Key Highlights

- Axis Bank money transfers from the USA are typically initiated from a US bank account and credited to Axis Bank in India through third-party remittance platforms.

- Traditional bank wires can involve higher fees, slower processing, and less transparent exchange rates compared to modern transfer options.

- Third-party remittance platforms simplify compliance, currency conversion, and local settlement for smoother transfers.

- Having the correct recipient and bank details upfront helps avoid delays and failed transactions.

- Transfer times depend on ACH processing, verification checks, and final credit to the Axis Bank account.

- Fees and exchange rates vary by method, making it important to look beyond “zero fee” claims and focus on total value.

- Tax treatment depends on whether the money is sent as a gift or income, with proper documentation playing an important role.

Sending money from the USA to an Axis Bank account in India often feels more complicated than expected. A quick search brings up multiple transfer options, unclear fees, and confusion around whether Axis Bank itself handles international transfers, turning what should be a simple task into guesswork.

That uncertainty usually becomes more frustrating once you try traditional bank wires. SWIFT charges, exchange rate markups, slow processing times, and limited tracking can make it hard to know where your money is during the transfer or how much will actually be credited to the Axis Bank account.

This guide explains how money transfers to Axis Bank from the USA work in practice. It covers common transfer methods, required details, realistic timelines, and how platforms like Frex help simplify the process with clearer costs and fewer surprises.

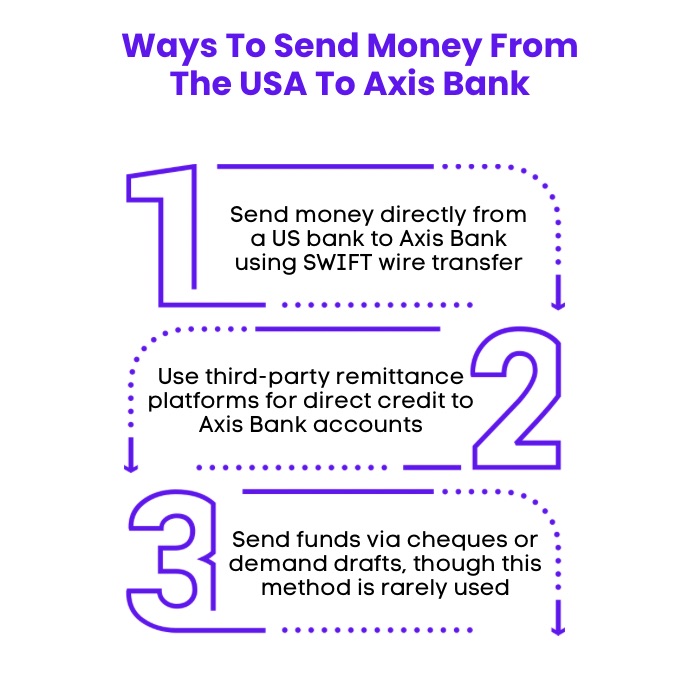

What Are the Common Ways To Send Money From USA To An Axis Bank Account?

Sending money from the USA to an Axis Bank account in India often comes down to choosing the transfer method that best fits your priorities, such as cost, speed, or convenience. Each option follows a different process and suits different transfer needs.

1. Bank Wire Transfers Using SWIFT

Bank wire transfers move money directly from a US bank to Axis Bank through the SWIFT network. While this method is widely accepted, it often involves higher fees, less favorable exchange rates, and longer processing times due to multiple intermediary banks. This method is best suited for large, one-time transfers where direct bank involvement is preferred, but not ideal for frequent or cost-sensitive payments.

2. Third-Party Remittance Platforms

Third-party remittance platforms allow you to send money from your US bank account and have it credited directly to an Axis Bank account in India. These platforms handle currency conversion, compliance checks, and local settlement, making Axis bank money transfer to India from the USA more straightforward for most individuals. Best suited for regular transfers, family support, or anyone looking for speed, lower costs, and simpler setup.

3. Cheques Or Demand Drafts

Cheques and demand drafts are older transfer methods that require physical processing and in-person deposits. Due to slow clearing times and additional paperwork, they are now rarely used for international remittances. Best suited only when digital transfer options are unavailable or not permitted.

For most people, third-party remittance platforms offer the best balance of convenience, transparency, and cost efficiency when sending money to an Axis Bank account from the USA.

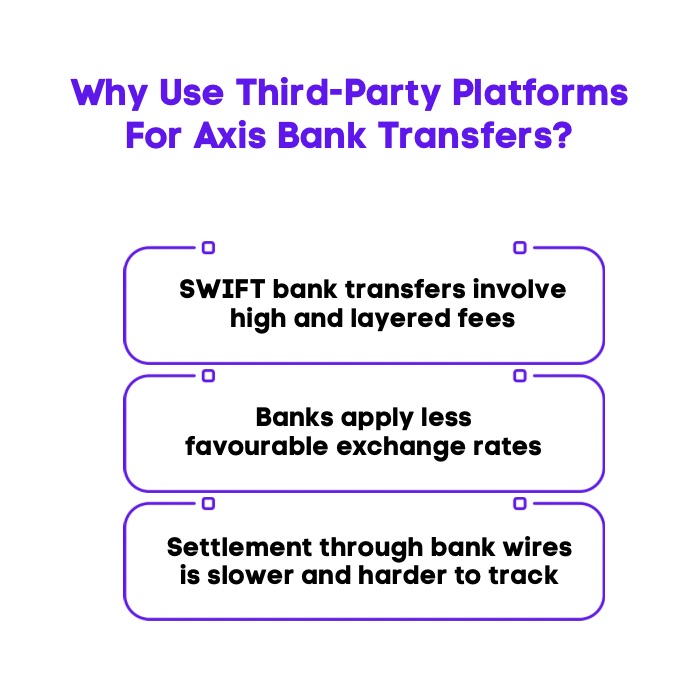

Why Do Most People Use A Third-Party Platform To Send Money To Axis Bank?

Many people start by considering traditional bank transfers, only to realize that the process can be expensive and time-consuming. As cross-border payments become more frequent, senders look for options that reduce friction and improve transparency. Here are the key reasons most users move away from direct bank wires.

1. More Of Your Money Reaches The Axis Bank Account

Third-party platforms reduce or avoid multiple intermediary bank charges. As a result, less money is deducted intransfer fees, and a higher portion of the original amount is credited to the Axis Bank account.

2. Clearer Exchange Rates Mean Predictable INR Credit

By offering better visibility into exchange rates, third-party platforms help senders know exactly how much INR will be credited before confirming the transfer. This reduces surprises where the recipient receives less than expected due to hidden rate markups.

3. Faster Credit To Axis Bank With Better Tracking

Third-party platforms often complete transfers in fewer business days by streamlining settlement and local delivery. Clear tracking updates also help senders know when the money will be credited to the Axis Bank account, instead of waiting without visibility.

Third-party remittance platforms simplify the process by managing compliance checks, offering clearer exchange rates, and settling funds locally in India. For anyone looking to send money to Axis Bank in India with fewer surprises, these platforms offer a more predictable and user-friendly option.

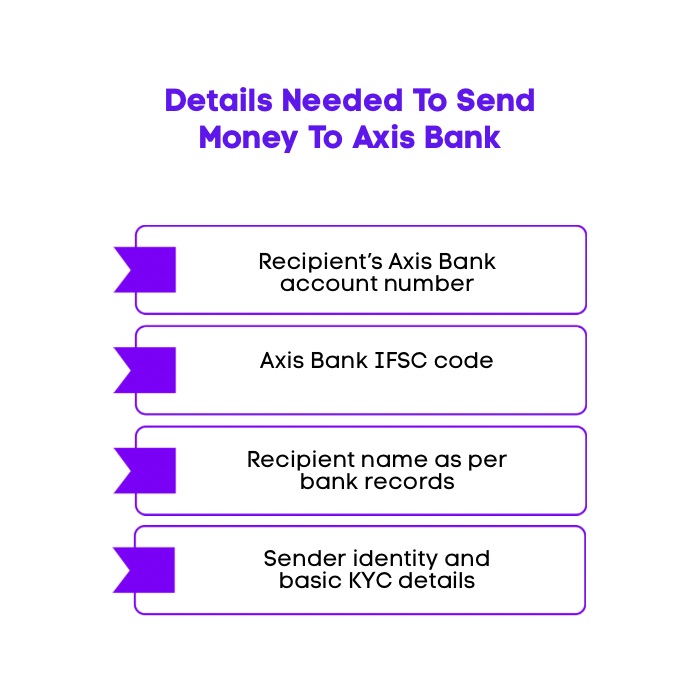

What Information Is Required To Send Money To Axis Bank From The USA?

Before starting a transfer, it helps to have the right details ready. This keeps the process smooth and reduces the chances of delays or failed transactions, especially when setting up an Axis bank money remittance to India from the USA.

Here is the basic information most platforms ask for when sending money to an Axis Bank account in India.

- Axis Bank Account Number: The recipient’s correct account number is essential to ensure the funds are credited to the right Axis Bank account.

- IFSC Code: The IFSC code identifies the specific Axis Bank branch and is used for routing the funds accurately within India.

- SWIFT Or BIC Code: The SWIFT or BIC code identifies Axis Bank for international transfers and is commonly required when money is sent from the USA to India.

- Recipient’s Full Name And Address: The recipient’s name should match the name on the Axis Bank account. Some platforms may also ask for the recipient’s address as registered with the bank.

- Bank Name And Branch Address: Axis Bank’s name and branch address are often required for international settlement and verification purposes.

- Purpose Of Remittance: You may be asked to select or state the reason for sending money, such as family support, education, or savings, to meet regulatory requirements in India.

- Sender Verification And KYC Details: Senders usually need to complete identity verification using basic US bank details and standard KYC information before the transfer can be processed.

Having these details prepared in advance makes the transfer process faster and helps ensure your money reaches the intended Axis Bank account without unnecessary follow-ups.

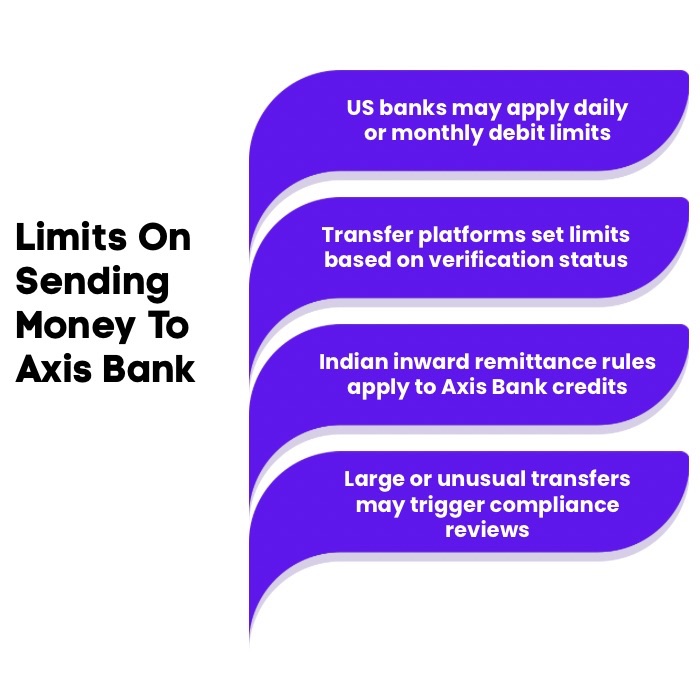

Are There Any Limits On Sending Money To Axis Bank From The USA?

Yes, there are limits to keep in mind when sending money from the USA to an Axis Bank account in India. These limits are not set by Axis Bank alone and can vary based on where the transfer starts, how it is processed, and regulatory requirements on both sides. Here are the main factors that influence how much you can send.

1. US Bank And Payment Method Limits

US banks may apply daily or monthly caps on how much can be debited from your account, especially for ACH-based transfers or newly linked bank accounts.

2. Platform-Specific Transfer Limits

Remittance platforms often set their own limits based on your verification status, transaction history, and risk checks. These transfer limits may increase over time as your account activity builds.

3. Indian Inward Remittance Rules

India has regulations that govern how much money can be received as inward remittance. These rules also apply when sending money to an Axis Bank account, including an Axis bank money transfer from the USA to India NRE account.

4. Compliance And Review Triggers

Larger transfers or unusual patterns may be temporarily reviewed for compliance purposes, which can affect how quickly funds are released rather than blocking the transfer entirely.

Understanding these limits in advance helps you plan transfers more effectively and avoid unexpected interruptions when sending money from the USA to an Axis Bank account in India.

How Long Does A Transfer To Axis Bank From The USA Usually Take?

In most cases, a transfer to an Axis Bank account from the USA takes 1 to 3 business days from start to finish. This is the typical range most senders should plan around when using bank transfers or ACH-funded remittance services.

The timeline includes the ACH debit processing in the US, followed by international settlement and local credit in India. Delays can happen due to bank holidays, higher transfer amounts, or additional verification checks, so it is best to plan for a few business days rather than expecting same-day delivery every time.

What Fees And Exchange Rates Apply When Sending Money To Axis Bank?

Fees and exchange rates can differ widely depending on the transfer method you choose. Traditional bank wire transfers often include upfront fees, intermediary charges, and wider FX margins that reduce the amount received in India.

Remittance platforms may advertise zero transfer fees, but the real value comes from the exchange rate used. A live or near-market rate with a clear breakdown usually results in better overall value than a low-fee transfer paired with a wide currency margin.

Is Axis Bank Money Transfer From the USA To India Taxable?

Whether a transfer is taxable depends on the purpose of the money. Funds sent as a gift to family members are generally not taxable for the recipient in India, while money received as income may be subject to tax under Indian regulations.

For NRIs, keeping basic documentation such as transfer records and purpose declarations helps avoid confusion during tax filing or compliance reviews. For a deeper explanation of tax rules and exemptions, read our blog on tax implications of US to India remittances.

Why Is Frex A Smarter Way To Send Money To Axis Bank?

When sending money from the USA to an Axis Bank account in India, clarity and predictability matter more than marketing promises. Many NRIs prefer platforms that clearly show costs, protect their data, and simplify the transfer from start to finish. Here are the key reasons Frex fits that need well.

- Built For US To India Transfers: Frex is designed specifically for the US to India corridor, ensuring smooth coordination between US bank accounts and Indian banks like Axis Bank.

- Live Mid-Market Exchange Rates: The app shows live mid-market Google rates upfront, helping users clearly understand the Axis bank money to India exchange rate before confirming a transfer.

- Zero Platform Fees: Frex does not charge hidden transfer fees, so the amount you see during setup closely reflects what reaches the Axis Bank account.

- Fast Local Settlement: Funds are settled locally in India after conversion, which helps reduce delays caused by international banking intermediaries.

- Low Minimum Transfer Amount: Users can send as little as $2, making it easier to transfer money as needed without waiting to accumulate larger amounts.

- Strong Security And Trusted Infrastructure: Transfers are protected using 256-bit encryption and supported by established partners like Bridge and Plaid for secure bank connections.

- Fully Compliant For Peace Of Mind: Frex follows regulatory requirements across both countries, including FinCEN USA, FIU India, and global FATF standards.

- Designed With NRIs In Mind: From simple onboarding to clear in-app tracking, the platform reflects how NRIs in the USA actually send money to India.

By combining transparent pricing, secure infrastructure, and a transfer flow built around NRI needs, Frex offers a dependable way to move money from a US bank account to Axis Bank in India.

How Can You Transfer Money From The USA To An Indian Axis Bank Account Using Frex?

If you want a smooth way to move money from your US bank account to an Axis Bank account in India, Frex keeps the steps simple and app-based. Here are the exact steps most users follow.

1. Download The Frex App

Install the Frex app from the App Store or Google Play Store to get started.

2. Complete Your One-Time Account Setup

Verify your identity, add your recipient’s Axis Bank account details, and link your US bank account securely through Plaid.

3. Enter The Amount And Review The INR You Will Send

Type in the USD amount you want to transfer and check how much INR will be received in the Axis Bank account before you confirm.

4. Confirm The Transfer Securely

Approve the transfer using Face ID and submit it in the app.

5. Track The Transfer Until It Reaches Axis Bank

Once confirmed, you can monitor the transfer in-app until the funds are credited to the recipient’s Axis Bank account.

With everything handled inside the app, Frex makes sending money to an Axis Bank account in India feel predictable and easy for NRIs in the USA.

Final Thoughts

When making an international money transfer from the United States, having the right bank account information and recipient’s bank details upfront makes the process smoother. With clear visibility into the amount of money you are sending in US dollars and what arrives as indian rupees, online banking tools reduce guesswork without asking for additional information at every step.

Frequently Asked Questions

How to transfer funds from overseas to an NRE account?

You can transfer funds to an NRE account by using a bank wire transfer, Axis Remit, or a third-party remittance platform. The transfer must originate from overseas income, and funds are credited in INR after currency conversion and compliance checks.

Can I transfer money from the USA to India bank account?

Yes, you can transfer money from the USA to an Indian bank account using SWIFT wire transfers, remittance platforms, or bank remittance services. The funds are converted to INR and credited directly to the recipient’s Indian bank account.

How much does Axis Bank charge for international transfers?

Axis Bank charges for international transfers can include inward remittance handling fees and exchange rate margins. The exact cost depends on the transfer method, intermediary banks involved, and whether the transfer is initiated via SWIFT or Axis Remit.

What is the SWIFT code of Axis Bank?

The standard SWIFT code for Axis Bank is AXISINBB. Additional branch-specific codes may apply in some cases. It is recommended to confirm the exact SWIFT code with Axis Bank before initiating an international wire transfer.

What are the steps to send money from my American bank account to an Axis Bank account in India?

You initiate the transfer through your US bank or a remittance platform, provide the Axis Bank account number and IFSC code, complete verification, and authorise the transfer. The funds are converted to INR and credited to the Axis Bank account.

What fees does Axis Bank charge for transferring money from the USA to India?

Axis Bank may apply inward remittance charges and exchange rate margins on international transfers. Additional fees can come from US banks or intermediary banks. Total costs vary based on the transfer route and service provider used.

Is it possible to use Axis Remit to send money to any Axis Bank branch in India from the US?

Yes, Axis Remit allows you to send money from the USA to Axis Bank accounts across India. Funds are credited directly to the recipient’s account, subject to standard verification, compliance checks, and applicable remittance limits.

Does Axis Bank offer better exchange rates for transfers from the USA to India compared to other services?

Axis Bank exchange rates for international transfers are typically less competitive than specialised remittance platforms. Many third-party services offer closer-to-market rates with greater transparency, which is why users often compare options before choosing a transfer method.

Leave a Reply