Key Highlights

- Understanding tax implications is essential when sending money from the USA to India to avoid unexpected fees or penalties.

- Gift transfers under ₹50,000 are typically tax-free, but larger sums or business-related transfers may incur taxes.

- IRS Form 3520 must be filed for money transfers exceeding $100,000 to ensure compliance with reporting requirements.

- FinCEN Form 114 (FBAR) is required if the transfer involves foreign bank accounts and exceeds $10,000 during the year.

- Business-related remittances are subject to income tax in India, depending on the nature of the transfer.

- Withholding tax may apply to investment income sent across borders, typically between 10%-15%.

- Failure to report transfers can result in penalties, interest on unpaid taxes, and potential audits by the IRS.

- Frex helps simplify the process by offering clear, transparent fees and compliance with tax regulations.

Most people assume sending money abroad is simple as long as the transfer goes through. Once the money reaches its destination, the job feels done. Few stop to ask whether that transfer triggered a reporting requirement or tax obligation on their side.

That assumption is where problems often begin. Certain international transfers must be reported even when no tax is owed, and others can affect how income, gifts, or assets are treated later. Missing a filing requirement does not usually feel urgent until penalties or notices appear.

This guide breaks down when money transfers require reporting, how tax rules apply, and what steps help you stay compliant. The goal is to help you recognize risks early and make informed decisions before small oversights turn into costly mistakes.

What Is the Tax on Money Transfer from USA to India?

When transferring money from the USA to India, it is important to understand the transfer money from USA to India tax implications, especially around IRS reporting requirements. In most cases, the sender does not owe tax, but certain transfers must still be disclosed.

If you send more than $100,000 in a year to a single recipient in India, you are required to file IRS Form 3520, even when the transfer is a gift or family support. This reporting obligation is commonly missed because no immediate tax payment is due.

For recipients in India, personal remittances are generally not taxable unless classified as income or business receipts. If you are unsure which method is safest or most cost effective, this guide explains the best way to send money to India from the USA and compares common transfer options clearly.

Questions also arise around transfer from India to USA tax when funds later move back, since treatment depends on source and purpose. More complex cases involving investments can trigger money transfer from India to USA tax implications, where transfer money from India to USA tax implications CPA guidance may be needed to avoid reporting errors.

What Are the Different Types of Taxes Related to International Money Transfers?

When sending money from the USA to India, different tax and reporting rules apply depending on which country’s authority is involved and who the rule applies to. The table below clearly separates Indian tax rules from US reporting obligations.

| Tax Component | Country Where It Applies | Amount for 2026 | Who It Affects | Details |

|---|---|---|---|---|

| Gift Tax Exemption Limit | India | ₹50,000 | Recipient in India | Personal gifts exceeding ₹50,000 in a year may be taxable in India. Gifts from close family members are generally exempt under Indian tax rules. |

| Income Tax Threshold | India | ₹2.5 lakh (individuals) | Recipient in India | If transferred funds are treated as income, such as business payments or services, they may be taxed once they exceed this threshold in India. |

| Remittance Reporting Limit | United States | $100,000 USD | Sender in the USA | Transfers above $100,000 in a year to a single recipient must be reported to the IRS using Form 3520, even if no tax is owed. |

| Estate or Inheritance Tax | United States (primary) | Varies by amount | Sender or estate in the USA | Inheritances originating from the USA may trigger US estate tax rules before funds are transferred to India. India currently does not levy inheritance tax. |

| Withholding Tax on Investments | Both USA and India | 10% to 15% (varies) | Depends on investment structure | Interest, dividends, or investment income may be subject to withholding tax based on where the income is generated and applicable tax treaties. |

Understanding the USA to India money transfer tax helps both senders and recipients avoid unforeseen liabilities. Whether money is sent as a gift, income, or investment, knowing how taxes and reporting rules apply supports compliance and smoother international transfers. To learn more about maximum limits, check out this guide on transfer limits for money sent from the USA to India.

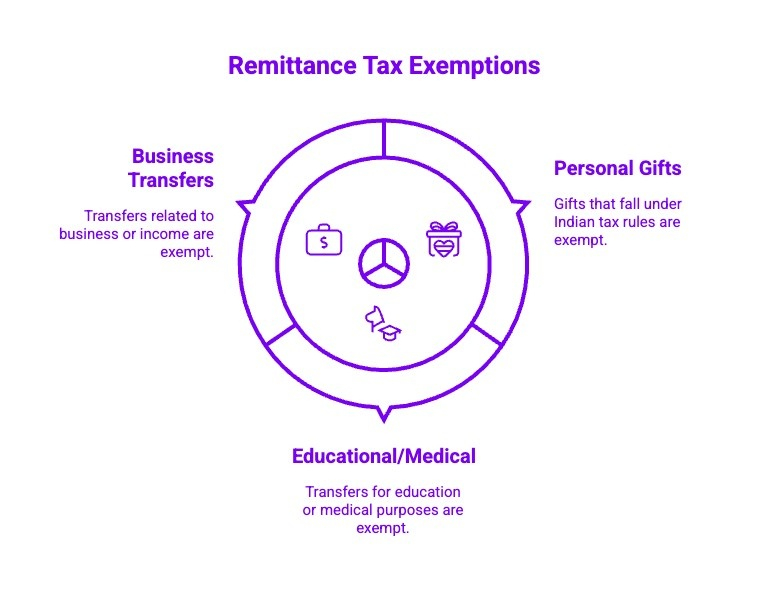

Who Is Exempt from the Remittance Tax?

There is no single or universal “remittance tax” for personal money transfers from the USA to India. Whether tax applies depends on how the transfer is classified under Indian tax law and what reporting obligations apply under US regulations. Understanding exemptions requires separating gifts, income, and business related transfers clearly.

1)Personal Gifts Under Indian Tax Rules

Under Indian income tax law, gifts received by a resident individual may be exempt from tax if specific conditions are met. Gifts received from close relatives are fully exempt from tax, regardless of the amount transferred. The definition of a close relative is specified under the Income Tax Act and includes immediate family members.

Gifts received from non-relatives are exempt only if the total value received during a single financial year does not exceed ₹50,000. This ₹50,000 threshold applies per recipient per financial year, not per sender or per transaction. If the total amount exceeds this limit, the entire value becomes taxable as income in India.

2) Educational and Medical Transfers

Money sent from the USA to India for education or medical expenses is generally not treated as taxable income for the recipient when the purpose of the transfer is clear and properly documented. Tax treatment depends on how the funds are used rather than the act of remittance itself. Maintaining records such as invoices or fee receipts is important in case clarification is required.

3) Business or Income Related Transfers

Transfers related to business activities or income are not exempt by default. Money sent for freelance work, consulting services, professional fees, commissions, or business payments is treated as taxable income in India. The recipient is required to declare this income and pay tax according to the applicable income tax slab.

Certain relief provisions may apply only in specific situations, such as when a double taxation avoidance agreement is relevant, when the payment qualifies under a registered non-profit structure, or when clearly documented foreign trade provisions apply. Without meeting these conditions, the transfer remains taxable.

Why These Distinctions Matter?

Using the term “remittance tax” can be misleading because India taxes income and gifts, not the act of remitting money. The USA, on the other hand, focuses primarily on reporting requirements for large transfers rather than taxing personal remittances. Exemptions depend on relationship, purpose, and classification, not on vague ideas of “small” or “large” amounts.

Being aware of who qualifies for remittance tax exemptions ensures that your transactions are smooth and hassle-free. For more details on how to transfer money from USA to India without tax, check out this guide on tax-free transfers.

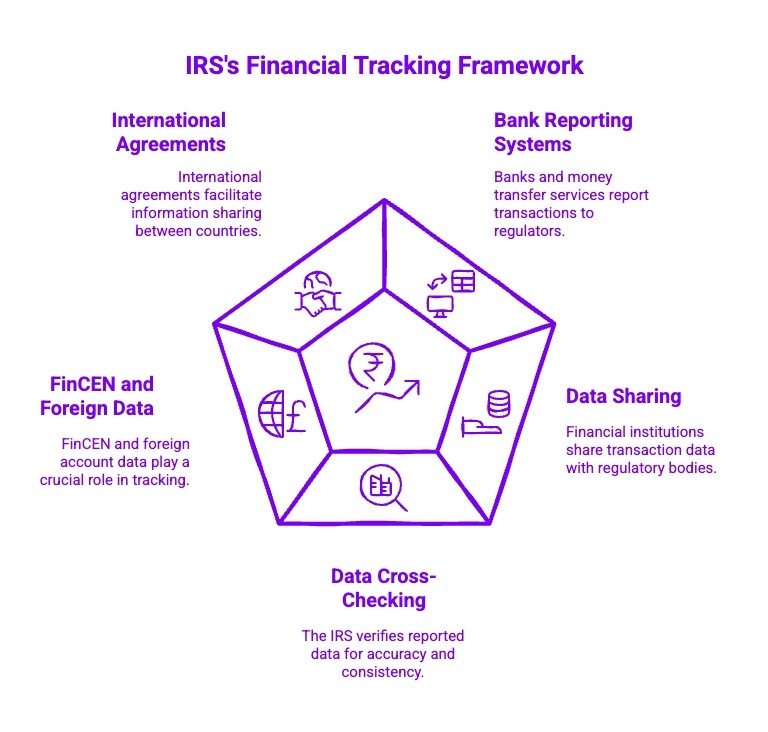

How Does the IRS Track Money Transfers to India?

The IRS does not manually monitor individual money transfers to India in real time. Instead, it relies on data reported by banks, money transfer services, and international financial systems, then cross checks that data against what taxpayers report on their returns and disclosure forms.

Understanding this data flow helps clarify why certain transfers trigger follow ups, even when no tax is owed.

1) Bank and Money Transfer Reporting Systems

US banks and licensed money transfer services automatically record international transfers as part of their compliance obligations. These records include sender details, recipient information, transfer amounts, dates, and destination countries. This data is available to regulators when thresholds or patterns require review.

2) Financial Institutions Share Data With Regulators

Banks and transfer providers operate under federal anti money laundering and financial transparency rules. Large or unusual international transfers may be flagged internally and can be accessed by US authorities, including the IRS, through established regulatory channels.

3) IRS Cross Checks Reported Data

The IRS uses reported transaction data to compare against individual filings. When a taxpayer files forms such as Form 3520 or discloses foreign accounts, the IRS checks whether those disclosures align with information already reported by financial institutions.

4) Role of FinCEN and Foreign Account Data

If you hold or control foreign bank accounts, financial activity connected to those accounts may also be visible through FinCEN reporting systems. The IRS has access to this information and uses it to identify discrepancies between account activity and reported income or disclosures.

5) International Information Sharing Agreements

The IRS also participates in international information exchange agreements that allow tax authorities to share financial data. While this does not mean every transfer is reviewed, it strengthens the IRS’s ability to verify large or recurring cross border transactions when necessary.

Why Reporting Forms Still Matter?

Forms like IRS Form 3520 and FinCEN Form 114 do not create the data trail. They are your opportunity to explain and align with data that already exists. Filing accurately reduces the risk of mismatches, audits, or penalty notices triggered by unreported activity.

Understanding how tracking works helps you focus on consistency, classification, and documentation, rather than assuming transfers go unnoticed.

What Happens If You Don’t Report a Required USA to India Money Transfer?

Sending money from the USA to India is not automatically a taxable event. Most personal transfers, such as family support or gifts, are not taxed. However, certain transfers must be reported, and penalties apply when required reporting is missed, even if no tax is owed.

Failure to meet reporting obligations can still lead to serious consequences under U.S. regulations.

1) Penalties for Not Filing IRS Form 3520

If you send more than $100,000 in a year to a single recipient and fail to file IRS Form 3520 when required, the IRS may impose penalties. These penalties can be substantial and are based on the amount transferred, even though the transfer itself is not taxed.

2) FBAR Penalties for Undisclosed Foreign Accounts

If you hold or control a foreign bank account and fail to file FinCEN Form 114 (FBAR) when required, penalties may apply. Non-willful violations can result in significant fines, while willful violations can lead to much higher penalties.

3) Interest Applies Only When Taxable Income Is Involved

Interest and additional penalties apply only if the transfer represents taxable income, such as business payments or professional fees that were not reported correctly. Personal remittances that are not taxable do not generate tax interest, but reporting failures can still trigger compliance action.

4) Increased Risk of IRS Review or Audit

Unreported large or recurring international transfers can raise red flags during IRS reviews. This does not mean every transfer is audited, but missing required disclosures increases the likelihood of follow-up requests or examinations.

The IRS penalizes non-compliance with reporting rules, not the act of sending money itself. Understanding when reporting is required helps avoid unnecessary fines, audits, and confusion, while ensuring that legitimate personal transfers remain compliant and stress free.

How Can Frex Help You Navigate Tax Implications?

Understanding the tax implications when sending money internationally can be complex, but using the right service can simplify the process. Frex helps you navigate the complexities of money transfer from USA to India tax implications with clear pricing, minimal fees, and transparent procedures. By providing detailed information on the fees and exchange rates before you confirm your transaction, Frex ensures that there are no hidden charges or surprises related to taxes.

Ready to send money without the guesswork? Download the Frex app today and experience a faster, clearer way to transfer money from the USA to India.

Conclusion

Understanding the tax for money transfer from usa to india is crucial for avoiding penalties and ensuring compliance with both U.S. and Indian tax laws. Most personal transfers are not taxable, but reporting requirements, exemptions, and classification rules still apply. By staying informed about filing thresholds, required disclosures, and when taxes may actually be triggered, you can manage international transfers with confidence. Keeping clear records, understanding the purpose of each transfer, and meeting all reporting obligations helps prevent costly mistakes, reduces audit risk, and ensures smoother, legally compliant money transfers between the USA and India.

Frequently Asked Questions

Is remittance tax always applicable for every transfer from the USA to India?

No, remittance tax is not always applicable. Foreign remittance is generally exempt if it stays within the annual gift exclusion limit. Service providers like Frex help you stay within tax limits, offering clear pricing for smooth transactions.

How can I lawfully avoid or minimize remittance taxes on my transfer?

To lawfully minimize remittance taxes, keep transfers below the annual exclusion limit. For higher amounts, consult a financial advisor. Choose money transfer services like Frex for transparent pricing, avoiding additional tax and unexpected extra costs.

Has the remittance tax rate changed recently for transfers from the USA to India?

The new remittance tax proposal has not yet been implemented, but adjustments may occur. The Income Tax Act remains the key source for tax rates. Stay informed by using reliable money transfer services to understand foreign currency conversion fees.

What is the latest remittance tax rate for money sent from the USA to India?

The latest remittance tax rate is 18-40% for gifts that exceed the annual exclusion limit. For accurate guidance on foreign remittance tax and exemptions, consult a financial advisor or tax expert to minimize liabilities.

Who is affected by the 1% US remittance tax when sending money to India?

US citizens or green card holders are primarily affected by the new remittance tax proposal. However, exemptions exist for transfers made via debit card, credit card, or bank accounts. Use a service like Frex to navigate these changes smoothly.

What are the key things I need to know about the US remittance tax when sending funds to India?

You need to understand the foreign tax credit rules and the impact of double taxation. It’s crucial to file the income tax return on time, especially if transfers exceed the annual exclusion amount. Seek guidance from tax experts for planning.

Has the US remittance tax rate for India changed recently?

The US remittance tax rate has not changed recently, but proposals like the 1% tax on remittances are still under discussion. Frex keeps you updated with tax changes, ensuring that your transfer complies with current regulations.

Are there any recommended methods or services to minimize tax on money transfers from the USA to India?

Staying within the annual exclusion limit minimizes foreign remittance tax exposure. Services like Frex offer lower fees and better exchange rates, ensuring your inward remittance arrives efficiently while avoiding additional tax costs.

Are there limits on how much money I can send to India from the USA?

The Reserve Bank of India regulates the amount of money you can send under the Liberalized Remittance Scheme. Individual types of remittances may be subject to limits, but Frex allows you to navigate these with ease, staying within compliance.

What are the privacy considerations when transferring money to India?

Always review the terms of use of your money transfer services to understand how your data is handled. For transfers related to medical treatment or mutual funds, be aware of foreign inward remittance certificate requirements and local privacy laws.

Leave a Reply