Key Highlights

- Xoom fees for money transfer to India from USA depend on the payment method, with bank transfers usually cheaper than debit or credit cards.

- Xoom exchange rates include a margin, which affects the final INR amount received even when transfer fees appear low.

- Transfer limits from USA to India vary based on user verification status, transfer history, and chosen payment method.

- The Xoom fee calculator helps estimate total transfer cost by showing fees, applied exchange rates, and final payout upfront.

- Delivery speed ranges from minutes to one business day, depending on payment method and payout option in India.

- Comparing Xoom with other USA to India money transfer services helps identify when Xoom is convenient versus when lower-cost options may be better.

Hidden fees and unclear exchange rates are often the biggest frustrations when choosing an international money transfer service. Even when a platform looks affordable at first glance, the final amount received can tell a very different story.

With Xoom, costs are influenced by more than just a visible transfer fee. Exchange rate margins, payment methods, transfer limits, and delivery speed all affect the real value of a USA to India transfer. Without understanding how these factors work together, it is easy to underestimate the total cost.

This blog explains Xoom fees for money transfer to India from USA in a clear and practical way. It breaks down fees, exchange rates, limits, and comparisons with other services, helping you decide whether Xoom is the right option for your transfer needs.

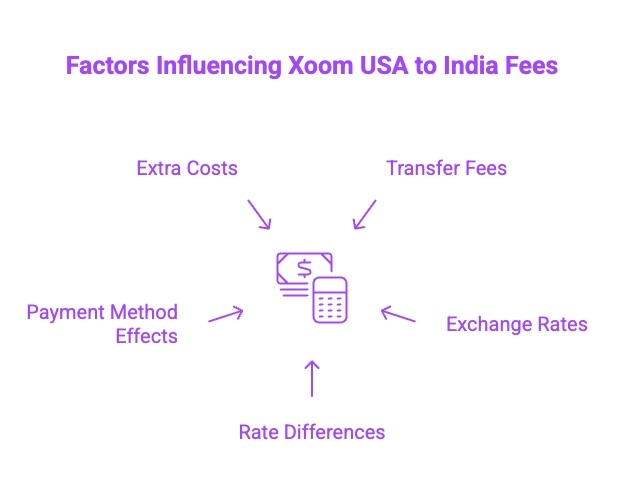

What Are the Xoom USA to India Fees and Rates?

Before sending money, it’s essential to understand how Xoom structures its transaction fees and exchange rates, as both directly impact how much your recipient receives in India.

To make sure you’re getting the best value for your transfer, let’s dive into the details of Xoom’s fees and exchange rate policies:

1) Transfer Fees

Xoom charges different fees depending on how you pay for the transfer. Knowing this upfront helps avoid unexpected costs.

- Fees vary based on bank transfer, debit card, or credit card

- Bank account transfers often have lower or zero fees

- Card payments usually come with higher charges

2) Exchange Rates

The exchange rate plays a major role in the total cost of your transfer. Even small rate differences can affect the final INR amount.

- Xoom uses its own USD to INR exchange rate

- Rates include a margin above the mid-market rate

- This margin reduces the amount received in India

3) Rate Differences

Many users compare Xoom rates with online market rates. Understanding why they differ helps set realistic expectations.

- Xoom rates may differ from Google or bank rates

- The difference acts as an indirect transfer cost

- Larger amounts show a bigger rate impact

4) Payment Method Effects

How you fund the transfer can change both fees and speed. Choosing the right method can help manage costs better.

- Bank transfers are usually the most cost-effective

- Debit and credit cards offer faster processing

- Card payments often increase total transfer cost

5) Extra Costs

Some costs are not listed as separate fees but still affect value. It is important to know where these costs come from.

- No additional service fees appear after confirmation

- Exchange rate margins are the main extra cost

- Recipient banks usually do not deduct fees

Understanding Xoom USA to India fees and rates in detail helps you make informed decisions. Reviewing each cost component before confirming ensures transparency and reduces surprises during international transfers.

What Are Xoom Fees for Different Payment Methods to India from USA?

Understanding the fee structure is essential before sending money internationally, as costs can vary based on payment method and transfer type. Below is a simple breakdown of Xoom fees for money transfer to India from USA:

| Payment Method (USA) | Typical Xoom Transfer Fee | Exchange Rate Markup | Notes |

|---|---|---|---|

| US Bank Account | Often $0 | Yes | Most cost-effective option, but delivery may take longer |

| Debit Card | Low to moderate fee | Yes | Faster processing with added convenience |

| Credit Card | Higher fee | Yes | Includes card processing charges |

| PayPal Balance | Usually low or $0 | Yes | Availability depends on user account |

| Cash Pickup Option | Varies by amount | Yes | Fees may increase based on pickup location |

While some Xoom transfers show low or zero upfront fees, the exchange rate markup plays a major role in the final cost. Reviewing both fees and rates together helps you understand the true cost of sending money from USA to India using Xoom.

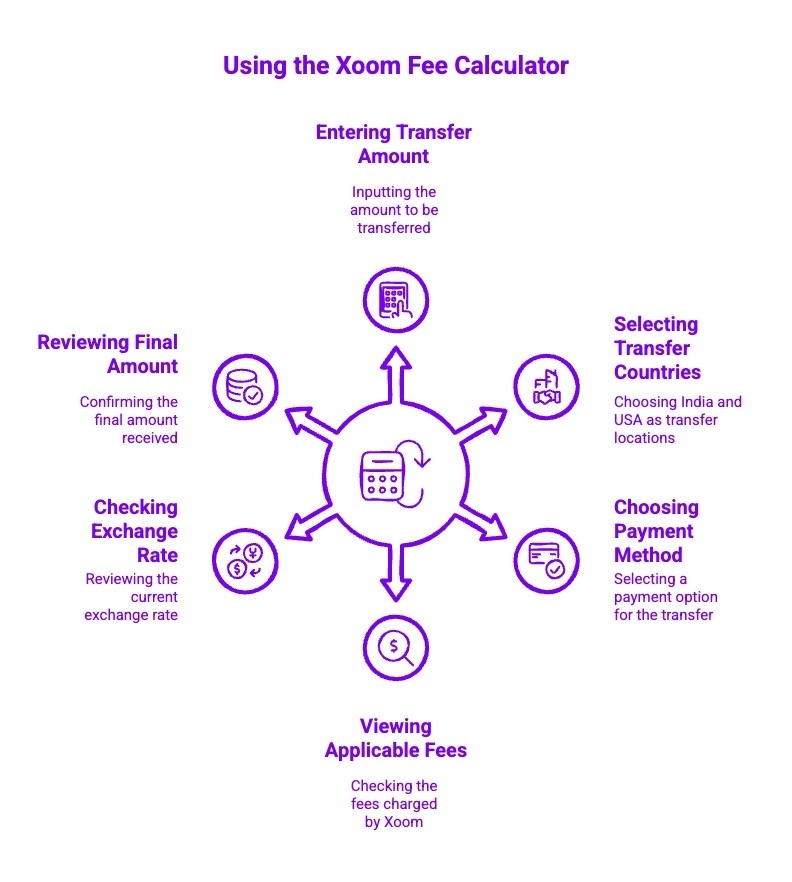

How to Use the Xoom Fee Calculator Exchange Rates from India to USA?

Before starting a transfer, it is important to understand how fees and exchange rates affect the final amount received. The Xoom fee calculator helps estimate costs accurately by showing applicable fees and exchange rates for money transfers from India to USA.

1) Enter the Transfer Amount

To start, define how much money you want to send.

Enter the amount in the Xoom fee calculator. This allows you to see estimated fees and exchange rates when checking Xoom exchange rates from India to USA.

2) Select India and USA as Transfer Countries

Once the amount is entered, choose the transfer route.

Select India as the sending country and USA as the receiving country. This ensures the calculator applies the correct Xoom rate India to USA and relevant transfer rules.

3) Choose Your Payment Method

Next, decide how the transfer will be funded.

Pick a payment method such as bank transfer or card. The chosen option directly impacts Xoom fees and the exchange rate shown in the fee calculator.

4) View Applicable Xoom Fees

After selecting the payment method, review the costs involved.

The calculator displays applicable Xoom fees based on your transfer details, helping you understand upfront charges before proceeding with a transfer from India to USA.

5) Check the Exchange Rate Applied

Now review how currency conversion affects your transfer.

The calculator shows the exchange rate used for converting INR to USD, allowing you to compare the Xoom rate India to USA with current market rates.

6) Review the Final Amount You Receive

Finally, confirm the outcome of the calculation.

The tool displays the final USD amount the recipient receives after fees and exchange rates, helping you assess the real cost of using Xoom for India to USA transfers.

Using the Xoom fee calculator makes it easier to understand exact fees and exchange rates before sending money. By reviewing each step carefully, you can estimate costs accurately and decide whether Xoom offers the right value for India to USA transfers.

For insights into the best exchange rates for transferring money from the USA to India in 2026, check out this guide on the best exchange rates.

How Does Xoom Compare to Other USA to India Money Transfer Services?

When choosing a money transfer service, it helps to compare fees, exchange rates, speed, and limits side by side. The table below shows how Xoom compares with other popular USA to India money transfer services.

| Service | Transfer Fees | Exchange Rates | Transfer Speed | Transfer Limits | Best For |

|---|---|---|---|---|---|

| Xoom | Low to moderate | Includes margin | Minutes to 1 day | Medium to high | Fast transfers and convenience |

| Frex | Zero fees | Mid-market rate | Instant transfer | No minimum transaction amount | Fee-free transfers with real exchange rates |

| Wise | Low and transparent | Near mid-market | 1 to 2 days | High | Low-cost and transparent pricing |

| Remitly | Low to moderate | Includes margin | Minutes to 3 days | Medium | Flexible delivery options |

| Western Union | Moderate to high | Includes margin | Minutes to 1 day | High | Cash pickup availability |

| Bank Wire | High | Bank-set rates | 2 to 5 days | High | Large transfer amounts |

While Xoom offers speed and ease of use, other services may provide better exchange rates or lower overall costs depending on your transfer needs. Comparing fees, rates, and delivery times helps you choose the most cost-effective option for sending money from United States to India.

Why Choose Frex for USA to India Money Transfers?

When comparing international transfer options, cost transparency and ease of use matter just as much as speed. Frex offers a streamlined way to send money from the USA to India without the confusion of fluctuating fees or unclear exchange rates.

Frex shows the exact transfer amount, fees, and exchange rate before you confirm, helping you understand the true cost upfront. With fast processing and reliable delivery to Indian bank accounts, it removes much of the uncertainty often associated with cross-border transfers.

Built for a mobile-first experience, Frex makes transfers simple with quick setup, secure verification, and real-time tracking.

Ready to send money without the guesswork? Download the Frex app today and experience a faster, clearer way to transfer money from the USA to India.

Conclusion

Understanding Xoom fees for money transfers to India from the USA is crucial for planning your financial transactions effectively. By being aware of the key highlights, hidden charges, and the impact of payment methods on fees, you can make informed decisions that suit your needs.

Whether you’re sending a small amount or a large sum, understanding these details helps you make the most cost-effective decision for your transfer. By being informed, you can ensure a smoother and more efficient transfer experience. Happy transferring!

Frequently Asked Questions

Are there hidden charges when sending money with Xoom from USA to India?

Xoom money transfer USA to India does not include hidden charges, but exchange rate margins may apply, and you can also utilize bank deposits for added convenience. Reviewing terms of use and full financial info helps users understand costs clearly at every step of the way.

Does Xoom’s fee change based on payment method or transfer amount?

Yes, fees vary by payment method and amount. Card payments usually cost more than bank transfers, and the Xoom transfer rate from USA to India may shift based on funding source and interbank rate conditions, impacting the recipient’s bank account directly.

Is Xoom cheaper than other services for sending money from USA to India?

Xoom can be competitive for speed and convenience, though not always the cheapest. Comparing the Xoom USA to india rate with the best exchange rates from other platforms helps assess the overall value for online transactions.

What is the Xoom money transfer limit from USA to India?

The Xoom transfer limit from USA to India depends on verification level, payment method, and transfer history. Limits are explained for general information purposes and may change without professional advice or prior notice.

Are there any promotions or ways to reduce Xoom’s fees for sending money to India?

Xoom occasionally offers promotions such as free transfers for first-time users. To make the most of savings opportunities, consider using a linked PayPal account and checking for updates from customer service centers. This can help you stay informed about the latest offers for Xoom money transfer from USA to India.

Is Xoom cheaper than other services for sending money to India from the US?

It depends on priorities. Xoom offers speed and human support, while others may cost less. The best part is comparing fees, rates, and convenience rather than relying on a single affordable online money transfer claim.

How often do Xoom’s fees or exchange rates for India transfers change?

Xoom’s fees and exchange rates can change frequently based on market conditions, payment method, and transfer amount. To ensure you get the best rate, the Xoom transfer rate to India from USA may update daily or even multiple times a day, so checking the latest rates before confirming a transfer is important.

Can I see a breakdown of all fees Xoom charges for a $1000 transfer to India?

Yes, Xoom shows a full cost breakdown before confirmation. You can view the transfer fee, applied exchange rate, and final INR amount for a $1000 transfer, helping you understand the total cost upfront.

Leave a Reply