Key Highlights

- Transfer limits vary by provider, payment method, and account verification status.

- Banks, services, and apps like Frex all have different caps.

- Exceeding transfer limits may lead to delays, additional checks, or reporting requirements.

- Personal remittances are generally not taxable, but documentation may be required.

- Frex offers better exchange rates, transparent fees, and no minimum transaction amount.

- You can manage limits better by verifying your account, planning transfers, and tracking documents.

- Digital apps are often faster, cheaper, and easier to use than traditional bank transfers.

Sending money from the USA to India might seem straightforward, but when you start looking into transfer limits, things can get confusing fast. Whether you’re helping family, paying for tuition, or investing in property, knowing how much you can send is more important than ever.

Different banks and services have different caps, and then there are government regulations, tax rules, and documentation requirements layered on top. Missing even one detail could lead to delays, penalties, or rejected transfers.

This blog will walk you through everything you need to know about transfer limits, tax implications, and the smartest ways to move your money securely and efficiently. If you’re planning to send funds to India, this guide will help you do it right.

What Are Transfer Limits?

Transfer limits refer to the maximum amount of money you can legally send from the USA to another country within a specific financial year. These limits vary depending on the money transfer service, bank, or platform you use, as well as the source of funds and purpose of transfer.

Under current regulations, financial institutions in the United States must follow international compliance rules and banking guidelines, including those set by the Reserve Bank of India for transfers to India.

If you want to understand how much you can send from the USA to India, check the transfer caps set by your bank or money transfer provider, since these limits vary widely across institutions. Exceeding this limit may require extra verification or documentation to confirm that funds are legitimate and compliant.

What Is The Maximum Limit For Money Transfer From the USA to India in 2025?

There is no official upper cap on how much you can send from the USA to India. However, banks and money transfer providers set their own limits for daily or per-transaction amounts to meet compliance and security standards. These limits vary depending on your provider, account type, and payment method, such as debit card, credit card, or bank transfer.

If you send more than 10,000 USD, the transaction must be reported to the IRS under US financial regulations. This helps authorities track large transfers, verify the source of funds, and prevent illegal activities.

While there’s technically no restriction on how much you can transfer, it’s smart to confirm your provider’s upper limit, expected processing time, and any additional verification steps for large amounts of money before initiating international transfers.

What Are The Tax Implications Of Transferring Money From The US To India?

When you transfer money from the US to India, there is usually no tax on the transfer itself. However, depending on the amount and purpose, you may need to meet certain reporting and documentation requirements.

Transfers over 10,000 USD must be reported to the IRS, and gifts above the annual exemption limit may attract gift tax. A proposed 1% remittance tax could also apply from January 1st, 2026, slightly increasing the cost of international transfers.

In India, inward remittances sent for family support, education, or medical needs are generally exempt from income tax, while money received as salary or business income is taxable. To stay compliant, check your provider’s policies, keep records, and confirm the limit to send money to India from the USA before making large transfers.

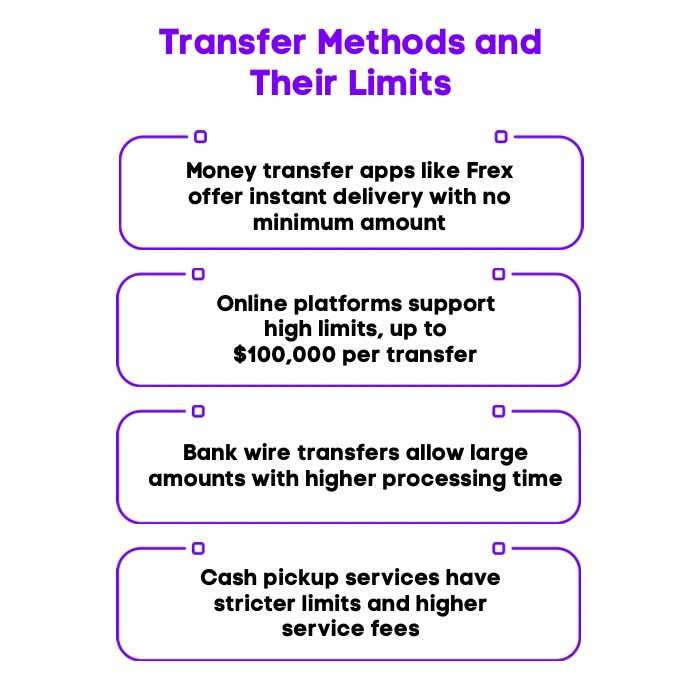

What Are The Different Transfer Methods And Their Limits?

When sending money from the USA to India, there are several reliable methods, each with its own transfer limits, fees, and processing times. The right option depends on how much you’re sending and how quickly you want it to reach your recipient.

1. Money Transfer Apps

Money transfer apps are built for speed, convenience, and transparency. They allow users to transfer money directly from a US bank account to an Indian bank account in just a few taps. Most offer real-time tracking, lower fees, and instant delivery.

Apps like Frex let you transfer as little as $2 with no minimum transaction amount, making them flexible for both small and large transfers.

2. Online Money Transfer Services

Web-based platforms such as Wise, Remitly, and Xoom specialize in international payments. They’re dependable but can have higher fees or less favorable exchange rates than newer digital platforms.

For example, Remitly allows transfers of up to $100,000 USD per transaction when sending from the United States.

3. Bank Wire Transfers

Banks remain a secure option for sending large sums, but often charge higher transfer fees and take longer to process. Bank wire transfer limits vary by institution and account type. Some banks have no cap for certain transactions, while others set daily limits of $50,000 or more.

4. Cash Pickups And Demand Drafts

Cash pickup services let recipients collect funds without a bank account, but usually come with higher service charges and stricter limits. For instance, Western Union allows unverified accounts to send up to $3,000 USD, while verified accounts can send up to $50,000 USD.

Each transfer method has its own advantages, costs, and upper limits. For most users, modern money transfer apps offer the fastest, most transparent, and most cost-effective way to move money from the USA to India.

Quick Comparison Of Top Money Transfer App Limits From The USA To India

Choosing the right platform can make a big difference when transferring funds overseas. Each money transfer app has its own rules, limits, and processing times, depending on the transfer amount and verification level.

Here’s a quick look at how the most popular apps compare in terms of transfer limits and speed.

| Money Transfer App | Transfer Limit (From USA to India) | Transfer Speed |

|---|---|---|

| Frex Money Transfer Limit from USA to India | As low as $2, no minimum transaction amount | Instant or same-day |

| Remitly Money Transfer Limit to India from the USA | Maximum of $10,000 USD per transfer | Minutes (Express) or 3–5 business days (Economy) |

| Wise Money Transfer Limit from USA to India | Up to $1,000,000 USD via wire | Same day or within 24 hours |

| Xoom Money Transfer Limit from USA to India | Up to $50,000 USD for verified accounts | Minutes to 2 days |

| Western Union Money Transfer Limit from USA to India | $3,000 USD (unverified) or $50,000 USD (verified) | Minutes to 5 days |

| Ria Money Transfer Limit from USA to India | Up to $14,999.99 per month (US app limit) | Minutes to 4 days |

| XE Money Transfer Limit from USA to India | Up to $500,000 USD per transfer | Minutes to 4 business days |

| Instarem Money Transfer Limit from USA to India | Up to $2,500 USD per card transaction (higher for bank transfers) | Within 2 business days |

Before sending funds, check your provider’s sending money to India from the USA limit and payment method options. Selecting the right platform ensures your transfer is quick, secure, and cost-effective.

How Can You Manage Money Transfer Limits More Effectively?

Managing transfer limits effectively ensures smooth, secure, and compliant transfers from the USA to India. Here are key practices to help you stay within limits and avoid disruptions.

- Verify Your Identity Early: Complete your KYC verification with your provider to access higher transfer limits and faster approvals.

- Plan Larger Transfers Smartly: Break down big transactions into smaller ones or schedule them over a few days to stay within daily or monthly transfer limits.

- Keep Transaction Records: Save digital receipts, confirmations, and bank statements for tracking purposes and potential reporting requirements.

- Review Provider Policies Regularly: Check your money transfer app’s terms of use, as transfer fees and upper limits can change without prior notice.

- Stay Informed On Regulations: Understand both US and Indian remittance rules to comply with financial regulations and avoid unnecessary delays.

- Use A Trusted Money Transfer App: Platforms like Frex simplify international transfers with transparent fees, no hidden charges, and real-time tracking.

Managing transfers proactively helps you stay compliant, avoid hidden charges, and ensure your money reaches India quickly and safely.

Frustrated With Hidden Fees And Delayed Transfers? Frex Has A Better Way

Tired of watching your money shrink every time you send it home? Many platforms surprise you with poor exchange rates, unclear fees, and unexpected delays. Over time, that means less money reaches your family and more gets lost in the process.

Frex is designed to change that experience completely.

With Frex, you get more INR for every USD you send, instantly and transparently. No minimum transaction rules. No hidden markups. Just faster, fairer transfers powered by real-time rates and secure tech.

Here’s what makes Frex the smarter choice:

- Best Exchange Rates: Get exchange rates higher than most providers.

- Transparent Fees: No surprise deductions or fine-print costs.

- Instant Transfers: Funds often arrive the same day.

- No Minimum Limit: Start with as little as $2.

- Licensed and Secure: Fully regulated in the USA and India with 256-bit encryption.

How To Send Money With Frex?

Sending money with Frex is simple, secure, and designed to make the entire process seamless. No forms, no confusion. Here’s how it works:

- Step 1: Download the Frex app from the Google Play Store or the App Store.

- Step 2: Complete your one-time account set-up by verifying your identity, adding details of your recipient bank account, and linking your US bank account via Plaid.

- Step 3: Enter the amount of USD to transfer. Check how much INR will be received in the Indian bank account. Confirm the transfer with FaceID and done! Funds will reach your recipient bank account within minutes.

Everything is done within the app; no paperwork, no delays, and no hidden steps.

Don’t settle for outdated money transfer services. Frex helps you send smarter, faster, and with full confidence.

Get the Frex app nowand feel the difference instantly.

Conclusion

Understanding the transfer limit from the USA to India helps you stay compliant, avoid delays, and choose the right method for your needs. Since limits vary by provider and purpose, it is important to plan ahead, keep records, and stay aware of any restrictions connected to a foreign currency transfer. By comparing digital options, reviewing fee information, and choosing a reliable international money transfer alternative, you can move money safely while avoiding the limitations often linked to transfers from USA to India bank accounts.

When sending a large amount of money to support a family in India, reviewing the types of remittances allowed and being mindful of trackable large amount transfers can help you stay within the remittance limit from the USA to India.

Frequently Asked Questions

Are there annual limits on money transfers from the USA to India for NRIs?

Per transfer or overall limits are different for each platform or the channel.

What documents are needed if I want to send the maximum allowable amount from the USA to India?

You may be asked for identity proof, banking details, income evidence, and forms such as 15CA and 15CB when sending a large amount of money. Your provider may request additional information depending on the purpose of the transfer.

What happens if you exceed the transfer limit?

Exceeding the allowed limit may cause delays, extra compliance checks, or questions about the source of funds. Institutions may require documentation for trackable large amount transfers and may also ask for financial clarification connected to the types of remittances you are sending.

Do I need to pay tax if I send money to India from the USA?

Most personal transfers are not taxed, but if the transfer relates to income, business activity, or investments, reporting rules may apply. You should also be aware of what is the limit on sending money to India from the USA to avoid unexpected tax obligations.

How much money can I transfer from the US to India?

You can transfer any amount from the US to India, but providers may set their own limits for security and verification. Large transfers may require documentation and IRS reporting. Always check your provider’s rules before initiating a high‑value transaction.

Leave a Reply