Key Highlights

- Payment methods like bank transfers tend to have lower fees compared to credit or debit card payments.

- Delivery options, such as cash pickups, may incur higher charges than direct bank deposits.

- Transfer speed can affect fees, with faster methods generally costing more.

- Exchange rates play a major role in determining the total cost of the transfer, influencing the final amount received.

- Comparing different transfer services helps find the most cost-effective option.

- Special promotions and fee waivers can offer opportunities for sending money without extra charges.

- Bank-to-bank transfers can be fee-free when both sender and recipient use the same bank.

- Larger transfer amounts may help secure better exchange rates and lower fees.

When sending money from the USA to India, navigating the costs can feel like a maze. With multiple factors like payment methods, delivery options, and exchange rates influencing the total charges, it’s easy to feel overwhelmed. Understanding how these fees stack up is key to finding the most cost-effective way to transfer funds.

The pain point is clear, high transfer fees can be a burden, especially when making frequent or large transfers. While many services offer convenient ways to send money, they often come with hidden fees or unfavorable exchange rates that impact the amount your recipient ultimately receives. Knowing how to avoid these pitfalls and reduce money transfer from USA to India charges can save you significant amounts over time.

This blog aims to provide insights into the factors affecting USA to India money transfer charges and offer practical tips for minimizing fees. By understanding these key elements, you’ll be able to make smarter decisions about how to transfer funds, ensuring that you get the best value for your money while avoiding unnecessary costs.

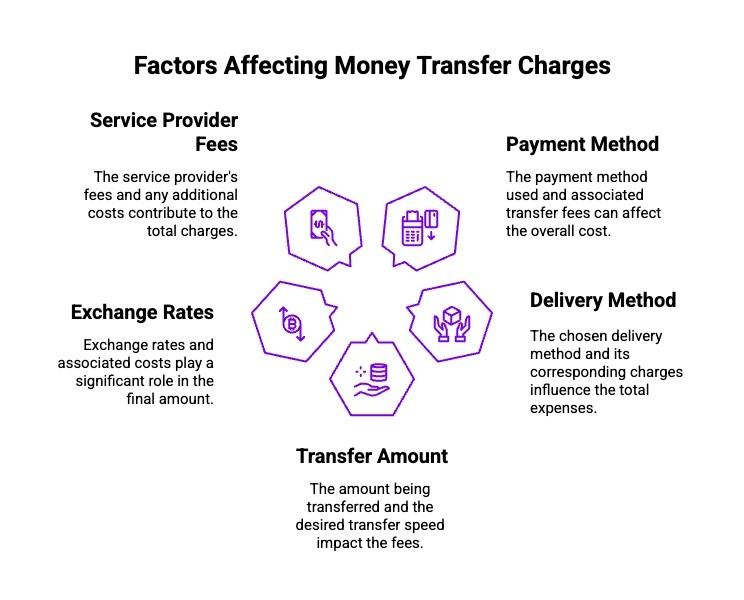

What 5 Factors Affect Charges for Money Transfers from USA to India?

Understanding the factors that influence money transfer charges can help you make an informed decision. Several elements, such as payment methods, delivery options, and exchange rates, play a major role in determining the cost of your transfer:

1) Payment Method and Transfer Fees

Different payment methods come with varying fees. Bank transfers are typically cheaper, while credit/debit card payments carry higher charges due to processing costs and additional risks for the transfer service provider.

2) Delivery Method and Charges

The delivery method you choose impacts transfer fees. Cash pickups tend to be more expensive than direct bank deposits into an Indian bank account due to additional handling, location costs, and logistics involved with physical cash delivery.

3) Transfer Amount and Speed

Larger sums often incur higher fees, and transfer speed can affect costs. While expedited transfers may offer quicker delivery, they usually come with extra charges to ensure faster processing and delivery, increasing overall transfer fees.

4) Exchange Rates and Costs

Exchange rates have a significant impact on the total cost of your transfer. Providers may offer attractive fees but use lower exchange rates, leading to hidden costs that reduce the amount the recipient ultimately receives in Indian Rupees.

5) Service Provider’s Fees and Additional Costs

Different providers may charge various fees, such as flat fees, percentage-based charges, or added costs based on service levels. It’s important to compare services like Frex to choose the one that offers the best balance of fees and service quality.

By considering these factors, you can make a more informed decision and choose a transfer service that offers the best balance of cost, speed, and convenience when looking at charges to transfer money from USA to India.

What Are the 4 Common Charges to Send Money from USA to India?

Several factors contribute to the charges for sending money from the USA to India. Understanding how payment methods, delivery options, transfer amounts, and exchange rates impact costs can help you make an informed choice:

1) Payment Method and Transfer Fees

Different payment methods come with varying fees. Bank transfers are usually more affordable, while credit or debit card payments often incur higher charges due to processing costs and risks associated with the transfer service.

2) Delivery Method and Charges

Delivery methods affect the cost of money transfers. Cash pickups are often more expensive than direct bank deposits into an Indian account due to the additional handling required for physical cash transfer services.

3) Transfer Amount and Speed

The transfer amount and delivery speed influence the total fees. Sending large amounts may lead to higher costs, while choosing expedited transfer methods often incurs additional charges to ensure quick processing and delivery of funds.

4) Exchange Rates and Costs

Exchange rates are crucial in determining the total cost of a transfer. Providers may offer lower exchange rates to attract customers, but this could result in hidden costs, impacting the final amount the recipient receives in Indian Rupees.

By considering these factors, you can make a more informed decision and choose a transfer service that offers the best balance of cost, speed, and convenience.

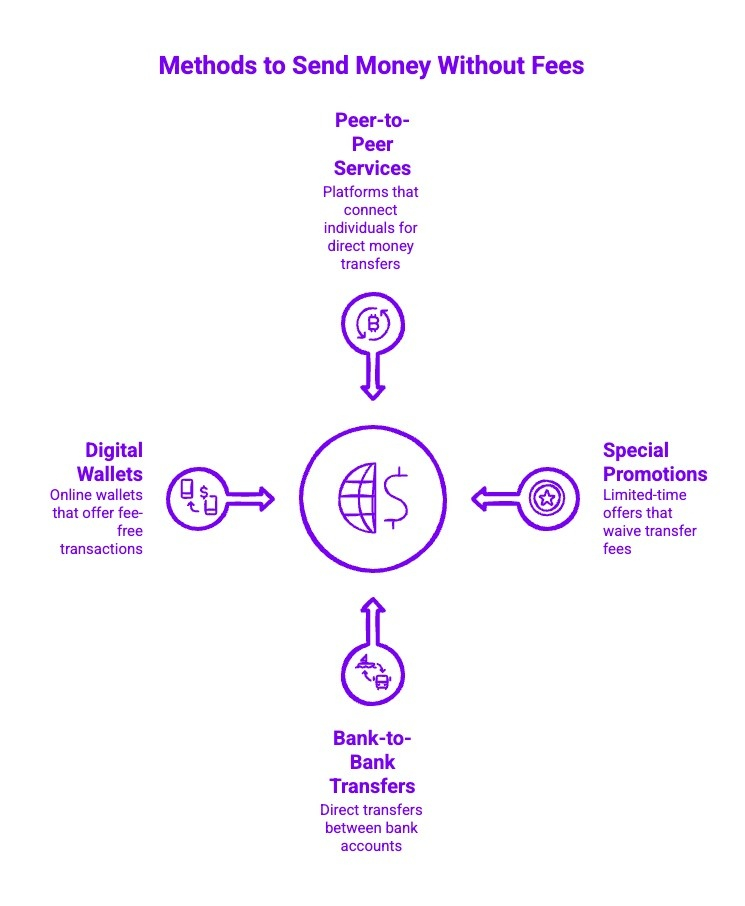

How To Send Money from USA to India Without Fees?

Charges for transferring money from USA to India may seem unavoidable, but there are ways to minimize or eliminate fees. Here are some methods to send money to Indian from the USA without paying any charges:

1) Using Peer-to-Peer Transfer Services

Peer-to-peer platforms like Venmo, PayPal, and Zelle offer fee-free transfers when both the sender and receiver are on the same platform. This method is most effective for personal payments, often without fees when linked to a bank account.

2) Taking Advantage of Special Promotions

Many transfer services run limited-time promotions that allow fee-free transfers. Services like Frex, Remitly, Xoom, and others frequently offer fee waivers during certain periods, especially for first-time users or during holiday seasons.

3) Choosing Bank-to-Bank Transfers

Some banks provide fee-free international transfers if both the sender and recipient have accounts with the same bank. Certain financial institutions may also waive transfer fees as part of their customer service package.

4) Leveraging Fee-Free Digital Wallet Options

Digital wallets like Google Pay or Apple Pay may offer free international transfers when linked to a bank account. These services may also provide promotions that allow transfers to be made at no extra cost, making them a convenient fee-free option.

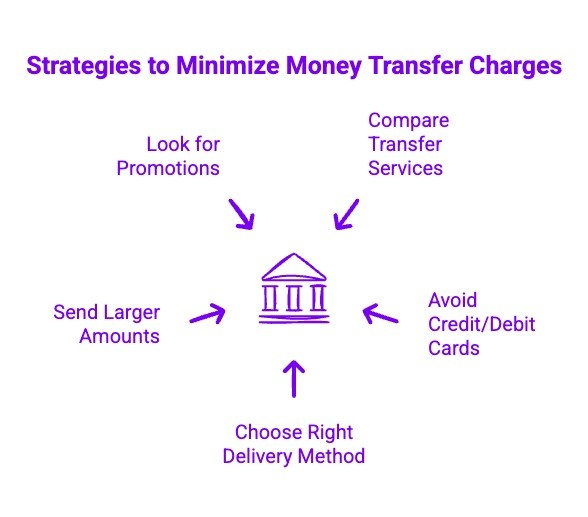

What Tips Help Minimize Charges When Sending Money from USA to India?

While sending money from the USA to India without charges is possible, minimizing money transfer charges from USA to India is a practical goal for many. Here are some key tips to help you reduce the charges for money transfer from USA to India, ensuring you get the best deal possible when transferring funds.

- Compare Transfer Services: Evaluate different services like Wise, Remitly, and Xoom to find the most cost-effective option based on transfer fees and exchange rates.

- Avoid Using Credit or Debit Cards: Opt for bank transfers instead of credit or debit card payments, as card payments often come with higher processing fees.

- Choose the Right Delivery Method: Direct bank deposits are typically cheaper than cash pickups, which include additional fees for handling.

- Send Larger Amounts at Once: Sending larger sums in one transfer may help you access better rates and avoid the higher fees associated with smaller transfers.

- Look for Fee-Free Transfer Promotions: Take advantage of promotional offers, especially for first-time users or special events, to send money without paying transfer fees.

With its easy-to-use app, no hidden fees, and instant transfers, Frex ensures you get the best value for your money every time. Download the app now!

How Do Money Transfer Services from USA to India Compare in Terms of Charges?

When comparing money transfer services, it’s important to consider not just the fees, but also the transfer speed, available payment methods, and currency conversion rates.

Below is a table that highlights how different services stack up against each other, helping you make an informed decision based on your specific needs:

| Service | Fee Structure | Delivery Time | Payment Method | Delivery Method | Exchange Rate |

|---|---|---|---|---|---|

| Frex | Low flat fee + percentage of transfer | Instant to 1 day | Bank transfer, debit/credit card | Bank deposit, mobile wallet | Competitive, transparent exchange rates |

| Wise | Low flat fee + percentage of transfer | 1-2 business days | Bank transfer, debit/credit card | Bank deposit, mobile wallet | Competitive, transparent exchange rates |

| Traditional Bank Transfers | Flat fee + percentage (varies by bank) | 2-5 business days | Bank transfer | Bank deposit | Exchange rate markup, often higher |

| Remitly | Flat fee + percentage (varies by country) | Instant to 3 days | Bank transfer, debit/credit card | Bank deposit, cash pickup | Exchange rate markup |

| Western Union | Percentage-based fee + fixed fee | Instant to 5 days | Bank transfer, debit/credit card | Cash pickup, bank deposit | High exchange rate markup |

| Xoom | Flat fee + percentage of transfer | Instant to 1 day | Bank transfer, debit/credit card | Bank deposit, cash pickup | High exchange rate markup |

| PayPal | Flat fee + percentage, depending on amount | Instant to 1 day | PayPal balance, debit/credit card | Bank deposit, PayPal balance | Exchange rate markup |

| MoneyGram | Flat fee + percentage of transfer | Instant to 3 days | Bank transfer, debit/credit card | Cash pickup, bank deposit | Exchange rate markup |

| Other Online Services | Varies (usually flat fee or percentage) | Instant to 3 days | Bank transfer, debit/credit card | Bank deposit, mobile wallet | Often competitive or low markup |

By carefully comparing these services based on fees, transfer speed, payment methods, and currency conversion rates, you can select the best option that meets your needs and minimizes the overall cost of transferring money from the USA to India.

Why Choose Frex for Your Money Transfers?

When it comes to sending money from the USA to India, Frex offers a fast, secure, and cost-effective solution. With our user-friendly platform, you can send money quickly and easily, ensuring your loved ones receive their funds without the hassle of high fees or hidden charges.

Key Features of Frex:

- Low, Transparent Fees: Frex offers competitive fees with no hidden charges, ensuring you get the best value for your money. You can always see the fees upfront before completing the transaction.

- Fast Transfers: Frex ensures rapid transfer times, with most transactions being completed within minutes, so your recipients get their money as soon as possible.

- Secure Transactions: Frex uses advanced encryption technology to ensure your transactions are safe and your personal data is protected throughout the transfer process.

- Multiple Payment Options: Whether you prefer to pay via bank transfer, debit/credit card, or digital wallet, Frex provides flexible payment methods to suit your needs.

- 24/7 Customer Support: Their dedicated support team is available around the clock, ensuring a smooth experience for every transfer you make.

Get started today! Download the Frex app now and start transferring money with ease:

- Download on Google Play

- Download on Apple App Store

Conclusion

To minimize the cost of sending money from the USA to India, focus on comparing transfer services based on their fees, transfer speed, payment methods, and exchange rates. By choosing the right method, such as bank-to-bank transfers or taking advantage of fee-free promotions, you can reduce unnecessary charges. Additionally, being mindful of currency conversion fees and opting for larger transfers can help you access better rates and lower fees. Take the time to evaluate your options to ensure you’re getting the best deal for your money transfer needs.

Frequently Asked Questions

Do charges change based on how quickly the money is delivered?

Yes, delivery speed impacts transfer fees. Faster methods, like “Express” transfers, often come with higher fees or less favorable exchange rates, while slower methods like “Economy” may offer lower fees and better currency exchange rates.

Are there limits on how much you can send from the US to India at one time?

Transfer limits depend on the provider. For example, Remitly allows higher amounts, such as $100,000, while Western Union limits unverified users to $3,000. Limits also vary based on account verification and service type.

What are the typical charges for sending money from the USA to India using popular transfer services?

Typical charges include flat fees, a percentage of the transfer amount, and currency exchange margins. Popular services like Wise, Remitly, and Western Union may also include fees for credit card payments and bank transfers, varying by service type.

Which money transfer provider offers the lowest fees for sending funds to India from the US?

Wise is known for offering low fees and transparent international transfers. Wise payments limit their charges, and their fee information is clearly stated upfront, making it one of the cheapest ways to transfer funds to India.

How do exchange rates affect the total cost of sending money from the USA to India?

Exchange rates are crucial in determining the total cost. A provider with low fees but a poor exchange rate may cost you more. Providers with transparent exchange rates, like Wise, offer competitive rates that reduce hidden fees.

Are there any hidden charges or additional fees to watch out for when transferring money to India from the US?

Yes, when considering money transfer from USA to India charges, be aware of hidden fees like high currency conversion margins or additional service charges, particularly when using a credit card. Always review the terms of use and fee information before transferring.

How do transfer speed and delivery times compare among different services for sending money from the USA to India?

Transfer speeds vary depending on the service. For example, Remitly offers instant transfers, while traditional bank wire transfers might take 1-5 business days. Speed often correlates with USA to India money transfer charges, so balance urgency with costs.

What information do I need to transfer money to India from the United States?

To complete a money transfer from USA to India, you’ll need the recipient’s bank account details, including the account number and routing information. You may also require the recipient’s phone number and email address for confirmation, along with your payment details.

How to send money from USA to India without charges?

While it may seem challenging, there are options to avoid charges. Using peer-to-peer services like PayPal, taking advantage of special promotions, or choosing bank-to-bank transfers can help you send money without any extra fees.

Leave a Reply