Key Highlights

- SBI offers various convenient methods to transfer money from the USA to India, including online banking and mobile apps.

- Competitive exchange rates help you maximize the value of your transfer, especially for larger sums.

- Frex ensures fast, fee-free transfers with instant processing and secure transactions.

- Transparent pricing lets you avoid hidden fees, providing a clear understanding of the total cost upfront.

- Double-checking recipient details, including the account number and IFSC code, ensures a smooth transfer.

- SBI’s extensive network in India guarantees easy access to funds for recipients across the country.

- Strong security measures, including encryption and fraud protection, safeguard your transaction from start to finish.

- Frex stands out with zero fees, quick transfers, and excellent exchange rates for a hassle-free experience.

If you have ever hesitated while sending money from the USA to India due to unclear fees, slow transfers, or shifting exchange rates, you are not alone. What should be a straightforward transfer for family support or expenses in India often turns complicated once you start comparing multiple services and promises. You want a transfer method that’s quick, affordable, and secure, but how do you know which one really delivers?

The challenges of hidden fees, slow processing times, and fluctuating exchange rates often leave senders frustrated. It’s easy to get lost in the sea of services, each promising a better deal, but it’s tough to know who’s offering the best value.

In this guide, we’ll simplify everything for you. We’ll walk through the best ways to transfer money from the USA to India via SBI, showing you the options that deliver on speed, value, and security. Ready to make your next transfer easier? Let’s dive in!

Why Do So Many NRIs Prefer Transferring Money to SBI India?

Many NRIs prefer SBI when transferring money to India because it offers a balance of trust, affordability, and nationwide accessibility. These strengths come together in several practical advantages that make SBI a reliable option for international money transfers, such as:

- Wide Reach: SBI has a vast network of branches and partner locations across India. This ensures your recipient can easily access their funds no matter where they live.

- Competitive Exchange Rates: SBI offers competitive exchange rates that help maximize the value of every dollar you send. By minimizing markups, you ensure your recipient gets the best possible rate.

- Secure Transactions: SBI uses state-of-the-art security protocols to protect your money transfers. With encryption and fraud protection in place, both senders and recipients are safeguarded throughout the transaction.

- Multiple Transfer Options: SBI offers a range of methods for sending money, including online banking, best apps, and wire transfers. This flexibility allows you to choose the best option for your needs.

- Customer Support: SBI provides responsive customer support through multiple channels, ensuring quick resolution of any issues. Whether online or over the phone, help is available 24/7 to guide you through the process.

What Are 5 Ways to Transfer Money From the USA to India SBI Account?

If you’re wondering how to send money from USA to India through SBI, there are several convenient options available for different needs. Whether you prefer online banking, mobile apps, or third-party transfer services, SBI supports multiple reliable methods.

Let’s explore the 5 most effective ways to transfer money from the USA to an SBI account in India.

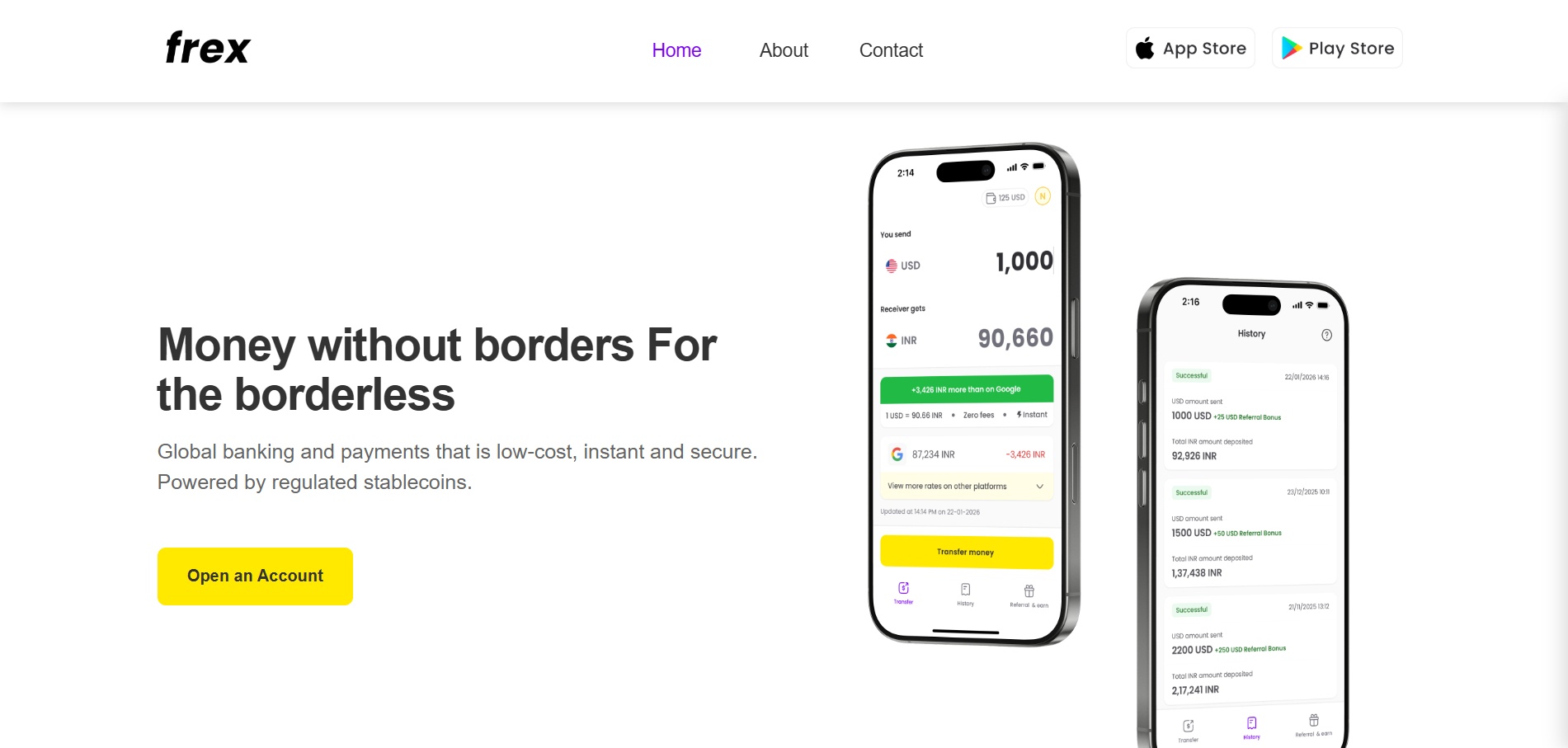

1. Frex

Frex stands out in the international transfer space by eliminating traditional fees and offering instant transfers. With competitive exchange rates, your funds are credited to the beneficiary’s bank account without delays.

How Do You Send Money With Frex?

- Download the Frex app from the Google Play Store or App Store.

- Complete your one-time account setup, which includes identity verification, adding your recipient’s bank details, and linking your US bank account via Plaid.

- Enter the amount you wish to send, check the foreign currency conversion rate, and confirm the transaction with Face ID for added security.

- The funds are transferred instantly to the recipient’s Indian bank account, without any extra charges or waiting time.

What Makes Frex the Smarter Option?

Frex offers a seamless, hassle-free experience for transferring money from the USA to India. Here are the key features that make Frex the smarter choice:

- Instant Transfers: Frex ensures that your funds are transferred to the recipient’s Indian bank account within minutes, making it one of the fastest money transfer services available.

- Zero Fees: Unlike traditional transfer services, Frex charges no extra fees on your transactions. You get the full value of your transfer without any hidden costs.

- Better Exchange Rates: Frex offers the best exchange rates, often better than Google’s live mid-market rate, so you get more Indian rupees for your dollar.

- Secure and Transparent: Frex employs top-notch 256-bit encryption, providing a secure platform for your transactions. All fees and rates are displayed upfront with no surprises.

- User-Friendly Interface: The Frex app is designed for ease of use, making it simple to send money to India from the USA in just a few steps. The process is streamlined for a seamless experience and even supports SBI send money to India from USA transfers.

- No Minimum Transfer Limit: Whether you’re sending as low as $2 or a higher amount, Frex accommodates all transfer sizes without any restrictions.

When to Use Frex?

Frex is perfect when you need a fast, fee-free transfer solution. Whether you’re sending small or large amounts, the app guarantees a smooth experience with zero hidden costs.

Download the Frex app today and send money instantly with just a few taps!

2. SBI YONO App (Online Banking)

SBI YONO app provides an easy and secure way to transfer money from the USA to India. The app offers competitive exchange rates and low transfer fees, ensuring that your transaction is completed smoothly. With robust security features, your personal and financial data are well protected.

Why Choose SBI YONO App?

Here are the key features of the SBI YONO app that support smooth and dependable money transfers:

- All-in-One Digital Banking: The SBI YONO app allows users to manage international transfers alongside everyday banking services within a single interface. This eliminates the need to rely on multiple platforms or branch visits.

- Competitive Exchange Rates: SBI YONO offers competitive exchange rates with minimal markup on USD to INR transfers. This helps ensure that recipients receive better value from every transaction.

- Low and Transparent Fees: Transfer fees are clearly displayed before confirmation, allowing users to understand the total cost upfront. This transparency reduces the risk of unexpected charges.

- Advanced Security Measures: The app uses multi-layer authentication, encryption, and OTP verification to protect financial data. These security controls ensure safe and secure transactions at every step.

- Anytime Transfer Access: Users can initiate transfers 24/7, regardless of location or time zone. This flexibility is ideal for NRIs who need consistent access to banking services.

- Real-Time Tracking and Alerts: The app provides real-time transfer updates and instant notifications. This keeps users informed from initiation to completion.

How to Transfer Money with the SBI YONO App?

- Download the SBI YONO app from the Google Play Store or App Store.

- Log in with your SBI account credentials.

- Enter your recipient’s Indian bank account details, including account number and IFSC code.

- Enter the amount you wish to transfer, check the current exchange rate, and review the transfer fees.

- Confirm the transfer and complete the authentication process using OTP or other security measures.

When to Use the SBI YONO App?

Use the SBI YONO app if you prefer online banking, want a straightforward process, and prioritize low fees. It is perfect for regular transfers and customers who want the added convenience of mobile banking.

3. SBI Remit (NRI Service)

SBI Remit offers an excellent solution for Non-Resident Indians (NRIs) to transfer money to India. It allows users to send money to an SBI account or other bank accounts in India with minimal transfer fees and good exchange rates. The process is secure and fast, offering 24/7 customer support.

Why Choose SBI Remit (NRI Service)?

The following features make SBI Remit a reliable and efficient option for sending money to India through SBI:

- Backed by SBI’s Global Presence: SBI Remit is supported by SBI’s extensive international operations and correspondent banking relationships. This global reach strengthens reliability and ensures smoother cross-border fund movement.

- Direct Integration with SBI India Accounts: Transfers through SBI Remit are seamlessly integrated with SBI’s core banking system in India. This allows faster crediting and better visibility for both senders and recipients.

- Strong Compliance Framework: SBI Remit follows RBI guidelines and SBI’s internal compliance standards for overseas transfers. This ensures transactions are processed within regulated limits and supported by proper documentation.

- Designed for High-Value Transfers: SBI Remit supports higher transfer thresholds aligned with SBI’s NRI banking services. This makes it suitable for large financial commitments such as property payments, education costs, or long-term investments.

- Reliable Processing Through SBI Channels: Transactions are routed through SBI’s established banking infrastructure rather than third-party processors. This reduces dependency on intermediaries and improves overall transfer stability.

- Dedicated SBI NRI Support: SBI Remit users benefit from SBI’s NRI customer support ecosystem. This provides access to bank-backed assistance for transfer-related queries and account coordination.

How to Transfer Money with SBI Remit?

- Register for SBI Remit on the official website or through their mobile app.

- Add your recipient’s Indian bank details.

- Enter the amount to transfer and choose the payment method (debit/credit card or bank transfer).

- Complete the necessary KYC (Know Your Customer) verification and submit.

- Review the transfer fees and exchange rates, then confirm and complete the transfer.

When to Use SBI Remit?

Ideal for NRIs sending funds to family members in India. SBI Remit provides reliable, secure services with transparent pricing and good customer support for first-time users and frequent remitters.

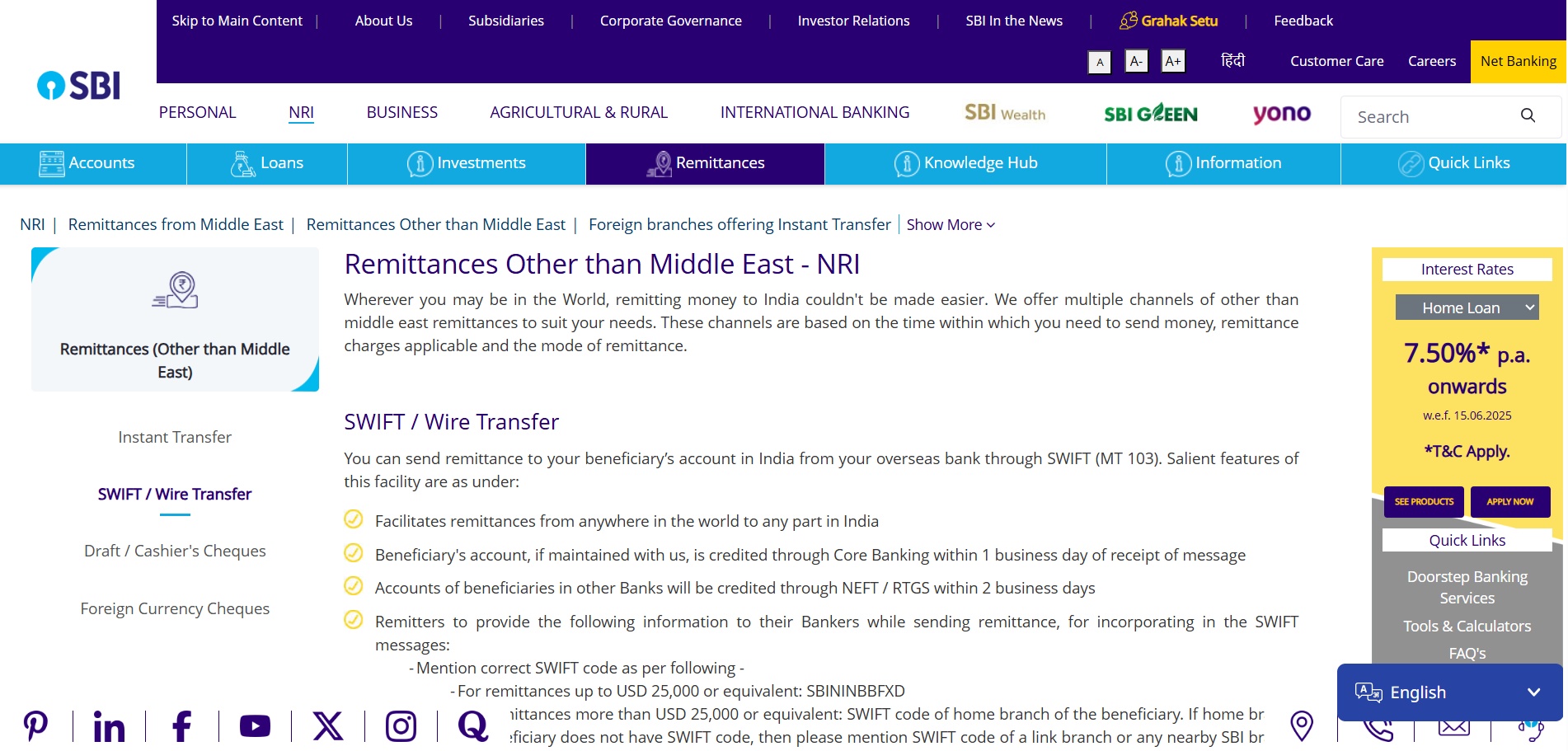

4. SBI International Wire Transfer (SWIFT Network)

SBI’s International Wire Transfer through the SWIFT network offers a secure and widely used method to send money from USA to India SBI. It is ideal for larger transactions and international business payments. While it takes a few days, it ensures high security with encryption and regulatory compliance.

Why Choose SBI International Wire Transfer (SWIFT Network)?

The features below explain how SBI’s international wire transfers through the SWIFT network enable secure, globally recognized money transfers to India:

- Globally Standardized SWIFT Network: SBI wire transfers operate on the SWIFT messaging system used by banks worldwide. This standardization ensures secure communication and compatibility across international banking institutions.

- Suitable for High-Value Transactions: SWIFT transfers through SBI are ideal for large sums that require formal banking channels. They are commonly used for property purchases, investments, or institutional payments.

- Direct Bank-to-Bank Processing: Funds are transferred directly between banks without app-based intermediaries. This structure adds an extra layer of control and formality to the transaction.

- Recognized for Official and Legal Payments: SBI SWIFT transfers are widely accepted for transactions requiring official proof of funds. This makes them suitable for regulatory, legal, or documentation-heavy purposes.

- End-to-End Traceability: Each transfer includes a unique SWIFT reference number that allows tracking across banks. This helps senders and recipients monitor progress and resolve delays more efficiently.

- SBI Branch-Level Support: SWIFT transfers are supported by SBI’s branch and international banking teams. This provides access to bank-assisted guidance for complex or high-stakes transfers.

How to Transfer Money with SBI International Wire Transfer?

- Visit your local SBI branch or use online banking.

- Provide the recipient’s account details, including the recipient’s bank name, account number, and SWIFT/BIC code.

- Specify the amount to transfer and review any fees that apply.

- Complete any necessary forms for the wire transfer and provide your identification for verification.

- The transfer will be processed through the SWIFT network and should take 3-5 business days to complete.

When to Use SBI International Wire Transfer?

Wire transfers are best suited for large transactions or when you need a secure, traceable transfer method. They are ideal for sending funds to a corporate account or if the recipient prefers bank-to-bank transfers.

5. SBI NRI Cash Pickup Services

For those who need to send money directly to their family or friends in India, SBI’s NRI Cash Pickup Services allow recipients to pick up cash at designated SBI branches in India. This service is particularly helpful when the recipient doesn’t have a bank account.

Why Should You Choose SBI NRI Cash Pickup Services?

SBI NRI cash pickup services come with specific features that prioritize accessibility and timely fund collection, such as:

- Immediate Access Without Bank Dependency: SBI’s cash pickup service allows recipients to receive funds without needing an active bank account. This is especially useful in situations where account access is limited or delayed.

- Designed for Urgent Personal Needs: Cash pickup is well suited for emergency or time-sensitive transfers such as medical expenses or short-term family support. It ensures recipients can access funds quickly when waiting for bank processing is not ideal.

- Verification-Based Payout Process: Funds are released only after identity verification at authorized SBI payout locations. This adds a controlled layer of security while enabling in-person collection.

- Flexible Recipient Accessibility: Cash can be collected from designated SBI-authorized locations across India. This offers convenience for recipients who may not be near their home branch.

- Supports Smaller, Short-Term Transfers: SBI cash pickup services are typically used for modest transfer amounts rather than long-term financial commitments. This makes them suitable for quick, situational financial support.

- Backed by SBI‘s Domestic Network: Payouts are supported through SBI’s established domestic banking infrastructure. This ensures reliability and consistency in cash disbursement across locations.

How to Transfer Money with SBI NRI Cash Pickup Services?

- Visit the SBI Remit website or use the mobile app.

- Choose the NRI Cash Pickup option.

- Enter the recipient’s details and the amount to transfer.

- Select the pickup location in India (SBI branch).

- Confirm the transfer and provide your payment details.

When to Use SBI NRI Cash Pickup Services?

Opt for NRI Cash Pickup if your recipient needs quick access to funds in cash, especially when they don’t have a local bank account or need emergency cash. This service provides convenient cash access without bank-related delays.

What Documents Are Required to Transfer Money Online from the USA to an SBI Account in India?

Before initiating an online money transfer to SBI India from USA, it’s essential to have the right documents in place. These documents ensure the smooth and secure processing of your transaction, protecting both the sender and the recipient. To help you prepare, here are the key documents you will need:

- Valid Government-Issued ID: A passport, driver’s license, or state-issued photo ID is necessary to verify your identity during the KYC (Know Your Customer) process.

- Proof of Address: A recent utility bill, bank statement, or lease agreement that matches the address on your transfer account ensures compliance with regulatory requirements.

- Recipient’s Bank Details: You’ll need to provide the beneficiary’s full name, account number, and the IFSC code for the recipient’s SBI account in India to ensure the funds reach the correct account.

- Source of Funds: For larger transfers, you may need to submit additional documentation, such as salary slips or tax returns, to verify where the funds are coming from.

- NRI Verification Documents: For transfers involving an NRI account, you may be asked to provide proof of your residency or account eligibility to meet regulatory guidelines.

Ready to transfer money to India quickly? With the Frex app, you can enjoy a smooth and secure transfer experience from the USA to India. Download now for fast, reliable, and cost-effective transfers!

What Are the Tips for Getting the Best Value When Transferring Large Amounts?

When transferring large amounts of money from the USA to India, ensuring the best value involves strategic planning. The right approach can save you significant amounts on fees and improve the overall exchange rate, giving you more value for your transfer. Here are some helpful tips to get the best value:

- Compare Exchange Rates: Always check the exchange rate offered by different services before sending money. A slight difference in the rate can have a substantial impact on the amount received by the beneficiary.

- Avoid Hidden Fees: Look for services that provide transparent pricing. Hidden fees, especially in exchange rates or service charges, can eat into the amount being sent. Be sure to ask about all possible fees upfront.

- Lock in Exchange Rates: If possible, consider locking in the exchange rate before transferring large sums. This can shield you from fluctuations in the market and help you plan more effectively for future transfers.

- Transfer Large Amounts Less Frequently: Transferring large amounts in fewer transactions can help you save on fees. Some services offer lower fees for larger transfers or a flat fee structure for amounts above a certain threshold.

- Use Services with Low Fees and High Limits: Opt for services that offer both low fees and higher transaction limits, which allow you to send large sums in a single transfer without paying multiple fees.

What Should You Keep in Mind Before Transferring Money from the USA to India?

Before transferring money from the USA to India, there are several factors to consider to ensure a smooth, cost-effective, and secure transaction. Being aware of these details will help you avoid unexpected costs and delays, making the process efficient and hassle-free. Here’s what you should keep in mind:

- Transfer Fees: Always check the fees charged by different transfer methods. Some services may have high fees, especially for large amounts or specific transfer methods. Compare costs to find the most economical option.

- Exchange Rates: Be mindful of the exchange rate offered by the service provider. A better exchange rate can help you send more money, especially when sending large sums. Always compare the current market rate to what’s being offered.

- Transfer Speed: Depending on the service, transfer speeds can vary. Instant transfers are ideal for urgent needs, while traditional methods like bank transfers may take several business days.

- Payment Methods: The payment method you choose can impact the cost and speed of your transfer. Bank transfers, credit/debit card payments, and digital wallets may have different processing times and fees.

- Recipient Information: Ensure that the recipient’s bank details, such as account number and IFSC code, are correct to avoid delays or errors in the transfer.

- Security and Compliance: Choose a service provider that offers strong security measures, such as encryption and regulatory compliance, to protect your funds and personal data.

- Transfer Limits: Some services may impose limits on the amount you can send. Make sure to understand these limits, especially if you’re transferring large amounts.

Looking for a seamless and reliable transfer option? Try the Frex app for a fast, secure, and cost-effective way to send money from the USA to India.

How to Track Your Money Transfer from the USA to India with SBI?

Tracking your SBI money transfer from USA to India is an essential step to ensure that your funds are processed and received on time. SBI provides several methods to help you keep tabs on your transfer, giving you peace of mind throughout the process. Here’s how you can easily track your transaction:

- SBI YONO App: The YONO app provides real-time tracking for international transfers. Simply log in to the app, go to the “Remittance” section, and you will find the option to track the status of your transfer. The app updates the progress of your transaction as it moves through various stages.

- SBI Online Banking Portal: If you are using SBI’s online banking platform, you can check the status of your transfer by logging into your account. Go to the “Transaction History” section to find your transfer details and check its current status.

- SWIFT Tracking Number: If you’re using a wire transfer, SBI provides a SWIFT tracking number for every international transaction. You can use this tracking number to follow the transfer’s progress through the SWIFT network.

- Customer Support: If you’re unable to track your SBI online money transfer from USA to India or through the app, you can contact SBI’s customer support team. They can help you track the transfer and provide updates on any delays or issues.

What Pitfalls Should You Avoid When Sending Money to India from the USA?

Sending money from the USA to India is an essential task for many NRIs, but the process can have pitfalls that result in delays, unnecessary costs, or mistakes. By avoiding common mistakes and being cautious, you can ensure that your transfer goes smoothly, efficiently, and cost-effectively. Here are the key pitfalls to avoid when sending money back home.

- Incorrect Recipient Information: Always verify the recipient’s bank account details, including their account number and IFSC code. A small mistake can lead to delayed or misdirected funds. Double-checking these details will ensure that the transfer reaches the right account without issues.

- Ignoring Hidden Fees: Hidden fees can drastically affect the total amount being transferred. Some services include hidden charges in the exchange rate or transfer fees. Make sure to ask about all fees upfront to avoid unpleasant surprises and ensure you’re getting the best value.

- Overlooking Exchange Rate Differences: Exchange rates can fluctuate, and providers often add a markup to the rate. A slight change in the rate could make a significant difference in how much your recipient will receive. Always compare exchange rates to get the best deal for your transfer.

- Choosing Slow Transfer Methods: Some transfer methods may take several business days to process, which may not be ideal for urgent transfers. To speed up the process, opt for instant or same-day transfer methods that ensure your funds reach your recipient promptly.

What Are the Key Security Measures for Safe International Transfers to India?

When sending money to India, ensuring the security of your funds is paramount. Here are the essential security measures to consider:

- Strong Encryption Technology: Always choose services with robust encryption to secure your sensitive financial data. This ensures that hackers cannot intercept or access your personal and transaction information during the transfer process.

- Regulatory Compliance (KYC and AML): Ensure the provider complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These safeguards verify the identities of both parties involved and help prevent illegal activities such as money laundering.

- Two-Factor Authentication (2FA): Opt for services that implement two-factor authentication (2FA) for an added layer of security. 2FA requires two forms of verification, such as a password and a phone verification code, preventing unauthorized access to your account.

- User Verification and Authentication: Choose services that thoroughly verify the identity of the sender and recipient. This helps prevent fraud by ensuring that the right individuals are involved in the transfer.

- Fraud Prevention and Monitoring Systems: Services with advanced fraud detection and monitoring systems help identify suspicious activities early. These systems automatically flag potentially fraudulent transactions, providing an additional layer of protection for your funds.

For a trusted and secure transfer, choose Frex. With 256-bit encryption, robust fraud protection, and a partnership with Plaid, Frex ensures your funds are safe every step of the way. Download now!

Unlock the Easiest Way to Send Money from the USA to India

Transferring money from the USA to India doesn’t have to be daunting or expensive. By understanding your options, comparing fees, exchange rates, and transfer speeds, you can ensure that your hard-earned money reaches home swiftly and securely. Whether you’re supporting family or managing investments, finding the right transfer method makes all the difference.

With solutions like Frex offering instant transfers and SBI’s wide range of services, you’re equipped with powerful tools for seamless money transfers. Stay informed, choose wisely, and make sure your money is working for you, not the other way around.

Frequently Asked Questions

Is there a preferred method to send large sums to SBI from the USA?

For large sums to SBI from the USA, use SBI Express Remit. It offers secure transfers with competitive fees and real exchange rates, especially for transactions to SBI or partner banks like ICICI and HDFC banks.

What documents do I need to transfer funds to an SBI account in India?

You’ll need identification (e.g., a passport), the beneficiary’s bank account number, proof of address, and additional information such as a phone number or email address. Ensure accuracy to avoid delays in international funds transfers.

How can I contact support if my SBI money transfer faces issues?

Contact SBI Express Remit support through the SBI Express Remit website, email, or by calling their helpline. Having your phone number and email address ready will expedite the process for resolving transfer issues.

How to transfer money from SBI India to USA?

Transferring funds from SBI India to the USA can be done via SBI’s SWIFT wire transfer service or online banking. You’ll need the recipient’s account details and SWIFT code, and the transfer usually takes 3-5 business days.

Which platforms allow direct transfers from the USA to SBI, and what are their fees?

Platforms like Frex, Wise Account, and ICICI Bank enable direct bank deposit transfers to SBI. Be sure to compare international money transfer charges and the time of transfer to choose the best service.

Are there any restrictions or limits on how much I can transfer from the US to SBI?

Yes, transfer limits vary by method. For instance, SBI Express Remit may impose restrictions based on regulatory guidelines by the Government of India. Verify with your service provider before initiating transfers.

Can I use Western Union to send money from the US to SBI in India, and how does the process work?

Yes, you can use Western Union to send money from the US to SBI in India. Simply select SBI as the destination, provide recipient details, choose a payment method, and complete the transfer. Fees may vary.

How to send money from India to USA through SBI?

To send money from India to the USA through SBI, you can use SBI’s online banking platform or the YONO app. SBI offers competitive exchange rates and secure transactions for international transfers, with clear fees and processing times.

How to transfer money from USA to India SBI account?

To make an SBI money transfer USA to India, use services like SBI Express Remit, online platforms, or apps like Frex. Ensure you check exchange rates, fees, and transfer times to choose the most cost-effective and fast option.

Leave a Reply