Key Highlights

- ICICI Bank offers a secure and reliable way to send money from the USA to India, backed by strong compliance standards and a global banking network.

- A clear, step-by-step transfer process helps reduce confusion, making international remittances easier to initiate, track, and complete.

- Transparent fees and USD to INR exchange rates allow senders to understand total costs upfront and estimate the exact amount credited in India.

- International wire transfers typically take one to three business days, depending on the sending bank, timing, and intermediary routing.

- Transfer limits are governed by regulatory guidelines and bank policies, with higher amounts requiring additional documentation or verification.

- Multiple transfer options and tracking tools provide flexibility, visibility, and better control over international payments.

Sending money to India is rarely just a transaction. It is often tied to supporting parents, paying tuition, meeting property commitments, handling emergencies, or moving savings at the right time. When money is needed, delays or uncertainty can quickly turn into stress.

For many people in the USA, sending money to India comes with worries around fees, exchange rates, transfer timelines, and limits. A transfer that should feel reassuring can feel risky if costs are unclear or funds do not arrive when expected.

Without clear information, even routine remittances can become complicated. This blog explains how ICICI Bank money transfers from the USA to India work, covering the process, fees, exchange rates, timelines, limits, and practical tips to help you send money with clarity and confidence.

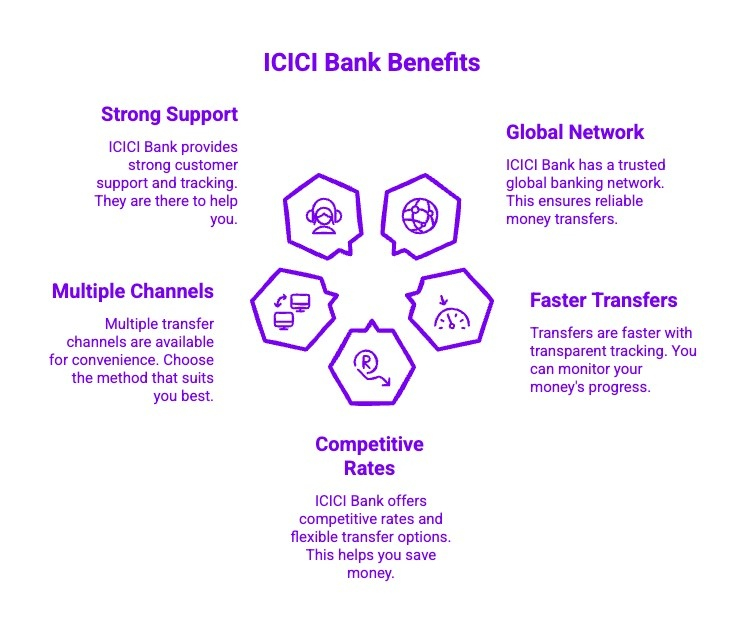

Why Should You Choose ICICI Bank for Transferring Money from USA to India?

ICICI Bank money transfer from USA to India offer a secure and reliable way to send funds with confidence. Transferring money internationally requires speed, transparency, and trust. Choosing the right banking partner ensures peace of mind and better value.

Here are the key reasons customers rely on ICICI Bank for international remittances:

1) Trusted Global Banking Network

ICICI Bank is one of India’s most established financial institutions, with a strong international presence. Its global banking network ensures funds move through secure, regulated channels. This reduces risks, avoids unnecessary delays, and gives senders confidence that money reaches parents safely and accurately.

Best for: NRIs who prioritize security, compliance, and institution-backed transfers.

2) Faster Transfers With Transparent Tracking

ICICI Bank offers efficient transfer timelines, often enabling quicker credit to Indian accounts. Clear tracking and timely notifications keep senders informed at every stage. This transparency reduces uncertainty and makes it easier to plan family support or urgent expenses without repeated follow-ups.

Best for: NRIs sending time-sensitive or medical support.

3) Competitive Rates and Flexible Transfer Options

With competitive exchange rates and multiple transfer methods, ICICI Bank helps maximize the value of each transfer. Clear fee structures allow better cost control, especially for regular remittances. This flexibility supports both recurring family support and one-time transfers.

Best for: NRIs who want predictable costs and better exchange value.

4) Multiple Transfer Channels for Convenience

ICICI Bank supports online banking, wire transfers, and partner-based remittance services. This allows senders in the USA to choose a method that suits their preferences while maintaining consistent service quality across channels.

Best for: NRIs who value convenience and channel flexibility.

5) Strong Customer Support and Transfer Visibility

Clear transaction tracking and responsive customer support make transfers easier to manage. Status updates and confirmations reduce confusion, especially for larger or frequent transfers. This added visibility provides reassurance throughout the process.

Best for: NRIs sending higher amounts or managing frequent transfers.

With strong security, efficient processing, and customer-focused services, ICICI Bank remains a dependable choice for transferring money from the USA to India with confidence and ease.

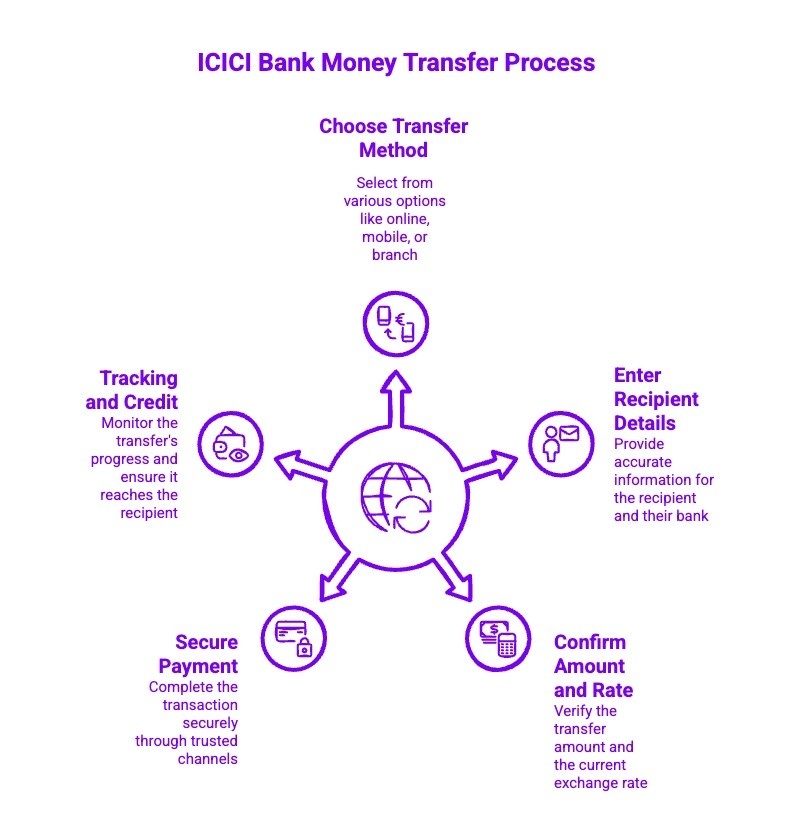

How Does ICICI Bank’s Money Transfer Process from USA to India Work?

ICICI money to India from USA is designed to be straightforward and secure for international senders. Sending money from the USA to India can feel complex without a clear process. ICICI Bank simplifies international remittances with a structured workflow that keeps transfers efficient and transparent.

Below are the five key steps involved in ICICI Bank’s money transfer process:

1) Choose Your Transfer Method

ICICI Bank allows customers in the USA to send money through multiple channels, including online banking platforms and authorized remittance partners. You begin by selecting the option that best suits your needs, whether for a one-time transfer or regular remittances, ensuring flexibility and convenience from the start.

2) Enter Recipient and Bank Details

Once the transfer method is selected, you provide the recipient’s Indian bank details. This includes the account number, bank name, and branch information. Accurate details are essential, as they help prevent delays and ensure the funds are credited to the correct account without unnecessary verification issues.

3) Confirm Amount and Exchange Rate

You then enter the transfer amount and review the applicable exchange rate and fees. ICICI Bank provides clarity at this stage, allowing you to see how much the recipient will receive in INR. This transparency helps you make informed decisions before confirming the transaction.

4) Secure Payment and Processing

After confirmation, the payment is processed through secure, regulated banking channels. ICICI Bank follows strict compliance and security protocols during this stage. These measures protect your funds, verify transaction legitimacy, and ensure the transfer meets all international and Indian regulatory requirements.

5) Tracking and Credit to Recipient Account

Once processed, you can track the transfer status until completion. Notifications and confirmations keep you informed as the funds move and are credited to the recipient’s account in India. This visibility reduces uncertainty and makes it easier to plan finances on both ends.

By following a clear, step-by-step process, ICICI Bank makes transferring money from the USA to India straightforward, secure, and easy to manage.

What Are ICICI’s Fees and Exchange Rates for USD to INR and How Can You Maximize Your Transfer Value?

ICICI money to India USD to INR rate plays a key role in determining how much your recipient finally receives. Understanding fees and exchange rates is essential when sending money from the USA to India, as small cost differences can significantly impact the credited amount.

Here are the key aspects of ICICI Bank’s pricing and rate structure to help you maximize transfer value:

1) ICICI Bank Transfer Fees

ICICI Bank applies fees based on the transfer channel, payment method, and service partner in the USA. In most cases, international wire transfer fees range from USD 15 to USD 50, depending on the sending bank and routing. All applicable charges are typically displayed before confirmation, helping senders plan accurately and avoid unexpected deductions.

| Fee Type | Description | Impact on Transfer |

|---|---|---|

| Service Fee | Processing and handling charge | Adds to total cost |

| Partner Fee | Charged by US remittance partner | Varies by channel |

| Intermediary Charges | Fees from correspondent banks | May reduce INR credited |

| Conversion Margin | Difference from market rate | Affects final value |

Note: Actual fees may vary by bank, location, and transfer method. Always review the final cost breakdown before confirming your transfer.

Looking for ways to avoid high transfer charges? Learn how to transfer money to India from the USA without fees and understand alternative options that focus on lower costs, better exchange rates, and transparent pricing.

2) USD to INR Exchange Rate Structure

Exchange rates are applied at the time the transfer is processed and can change with market movements. ICICI Bank shows the applicable rate upfront so senders can see how much the recipient will receive in INR. This transparency allows informed decisions, especially when timing transfers during favorable market conditions.

Want to understand how exchange rates compare across providers in 2026? Read this guide on finding the best exchange rate to transfer money from the USA to India and learn what factors influence USD to INR pricing trends.

3) Additional Charges and Deductions

Some transfers may involve intermediary banks, depending on routing and payment method. These banks can apply their own charges, which may be deducted before the funds reach the recipient. Reviewing the full transaction breakdown before confirming the transfer helps reduce surprises and ensures clarity on the net amount credited in India.

4) Ways to Maximize Transfer Value

Choosing the most suitable transfer channel, consolidating amounts into fewer transactions, and monitoring exchange rate trends can help improve overall value. Planning transfers ahead of urgent needs also reduces exposure to unfavorable rate fluctuations. A small adjustment in timing or method can lead to meaningful savings over time.

5) Cost Transparency Compared to Other Methods

ICICI Bank follows a structured and transparent pricing approach, making it easier to compare fees and exchange rates with other banks or remittance services. Clear visibility into charges and credited amounts helps users balance speed, cost, and reliability when choosing the most suitable option for their transfer needs.

With clear fees, visible exchange rates, and predictable costs, ICICI Bank helps senders plan smarter and get better value when transferring money from the USA to India.

How Long Does ICICI International Wire Transfers Take and What Is the Transfer Limit?

Send money to India from USA ICICI Bank transfers are designed to balance speed, security, and regulatory compliance. When sending money internationally, timing and limits matter as much as security. Knowing what to expect helps you plan transfers confidently and avoid delays or compliance issues.

Here are the key details on ICICI Bank’s wire transfer timelines and transfer limits:

International Wire Transfer Processing Time

ICICI Bank international wire transfers from the USA to India are typically processed within one to three business days. Actual timelines may vary depending on the sending bank, intermediary banks involved, time of initiation, and compliance checks. Transfers initiated earlier in the business day often move faster through the banking network.

Timing can make a difference. Learn about the best time to send money to India from the USA and how market hours, weekdays, and holidays can impact transfer speed and exchange rates.

Wire Transfer Limits and Applicable Caps

ICICI wire transfer limits depend on regulatory guidelines, the sender’s bank policies, and the purpose of remittance. Transfers to India are subject to reporting and compliance requirements, especially for large amounts. Banks may apply daily or per-transaction caps, and additional documentation may be required when higher-value transfers are initiated.

Curious about how much money you can legally send? This guide explains the maximum limit for money transfer from the USA to India, including regulatory caps, reporting rules, and factors that affect higher-value transfers.

Understanding timelines and limits helps ensure smoother ICICI international wire transfers, allowing you to plan amounts and schedules with greater confidence.

Why Choose Frex for Sending Money from the USA to India?

Frex is built to make international money transfers simple, fast, and cost-effective. Designed for users who want clarity and control, Frex offers competitive exchange rates with low, transparent fees, so more of your money reaches India without unnecessary deductions. Transfers are processed through secure, regulated channels, giving you confidence at every step.

Frex also focuses on ease of use. The platform allows you to initiate transfers quickly, track progress in real time, and avoid the paperwork and delays often associated with traditional banking routes. Whether you are sending money for family support, education, investments, or regular remittances, Frex helps you move funds efficiently while maintaining full visibility into costs and timelines.

Contact us to speak with our team and get personalized assistance for your USA to India transfers.

Download the Frex app today to start sending money smarter, faster, and with better value.

Conclusion

Transferring money from the USA to India with ICICI Bank not only simplifies the process but also offers competitive exchange rates and a host of benefits tailored to meet your needs. Whether you’re sending funds for personal reasons, investments, or family support, ICICI Bank ensures a smooth and efficient transfer experience.

Remember, understanding the various methods available and how to maximize your transfer value can significantly enhance your remittance experience. If you’re ready to make your transfer hassle-free, get started today with ICICI Bank’s services to send money back home effortlessly!

Frequently Asked Questions

Do I need an ICICI Bank account in the USA to send money to India?

No, you do not need an ICICI account in the USA. You can use an online money transfer service or online wire transfer from any overseas bank account, as long as you have the recipient’s bank account details and full name.

Can I use Western Union to transfer funds from the US to an ICICI Bank account?

Yes, Western Union allows international transfers to an ICICI account in India. You will need the recipient’s bank account number, full name, and mobile number. Fees, exchange rates, and additional charges vary by transfer amount and method.

What documents do I need to transfer money to ICICI Bank in India from the USA?

Most online money transfer services require basic details such as your full name, birth date, email address, and payment method like a debit card or credit card. Large international transfers may require identity verification for compliance purposes.

What is the easiest way to transfer money from the USA to an ICICI Bank account in India?

The easiest option is using a secure online money transfer service or mobile app. These platforms allow you to send the exact amount directly to the recipient’s bank account with clear fee information and faster processing than traditional methods.

Is there a transfer limit when sending money from the USA to India with ICICI Bank?

Transfer limits depend on the sending bank, transfer method, and regulatory guidelines. Online wire transfers may have daily or per-transaction caps. Higher amounts may require additional verification or documentation to meet international transfer compliance rules.

How much does ICICI charge for international wire transfers?

ICICI Bank charges vary based on the amount of money, transfer route, and intermediary banks involved. Fees typically include processing costs and possible additional fees, which are usually disclosed before confirming the international transfer.

How can I track the status of my money transfer to India through ICICI Bank?

You can track your international transfer using the reference number provided by your bank or online money transfer service. Status updates are often available through email notifications, mobile apps, or online banking dashboards for better visibility.

Do I need an ICICI Bank account in the USA to send money to India?

No ICICI account in the USA is required. Funds can be sent from any international bank account or secure online money transfer service, provided you enter accurate recipient bank account details and comply with the platform’s terms of use.

Leave a Reply