Key Highlights

- NRIs can legally gift money to parents in India under Indian tax laws, with gifts from children fully exempt from tax on the transferred amount.

- There is no upper limit on the gift amount or the frequency of transfers to parents, as inward remittances are permitted for family support.

- Parents, as resident Indian recipients, do not pay tax on the gifted money, though any income earned from it is taxable.

- Transfers should be made through regulated banking or digital remittance channels with the purpose clearly declared as a gift.

- Maintaining proper transaction records is important for compliance within a financial year and for future tax verification.

- Using compliant digital remittance platforms simplifies gifting and reduces the risk of regulatory or documentation issues.

Many NRIs send money home not as a transaction, but as care. It may be for medical needs, daily comfort, or simply the reassurance that parents never have to hesitate before asking for help. Yet concerns around tax rules, remittance limits, and compliance often turn this simple act into a stressful decision.

Questions about gift tax, documentation, and transfer safety tend to surface when support is needed most. Without clear guidance, NRIs may delay transfers or rely on uncertain advice, adding unnecessary anxiety.

This blog removes that uncertainty. It explains how NRIs can gift money to parents in India safely, tax efficiently, and in full compliance with the Foreign Exchange Management Act, so support reaches home smoothly and with confidence.

Can NRI Gift Money to Parents in India?

Yes, an NRI can gift money to parents in India legally and without complications when done through approved banking channels. Indian regulations, including the Foreign Exchange Management Act, allow NRIs to support their parents financially for personal needs, emergencies, medical expenses, or general family support.

Money gifted by an NRI to parents is treated as a legitimate monetary gift under Indian tax laws. Parents, as Indian residents, are not required to pay tax on the gifted amount, as gifts received from children fall under the exempt category. However, any income generated from that money, such as interest or investment returns, may have tax implications for the parents.

There is no fixed upper limit on the gift amount an NRI can send to parents in India. Still, large transfers may require proper documentation and clear transaction records to meet bank and regulatory compliance requirements.

Can NRI Send Money to Parents in India Without Tax?

Yes, an NRI can send money to parents in India without tax, provided the transfer qualifies as a gift. Under the Indian Income Tax Act, money received by parents from their children is fully exempt from tax, regardless of the amount. This makes family support remittances one of the most tax-efficient ways for NRIs to assist their parents.

However, while the gifted amount itself is not taxable, any income earned from that money, such as interest from fixed deposits or returns from investments, is taxable in the parents’ hands. To stay compliant, NRIs should send money through recognized banking channels, clearly mention the purpose as a gift, and maintain proper transfer records for future reference or tax verification.

Want to make sure your transfer is completely tax compliant? This guide explains how to transfer money from the USA to India without tax, with clear steps and common mistakes to avoid.

What Is the Best Way for NRI to Gift Money to Parents in India?

Sending money to parents in India should be simple, secure, and fully compliant with Indian regulations. Choosing the right method helps NRIs avoid delays, documentation issues, and tax confusion while ensuring parents receive funds smoothly.

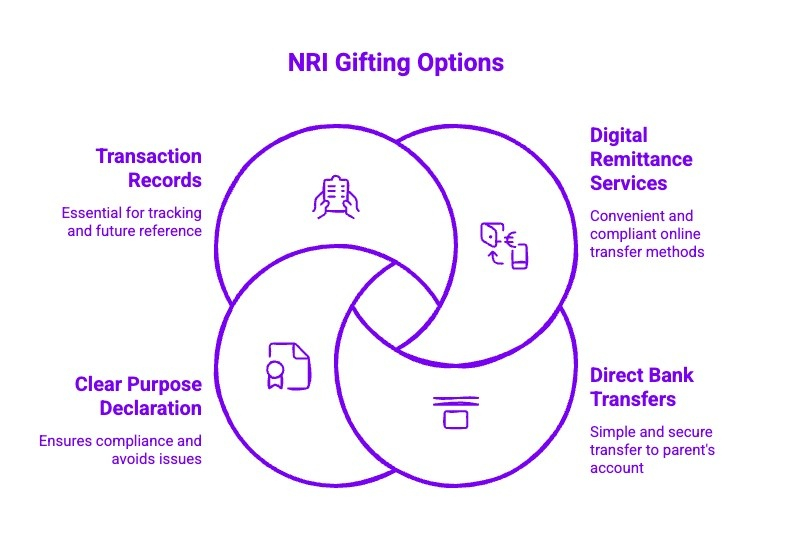

Here are the best ways NRIs can gift money to parents in India:

- Use Compliant Digital Remittance Services: Choose regulated online platforms that offer secure transfers, competitive exchange rates, and clear transaction tracking for peace of mind.

- Transfer Directly to Bank Accounts: Send funds straight to parents’ savings or NRO accounts to ensure transparency and easy access to money.

- Declare the Purpose Clearly: Always select “gift” or “family support” as the transfer purpose to avoid compliance or tax issues later.

- Maintain Proper Transaction Records: Keep receipts and transfer confirmations to support future tax reviews or bank queries.

Following these best practices ensures smooth, reliable, and stress-free financial support for parents in India.

What Documents Are Required When NRI Gifts Money to Parents in India?

When an NRI gifts money to parents in India, banks may request documents to verify identity, relationship, and the source of funds. Keeping everything prepared in advance helps avoid delays and compliance issues.

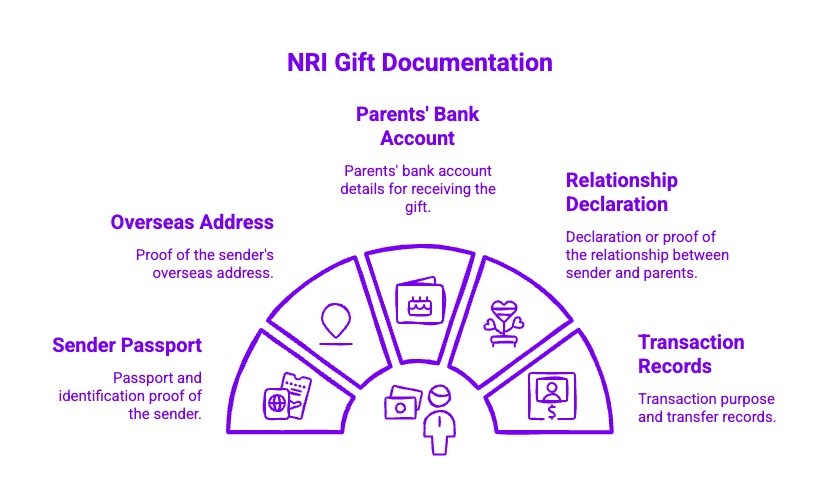

Here are the key documents typically required for NRI gift transfers:

1) Sender Passport and Identification Proof

NRIs must provide a valid passport as primary identification. This confirms the sender’s identity and overseas residency status. Banks rely on this document to meet Know Your Customer requirements and ensure the transfer complies with cross-border remittance regulations.

2) Overseas Address Proof

Banks may request proof of the NRI’s overseas address, such as a utility bill, bank statement, or rental agreement. This helps validate the sender’s country of residence and supports anti-money laundering checks during the remittance process.

3) Parents’ Bank Account Details

Accurate Indian bank account details of the parents are required, usually a savings or NRO account. Correct information ensures smooth credit of funds and avoids delays, rejections, or compliance flags from the receiving bank.

4) Relationship Declaration or Proof

In some cases, banks may ask for a simple declaration stating the parent-child relationship. This helps classify the transfer as a gift, ensuring tax exemption eligibility under Indian income tax rules.

5) Transaction Purpose and Transfer Records

NRIs should clearly mention the purpose as a gift or family support and retain transfer receipts. These records are important for future tax clarification, bank queries, or financial audits.

Having these documents ready ensures a smooth, compliant, and stress-free gifting process for both NRIs and their parents.

What Common Mistakes Should NRIs Avoid When Gifting Money to Parents?

When NRIs gift money to parents in India, small oversights can lead to delays, compliance questions, or tax confusion later. Understanding common pitfalls helps ensure transfers remain smooth, compliant, and stress-free.

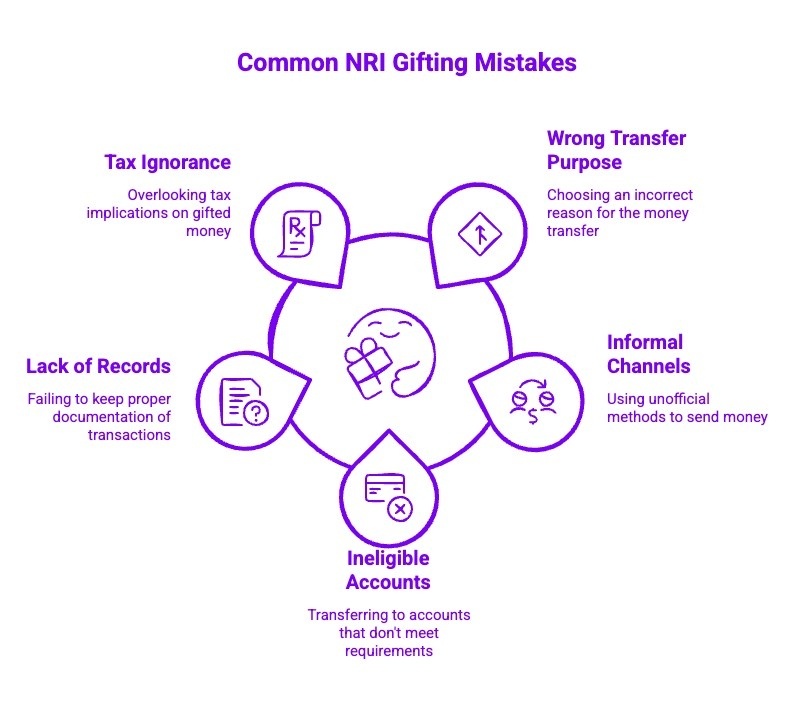

Here are the most common mistakes. NRIs should avoid the following when gifting money to parents:

1) Selecting the Wrong Transfer Purpose

Choosing an incorrect purpose, such as investment or services, instead of gift or family support can trigger unnecessary compliance checks or tax scrutiny. Always ensure the purpose is clearly stated to match gifting rules under Indian regulations.

2) Sending Money Through Informal Channels

Using cash, friends, or unregulated methods may seem convenient but creates risks. Informal transfers lack documentation, are harder to track, and can raise red flags with banks or tax authorities later.

3) Transferring to Ineligible Bank Accounts

Sending money to incorrect or restricted account types can cause delays or reversals. Parents’ savings or NRO accounts are typically the safest and most accepted options for receiving gift remittances.

4) Not Maintaining Proper Records

Failing to keep transfer receipts, confirmations, or purpose details can create problems during audits or tax queries. Proper records protect both the sender and the recipient.

5) Ignoring Tax on Income Earned From Gifts

While the gifted amount is tax exempt, income generated from it is taxable. Overlooking this can lead to compliance issues for parents.

Avoiding these mistakes helps NRIs gift money confidently and without unnecessary complications.

Also read: If you are planning frequent or high value transfers, this guide on NRIs sending money to India the right way explains compliant transfer options, common pitfalls, and best practices to follow.

How Can NRI Send Gift Money to Parents in India Using Frex?

NRIs can send gift money to parents in India easily and securely using Frex, a digital remittance platform built specifically for compliant personal transfers. The process starts by creating an account, completing a quick verification, and selecting gift or family support as the transfer purpose. This ensures the transaction aligns with Indian regulatory and tax requirements.

Frex allows NRIs to transfer money directly to their parents’ Indian bank accounts with transparent exchange rates and low fees. Transfers are fast, fully trackable, and supported by proper documentation, which helps parents and senders stay prepared for any future bank or tax queries. Whether it is a one time gift or regular family support, Frex keeps the process simple and reliable.

For personalized assistance or transfer queries, contact us to speak with the Frex support team.

Ready to get started? Download the Frex app and send money to your parents in India with confidence.

Conclusion

Gifting money to parents in India is a practical and meaningful way for NRIs to provide financial support, as long as it is done correctly. Indian regulations allow such gifts without tax on the transferred amount, offering flexibility and peace of mind.

Understanding the rules around purpose declaration, documentation, and bank compliance helps avoid delays or future complications. Using secure, regulated remittance channels and maintaining proper records ensures transparency for both parents and senders. With the right approach, NRIs can support their parents confidently, meet all legal requirements, and focus on what matters most: taking care of family without unnecessary stress.

Frequently Asked Questions

How should an NRI declare gifted money to Indian tax authorities?

NRIs generally do not need to declare gifts sent to parents in India. Parents should disclose the source of any sum if asked by the income tax department, while the gift itself remains exempt under Indian tax laws and FEMA guidelines.

Are there any limits on the frequency of gifts NRIs can make to parents in India?

There are no limits on how often NRIs can gift money to parents. Multiple transfers are allowed for various purposes, provided they follow Reserve Bank of India regulations and are routed through recognized financial institutions or money transfer services.

What is the maximum amount an NRI can gift to parents in India tax-free?

There is no maximum cap on the value of the gift sent by an NRI to parents. Under the tax treatment of gifts, amounts received from family members are fully exempt, though income generated later becomes taxable income.

Are there any legal documents required for an NRI to gift money to parents in India?

Formal legal documents are usually not mandatory. However, banks may request identification, a relationship declaration, or an NRI gift deed for record purposes, especially for large wire transfers or compliance checks.

Do Indian banks have specific rules for NRIs transferring money as a gift to parents?

Yes, banks require transfers to follow NRI banking services rules, FEMA guidelines, and proper purpose declaration. Funds are usually credited to a savings account or NRI account, with records maintained at the bank branch.

How should an NRI declare gifted money to Indian tax authorities?

NRIs are not required to report gifts made to parents in India. Parents may disclose the gift as exempt income if queried, supported by bank records or a foreign inward remittance certificate, ensuring transparency with tax authorities.

Can NRIs use regular bank transfers to gift money to their parents in India?

Yes, NRIs can use regular bank transfers, wire transfers, or platforms like Western Union. Using regulated channels ensures compliance with Indian government rules and provides proper documentation for future reference.

Are there any limits on the frequency of gifts NRIs can make to parents in India?

Indian regulations do not restrict gifting frequency. NRIs can send money regularly for family support, as long as transfers are compliant, documented, and aligned with tax laws and anti-money laundering norms.

Are There Restrictions on Sending Gifts Abroad by NRIs?

NRIs must follow the Reserve Bank of India and FEMA guidelines when sending gifts abroad. Restrictions may apply based on destination country rules, total value, and purpose, so consulting a financial advisor or own tax consultant is recommended.

Leave a Reply