Key Highlights

- Compare different transfer methods to find the one that offers the best cost, speed, and convenience.

- Online money transfer services and mobile apps offer the fastest and most affordable options.

- Bank and wire transfers remain secure choices for large-value or business-related transactions.

- Always check exchange rates, transfer fees, and recipient details before sending money.

- Ensure that the provider follows RBI and US regulatory compliance for safe transactions.

- Platforms like Frex provide instant, transparent, and secure transfers with zero hidden fees.

Sending money from the USA to India sounds simple enough, but it often becomes confusing with too many options, unclear fees, and exchange rates that never seem to stay still. What should be a quick transfer can turn into a guessing game about which service actually gives you the best deal.

It’s frustrating when every provider claims to be fast or low-cost, yet your recipient still ends up waiting days or losing a few dollars along the way. Whether you’re supporting family, investing in India, or covering bills back home, you need a money transfer option that is reliable, transparent, and easy to track.

That’s exactly what this guide is here for. We’ll walk through the best way to send money to India from the USA, explore different transfer methods, and share what to consider so you can move your money confidently and keep more of it in your recipient’s account.

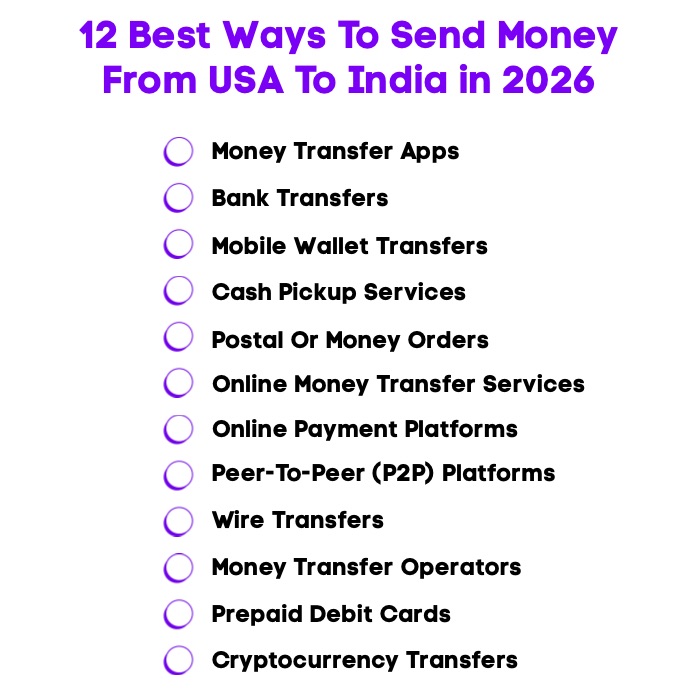

What Are the 12 Best Ways To Send Money to India From the USA in 2026?

Transferring money from the USA to India has never been more flexible, but the options can be overwhelming. Whether you’re sending support to family, covering tuition fees, funding your investments in India, or handling business payments, each method offers something different in terms of speed, cost, and convenience.

Here’s a breakdown of some of the most popular and reliable ways to send money, so you can choose what works best for your specific needs.

1. Money Transfer Apps

Money transfer apps like Frex are designed for instant, easy, and secure international transfers. They offer real-time exchange rates, zero hidden fees, and instant delivery directly to Indian bank accounts. These apps are perfect for users who value convenience, transparency, and control.

Let’s explore why these apps are one of the most efficient options available.

| Pros | Cons |

|---|---|

| Instant transfers | Internet connection required |

| Transparent exchange rates (better than Google rates) | Transfer limits may apply |

| Secure and 100% compliant | May not support every currency |

| Zero hidden fees | Not ideal for cash pickup |

When To Use Money Transfer Apps

- You prefer fast, secure transfers with full visibility

- You prefer managing everything from your phone

- You’re sending money to your own account or your family regularly

- You want better rates than banks or operators

2. Bank Transfers

Bank transfers are a traditional, secure method for sending money from the USA to Indian bank accounts. While dependable, they are usually slower and come with higher costs.

Here’s a quick view of how bank transfers compare with newer options.

| Pros | Cons |

|---|---|

| Highly secure | Slower processing times |

| Works for large transfers | Higher fees and rate margins |

| Trusted by most senders | Limited transparency in total cost |

When To Use Bank Transfers

- You’re transferring large sums

- You trust your bank for international payments

- Your recipient prefers direct deposits

3. Mobile Wallet Transfers

Mobile wallet transfers allow funds to be delivered to apps like Google Pay and Paytm in India. They’re commonly used for smaller payments to students or younger recipients.

Here’s how mobile wallets perform when used for international transfers.

| Pros | Cons |

|---|---|

| Instant delivery | Limited to certain wallets |

| Simple mobile process | Transfer amount caps apply |

| Great for small transfers | Not all wallets support cross-border transfers |

When To Use Mobile Wallet Transfers

- Your recipient prefers digital wallets

- You’re sending small or frequent transfers

- You need instant access to funds in India

4. Cash Pickup Services

Cash pickup allows recipients to collect funds at a nearby partner outlet without needing a bank account. It’s a fast and flexible option when digital access is limited.

Let’s break down where cash pickup works best and where it may fall short.

| Pros | Cons |

|---|---|

| No bank account required | Must visit a physical location |

| Instant availability | May have collection limits |

| Convenient for rural areas | Fees may apply for both sides |

When To Use Cash Pickup Services

- Your recipient prefers or needs cash.

- They don’t have access to banking services.

- You want guaranteed same-day access.

5. Postal or Money Orders

Though rarely used today, postal or money orders still serve as an option in places with limited banking infrastructure. They are secure but much slower than modern alternatives.

Here’s how this traditional method stacks up against newer options.

| Pros | Cons |

|---|---|

| Reliable for official payments | Very slow delivery |

| Recognized for documentation | Limited tracking |

| Suitable for rural areas | Declining availability |

When To Use Postal or Money Orders

- You’re sending funds where digital access is limited.

- You need a documented paper trail.

- Your recipient is in a remote region.

6. Online Money Transfer Services

Online transfer services offer reliable platforms for sending money across borders via desktop or mobile. They’re ideal for those who prefer web-based tools and competitive exchange rates.

Here’s how these services compare in terms of strengths and limitations.

| Pros | Cons |

|---|---|

| Good rates for higher transfers | Setup can take longer |

| Secure and regulated | Not as convenient as mobile apps |

| Suitable for personal or business use | Delays possible on the first transaction |

When To Use Online Money Transfer Services

- You’re sending large or one-time transfers

- You prefer managing transfers on a desktop

- You need a regulated platform with strong customer support

7. Online Payment Platforms

Platforms like PayPal and Revolut are commonly used for small cross-border payments. They offer flexibility in funding and receiving money, though rates and fees vary.

Let’s take a quick look at the pros and cons of using these platforms.

| Pros | Cons |

|---|---|

| Widely used and trusted | Higher fees than transfer apps |

| Easy to send small payments | Exchange rate margins can be high |

| Good customer support | Not always optimized for India transfers |

When To Use Online Payment Platforms

- You’re sending small or infrequent payments

- Your recipient already uses PayPal or Revolut

- You want an easy-to-use international payment tool

8. Peer-to-Peer (P2P) Platforms

P2P platforms help users send money directly using linked accounts or wallet systems. Some offer global connections, though international support may be limited.

Let’s compare the benefits and challenges of P2P transfers.

| Pros | Cons |

|---|---|

| Fast transfers | International support may vary |

| Convenient for individuals | Not always regulated for cross-border use |

| Low fees | Requires verified accounts |

When To Use P2P Platforms

- You’re sending money to someone you know personally

- You need quick, smaller transfers

- You’re comfortable using app-based networks

9. Wire Transfers

Wire transfers are best for high-value payments or formal transactions. They are bank-to-bank, regulated, and operate via the SWIFT network.

Let’s break down what wire transfers offer and what to consider before using them.

| Pros | Cons |

|---|---|

| Reliable for large transfers | Expensive fees |

| Globally recognized system | Takes several business days |

| Works for business and personal needs | Requires detailed recipient info |

When To Use Wire Transfers

- You’re sending large or corporate payments

- You need secure bank-to-bank transfers

- You’re okay with a few days of processing time

10. Money Transfer Operators

These services let you send money online or in person through companies like Western Union and MoneyGram. Funds can be delivered to a bank account or picked up as cash in India.

Here’s how money transfer operators compare in terms of strengths and trade-offs.

| Pros | Cons |

|---|---|

| Broad global network | Higher service fees |

| Supports cash pickup | Slower delivery for non-digital options |

| Accessible to unbanked users | Exchange rates can vary widely |

When To Use Money Transfer Operators

- Your recipient doesn’t have a bank account.

- You prefer in-person cash handling.

- You’re sending to rural or remote areas.

11. Prepaid Debit Cards

Prepaid debit cards can be loaded in the United States and used in India for purchases or ATM withdrawals. They’re handy for recurring transfers or controlled spending.

Let’s take a quick look at what makes prepaid cards convenient and where they may fall short.

| Pros | Cons |

|---|---|

| Convenient for recurring transfers | ATM withdrawal limits apply |

| Great for students | Fees for card reloads may apply |

| Easy to use abroad | Exchange rate variation possible |

When To Use Prepaid Debit Cards

- You’re supporting students or frequent travelers.

- Your recipient prefers card access over cash.

- You want recurring use without new transfers each time.

12. Cryptocurrency Transfers

Crypto transfers offer fast, global fund movement but are unregulated for remittances in India. This method is risky and best suited for experienced users.

Here’s how crypto compares to more traditional money transfer methods.

| Pros | Cons |

|---|---|

| Fast global transfers | Market volatility |

| Bypasses traditional banking | Limited regulatory support in India |

| Low transfer fees | Requires crypto familiarity |

When To Use Cryptocurrency Transfers

- Both sender and recipient understand crypto use.

- You want near-instant global transfers.

- You’re transferring small amounts securely and fast.

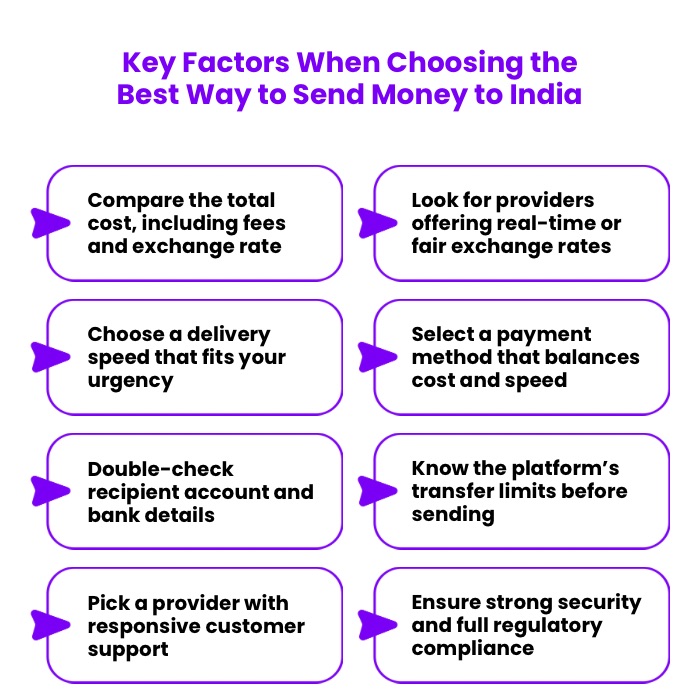

What Are the Key Factors to Consider Before Choosing the Best Way to Remit Money to India From the USA?

Choosing how to transfer funds isn’t just about convenience. The best option depends on how much you’re sending, how quickly it needs to arrive, and what matters most to you: cost, speed, or flexibility.

Here are the key things to evaluate before you make your next international money transfer:

1. Understand the Full Cost of Transfer

Look beyond the upfront transfer fees. Some services may appear cheaper but hide costs in the exchange rate. Always compare the total amount your recipient will receive after all deductions.

2. Check the Exchange Rate You’re Getting

Exchange rates fluctuate constantly, and even small differences can affect the final amount received in India. Choose a provider that offers live mid-market rates.

3. Confirm the Delivery Time

Transfer speed varies from instant to several business days. If you’re paying tuition fees, covering hospital bills, or sending urgent support, prioritize faster delivery even if it costs slightly more. Frex offers instant transfers at no extra fee, making it a strong choice when time matters the most.

4. Choose the Right Payment Method

How you pay affects both cost and timing. Transfers funded by a debit card are often faster, while those linked to a bank account can take longer but may have lower fees. Credit cards typically incur cash advance charges.

5. Verify Recipient Details Carefully

Errors in account number, SWIFT code, or beneficiary bank name can delay your transfer. Double-check your recipient’s bank account details and ensure they match the information required by the destination country. Frex automatically matches the recipient bank account details and the recipient name eliminating manual errors.

6. Know the Transfer Limits

Different providers have minimum and maximum limits for each transaction. If you plan to send larger sums or schedule recurring payments, confirm that your provider supports your transfer amount without restrictions.

7. Evaluate Customer Support Quality

Reliable customer support can save you time when issues arise. Look for providers with 24/7 assistance, multilingual support, and clear refund or resolution processes.

8. Ensure Security and Regulatory Compliance

Your chosen platform should comply with both U.S. and Indian regulations, including those set by the local financial regulator. Make sure your service provider uses encryption and identity verification to protect your data.

Before sending money, review the fees, exchange rate, speed, and security of each option carefully. Choosing wisely helps you get the best value and ensures your recipient receives the money safely and on time.

Why Frex Is the Best Way to Send Money to India From the USA?

When you send money from the USA to India, you shouldn’t have to choose between speed, savings, and security. Frex gives you all three in one simple, seamless experience.

Here’s what makes Frex stand out:

- Better Rates, Zero Fees: Get more INR per dollar with live mid-market Google rates and no hidden costs.

- Instant Transfers: Enjoy instant delivery to your Indian bank account at no extra charge. No waiting, no worrying.

- No Minimum Amount: Send as little as 2 USD with no minimum transfer limits. Don’t worry about pooling funds and making large transfers to save on the fees.

- Secure and Reliable: Protected by advanced 256-bit encryption and powered by top providers like Bridge and Plaid for safety, stability, and instant settlements.

- Fully Compliant: Regulated and fully compliant with FinCEN USA, FIU India, and Global FATF.

- Trusted by NRIs: Built by NRIs, for NRIs in the USA who value transparency, speed, and trust.

With Frex, you can send money directly from your US bank account to any Indian bank account and know exactly how much your recipient will receive before you confirm.

How To Send Money With Frex: The Easiest Way To Transfer Money From the USA to India

Getting started with Frex is quick and effortless. Here’s how it works:

- Step 1: Download the Frex app from the Google Play Store or the App Store.

- Step 2: Complete your one-time account set-up by verifying your identity, adding details of your recipient bank account, and linking your US bank account via Plaid.

- Step 3: Enter the amount of USD to transfer. Check how much INR will be received in the Indian bank account. Confirm the transfer with FaceID and done! Funds will reach your recipient bank account within minutes.

Everything is done within the app; no paperwork, no delays, and no hidden steps.

Download the Frex app now and start sending money smarter, faster, and safer.

Final Thoughts

Transferring money from the USA to India isn’t just about finding the cheapest or fastest way to send money from the USA to India. It’s about making an informed choice that fits your goals, whether that’s helping family, funding your investments, paying for education, or handling business needs. Before you send your next transfer, take a minute to compare exchange rates, transfer fees, and delivery times. That small effort can make a real difference in how much your recipient receives.

The best way to transfer money from the USA to India isn’t always the one everyone uses, but the one that gives you clarity, control, and confidence every single time you hit “send.”

Frequently Asked Questions

What documents are required to send money from USA to India?

You’ll need a valid ID such as a passport, your bank account details, the recipient’s Indian bank account information, and the purpose of the transfer. Some providers may also ask for additional verification or proof of income for larger transfers.

What is the best way to transfer a large sum of money to India?

For large transfers, bank wire transfers are a secure option. You can also use trusted online services like Frex, which offer strong security, better exchange rates, and tracking features. Always verify the recipient’s bank account details before confirming the transfer.

Which bank is best for sending money to India?

Major banks such as ICICI Bank, HDFC Bank, and State Bank of India offer secure and reliable transfer options. However, banks may charge higher transfer fees, so it’s wise to compare their rates with specialized online transfer services.

Are there any hidden charges when sending money from USA to India?

Some providers include hidden charges within their exchange rates or add processing fees. Always check the total cost before sending. Transparent platforms show you the exact amount the recipient will receive with no surprises.

Which online platforms offer the lowest fees for transferring money to India from USA?

If you are looking for the cheapest way to send money to India from the USA, online platforms like Frex offers some of the lowest transfer fees with real-time exchange rates and instant delivery. Frex also ensures full transparency, so you know exactly how much your recipient will receive before confirming the transaction. This makes it the best way to send money to India from the USA online.

Can I send money to India for cash pickup?

Yes, you can send money for cash pickup through providers like Western Union. The recipient can collect the funds from a nearby partner location in India by showing valid identification and the transaction reference number.

Leave a Reply