Key Highlights

- Wise offers real mid-market exchange rates and transparent fees for U.S.- India transfers.

- Remitly provides faster Express transfers and flexible delivery options like cash pickup.

- Frex delivers the highest exchange rate, zero fees, and instant transfers to India.

- All three apps are regulated and secure, with verified KYC and AML compliance.

- Wise suits users who send large amounts and want clarity on every cost.

- Remitly works best for senders who value convenience and delivery flexibility.

- Frex is ideal for frequent senders looking for maximum value and no hidden fees.

- Transfers for personal use are generally tax-free when sent from the U.S. to India.

If you’ve ever sent money from the United States to India, you’ve likely faced the familiar challenge of choosing between remittance apps that promise the “best rates” and those that actually deliver on their claims. Sometimes, a small difference in exchange rate or fees can quietly reduce what your family receives, making it important to find a platform that’s truly transparent and reliable.

For NRIs, these transfers aren’t just numbers on a screen. They’re school fees, family support, or festive gifts that connect you with home. Yet, with fluctuating exchange rates and confusing fee structures, finding the right balance between speed and value can feel like a guessing game.

We’ll compare Remitly and Wise, two of the most trusted apps for US to India money transfers, to see which one truly offers the best mix of exchange rate, reliability, and real value.

At a Glance: Remitly vs Wise Comparison 2025

Choosing between Remitly and Wise often comes down to one thing: how much money actually reaches your family in India. Both platforms are secure, reliable, and widely trusted, but they differ in how they handle exchange rates, fees, and transfer limits.

Here’s a quick overview of how Remitly and Wise compare for US to India transfers.

| Factor | Remitly | Wise |

|---|---|---|

| Exchange Rate | ₹89.05 for new users ₹88.50 for regular users | ₹88.66, no markup Still lower than market leaders |

| Fees | Free for the first transfer $3.99 for transfers under $1,000 after the first transfer | ~$11.72 on $1,000 transfer Fees scale with the amount |

| Speed | Express in minutes Economy: 3–5 business days | Same-day or within 24 hours Depends on bank/payment method |

| Tax | Tax-free for personal transfers | Tax-free for personal transfers GST may apply to service fees |

| Transaction Limits | Up to $100,000 per transfer | Up to $1 million via wire transfer |

| Security | Licensed in the U.S. KYC and AML checks | Regulated in the U.S. and the U.K. Standard security compliance |

| Delivery Options | Bank, cash pickup, mobile wallets Not always instant | Bank transfers only No cash pickup |

| Support | 24/7 chat and email supportPossible delays during peak times | Responsive support No phone option |

* Disclaimer: Exchange rates, fees, and transfer limits mentioned above are subject to change frequently based on market conditions and platform policies. Always check the latest rates and fees on the official Remitly and Wise websites before making a transfer.

| Want a Better Alternative? Try Frex: Higher Rates, Lower Fees, Zero Complexity.Remitly adds fees and rate markups, Wise charges higher transfer fees, but Frex gives you the best of both: instant transfers, zero fees, and real market exchange rates, so more money reaches home every time.Download the Frex Pay app for iPhone today! |

|---|

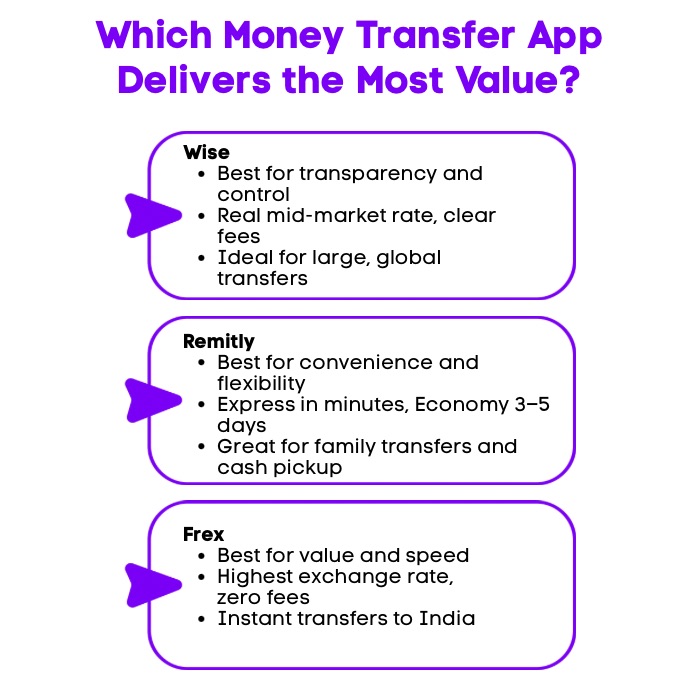

Remitly vs Wise vs Frex: Which Money Transfer App Should You Choose?

If you’re an NRI living in the United States, sending money to India isn’t just about moving funds; it’s about maximizing what your family actually receives. Among all the available platforms, Remitly, Wise, and Frex have become top picks for their reliability, transparency, and convenience.

Each platform gets the basics right, but they differ in what really matters: exchange rates, transfer fees, speed, and overall value. Let’s break down how they compare so you can decide which one fits your needs best.

Exchange Rate: Wise vs Remitly vs Frex

Remitly Exchange Rate:

Around ₹89.05 per USD for new users. Regular rates usually stay between ₹88 and ₹89, which includes a small markup over the mid-market rate.

Wise Exchange Rate:

About ₹88.66 per USD, based on the live mid-market rate. Wise does not add hidden margins, so what you see is what you get.

Frex Exchange Rate:

Approximately ₹90.54 per USD. Frex stands out with one of the best exchange rates available, which means your recipient in India gets more rupees for every dollar.

Which Has the Best Exchange Rate: Wise, Remitly, or Frex?

Frex vs Remitly vs Wise exchange rate comparison clearly shows that Frex offers the strongest value for exchange rates. Even a difference of one or two rupees per dollar can add up quickly for larger transfers.

Fees: Remitly vs Wise vs Frex

Remitly Transfer Fees:

The first transfer is free, and subsequent transactions typically cost $3.99 for transfers under $1,000, depending on your chosen speed and delivery option

Wise Transfer Fees:

Uses a simple fixed and variable fee structure, roughly $11.72 for every $1,000 sent. All costs are shown upfront before you confirm.

Frex Transfer Fees:

Has no extra fees for personal transfers from the United States to India. The amount you send is exactly what arrives in your recipient’s account.

Which App Has the Lowest Transfer Fees: Wise, Remitly, or Frex?

From the Frex vs Remitly vs Wise fees comparison, we see how Frex takes the lead with zero fees, making it ideal for regular senders. Wise ranks second for its transparent pricing, while Remitly costs slightly more for smaller transfers.

Speed: Remitly vs Wise vs Frex

Remitly Transfer Speed:

Offers two options. Express transfers arrive within minutes, while Economy transfers take about three to five business days.

Wise Transfer Speed:

Most U.S. to India transfers arrive the same day or within 24 hours, depending on your bank and payment method.

Frex Transfer Speed:

Offers instant transfers and same-day deposits using blockchain-based stablecoin rails. Express transfers come at no extra cost, making fast, reliable delivery the default.

Which Is the Fastest Money Transfer App: Wise, Remitly, or Frex?

Frex is the fastest, while Remitly’s Express option comes close. Wise offers a balance between quick transfers and fair pricing.

Tax: Remitly vs Wise vs Frex

Remitly Tax Fees:

Personal remittances from the United States to India are typically tax-free, though users should confirm local rules for high-value or business transfers.

Wise Tax Fees:

Transfers for personal remittances remain tax-free. U.S. gift tax rules may apply to very large amounts.

Frex Tax Fees:

Transfers made for personal use are not taxed, and Frex ensures full compliance with U.S. and Indian remittance regulations as they evolve.

Which Platform Handles Taxes Best: Wise, Remitly, or Frex?

All three platforms handle tax compliance well since personal remittances are generally exempt. However, Frex stands out for clearly communicating its compliance with both U.S. and Indian remittance regulations, offering extra peace of mind for frequent senders.

Security Compliance: Remitly vs Wise vs Frex

Remitly Security Compliance:

Licensed as a money transmitter in the United States with full KYC and AML verification.

Wise Security Compliance:

Regulated by FinCEN in the United States and the Financial Conduct Authority in the United Kingdom.

Frex Security Compliance:

Trusted, secure, and Plaid-integrated, Frex uses 256-bit encryption and fraud protection. It’s built on regulated stablecoin rails and complies with FinCEN (USA), FATF, and FIU (India).

Which Money Transfer App Is Safest: Wise, Remitly, or Frex?

All three platforms are secure, but Frex leads with next-generation blockchain security and global compliance standards that set a new benchmark for safety.

Customer Support: Remitly vs Wise vs Frex

Remitly Customer Support:

Provides 24-hour chat and email support. Some users report slower responses during busy periods.

Wise Customer Support:

Offers responsive chat and email support, along with a detailed online help center.

Frex Customer Support:

Features in-app chat and human support during business hours, with quick help for failed or delayed transfers.

Which App Offers the Best Customer Support: Wise, Remitly, or Frex?

Both Frex and Wise offer quick, reliable, and transparent customer support experiences, while Remitly remains dependable but can be slower to respond during peak hours.

Verdict: Wise and Remitly Are Good, But Frex Wins on Value

After comparing Remitly, Wise, and Frex across real exchange rates, fees, and speed, the results are clear. All three are reliable for sending money from the United States to India, but they serve slightly different needs.

Here’s how to decide which app fits your specific transfer needs.

When to Choose Frex?

If you’re tired of losing value to hidden fees or slow transfers, Frex offers a refreshing alternative that puts speed and savings first.

Choose Frex if you:

- Want the highest exchange rate among the three

- Are you looking for zero transfer fees

- Prefer instant or same-day delivery to Indian bank accounts

- Send money frequently and want maximum value per dollar

- Value modern, blockchain-secured rails with regulatory compliance

- Need fast, in-app support for transfers

Download the Frex app today and start sending money the smart way.

When to Choose Wise?

If you want full clarity on how much you’re sending, how much it costs, and what exchange rate you’re getting, Wise is the way to go. Choose Wise if you:

- Prioritize full transparency and real mid-market exchange rates

- Frequently send larger transfer amounts

- Want to see the exact fees before sending

- Prefer a clean, easy-to-use app interface

- Need to manage multi-currency or global accounts

- Value strong regulatory oversight in the US

When to Choose Remitly?

If your priority is delivery flexibility and convenience for your recipient, especially if they need cash pickup or mobile wallet access, Remitly is a solid choice.

Choose Remitly if you:

- Want fast Express transfers or low-cost Economy transfers

- Are you sending small to medium amounts regularly

- Need flexible delivery options like cash pickup or mobile wallets

- Prefer a familiar, easy-to-navigate app experience

- Appreciate 24/7 customer support availability

In short, Wise wins on transparency, Remitly shines for convenience, but Frex takes the crown for pure value and speed.

Ready to experience faster, zero-fee transfers? Download the Frex app today and start sending more and saving more with Frex.

Choosing the Right App for Smarter, Faster Transfers

For NRIs in the United States, sending money to India has never been easier, but choosing the right platform can make every transfer smarter. As digital payments evolve, the real advantage lies in knowing where your money works hardest.

Whether you prefer the transparency of Wise, the convenience of Remitly, or the instant, zero-fee model of Frex, the best choice is the one that saves you both time and value. The smartest senders don’t just move money, they move it wisely.

Frequently Asked Questions

Wise vs Remitly: Which is better?

Wise is better for users who value transparency and real currency exchange rates, while Remitly suits those who prefer faster delivery options. Both offer reliable money transfer services, but your choice depends on specific needs like speed, cost, and delivery flexibility.

Is Remitly safe to send money?

Yes, Remitly is safe. It uses strong encryption and strict security measures to protect your transactions. The platform is licensed and monitored by financial authorities, ensuring your bank transfers and international money transfers are handled securely every time.

Is Wise better than Remitly?

Wise often provides more competitive exchange rates and lower overall costs. Its mobile app is known for transparency and ease of use. However, Remitly offers more transfer methods, including cash pickup, which may benefit senders looking for flexible delivery options.

Who is Wise’s best competitor?

Remitly is Wise’s closest traditional rival, while Frex is emerging as a strong alternative for new customers. Frex combines zero fees, instant transfer times, and higher exchange rates, giving it an edge in value for frequent international transfers.

What are the disadvantages of Remitly?

Remitly’s disadvantages include higher transfer fees for smaller amounts, exchange rate markups that reduce total value received, and slower Economy transfers that can take several business days. Additionally, pricing transparency is limited since rate markups aren’t always clearly displayed.

Are there hidden fees when using Remitly compared to Wise?

Both platforms are generally transparent, but Remitly’s exchange rate includes a small markup that can feel like hidden fees. Wise clearly shows its charges upfront, giving users a clearer picture of total costs before confirming their transfer.

Which is cheaper for international money transfers: Remitly, Wise, or Frex?

Wise is typically cheaper than Remitly because it uses real-time currency exchange rates and minimal fees. Frex, however, is even more affordable with zero fees and instant delivery, making it the most cost-effective choice for cross-border payments.

Is Frex safe for international money transfers?

Yes, Frex is secure and fully regulated. It uses blockchain-based stablecoin infrastructure, advanced encryption, and strict KYC and AML compliance to ensure safe, transparent transfers between the US and India.

How fast are transfers with Frex?

Frex offers instant or same-day transfers to India using stablecoin-powered payment rails. Most transactions are completed within minutes, making Frex one of the fastest options for U.S.–India remittances.

Leave a Reply