Key Highlights

- Timing your transfer can directly impact how much INR is received due to exchange rate movements.

- Weekdays, especially mid-week, often offer more stable rates than weekends or holidays.

- Mid-month transfers usually face fewer delays and less pricing pressure than month-end periods.

- Sending money during active market hours improves rate accuracy and processing speed.

- Seasonal demand during festivals and tuition periods can influence rates and settlement times.

- Tracking live USD to INR rates helps identify better moments to transfer funds.

- Using platforms with fast execution reduces exposure to rate changes after initiating a transfer.

Sending money to India from the USA often feels more complicated than it should. You check the exchange rate in the morning, come back a few hours later, and the number has changed. Suddenly, you are unsure whether to send the money now or wait, worrying that a small timing mistake could cost your family or savings more than expected.

The confusion usually grows because exchange rates move constantly, and most people are never told why. Weekends, holidays, market hours, and processing delays can all affect how much INR actually reaches the recipient. Without clear guidance, it is easy to send money at the wrong moment and feel like you missed out on a better rate.

This blog breaks down the best time to send money to India from the USA in simple terms. You will learn how timing affects exchange rates, which days and hours work best, and how to avoid common mistakes so you can send money with more confidence and fewer surprises.

Why Timing Matters When Sending Money From The USA To India?

Timing plays a crucial role in how much your recipient receives, as exchange rates fluctuate constantly throughout the day. Even small shifts can make a difference, especially for larger or recurring transfers. Transfers made during low-activity periods, like weekends or holidays, can experience delays, making them more susceptible to unfavorable rate changes before settlement.

To avoid these issues, understanding when market activity is highest and choosing the right time to send money helps you lock in the best rates. Proper timing reduces uncertainty and gives you greater control over the value of your transfer.

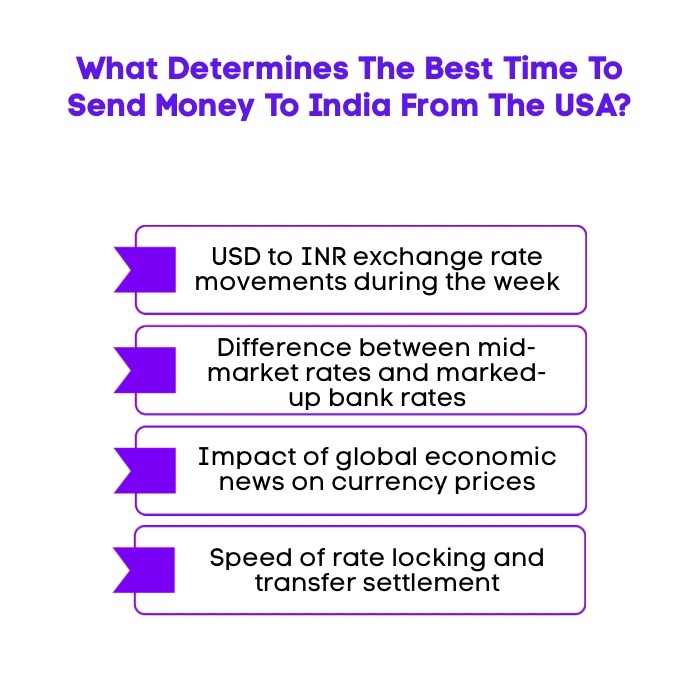

What Determines The Best Time To Send Money To India From The USA?

The best time to send money is not random. It is shaped by how exchange rates move, how pricing is set by providers, and how quickly a transfer is settled. Understanding these factors helps you decide when to send money to India with more confidence instead of relying on guesswork.

Here are the key factors that influence remittance timing and value.

1. Exchange Rate Volatility Throughout The Week

USD to INR rates fluctuate constantly based on market activity. Rates tend to be more stable during peak trading hours, typically when major markets are active. However, they can shift quickly during off-hours or lower liquidity periods, directly impacting how much INR your recipient will get.

2. Mid-Market Rates Versus Marked-Up Bank Rates

The mid-market rate reflects the real exchange rate on global markets. Many traditional banks apply markups on top of this rate, which can result in a less favorable conversion for the sender. Using live rates helps you see the true value of your transfer before confirming.

3. Impact Of Global Economic News And Market Sentiment

Global economic news, such as interest rate announcements, inflation data, and major events, can cause significant fluctuations in currency demand. These events can lead to sharp movements in the USD to INR exchange rate, making it critical to monitor the news during volatile periods.

4. Importance Of Live-Rate Platforms When Rates Change Quickly

When exchange rates shift rapidly, timing becomes more important. Platforms offering live-rate tracking allow you to lock in rates as soon as you confirm your transfer, preventing delays and minimizing the risk of unfavorable rate changes during the transfer process.

The best time to send money comes down to understanding how rate volatility, pricing transparency, and platform execution speed affect the value of your transfer.

Looking for the right platform to transfer funds? Explore Which Is the Best App for Sending Money to India from the USA to compare features, rates, and transfer experiences before you choose.

What Are The Best Days Of The Week To Send Money To India?

Weekdays generally offer better exchange rate stability than weekends because global currency markets are fully active. From Monday through Friday, USD-INR rates reflect real-time market activity, making pricing more transparent and less prone to sudden adjustments. Mid-week, especially Tuesday and Wednesday, often sees steadier FX movement once early-week volatility settles.

Weekend transfers can face delayed processing since most FX markets are closed, which may expose your transfer to rate changes when settlement resumes. Choosing services that offer live exchange rates with same-day settlement can help you lock the rate at the time of transfer and reduce uncertainty, even during periods of market volatility.

What Is The Best Time Of The Month To Transfer Money To India?

The start and end of the month often see higher transfer volumes due to salary cycles, bill payments, and recurring expenses. This increased demand can lead to slower processing times and slightly less favorable exchange rates, especially when many transfers are queued at once.

Mid-month periods tend to be calmer, with more predictable USD-INR movement and fewer settlement delays. Sending money during this window can make it easier to secure stable rates and ensure smoother processing, particularly when timing matters for larger or recurring transfers.

What Is The Best Time Of The Day To Send Money To India?

Exchange rates tend to be more stable and accurately priced during periods when global FX markets overlap, particularly when US and Asian trading hours are both active. Higher liquidity during these windows reduces sharp rate swings and helps ensure that USD-INR pricing reflects real market conditions rather than temporary gaps in trading activity.

Sending money during standard US business hours also supports faster processing and fewer settlement delays. When a transfer is executed while markets are active and systems are fully operational, it becomes easier to lock the best exchange rate and complete the transfer the same day, reducing exposure to unexpected rate changes.

Want to avoid the tax hassle while sending money? Read our blog on How to Transfer Money from the USA to India Without Tax.

How Do Seasonal And Annual Trends Affect The Best Time To Send Money To India?

Remittance demand often increases during festivals, holiday periods, and tuition payment seasons, when many people send money home at the same time. These spikes in volume can place pressure on exchange rates and may also lead to longer processing times, especially if transfers are initiated close to peak dates.

Outside of these high-demand periods, exchange rates tend to move more gradually and settlements are often smoother. Keeping an eye on live exchange rates during peak seasons can help you act quickly when favorable pricing appears, rather than sending money during periods of heavy demand and tighter margins.

Why Frex Is A Smarter Way To Time Your Money Transfer To India?

When timing your transfer matters, live-rate remittance platforms make a real difference. Instead of guessing or waiting, you can track real-time USD to INR rates, lock the exact rate you see, and complete your transfer without worrying about delays or sudden market shifts.

This is where Frex stands out for NRIs sending money from the USA to India:

- Live Mid-Market Rates With Zero Fees: Get more INR per dollar using live Google mid-market rates with no hidden charges.

- Lock The Exact Rate You See: What you see is what your recipient gets, with no estimated pricing or surprises.

- Same-Day And Instant Settlement: Faster execution reduces exposure to exchange rate changes during processing.

- No Minimum Transfer Amount: Send as little as USD 2 without needing to bundle transfers to save on fees.

- Secure And Fully Compliant: Protected with advanced encryption and compliant with FinCEN USA, FIU India, and global FATF standards.

- Built For NRIs In The USA: Designed for transparency, speed, and trust, with direct transfers to any Indian bank account.

Download the Frex app today and start sending money to India with better timing, better rates, and complete confidence.

Frequently Asked Questions

When is the best time to send money to India?

The best time depends on exchange rate fluctuations, market demand, and the value of its currency. Watching trends helps decide if it is a good time to send money to India, especially when rates are stable and aligned with your transfer needs.

What is the best day of the week to transfer money internationally?

Mid-week is often preferred for international money transfers because markets are fully active and pricing is clearer. This timing can reduce the risk of sudden shifts caused by low liquidity or delayed processing during weekends.

Are there any international money transfer services that recommend the best time to send money?

Many money transfer services and money transfer companies offer insights through rate alerts and dashboards. These tools highlight competitive exchange rates and transfer rates, helping users act at the right time instead of relying on guesswork.

Does the method I use, like wire vs. remittance apps, impact the timing for sending money to India?

Yes, bank transfers and wires may take longer and involve higher fees, while online money transfer apps often process faster. The method you choose affects currency conversion speed, transfer fees, and how quickly funds reach India.

How can I track USD to INR exchange rate changes to pick the best moment to send money?

You can monitor rates using online platforms that show real-time pricing and historical trends. These tools help track current time movements between the United States and India standard time without manually following markets.

Do exchange rates fluctuate throughout the day between USD and INR?

Yes, rates change throughout the day based on global trading activity, time zone overlaps, and the time of day. Economic updates and international transfers volume can influence short-term movements and pricing accuracy.

What factors should I consider when choosing when to transfer money from the USA to India?

Consider exchange rate stability, online money transfer speed, money transfer time from the USA to India, and broader factors like the value of a country and the fall of currency values. Comparing online platforms helps secure competitive rates for international money transfers.

Leave a Reply