Key Highlights

- NRI remittance tax does not apply simply because money is sent from the US to India.

- Tax liability depends on the source and purpose of funds, not the transfer itself.

- Most US to India remittances for savings or family support remain tax-free.

- Indian and US tax rules affect remittances differently and should be viewed separately.

- FEMA governs permitted remittances while income tax laws decide tax treatment.

- The US remittance tax in effect applies only to specific transfer methods.

- Proper documentation and compliant transfer channels help avoid issues.

Sending money to India should be straightforward, yet for many NRIs in the US it often feels confusing and stressful. Between talk of remittance tax, TDS, DTAA, and new US rules, it is hard to tell whether a simple transfer could lead to unexpected tax issues.

The problem is made worse by mixed and outdated advice. Some sources suggest every transfer is taxable, others ignore US side changes, and few clearly explain the difference between sending savings, income, or gifts. This leaves NRIs unsure about when to send money and how to stay compliant.

This blog clears the confusion. It explains how NRI remittance tax actually works, when tax applies, what current rules mean for US NRIs, and how to send money to India with confidence and clarity.

What Is NRI Remittance Tax?

Remittance refers to money an NRI transfers from abroad to India for purposes such as family support, investments, or savings. The act of sending money itself is not taxable in India. Tax liability depends on the source of the funds and whether that income is taxable under Indian income tax laws.

There is no separate remittance tax in India. What is often called NRI remittance tax USA is actually income tax that may apply to the earnings being transferred. If the income was earned overseas and taxed in the country of residence, remitting that money to India does not create an additional tax obligation.

What Is The Current Remittance Tax Rate For NRIs Sending Money From The US To India?

There is still no remittance tax imposed by India on money sent from the US to India. Indian tax laws do not tax inward remittances. Any tax liability depends on whether the funds represent taxable income under Indian law, not on the act of transferring money.

From the US side, a 1% remittance excise tax is now in effect for certain outbound transfers made by non-citizens. This applies only to specific physical transfer methods such as cash or money orders. Most US NRIs who use bank transfers or online money transfer apps are not impacted, but the rule is now active and should be factored into how remittances are made.

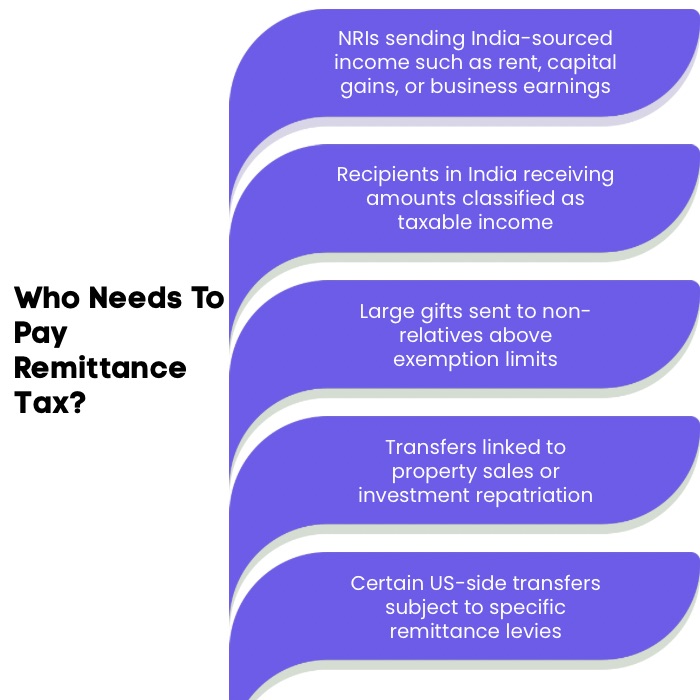

Who Needs To Pay Remittance Tax When Sending Money To India From The US?

Not every international money transfer from the US to India creates a tax obligation. In most cases, NRIs worry about US remittance tax because the rules are misunderstood, not because tax is actually due. The key factor is always the nature and source of the money, not the act of sending it.

Here are the situations where tax liability may come into play.

- NRIs Remitting India-Sourced Income: If the money being sent represents income earned in India, such as rental income, capital gains, or business income, Indian tax rules may apply before or at the time of transfer.

- Recipients Receiving Taxable Amounts In India: Even when the sender is an NRI, tax liability can arise for the recipient if the funds qualify as taxable income under Indian law, such as certain gifts or income-linked transfers.

- Large Gifts To Non-Relatives: Gifts sent to individuals who are not classified as relatives under the Income Tax Act may be taxable for the recipient if they exceed the applicable exemption limits.

- Property And Investment-Related Transfers: Remittances linked to property sales, investment redemptions, or asset repatriation can attract tax depending on capital gains rules and compliance requirements.

- Certain US-Side Remittance Scenarios: From 2026 onward, specific US regulations may impose a small remittance levy on certain transfers by non-citizens, depending on how the money is sent, even though Indian tax treatment remains unchanged.

Remittance tax for NRIs depend on where the money comes from, how it is classified, and which country’s rules apply, not simply on the fact that funds are sent from the US to India.

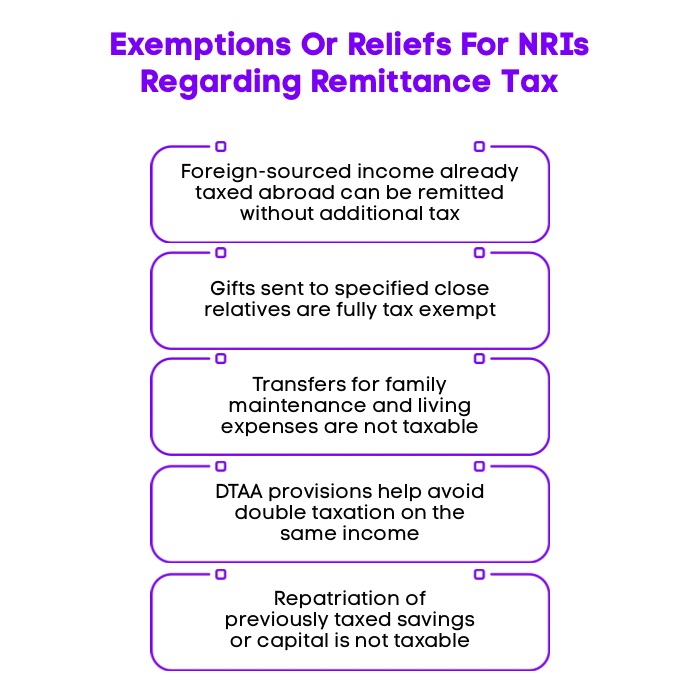

What Are The Exemptions Or Reliefs For NRIs Regarding Remittance Tax?

Many NRI remittances are fully exempt from tax, which is why understanding the available reliefs can prevent unnecessary worry or overpayment. Indian tax laws focus on the nature of income, not the transfer itself, and several exemptions are built in to protect legitimate cross-border transfers.

Here are the key exemptions and reliefs for NRIs based on how they send money.

1. Income Earned Outside India

- Foreign-Sourced Income Already Taxed Abroad: Money earned outside India and already taxed in the US can be sent to India without additional tax, as long as it is not classified as India-sourced income.

- DTAA Benefits Between The US And India: The Double Taxation Avoidance Agreement (DTAA) allows NRIs to claim relief and avoid paying tax twice on the same income. This protection acts as a backup, especially if the income overlaps across both countries’ tax systems.

2. Family And Personal Transfers

- Gifts To Specified Relatives: Remittances sent as gifts to close relatives such as parents, spouse, children, or siblings are fully exempt from tax in the hands of the recipient.

- Family Maintenance And Living Expenses: Regular transfers made to support family expenses in India, such as schooling or household support, are not treated as taxable income for the recipient.

3. Own Money Being Moved

- Repatriation Of Own Capital Or Savings: Sending back previously taxed savings or capital does not attract tax, as it is not considered new income. This means you can transfer your hard-earned funds without worrying about double taxation.

Taken together, these exemptions ensure that most genuine NRI remittances remain tax-free, provided the source of funds is clear and the transfer is properly documented.

Want to know how much you can send? Read our guide on the maximum limit for money transfer from USA to India.

Does The One Big Beautiful Bill Act Affect NRI Remittances From The US To India?

The One Big Beautiful Bill Act introduces a new rule for certain remittances from the US to India starting January 1, 2026. It applies specifically to non-citizens who send money using physical methods like cash, money orders, or cashier’s checks. The law imposes a 1% excise tax on these types of transfers.

However, this law does not affect digital remittances or bank transfers. It also does not impact Indian tax rules, which continue to depend on the source and nature of the income being sent. If you rely on digital or bank transfers, you won’t be affected, but cash-based transfers may incur additional costs due to this new tax.

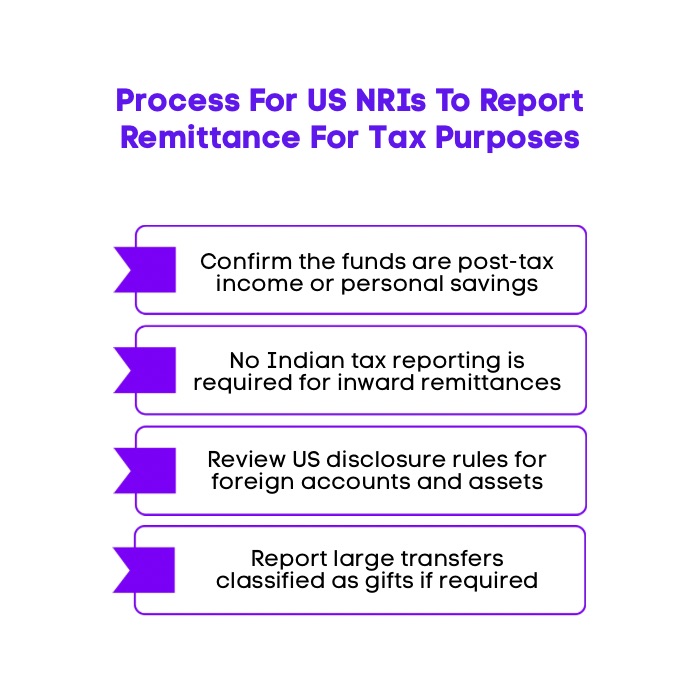

What Is The Process For US NRIs To Report Remittance For Tax Purposes?

For most US NRIs, money transfer from the US to India, the process of reporting remittances for tax purposes is straightforward and involves minimal steps. The transfer itself is not treated as income. Reporting becomes relevant only in specific situations tied to disclosures rather than taxation.

Here is how the reporting process typically works.

- Confirm The Nature Of Funds: If the money comes from post-tax US income or savings, no tax reporting is triggered simply by sending it to India.

- Check Indian Reporting Requirements: Inward remittances to India do not require Indian tax forms such as Form 15CA or Form 15CB.

- Review US Disclosure Obligations: If you hold Indian bank accounts or financial assets above reporting thresholds, you may need to file FBAR or FATCA disclosures with your US tax return.

- Assess Gift Reporting Needs: Large transfers structured as gifts may require disclosure under US rules, even though no tax is paid on the remittance.

The process for most US NRIs is minimal. As long as the funds are legitimate US earnings and disclosures are reviewed annually, remitting money to India remains largely straightforward.

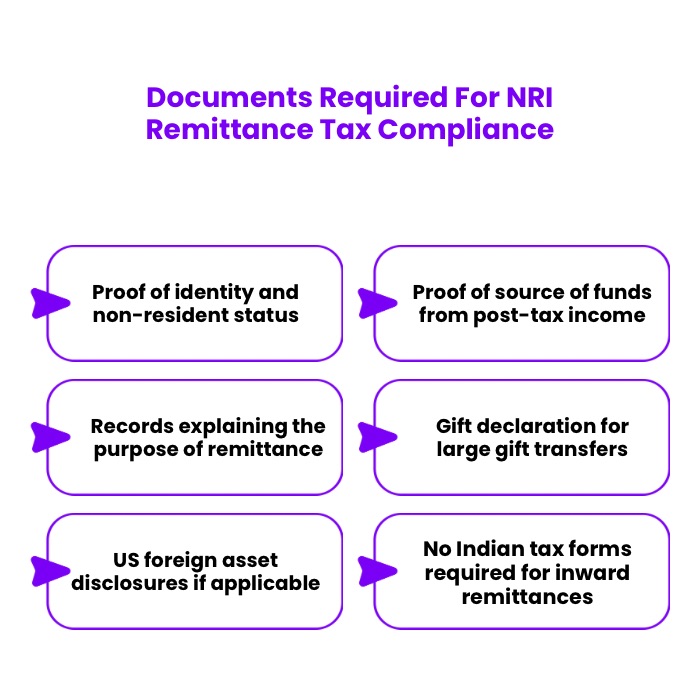

What Documentation Is Needed By NRIs To Comply With Remittance Tax Regulations?

For US NRIs sending money to India, there is usually no formal tax paperwork required just to complete the remittance. However, keeping the right documentation helps ensure smooth transfers and protects you in case banks or tax authorities request clarification later.

Here are the key documents US NRIs should have in place:

- Proof Of Identity And NRI Status: A valid passport and evidence of non-resident status, such as a visa or residency permit, help banks and remittance providers verify your profile.

- Proof Of Source Of Funds: US bank statements, salary slips, or tax returns help establish that the money being sent comes from legitimate, post-tax income.

- Purpose Of Remittance Records: Documents related to the reason for sending money, such as family support, education fees, medical expenses, or investments, help clarify the nature of the transfer if questions arise.

- Gift Documentation If Applicable: For large transfers treated as gifts, a simple gift deed or written declaration can help show that the amount is not income for the recipient in India.

- US Foreign Asset Disclosures: If you hold Indian bank accounts or financial assets above reporting thresholds, filings such as FBAR or FATCA forms may be required as part of your US tax compliance, even though they do not tax the remittance itself.

- Indian Tax Forms Not Required For Inward Remittances: Forms like 15CA and 15CB are not needed when sending money from the US to India, as they apply only to remittances made from India to another country.

Overall, documentation for US to India remittances is more about readiness than obligation. Maintaining clear records of identity, source, and purpose ensures compliance without adding unnecessary complexity to routine transfers.

Want better value on every transfer? Read our guide on the best exchange rate to transfer money from USA to India in 2026.

How Do FEMA Guidelines Affect NRI Remittances To India?

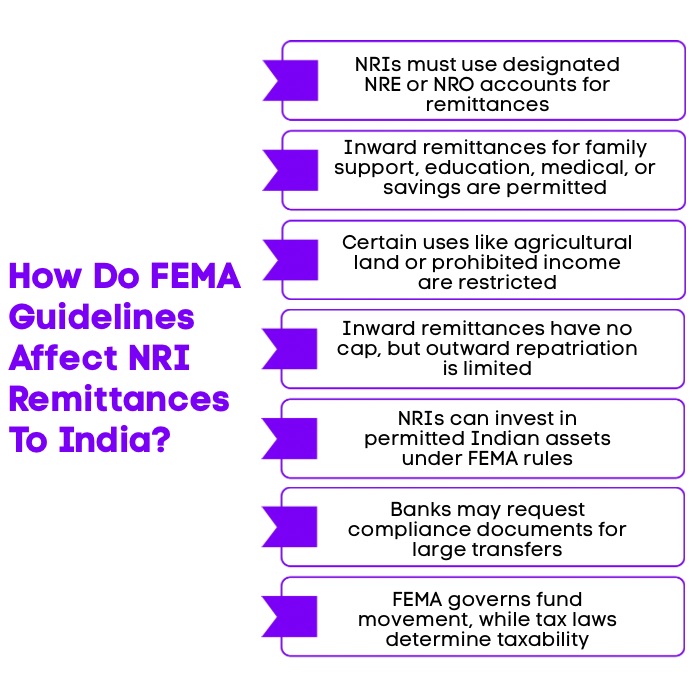

FEMA regulates how NRIs can move money into and out of India, with the goal of ensuring legitimate fund flows and preventing misuse. While most inward remittances from the US to India are freely permitted, FEMA still governs account usage, investment routes, and repatriation limits tied to NRI funds.

Here are the key FEMA guidelines US NRIs should understand.

- NRI Account Requirements: NRIs must use designated accounts such as NRE or NRO accounts for cross-border transactions. Regular resident savings accounts are not permitted once residential status changes.

- Permitted Inward Remittances: Funds sent from the United States for family maintenance, education, medical treatments, investments, or personal savings are fully allowed under FEMA when routed through authorized banking channels.

- Restrictions On Certain Uses: FEMA restricts specific activities such as purchasing agricultural land, farmhouses, or plantation property. It also prohibits remittances linked to illegal or prohibited earnings.

- Repatriation Limits And Context: While inward remittances to India are not capped, FEMA sets limits when funds are sent out of India. For example, up to one million US dollars per financial year can be repatriated from NRO accounts or asset sale proceeds, subject to compliance.

- Investment Rules Under FEMA: NRIs are allowed to invest in residential and commercial property, Indian stocks, and mutual funds through permitted routes. Some investments may require additional reporting or adherence to portfolio investment regulations.

- Compliance And Documentation Expectations: For large remittances, banks may ask for proof of identity, source of funds, or purpose of transfer. It’s important to note that Forms 15CA and 15CB are only required when repatriating funds from India, not when sending money into India from the US.

- Difference Between FEMA And Income Tax Rules: FEMA determines whether a transaction is permitted and how funds move across borders. Income tax laws separately decide whether the money involved is taxable based on source and classification.

FEMA ensures that NRI remittances are lawful and properly routed, while tax laws decide if any tax applies. Understanding both helps US NRIs send money to India confidently and without compliance issues.

Frex: A Smarter Approach To US To India Money Transfers

With evolving US remittance rules, how you send money matters just as much as how much you send. Additional charges and unclear exchange rates can quietly reduce the value of every transfer. Frex is designed to help you avoid that, so more of your money reaches India without unnecessary losses.

Frex focuses on transparency and efficiency. You see the exchange rate upfront, understand the cost before you confirm, and send money with confidence knowing there are no hidden deductions along the way.

Here’s why many NRIs choose Frex for US to India transfers:

- No Transfer Fees: What you send is what gets converted, with no surprise charges.

- Built For Digital Compliance: Optimised for compliant online remittance methods under current US regulations.

- Competitive Exchange Rates: Get more INR per USD compared to many traditional banks and popular remittance apps.

- Fast Bank-To-Bank Transfers: Move money directly from your US bank account to an Indian bank account in minutes.

- Low Minimum Transfer Amount: Send as little as 2 dollars whenever you need to.

- Strong Security Standards: Regulated across the US and India and protected with advanced encryption for peace of mind.

Frex helps you send money with clarity and control, not guesswork. Download the Frex app today and make every transfer work harder for you and your family.

Final Thoughts

Sending money to India is usually straightforward when you understand the rules. For US citizens and US residents, most remittance transfers are simple transfers of money to their home country and are not taxed just because they are sent across borders. Tax issues generally arise only in limited cases involving taxable transfers.

For Indian residents, the key is knowing the source and purpose of the funds, especially when money is sent for various purposes like family support or investments. Being aware of the proposed remittance tax, choosing the right transfer method in USD, and factoring remittances into overall financial planning helps keep cross-border transfers smooth and predictable.

Frequently Asked Questions

Is NRI sending money to India taxable?

Sending money from the US to India is not taxable by itself. Indian tax applies only if the funds represent taxable income under Indian law. Personal savings, family support, and post-tax foreign income are generally not taxed.

What are the types of remittances NRIs commonly make to India?

NRIs commonly send money to India for family maintenance, education expenses, medical costs, investments, property purchases, loan repayments, and personal savings. These remittances are usually permitted and tax treatment depends on the purpose and source of funds.

What should NRIs know about upcoming changes in remittance tax for 2026?

From 2026 onward, the US has introduced a remittance excise tax on certain outbound transfers. This change affects how money leaves the US but does not alter Indian tax rules for inward remittances received by beneficiaries in India.

How does the proposed US remittance tax affect NRIs?

The US remittance tax applies only to specific physical transfer methods such as cash or money orders. Most NRIs using bank transfers or digital remittance platforms are not impacted, but understanding the rule helps avoid unnecessary charges.

How to avoid 20 percent TCS on foreign remittance?

The 20 percent TCS applies mainly to residents under the Liberalised Remittance Scheme. NRIs sending money from the US to India are not covered under this rule, so TCS does not apply to their inward remittances.

How to avoid 1 percent remittance tax?

The 1 percent US remittance tax applies only to certain physical transfer methods. Using digital remittance platforms, bank transfers, or US-issued debit or credit cards generally helps NRIs avoid this charge.

What is the remittance limit for NRI?

There is no specific cap on how much money NRIs can send to India from the US. Limits usually apply only when funds are repatriated out of India, not when money is sent into India for permitted purposes.

Does TDS apply on NRI remittances?

TDS does not apply to normal remittances sent from the US to India. It may apply only when the funds represent taxable India-sourced income, such as rent or capital gains, before or at the time of payment.

Does double taxation avoidance agreement matter for US NRIs sending money to India?

DTAA matters only when the remittance involves taxable income that could be taxed in both countries. It does not apply to routine transfers of personal savings or foreign income that is not taxable in India.

Does NRI remittance to India tax apply to property transactions?

Remittances linked to property transactions may involve tax if they relate to capital gains or rental income. The tax applies to the income component, not to the act of sending money from the US to India.

Leave a Reply