reply