Key Highlights

- No-fee transfers can still include hidden charges such as exchange rate markups, payment method fees, and intermediary bank charges, making it essential to evaluate the total cost.

- Digital transfer services like Frex offer transparent pricing and competitive exchange rates, often reducing fees compared to traditional banks.

- Choosing the correct payment method (bank transfer vs. debit/credit card) can significantly lower costs and improve overall value.

- Achieving the lowest fees requires checking exchange rates, reviewing final INR amounts, and ensuring no hidden costs during the transfer process.

High fees and hidden charges are a significant concern when sending money internationally, especially when transferring funds from the USA to India. Even when a service promises “no fees,” there can still be costs that add up over time.

These additional costs often come from exchange rate markups, payment method charges, or intermediary bank fees. Without understanding how these work, you could end up paying more than expected, even when choosing a “no-fee” service.

By exploring the details of these charges and identifying the most transparent options, you can save money while ensuring your funds are transferred securely and efficiently. This guide will help you make the best choice for your needs.

How Do Money Transfer Fees from USA to India Usually Work?

Now that you know how transfer fees, exchange rates, and payment methods affect the overall cost, it’s easier to understand why even “no-fee” transfers might not be as cost-effective as they seem.

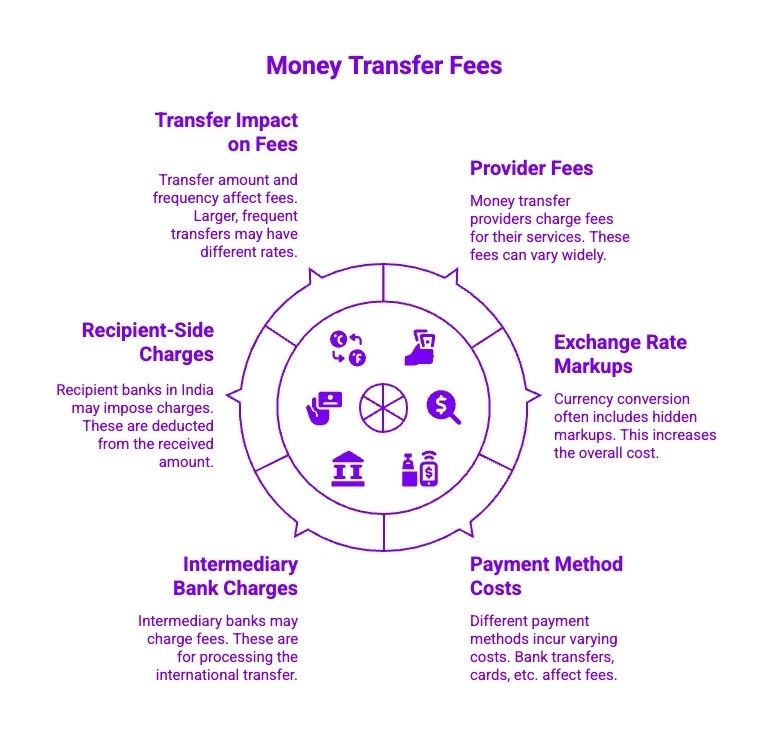

Let’s break down the key factors that contribute to the actual cost of transferring money from the USA to India:

1) Transfer Fees Charged by the Money Transfer Provider

To begin with, most providers charge a visible transfer fee, either flat or percentage-based, depending on the amount sent. These fees may look small, but they add up over time, making it essential to check them before confirming any transfer.

2) Exchange Rate Markups Hidden in Currency Conversion

Beyond upfront fees, exchange rate markups often account for the most significant cost difference. Providers may offer zero transfer fees when adjusting the USD-to-INR rate. Understanding this hidden margin helps you evaluate the transfer’s actual cost.

Learn more about the best exchange rates to transfer money from the USA to India in 2026.

3) Payment Method Costs (Bank Transfer, Debit, Credit Card)

Next, the chosen payment method significantly affects fees. Bank transfers via ACH are usually cheapest, while debit and credit cards attract higher processing charges. Selecting the right payment option can substantially reduce overall transfer costs.

4) Intermediary and Correspondent Bank Charges

In some cases, transfers pass through intermediary banks, especially with wire payments. These banks may deduct handling charges without notice. Knowing when intermediaries are involved helps you avoid unexpected reductions in the final amount received.

5) Recipient-Side Charges in India

On the receiving end, Indian banks generally do not charge for inward remittances, but exceptions can exist. Certain account types or transfer routes may involve small deductions, so verifying recipient-side policies adds clarity and prevents confusion.

6) Transfer Amount and Frequency Impact on Fees

Additionally, sending smaller amounts frequently can increase total fees over time. Many providers offer better rates for higher-value transfers. Planning fewer, consolidated transfers often leads to lower overall costs and better value.

By focusing on transparency, fair exchange rates, and the proper transfer method, you can consistently send money from the USA to India while keeping fees to an absolute minimum.

What Are the Best and Most Cost-Effective Ways to Send Money to India from the USA Without Fees?

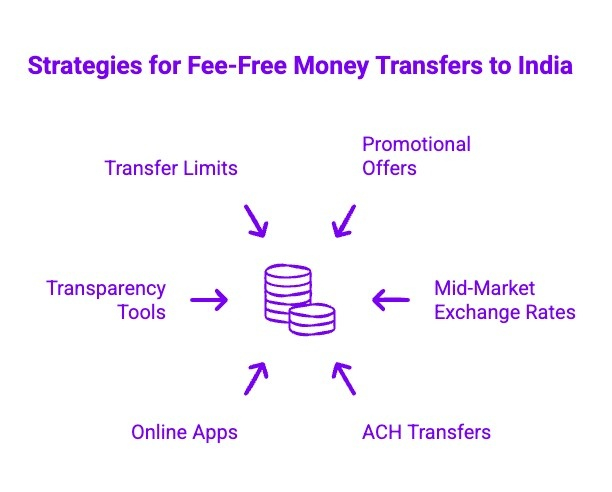

When choosing the best way to send money to India from USA without fees, it’s essential to consider more than just promotional offers or zero-fee labels. Several factors, such as transfer costs, exchange rates, and payment methods, all play a role in the overall cost. Here’s a breakdown of the most effective methods:

1) Promotional Zero-Fee Offers from Money Transfer Services

Many money transfer services attract new users with zero-fee promotions. These offers may remove the transfer charges, but typically come with conditions such as limits on the first transfer or capped amounts. Always check the promotion terms to confirm that the savings are real.

2) Mid-Market Exchange Rate Providers with Transparent Pricing

Some providers use the mid-market exchange rate without adding hidden markups. Even if a small transfer fee applies, the fair USD-to-INR rate often results in lower overall costs, making transparency a key factor in ensuring true savings.

3) ACH Bank Transfers Instead of Cards or Wire Payments

ACH bank transfers are generally cheaper than using debit or credit cards, or wire transfers. Although ACH transfers may take longer, they have lower processing fees and avoid card surcharges, making them ideal for low-cost USA-to-India transfers.

4) Online Money Transfer Apps with No Transfer Fees

Several platforms, like Frex, offer fee-free transfers for USA-to-India payments. While these platforms often recover their costs through exchange rate markups, it’s important to compare the final INR amount received to ensure you’re truly saving money.

5) Exchange Rate Transparency and Fee Breakdown Tools

Providers that offer a complete fee breakdown upfront make it easier to compare services. Seeing the exchange rate, transfer fees, and final INR payout before confirming helps you avoid surprises and select the most cost-effective option.

6) Transfer Limits and Conditions Affecting Zero-Fee Eligibility

Many zero-fee transfers come with restrictions, such as limits on transaction size, frequency, or payout method. Understanding these limits allows you to plan your transfers better and avoid unexpected charges once promotional thresholds are exceeded.

By focusing on zero-fee promotions, fair exchange rates, and cost-efficient payment methods, you can send money from the USA to India without overpaying. The key is to evaluate the total cost, not just the fee, to ensure you’re getting the best value.

What Should You Check Before Using a No-Fee Online Money Transfer Option from the USA to India?

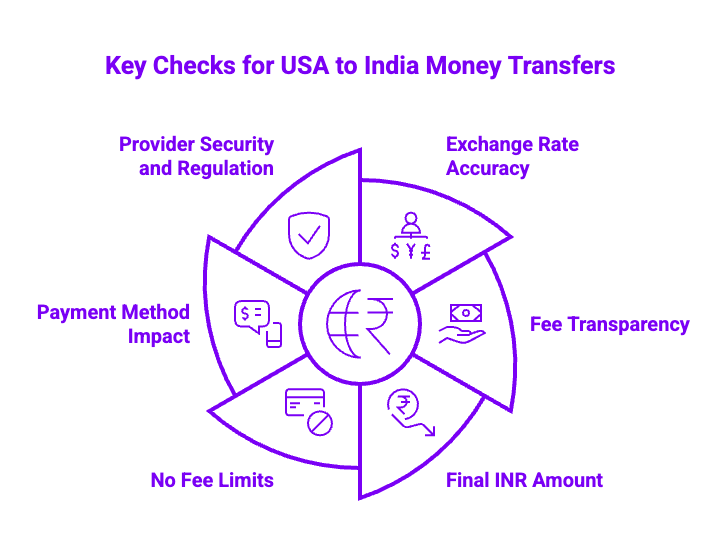

Before confirming a no-fee transfer, review these key checks carefully to avoid hidden costs and ensure your money reaches India as expected:

- Exchange Rate Accuracy: Confirm that the USD-to-INR rate matches the mid-market rate. Even small markups can outweigh a zero transfer fee, reducing the final amount received.

- Fee Transparency Before Confirmation: Ensure all costs are displayed upfront, including transfer fees, exchange rates, and any additional charges. Transparent pricing prevents surprises after the transfer is processed.

- Final INR Amount Received: Always check the exact INR amount the recipient will get. This figure reveals the actual cost of the transfer more accurately than advertised no-fee claims.

- No Fee Limits and Conditions: When you send money to India from USA no fees, review eligibility rules such as transfer caps, first-time user restrictions, or limited usage. These conditions can impact how often you can send money without fees.

- Payment Method Impact: Choose bank-funded ACH transfers where possible. Debit and credit cards often introduce processing fees that cancel out the benefit of a no-fee transfer.

- Provider Security and Regulation: Verify that the provider is licensed and regulated, and that it uses secure encryption. Safety and compliance are just as important as low cost when transferring money internationally.

Focusing on transparency, exchange rates, and secure payment methods ensures your online money transfer from the USA to India remains truly fee-free while delivering the maximum value to the recipient. Try Frex for your next transfer and experience transparent, cost-effective, and reliable international payments.

What Are the Common Mistakes That Increase Money Transfer Fees Without You Realizing?

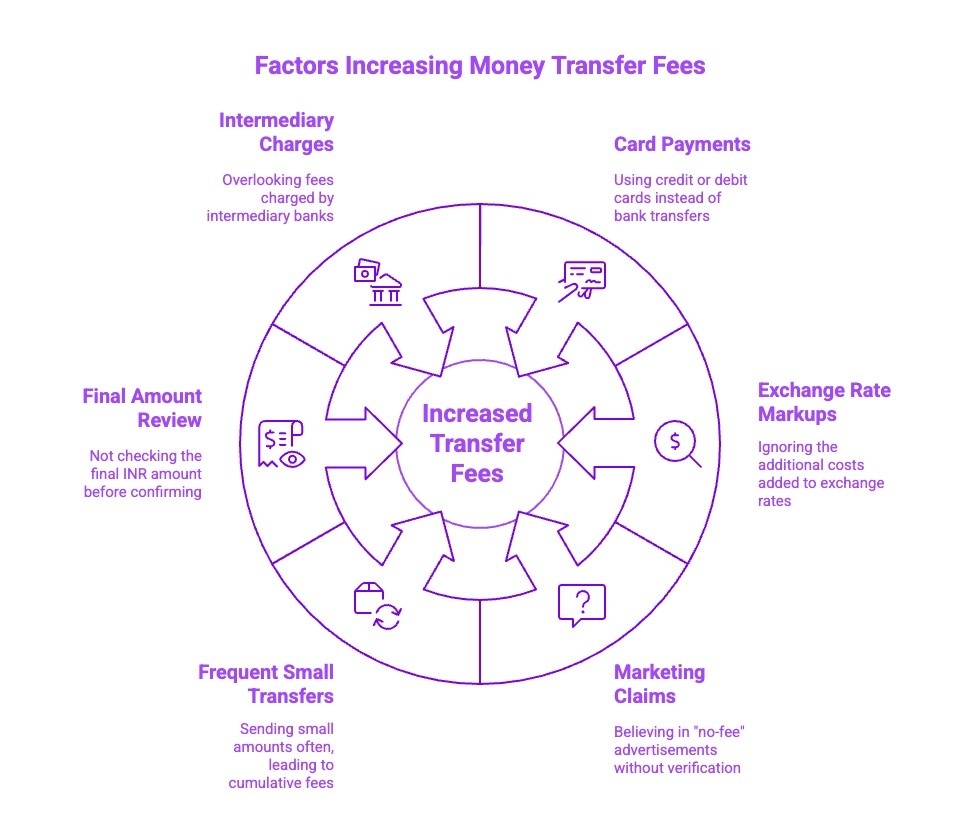

While sending money internationally, inevitable mistakes can quickly increase fees without you realizing it. Understanding these common errors and taking the time to avoid them can help ensure that your transfer is as cost-effective as possible.

Let’s look at these pitfalls in detail:

1) Choosing Card Payments Instead of Bank Transfers

Debit and credit cards often seem convenient, but they usually carry higher processing fees. These charges can quietly raise the total cost, making card-funded transfers more expensive than bank transfers for USA-to-India payments.

2) Ignoring Exchange Rate Markups

Many users focus only on visible fees and overlook exchange rate margins. Even a small markup on the USD-to-INR rate can reduce the final amount received, outweighing the benefit of a zero-fee transfer.

3) Falling for “No-Fee” Marketing Claims

Some services advertise no transfer fees while recovering costs through poorer exchange rates. Without checking the final INR payout, these offers may end up costing more than transparent providers with small visible fees.

4) Sending Small Amounts Frequently

Frequent low-value transfers can increase total fees over time. Many providers offer better rates for higher amounts, so consolidating transfers often results in lower overall costs and better value.

5) Not Reviewing the Final INR Amount

Skipping the final payout review can lead to unexpected deductions. Always verify the exact INR amount the recipient will receive, as this reflects the actual cost of the transfer more accurately than fee labels.

6) Overlooking Intermediary or Bank Charges

Wire transfers and specific payment routes may involve intermediary banks that deduct fees without notice. Understanding the transfer route helps avoid surprise deductions that reduce the money reaching the recipient.

By avoiding these errors and focusing on exchange rates, payment methods, and final payouts, you can significantly reduce hidden costs and keep your USA-to-India money transfers as affordable as possible.

Why Frex Is a Smarter Way to Send Money from USA to India?

Frex is designed for people who want clarity, control, and lower costs when transferring money from the USA to India. Unlike services with complex or hidden fee structures, Frex prioritizes transparent pricing and competitive exchange rates, so you know exactly how much will reach your recipient.

With Frex, users enjoy clear fee visibility upfront, reliable bank transfer options, and a simplified process that eliminates unnecessary charges. This makes it particularly beneficial for NRIs, families supporting loved ones, and anyone who makes regular international transfers. Frex ensures that you’re in control, with no surprises or hidden fees, making it an ideal choice for those looking to send money without overpaying.

Download Frex today and see how much more your money can deliver to India.

Conclusion

Keeping transfer costs low requires paying attention to details that are often overlooked. Start by comparing exchange rates rather than focusing solely on zero-fee claims, and choose bank transfers over card payments whenever possible. Always review the final INR amount before confirming and avoid making multiple small transfers that increase overall costs.

Transparent platforms help make this process easier by showing fees and rates upfront, allowing you to make informed decisions. Taking a few extra moments to check limits, payment methods, and delivery timelines can lead to consistent savings. With the right approach, more of your hard-earned money reaches India safely, efficiently, and without unnecessary deductions.

Frequently Asked Questions

Can I avoid exchange rate markups when using no-fee transfer services?

Yes, you can minimize markups by choosing providers that show great exchange rates upfront, compare totals, and confirm overseas money transfers before paying, even when sending money to India from the USA with no fees.

Are there any hidden charges or limits on fee-free money transfers?

Fee-free international money transfers may include limits on the amount of money, delivery method, or transaction frequency, as well as additional information checks. To avoid surprises, review the terms carefully when selecting the lowest-fee option for easy money transfers to India.

Is using fee-free apps safe for sending money to India from the US?

Most regulated apps, like Frex, are safe, using secure mobile app systems, bank-level encryption, and verification methods such as phone number or email address checks. This adds peace of mind for users making fee-free overseas money transfers today.

Are there any money transfer services that allow fee-free transfers from the USA to India?

Some platforms, like Frex, allow fee-free transfers to India, including bank deposits. However, the availability of these offers depends on provider rules, transfer corridors, and promotional timing, typically available for new users.

Can I send money to India from the US using apps that don’t charge transfer fees?

Yes, many users choose mobile apps like Frex to send funds, link a local bank account, and select direct debit, making money transfers simple and transparent. With fewer steps and clearer costs, these apps are ideal for first-time senders looking to avoid hidden fees.

Does Wise or Remitly offer free money transfers to India from the USA?

Wise or Remitly sometimes advertises no-fee transfers, but costs vary by transaction type, recipient’s bank account number, and routing, so always compare final payouts before confirming to ensure transparency and fair pricing for users.

How do I set up my first money transfer from the USA to India?

Start by choosing a provider, entering bank account information, adding recipient details, confirming the amount, and selecting a delivery method to begin your first transfer safely and smoothly within regulated international payment systems today.

How do I estimate the cost to make a ‘large amount’ money transfer to India?

Wise or Remitly sometimes advertises no-fee transfers, but costs vary by transaction type, recipient’s bank account number, and routing. Always compare final payouts before confirming to ensure transparency and fair pricing, especially when looking for the lowest fees money transfer USA to India.

How do I view my transfer status when sending money from the US to India?

Most providers offer real-time tracking of your international money transfer, with updates on processing stages, currency exchange, and delivery, ensuring peace of mind with alerts and support throughout the transfer process.

How to send money from USA to India without fees?

To make an online money transfer USA to India no fees, use services offering zero-fee transfers, such as specific digital wallets or bank transfers. Be mindful of potential hidden charges, like unfavorable exchange rates or markups.

Do Indian banks have options for fee-free remittances from the United States?

Yes, some Indian banks offer fee-free remittances from the USA through partnerships or their own online banking platforms. However, exchange rate markups may apply. Always check the final amount sent to your Indian bank account. Services with low fees and mobile wallet or UPI ID transfers can often process payments in business days.

Leave a Reply