Which Is the Best App for Sending Money to India from USA?

Key Highlights

-

Discover the top 8 money transfer apps from the USA to India: Frex, Remitly, Wise, Xoom, Western Union, Ria, XE, and Instarem.

-

Frex leads with the best USD to INR rates, zero fees, and instant transfers, while being fully compliant and encrypted.

-

Remitly and Xoom offer fast express options, ideal for users prioritising speed and flexible delivery but at a premium fee.

-

Wise and XE stand out for transparency, competitive mid-market exchange rates, and high sending limits.

-

Western Union and Ria remain trusted for global reach and cash option.

-

Instarem brings modern digital convenience with UPI support and low-cost ACH transfers.

If you’ve ever tried sending money from the United States to India, you already know it’s rarely as simple as it sounds. Between unpredictable USD to INR exchange rates, hidden fees, and long transaction settlement times – what should be a quick gesture of support often turns into a frustrating process.

Many people only realize how much time and money they’ve spent after the transfer goes through. A few dollars here, a few rupees there, all eaten away by small markups and service charges. Add to that the confusion of comparing multiple apps, different delivery speeds, and complex transfer limits, and the process can feel anything but transparent.

But sending money home doesn’t have to be stressful or costly. With newer digital remittance solutions designed for NRIs, you can now transfer funds to India quickly, securely, and at rates that truly work in your favor.

In this blog, we’ll explore the best apps for sending money from the USA to India in 2026, what to look for before choosing one, and how modern remittance platforms are transforming the way people support loved ones back home.

How Choosing the Right Money Transfer App Saves You Time and Money?

Sending money from the US to India is often more than just a transaction. It’s about helping parents with bills, paying a child’s college fees, or funding your own investments or EMIs – ensuring someone back home never has to wait too long for support. Yet, the process often feels harder than it should be.

Traditional banks and wire services can come with high transfer fees, slow processing times, and too many confusing payment options. Even popular digital platforms like Google Pay don’t yet support direct transfers from the USA to India. They rely on third-party providers, which means users have limited control over rates, fees, and delivery times.

That’s why choosing the right money transfer app matters. It helps you:

-

Save more with transparent rates and lower fees.

-

Send faster through instant or same-day transfers.

-

Stay secure with regulated, encrypted transactions.

A reliable app doesn’t just move your money; it gives you peace of mind every time you send it home.

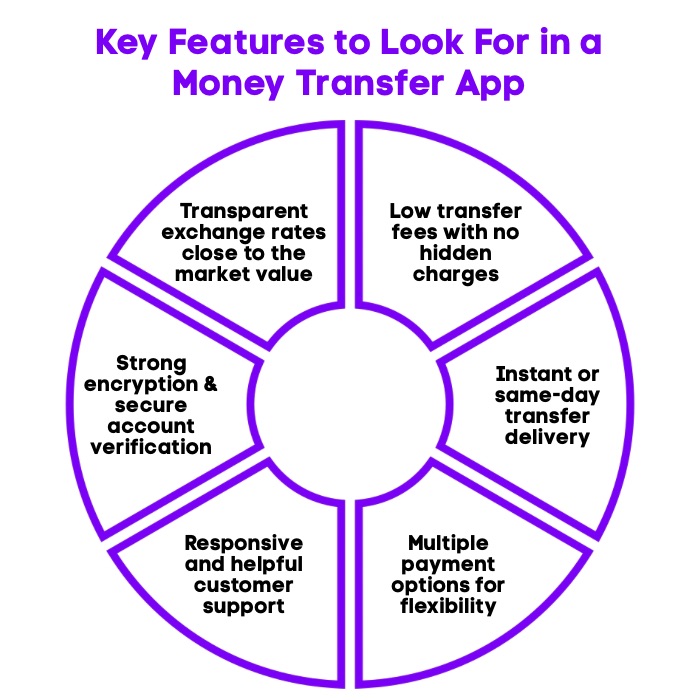

What to Look For in a USA to India Money Transfer App?

When you’re sending money from the United States to India, a few simple choices can make a big difference in how smooth and affordable the experience feels. The right app doesn’t just move your money; it makes the process effortless and gives you confidence from start to finish.

Here’s what you should keep in mind:

-

Fair Exchange Rates: Even a small difference in exchange rates can affect how much your recipient receives. Choose platforms that keep rates transparent and close to the real market value.

-

Low Transfer Fees: The less you pay in fees, the more your loved ones receive. Pick an app that’s upfront about its costs and avoids hidden charges.

-

Fast Transfer Speed: Timing matters, especially when someone is waiting on the other end. Check whether transfers arrive instantly or within a few business days so you can plan ahead.

-

Flexible Payment Options: It’s easier when you can choose what works for you: bank account, credit card, debit card, wire transfer, or direct debit. Flexibility adds convenience and control.

-

Reliable Customer Support: When you’re dealing with money, having real help available makes all the difference. Look for a service that’s responsive and easy to reach whenever you need assistance.

-

Strong Security Measures: The right app protects your money and data with encryption, identity verification, and regulatory safeguards, giving you peace of mind with every transfer.

Once you know what to look for, it’s time to find the services that actually deliver. Here are the 8 best money transfer apps from the USA to India that combine great rates, low fees, and reliable delivery.

Top 8 USA to India Money Transfer Apps: Quick Comparison Table

Every money transfer app offers a slightly different mix of speed, cost, and convenience. The right choice depends on which factors matter most to you. Some apps prioritize faster delivery, while others focus on better rates, but finding the right balance between both is what truly matters.

Here’s a quick comparison table of 8 leading money transfer apps and how they perform across the factors that matter most when sending money home to India.

|

App |

Exchange Rate (USD → INR) |

Fees / Charges |

Speed |

Tax |

Transaction Limits |

Security & Compliance |

|---|---|---|---|---|---|---|

|

Frex |

₹90.54 per USD |

Zero (0%) extra fees |

|

No tax for personal remittances from the USA to India |

|

|

|

Remitly |

₹89.09 per USD (only new user offer) |

|

|

Generally, tax-free for personal transfers |

Around $100,000 per transfer |

|

|

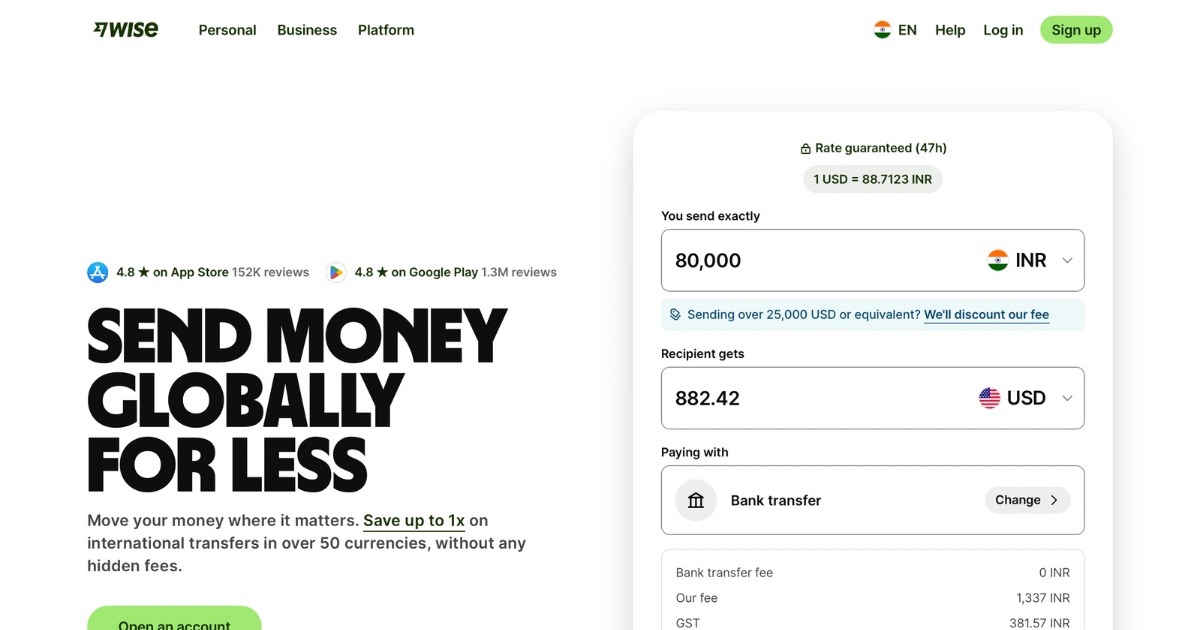

Wise |

₹88.70 per USD |

|

Same day or within 24 hours for most transfers |

|

Up to $1,000,000 via wire |

|

|

Xoom (PayPal) |

₹88.73 per USD |

|

|

|

Up to $50,000 for verified accounts |

|

|

Western Union |

₹87.47 per USD |

$0–$100 depending on amount and method |

|

Generally tax-free for personal transfers |

$3,000 (unverified) to $50,000 (verified) |

|

|

Ria Money Transfer |

₹88.73 per USD |

|

|

Tax-free for personal remittances |

Up to $14,999.99 per month (US app limit) |

|

|

XE Money Transfer |

₹88.66 per USD |

~$1 + ~0.5% markup |

Minutes to 4 business days |

Generally tax-free for personal remittances |

Up to $500,000 online per transfer |

|

|

Instarem |

₹88.65 per USD |

|

Within 2 days |

Tax-free for personal transfers |

|

|

Disclaimer: Exchange rates, fees, and transfer limits mentioned above are subject to change based on market conditions and each platform’s policies. Always verify the latest rates, charges, and limits directly on the official website of your chosen money transfer service before making a transaction.

Which Are the 8 Best Money Transfer Services from the US to India in 2025?

Here’s a closer look at the 8 most popular money transfer apps to help you choose the best app to transfer money from the USA to India.

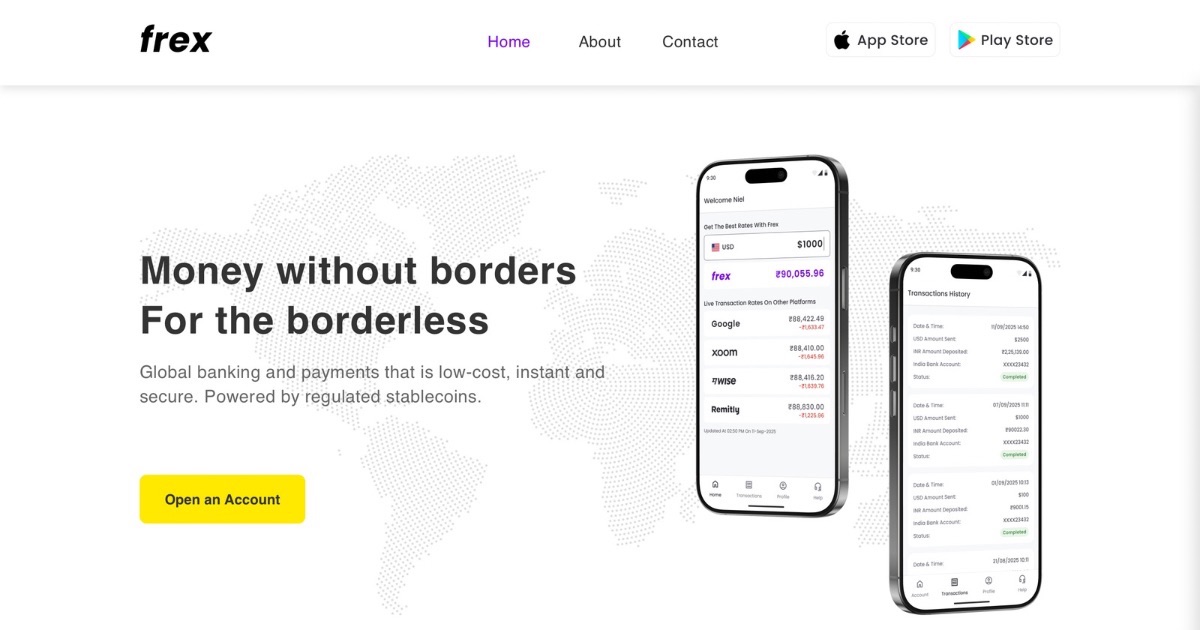

1. Frex: Top-Rated App for USA to India Transfers (2026)

Frex delivers one of the best exchange rates for USD to INR transfers, giving users more value for every dollar. With no extra fees and instant delivery, it’s designed to make international money transfers as simple as sending a message. You can easily send money directly from your US bank account to your recipient’s Indian bank account, ensuring quick, seamless, and transparent transfers every time.

Why Choose Frex for Your Next Transfer?

Frex combines speed, transparency, and technology to make sending money to India effortless and secure. Here’s what sets it apart:

-

Best rates and zero fees: Frex offers one of the highest USD–INR conversion rates in the market: about 2-3% better than Google’s rate.

-

Instant transfers: Send money to Indian bank accounts instantly or on the same day.

-

Send any amount: Start from as little as $2, with no minimum transfer requirement.

-

Reliable and secure: A trusted platform with strong fraud protection and transparent tracking.

-

Advanced encryption: Built on regulated stablecoins technology with 256-bit encryption and Plaid-powered bank connectivity for safety and speed.

-

Fully compliant: Licensed and regulated under FinCEN (USA), FATF (Global), and FIU (India) for cross-border remittances.

Frex’s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Get one of the most competitive live USD–INR rates at ₹90.54 per USD, updated in real time for accuracy.

-

Fees: Enjoy zero transfer fees and complete transparency; no hidden costs or currency markups.

-

Transfer Limit: Send any amount starting from just $2, with no minimum transaction barrier for small or frequent transfers.

When to Choose Frex?

Ideal for NRIs who send money regularly and want to maximize every transfer without worrying about hidden fees or delays.

Experience Frex. Get it on the App Store.

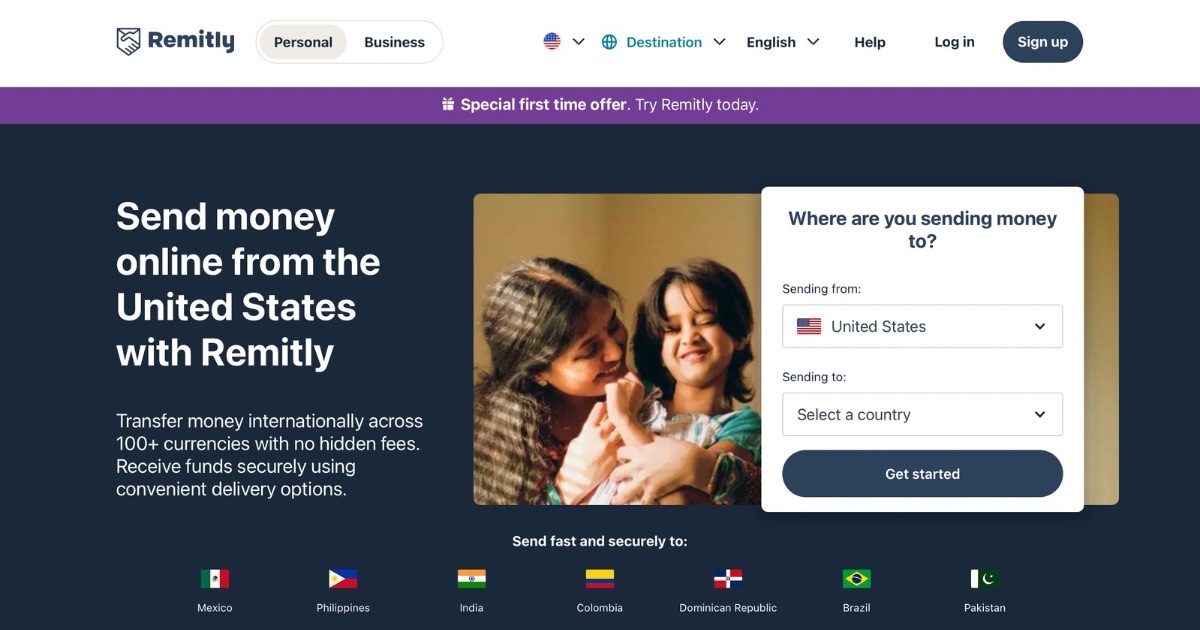

2. Remitly

Remitly offers fast delivery and an easy-to-use mobile app. With its express and economy options, you can choose between speed and a slightly better rate depending on your needs.

Why Remitly Stands Out?

Remitly blends flexibility and reliability, offering features that make every transfer quick and convenient:

-

Express transfers in minutes; economy takes 3–5 business days

-

Multiple payment methods, including bank account and debit card

-

PCI-certified platform ensuring secure payment processing

-

Reliable customer support with real-time tracking

Remitly’s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: New users can enjoy a promo rate of ₹89.09 per USD, offering extra value on your first transfer.

-

Fees: $3.99 for transfers under $1,000; often waived for new customers.

-

Transfer Limit: Send up to $100,000 per verified transfer, suitable for both small and high-value remittances.

When to Choose Remitly?

Perfect for first-time users or anyone who values quick delivery and a straightforward experience with reliable support.

3. Wise

Wise stands out for its transparency; you always get the real mid-market exchange rate, with fees shown upfront before you send.

What Makes Wise Stand Out?

Wise focuses on transparency and simplicity, ensuring users always know exactly what they’re paying for:

-

Real-time tracking through an intuitive mobile app

-

Regulated by FCA and FinCEN for strong global compliance

-

Secure infrastructure with transparent pricing and no markups

Wise’s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Wise gives you the mid-market rate (₹88.70 per USD); the same rate you see on Google, with no markup.

-

Fees: Pay around $11.72 per $1,000, clearly displayed before every transfer for full transparency.

-

Transfer Limit: Transfer as much as $1,000,000 via wire, ideal for larger payments or business use.

When to Choose Wise?

Best for users who value transparency and want predictable, fair pricing on every transfer.

4. Xoom (PayPal)

Xoom combines PayPal’s global reach with quick delivery times. It’s ideal for people who need funds to reach India fast, especially if they prefer flexible payment and payout options.

What Makes Xoom Stand Out?

Backed by PayPal, Xoom stands out for speed and global accessibility. Here’s what makes it convenient:

-

Multiple funding methods: bank account, debit, or credit card

-

Instant delivery for many transfers

-

Supports both bank deposits and cash pickup locations across India

-

Fully regulated platform with strong encryption and fraud protection

Xoom’s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Offers competitive rates around ₹88.73 per USD, which can vary depending on your chosen payment method.

-

Fees: Ranges from $0 to $15 based on funding source, with higher costs for card payments.

-

Transfer Limit: Send up to $50,000 per verified account, giving flexibility for both quick and large transfers.

When to Choose Xoom?

Great for PayPal users and those who need urgent transfers or prefer the option of cash pickup for recipients.

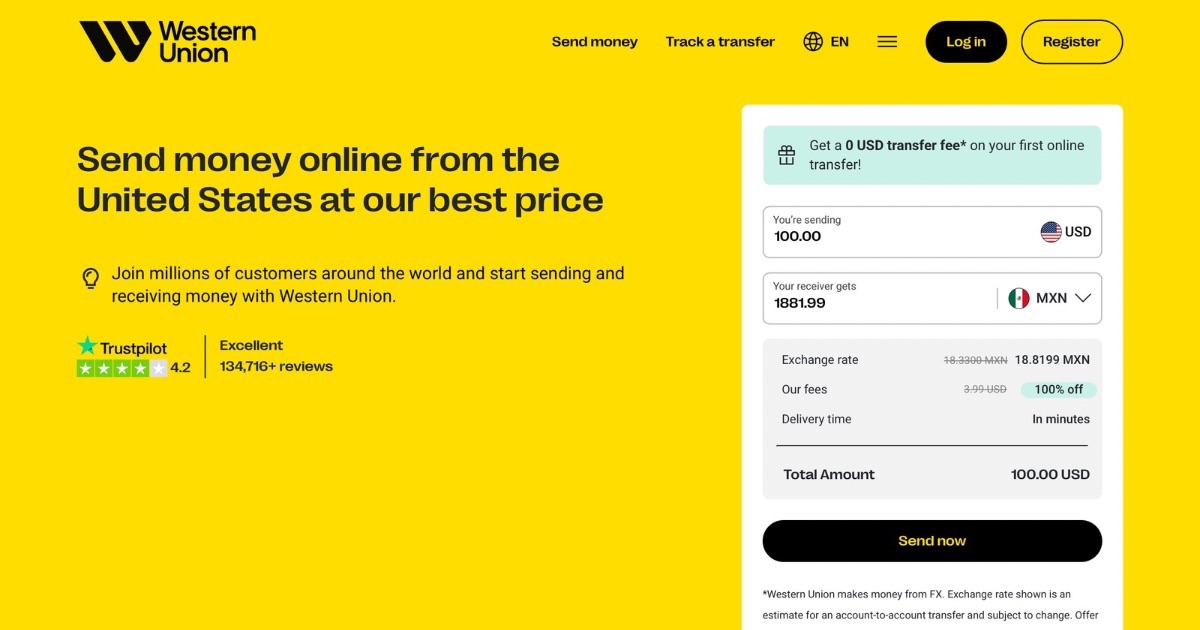

5. Western Union

With over a century of experience, Western Union remains a trusted choice for users who prefer flexibility and global reach. Its digital platform makes sending money online as simple as visiting an agent.

What Makes Western Union Stand Out?

Western Union combines legacy trust with modern convenience, providing options for every kind of sender:

-

Instant cash pickup or bank deposit options

-

Widely accessible payout network across India

-

User-friendly mobile and online platforms

-

Strong KYC and AML compliance worldwide

Western Union‘s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Provides rates close to ₹89.47 per USD, updated regularly to reflect market movements.

-

Fees: Typically between $0 and $100, depending on transfer amount and delivery method.

-

Transfer Limit: Supports transfers of up to $50,000 for verified users, while unverified accounts can send up to $3,000.

When to Choose Western Union?

Best for users who value a long-standing reputation, extensive payout network, and the convenience of cash pickup across India.

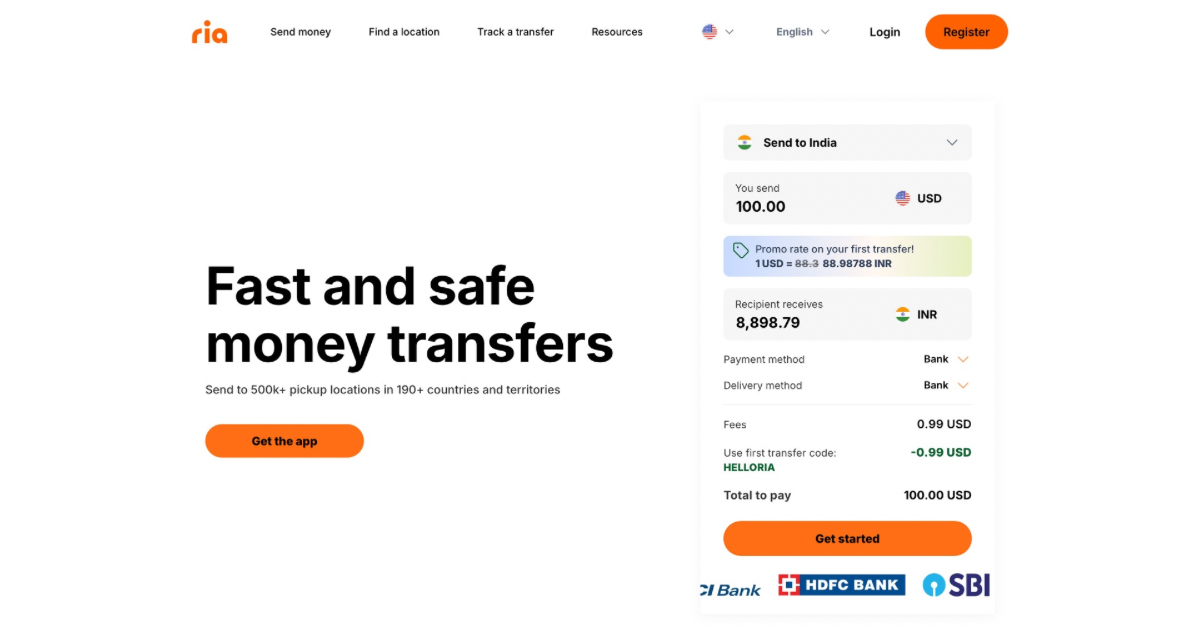

6. Ria Money Transfer

Ria combines a large global payout network with flexible payment options, making it easy to send money directly to Indian bank accounts or for cash pickup.

What Makes Ria Stand Out?

Ria’s strength lies in its reach and flexibility, helping users transfer funds quickly and securely:

-

Multiple payout options: bank deposits, Paytm wallet, and cash pickup

-

Card-funded or cash-pickup transfers often complete in minutes

-

Real-time tracking and transparent fee display

-

PCI DSS compliant with AES encryption and fraud monitoring

Ria’s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Usually around ₹88.90 per USD, though rates may vary slightly each day.

-

Fees: Depends on your payment method and are clearly shown before you confirm your transfer.

-

Transfer Limit: Send up to $14,999.99 per month through the Ria U.S. app.

When to Choose Ria?

Ideal for users who need fast transfers or prefer cash pickup flexibility for recipients.

7. XE Money Transfer

XE, part of Euronet Worldwide, is known for competitive rates, high sending limits, and robust compliance. It’s great for users who transfer larger amounts or prefer a trusted, established platform.

What Makes XE Stand Out?

XE delivers strong rates and high limits, making it a reliable choice for larger or planned transfers:

-

Supports high-value transfers securely

-

Low or no transfer fees with transparent pricing

-

Wide coverage for bank deposits and cash pickup

-

Advanced security, including AES-256 encryption and 2FA

XE Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Offers live market rates near ₹89.00 per USD, often with minimal markup.

-

Fees: Low or no fees, typically around $1 plus a 0.5% rate margin, depending on transfer amount.

-

Transfer Limit: Send up to $500,000 per online transfer, suitable for larger remittances.

When to Choose XE?

Best for users sending large sums who want high limits, competitive rates, and secure, compliant transfers.

8. Instarem

Instarem offers fast, affordable transfers with support for both bank and UPI payments in India. It’s ideal for tech-savvy users seeking competitive rates and modern digital experiences.

What Makes Instarem Stand Out?

Instarem merges affordability and speed with innovative payment options for a modern transfer experience:

-

Fast transfers; typically within minutes

-

Supports ACH, debit/credit card, wire, and “Instarem as Payee”

-

UPI support for instant bank-to-bank transfers

-

Encrypted infrastructure with regulatory oversight in 11 countries

Instarem’s Transfer Limit, Charges, and Exchange Rate

-

Exchange Rate: Provides competitive rates around ₹89.20 per USD, updated in real time.

-

Fees: Starts from 0.4% of the transfer amount, and your first transfer is often free.

-

Transfer Limit: Allows unlimited bank transfers, while card and UPI payments are capped as per bank rules.

When to Choose Instarem?

Ideal for users who want UPI delivery, low-cost ACH transfers, or fast, secure payments through an intuitive app.

Each money transfer app has its strengths; some excel at speed, others at exchange rates or flexibility. Before you send money, compare real-time rates, total fees, transfer limits, and delivery speed to get the best value for your recipient. The right app helps you balance cost, convenience, and security, ensuring every dollar you send goes further.

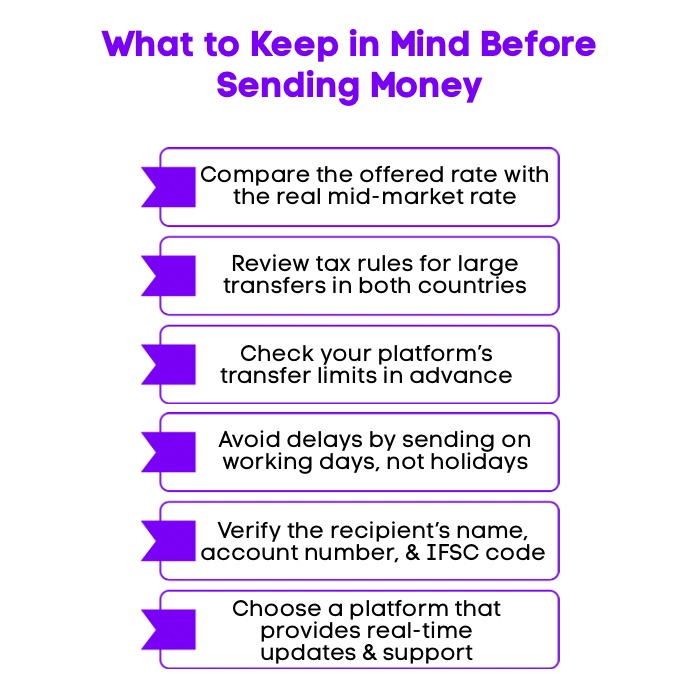

Planning to Send Money to India? Don’t Miss These Key Checks

Before you transfer money from US to India NRI account, a few simple checks can help you avoid delays, extra costs, and unnecessary stress. Whether it’s your first transfer or one of many, keeping these points in mind ensures your money reaches home safely and on time.

1. Watch the Real Rate, Not Just the Displayed Rate

Many services show attractive exchange rates that include hidden markups. The mid-market rate, which you can see on Google, is the fairest benchmark. Always compare what you’re offered to this rate so you know exactly how much your recipient will receive.

2. Understand the Tax Rules in Both Countries

Most personal transfers are tax-free, but large amounts can trigger reporting requirements. In the United States, check gift tax thresholds before sending high-value transfers. In India, recipients should be aware of possible local tax considerations for large deposits.

3. Know the Transfer Limits

Every app and payment method has a maximum limit for how much you can send. These limits vary depending on your verification level and transfer type. Review them in advance to avoid multiple smaller transactions or processing delays.

4. Check for Bank Holidays and Cut-Off Times

Even the fastest transfers can slow down if banks are closed. Holidays or weekend cut-off times in either country can delay delivery. If timing is important, schedule your transfer on a weekday and confirm the expected delivery window.

5. Double-Check Recipient Details

A small mistake in the account number or name can hold up your transfer. Always verify your recipient’s name, account number, and IFSC code carefully before confirming your payment.

6. Choose a Platform That Keeps You Informed

Pick a service that sends real-time updates and offers responsive customer support. Clear communication gives you confidence at every step and ensures you always know where your money is.

Frex simplifies these checks with real-time rates, automatic compliance verification, and secure transfer tracking, so sending money feels effortless and worry-free.

Download the Frex on Google Play today to experience faster, safer, and smarter transfers from the USA to India.

Get More From Every Dollar You Send With Frex

You’ve seen how small details like exchange rates and fees can make a big difference in what your loved ones receive. Now, make every transfer count with an app built for speed, value, and peace of mind.

With Frex, you get more for every dollar you send through better exchange rates, zero extra fees, and instant transfers that arrive in minutes. Whether it’s family support, tuition payments, or investments back home, Frex helps your money move faster, safer, and smarter.

Download the Frex from the App Store today to start sending directly from your US bank account with real-time tracking, secure transfers, and complete transparency.

How To Send Money With Frex – The Easiest Way To Transfer Money From the USA to India

Getting started with Frex is quick and effortless. Here’s how it works:

-

Step 1: Download the Frex app from the Google Play Store or the App Store.

-

Step 2: Complete your one-time account set-up by verifying your identity, adding details of your recipient bank account, and linking your US bank account via Plaid.

-

Step 3: Enter the amount of USD to transfer. Check how much INR will be received in the Indian bank account. Confirm the transfer with FaceID and done! Funds will reach your recipient bank account within minutes.

Everything is done within the app; no paperwork, no delays, and no hidden steps.

Conclusion

Sending money from the United States to India has never been more convenient, but it’s still worth taking the time to choose wisely. The best app for you depends on what matters most, whether it’s speed, cost, or flexibility. Understanding how exchange rates, transfer fees, and limits work helps you make every transaction more intentional and informed.

At its core, foreign remittance from US to India isn’t just about moving funds. It’s about connection, responsibility, and care. When you send money home, you’re not just completing a transaction; you’re supporting dreams, opportunities, and the people who matter most. The right platform is simply the bridge that helps you do that with confidence and peace of mind.

Frequently Asked Questions

What is the best way to send money to India from USA?

The best way to send money to India from USA depends on your priorities. Online money transfer services and apps like Frex offer fast, secure, and low-cost transfers with live exchange rates and no hidden fees, making them ideal for most users.

Which is the cheapest international money transfer app?

The cheapest app varies by exchange rate and fees, but Frex consistently offers some of the lowest costs and best conversion rates. It provides zero transfer fees, transparent pricing, and real-time rate comparisons for sending money from the USA to India.

Can I track my money transfer to India using mobile apps, and which ones allow this?

Yes, most modern transfer apps allow real-time tracking of your transactions. Frex offers in-app tracking, instant status updates, and notifications once funds reach your recipient’s Indian bank account, giving you full visibility and peace of mind.

What are the best remittance services from the US to India?

Among the best remittance services US to India, Frex stands out for its speed, transparency, and zero fees. As one of the best digital remittance services USA to India, it offers secure, real-time transfers that make sending money simple and stress-free.

Can I GPay from the USA to India?

Google Pay does not currently support direct international transfers from the USA to India. However, users in the US can use global remittance apps like Frex, Wise, or Remitly to send money securely to Indian bank accounts.

Is it possible to send money directly to an Indian bank account using popular remittance apps?

Yes, most leading remittance apps, including Frex, Wise, and Remitly, allow you to transfer money directly to an Indian bank account. You only need the recipient’s account number and IFSC code for secure and quick delivery.

Are there any apps that provide fast transfers when sending money to India from the USA?

Several apps offer near-instant delivery. Frex provides one of the fastest transfer experiences, often completing transactions within minutes. Other reliable options for quick transfers include Xoom and Remitly’s express delivery service.

Which money transfer app offers the lowest fees for sending money to India from the US?

Frex offers zero extra fees and highly competitive exchange rates, making it one of the most cost-effective choices. Wise and Remitly also provide transparent pricing, though fees may vary based on transfer method and amount.

Leave a Reply