Key Highlights

- Instarem transfer fees are not always shown as a single charge and often include exchange rate margins that affect the final INR received.

- Zero-fee transfers can still carry hidden costs through USD to INR rate markups, especially for smaller transfer amounts.

- Payment methods influence total cost, with card-funded transfers potentially triggering additional bank-side charges.

- Foreign transaction fees usually come from US banks, not Instarem, but can still impact overall transfer value.

- Transfer speed, market volatility, and holidays can affect both exchange rates and processing timelines.

- Transfer limits, verification levels, and compliance checks may influence how much and how smoothly NRIs can send money.

- Comparing total landed INR rather than advertised fees helps NRIs evaluate Instarem against alternative remittance options.

Sending money from the USA to India should be simple, yet many NRIs struggle to understand the real cost behind international transfers. Advertised low or zero fees often fail to explain why the final amount credited in India looks lower than expected.

This confusion usually comes from exchange rate margins, payment method charges, transfer limits, and bank-side fees that are not always obvious at checkout. Without clarity, it becomes difficult to judge whether a platform truly offers good value.

This blog breaks down how Instarem transfer fees work, highlights where hidden costs can appear, and explains what NRIs should evaluate when comparing Instarem with other money transfer options for USA to India remittances.

How Do Instarem Transfer Fees Work for International Money Transfers?

Instarem transfer fees are not always presented as a single, visible charge. Instead, the total cost is usually split between any upfront transfer fee and the exchange rate applied to the transaction. In many USD to INR transfers, the upfront Instarem fee may appear as zero, but the cost is often built into the exchange rate margin rather than shown separately.

The final amount an NRI pays depends on multiple factors, including the transfer corridor, the amount sent, the payment method, and market movements at the time of processing. Card funded transfers can also attract additional charges from the issuing US bank, even when Instarem does not display a separate fee.

Because of this structure, the advertised fee does not always reflect the true cost. Understanding how these components work together helps avoid surprises:

- Upfront fee: The visible transfer charge, which may be zero in some cases

- Exchange rate margin: The difference between the mid market rate and the rate applied

- Payment method impact: Possible bank side or card related charges

Example:

If the mid market rate is 1 USD = 83.50 INR, Instarem may apply 82.90 INR. On a $1,000 transfer, that difference alone can reduce the payout by over ₹500, even if no fee is shown.

To assess the real cost, NRIs should always look beyond the displayed fee and focus on the combined impact of exchange rates and payment methods. Comparing the final INR credited offers a clearer and more reliable way to evaluate Instarem against other transfer options.

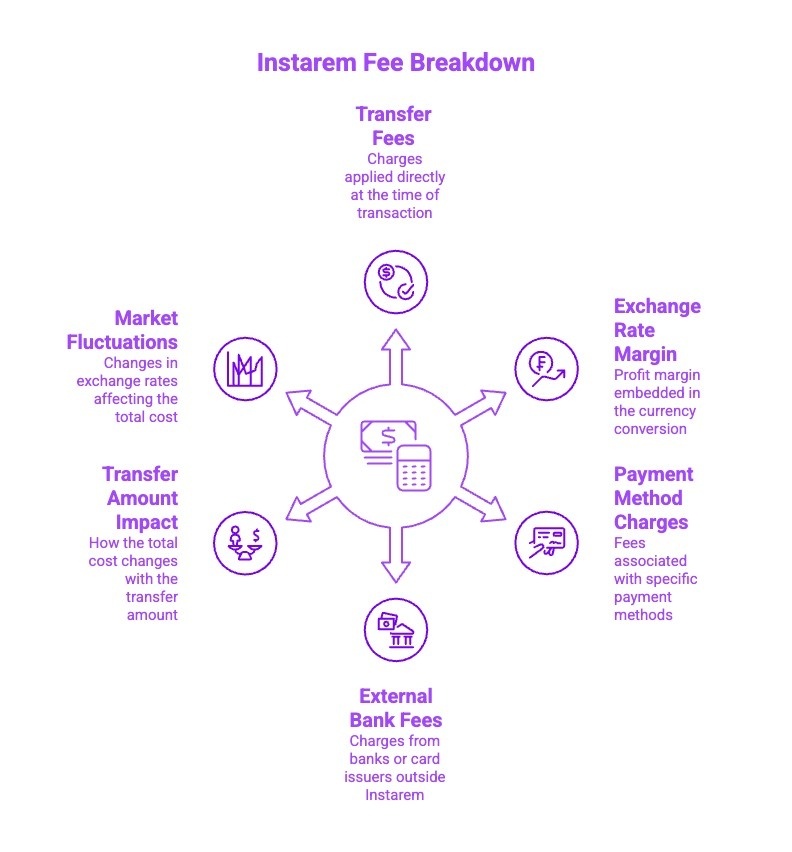

What Do Instarem Fees Actually Include?

Instarem fees are not limited to a single visible charge. Several cost components influence how much actually reaches India.

Below are the main elements that together shape the true cost of an Instarem transfer for NRIs:

- Transfer Fees Charged at Checkout: Fixed or variable fees shown before confirmation, depending on the transfer corridor and amount.

- Exchange Rate Margin Built Into the Conversion: A markup added to the USD to INR rate, often the largest hidden cost.

- Payment Method–Related Charges: Card-funded transfers may cost more than bank-funded ones.

- Bank or Card Issuer Fees Outside Instarem: US banks may apply their own processing or foreign transaction fees.

- Impact of Transfer Amount on Total Cost: Smaller transfers feel costlier due to fixed charges.

- Timing and Market Rate Fluctuations: Exchange rates can change between initiation and processing.

Together, these factors explain why Instarem’s total cost may differ from what NRIs expect.

Is There an Instarem Foreign Transaction Fee for USA Senders?

Instarem does not usually add a separate foreign transaction fee for USA senders, but costs can still appear depending on how the transfer is funded.

Below are the key factors that determine whether foreign transaction charges apply:

- Instarem’s Own Foreign Transaction Policy: Instarem generally does not levy an explicit foreign transaction fee on transfers initiated from the USA. The platform processes payments as international remittances rather than card-based foreign purchases, which helps avoid an extra Instarem-level foreign transaction charge for most bank-funded transfers.

- Foreign Transaction Fees Charged by US Banks: When a transfer is funded using a debit or credit card, the issuing US bank may apply its own foreign transaction fee. These fees are typically charged as a percentage of the transaction value and appear separately on the card statement after the transfer is completed.

- How Payment Method Influences Total Cost: Bank-funded transfers are less likely to trigger foreign transaction fees compared to card-funded ones. Choosing the right payment method can help NRIs reduce unexpected charges, even when Instarem itself advertises zero fees.

Understanding where foreign transaction fees originate helps NRIs avoid surprises and compare Instarem more accurately with alternative transfer options.

What is the InstaReM Exchange Rate?

InstaReM does not use a fixed exchange rate. Its rates vary based on market conditions and the transfer corridor.

Below are the key factors that determine how the InstaReM exchange rate is calculated for international transfers:

| Factor | How It Affects the InstaReM Exchange Rate |

|---|---|

| Market Exchange Rate | Rates are based on prevailing interbank market movements |

| Exchange Rate Margin | A markup may be built into the rate instead of showing a separate fee |

| Currency Pair | Rates differ for each corridor, such as USD to INR |

| Transfer Amount | Larger amounts may receive slightly better rates |

| Timing of Transfer | Rates can change between initiation and processing |

| Transfer Type | Promotional or zero fee transfers often rely more on rate margins |

Because the exchange rate can include hidden margins, NRIs should always compare the final INR received, not just the displayed rate, before choosing InstaReM or its alternatives.

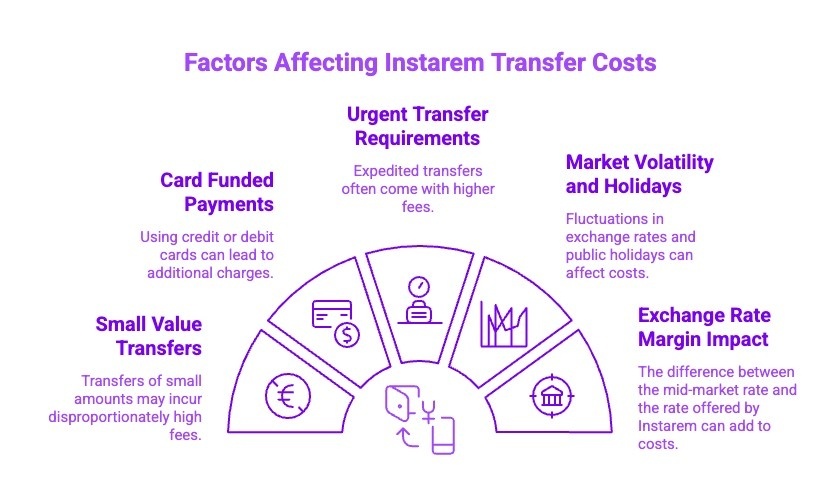

When Can Instarem Transfer Charges Feel Expensive for NRIs?

Instarem transfer charges may seem low upfront, but certain situations can increase the overall cost for NRIs. These costs often come from indirect factors rather than visible fees.

Below are scenarios where Instarem transfers can feel more expensive than expected:

- Small Value Transfers: Fixed fees and exchange rate margins take up a larger percentage when sending smaller amounts.

- Card Funded Payments: Debit or credit card transfers may trigger additional charges from US banks.

- Urgent Transfer Requirements: Faster processing can result in less favorable exchange rates.

- Market Volatility and Holidays: Exchange rate swings or non-business days can affect final payouts.

- Exchange Rate Margin Impact: Even zero-fee transfers may deliver fewer INR due to rate markups.

Recognizing these cost drivers helps NRIs compare Instarem more accurately with alternative transfer options.

How Long Can a Transfer with InstaReM Take?

Transfers with InstaReM are usually processed quickly, but delivery time can vary based on several factors. This includes the transfer corridor, payment method, and compliance checks.

Below are the key factors that influence how long an InstaReM transfer may take:

- Payment Method Used: Bank-funded transfers are generally faster than card-funded ones, which may need extra verification.

- Sending and Receiving Countries: Popular corridors like USA to India are typically processed more quickly.

- Compliance and Verification Checks: First-time users or large transfers may require additional review.

- Time of Initiation: Transfers started during business hours usually move faster.

- Bank Processing Timelines: Delays can occur due to intermediary or recipient bank schedules.

While many InstaReM transfers reach India within one to two business days, checking these factors helps NRIs set realistic expectations and avoid delays.

Are There Any Limits to The Amount You Can Transfer?

Yes, InstaReM does apply limits to how much you can transfer, and these limits depend on several factors. Transfer caps are influenced by the sending country, the destination corridor, and regulatory requirements. For USA to India transfers, limits are often linked to identity verification levels and compliance checks.

New users or unverified accounts usually face lower transfer limits until additional documentation is submitted. Higher value transfers may require enhanced due diligence, including source of funds verification. Payment methods can also affect limits, with bank-funded transfers typically allowing higher amounts than card-funded ones.

Daily, monthly, or per transaction limits may apply, and these can change over time. Checking current limits before initiating a large transfer helps avoid delays or rejected transactions.

How Should NRIs Compare Instarem With Other Options?

Comparing remittance services only by advertised fees can be misleading for NRIs. The real difference lies in outcomes, transparency, and consistency.

Below are practical checks that help you compare Instarem with other options more accurately:

- Compare the actual INR received, not zero fee claims, as exchange rate margins often affect the final amount more than visible charges.

- Check payment method fees, especially for card funded transfers that may include bank side or foreign transaction costs.

- Watch promo rates vs standard rates, since introductory exchange rates rarely reflect long term pricing.

- Consider transfer size, because small exchange rate differences can significantly impact larger transfers.

Using these points helps NRIs make an informed comparison based on outcomes rather than marketing claims.

Looking for a more predictable option?

Frex is designed for NRIs who want clear pricing, competitive exchange rates, and upfront visibility on how much reaches India before confirming a transfer.

Conclusion

Understanding Instarem transfer fees helps NRIs avoid surprises and make more informed decisions when sending money from the USA to India. While Instarem can offer competitive pricing in some cases, costs such as exchange rate margins, payment method charges, and bank-side fees can affect the final amount received. Evaluating the total cost rather than just advertised fees is essential.

By comparing Instarem with alternative remittance platforms that prioritize transparency, predictable pricing, and NRI-focused support, senders can choose an option that better matches their transfer size, urgency, and financial goals. A well-informed comparison leads to smoother transfers and better value over time.

Frequently Asked Questions

Is there a fee for receiving money through Instarem?

Instarem usually does not charge recipients for receiving money into a bank account in the destination country. However, receiving banks or financial institutions may apply additional fees, especially for foreign currency credits or international transfer fees, depending on local policies.

Are there extra charges for overseas spending with Instarem cards?

Overseas spending with Instarem cards may involve foreign exchange rates and additional fees set by global financial exchanges or card networks. While Instarem aims for low fees, foreign currency conversion, merchant location, and the preferred payment method can affect total costs.

Do students get any special discounts or lower transfer fees with Instarem?

Instarem does not consistently offer student-specific discounts, though first-transfer promotions or low-fee offers may apply. Fees still depend on transfer size, popular currency pairs, and exchange rate margins rather than personal details such as student status.

What fees does Instarem charge for US-based transfers?

For US-based transfers, Instarem fees may include a small margin in foreign exchange rates rather than visible charges. Bank transfer methods usually offer better value, while card payments can trigger additional fees from traditional banks or card issuers.

Has anyone had issues with Instarem’s transfer fees based on Reddit experiences?

Reddit users often mention hidden charges linked to exchange rate margins or receiving bank deductions. While many report good value and secure transactions, others note that small amounts or urgent transfers sometimes feel costly compared with other money transfer services.

What are the standard transfer fees charged by Instarem?

Instarem does not always apply a fixed transfer fee. In many cases, costs are built into the exchange rate through a small margin. Even when transfers are advertised as zero fee, exchange rate markups can still affect the final amount received.

Does Instarem Charge Different Fees for Different Countries or Currencies?

Yes, Instarem fees can vary by country and currency pair. Transfer corridors, local regulations, and exchange rate conditions influence pricing. As a result, costs for USD to INR transfers may differ from other international routes.

What Are the Currencies That InstaReM Supports?

InstaReM supports multiple currencies across major corridors, including USD, INR, GBP, EUR, SGD, and AUD. Currency availability depends on the sending country, payment method, and regulatory requirements, so it should always be verified before transferring.

Leave a Reply