Key Highlights

- Wise offers the mid-market exchange rate with no markup for better transfer value.

- Western Union provides fast cash pickup with a broad agent network for urgent transfers.

- Frex guarantees the highest exchange rate, zero fees, and instant transfers to India.

- Wise is perfect for users sending large amounts with clear upfront costs.

- Western Union is ideal for those who need flexible delivery options, including cash pickup.

- Frex is best for frequent senders seeking maximum value with no hidden fees.

- Personal transfers from the U.S. to India are generally tax-free, making them cost-effective.

- Your chosen payment method can affect the speed and cost of your transfer with either service.

Are you struggling to find the best way to send money from the U.S. to India as an NRI? With so many transfer services offering varying rates and promises, it can be hard to know which one truly delivers the most value. You want to ensure every dollar goes further, with minimal cost and hassle, but how do you make the right choice?

The decision between services like Wise and Western Union can be tricky. Do you choose the service that promises the fastest transfer, or the one that offers the best exchange rate? Plus, there’s always the question of hidden fees, which can really add up if you’re not careful.

That’s exactly why we’ve put together this comprehensive guide! We’ll compare Wise vs Western Union, looking at fees, speed, exchange rates, and more, so you can choose the best option for sending money to India from the U.S. with ease.

At a Glance: Wise vs Western Union Comparison

When comparing money transfer services, cost and convenience are key. Wise focuses on low fees with real exchange rates, while Western Union boasts a large network for cash transfers. The table below will break down their exchange rates, fees, and features to help you choose the best option for sending money to India.

| Factors | Wise | Western Union |

|---|---|---|

| Exchange Rate | ₹90.24 per USD | ₹90.68 INR per USD |

| Fees | Approximately $11.72 per $1,000 transfer Transparent pricing system | $0–$100 depending on the transfer amount and payment method used |

| Speed | Most transfers are completed the same day or arrive within 24 hours | “Money in Minutes” for cash pickup Bank deposits can take up to 1-5 business days |

| Tax | No tax for personal remittances Gift tax may apply to larger amounts | Generally tax-free for personal transfers |

| Transaction Limits | Up to $1 million for wire transfers | $3,000 (unverified) to $50,000 (verified) |

| Security | Regulated under FCA and FinCENStrong global compliance (KYC and AML | Globally regulated by the FCA, FinCEN and the Central Bank of IrelandKYC and AML compliant |

| Delivery Options | Bank transfersNo cash pickup | Cash pickupBank account depositsMobile wallet deposit |

| Support | User-friendly app24/7 customer support through phone, email and live chat | In-person support at agent locationsOnline and phone support24/7 digital access |

* Disclaimer: Exchange rates, fees, and transfer limits are subject to change regularly due to market fluctuations and platform policies. For the most up-to-date information, please refer to the official Wise and Western Union websites before initiating any transfers.

| Looking for a Better Choice? Try Frex: Better Rates, Lower Fees, Zero HassleWhile services like Wise and Western Union add hidden fees and adjust exchange rates, Frex gives you the best of both: instant transfers, zero fees, and real market exchange rates, so more money reaches home every time. Download the Frex app for iOS today! |

|---|

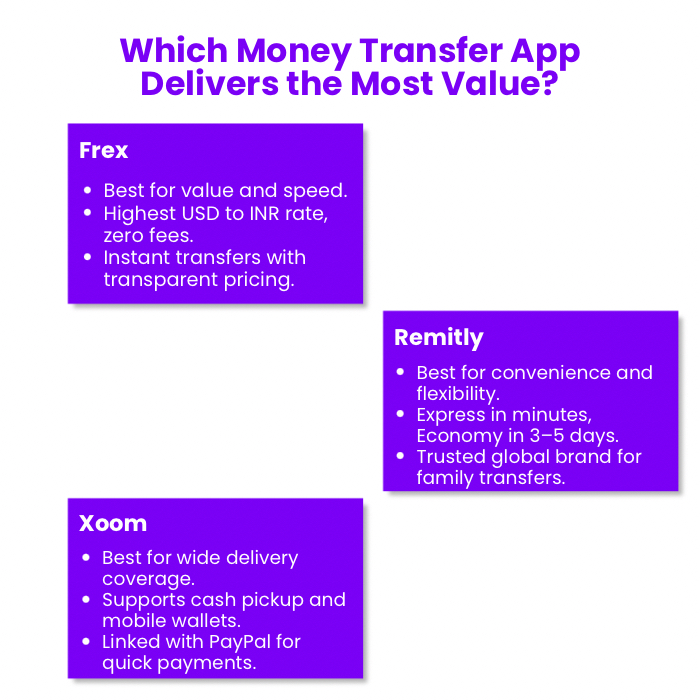

Wise vs Western Union vs Frex: Which Money Transfer Service Reigns Supreme?

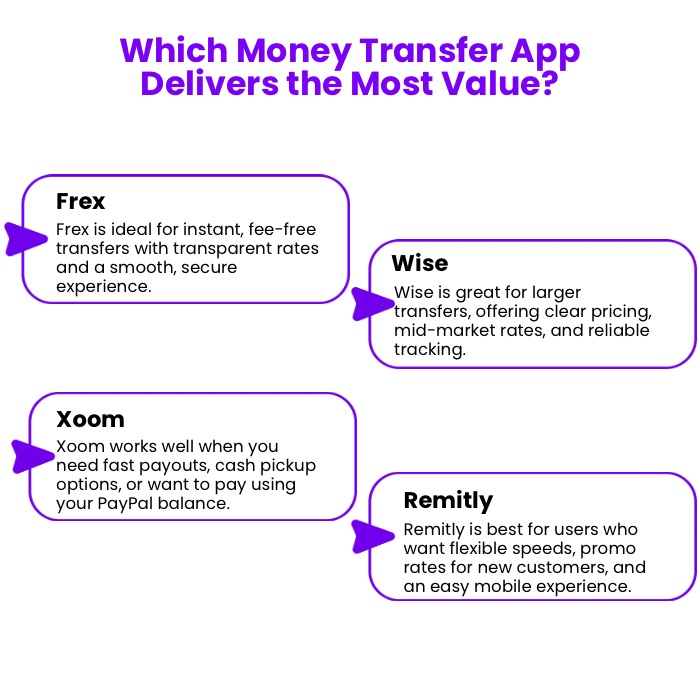

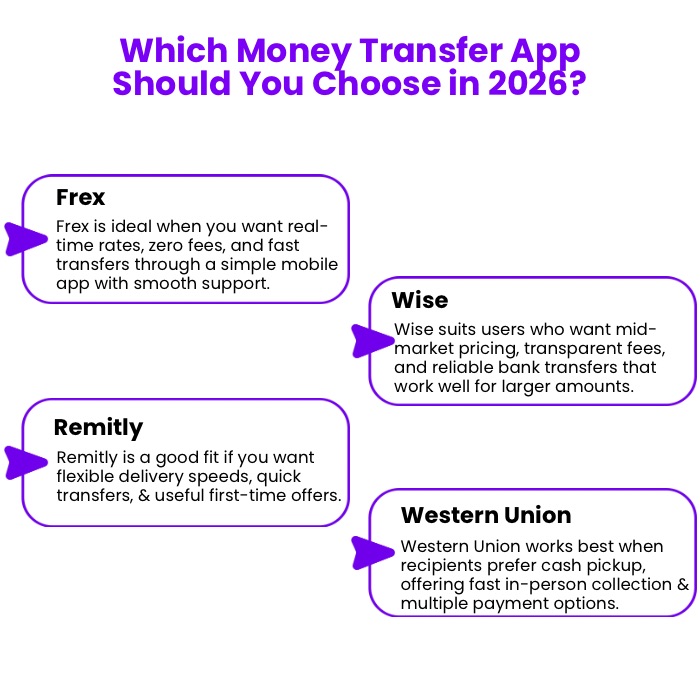

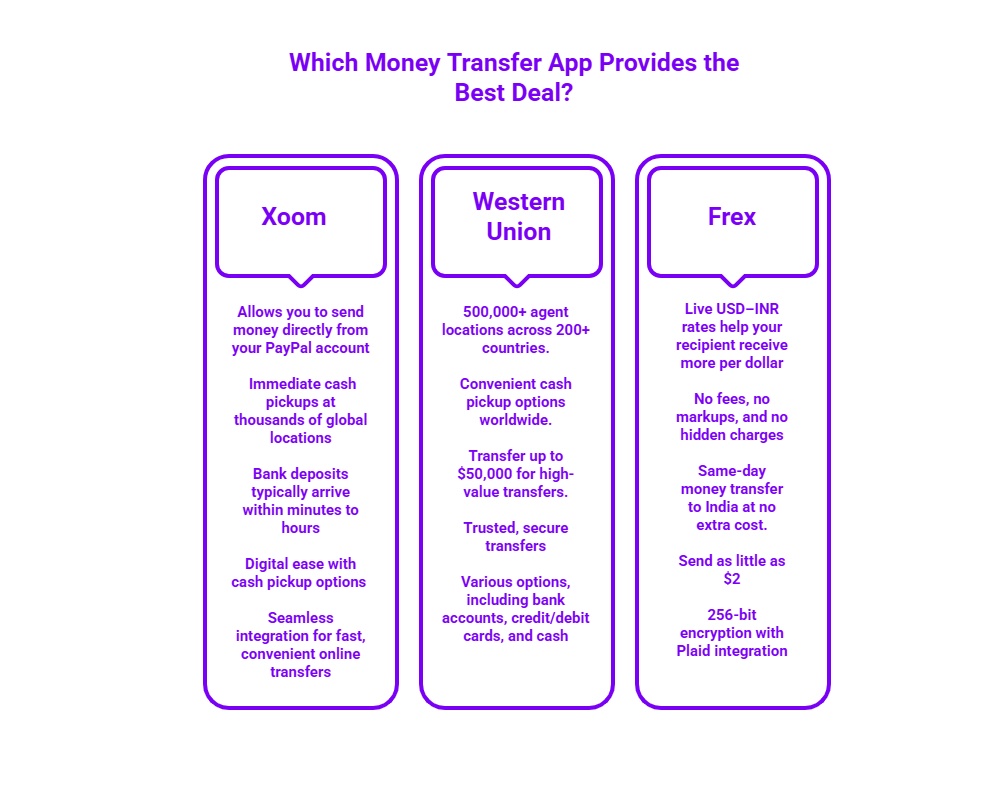

Choosing the right money transfer service can feel like a big decision, especially when you’re sending funds across borders. With options like Wise, Western Union, and Frex available, it can be tough to know which one offers the best deal. Whether you’re prioritizing low fees, fast transfers, or secure delivery, each service has its unique strengths.

Let’s break it down and see how these three compare across key factors to help you find the perfect fit for your needs.

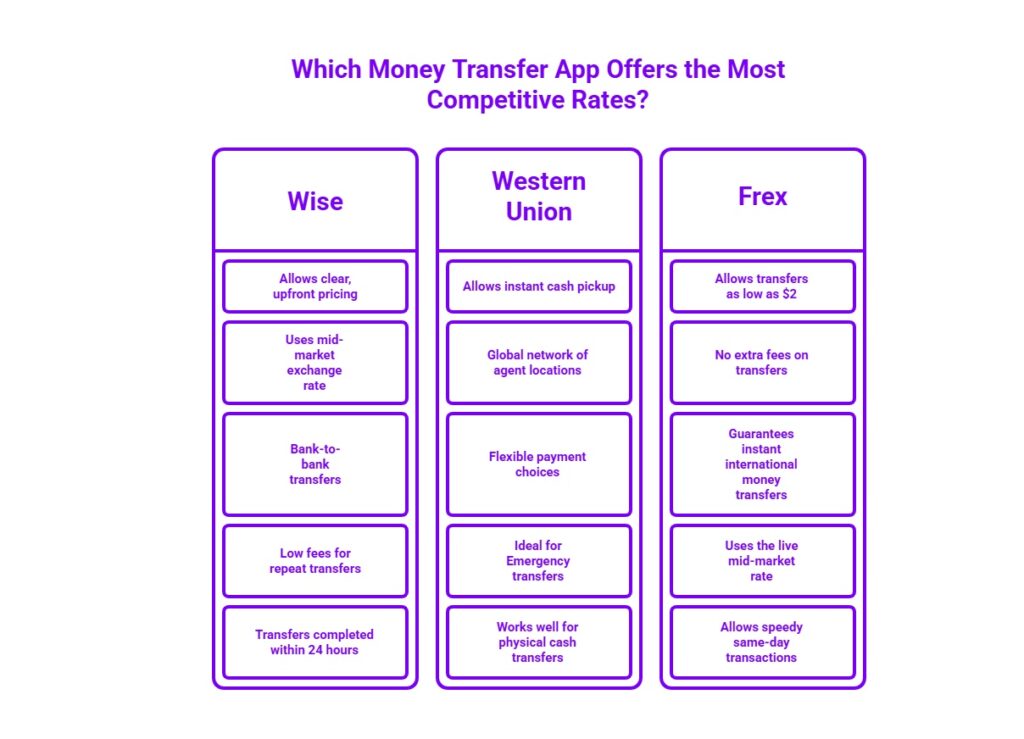

Exchange Rate: Wise vs Western Union vs Frex

Wise Exchange Rate

Wiseoffers an exchange rate of ₹90.24 per USD for foreign currency transfers. They use the mid-market rate, which is the real currency exchange rate without any markup. This ensures you get the most competitive rate for your transfer.

Western Union Exchange Rate

Western Union provides an exchange rate of ₹90.68 per USD. While this may seem better than Wise, it’s important to note that Western Union often applies a markup to the rate, meaning the actual value received by your recipient could be less than the market rate.

Frex Exchange Rate

Frex offers an exchange rate of ₹90.54 per USD, which is competitive and closely aligned with the market rate. It’s a solid option for those looking to maximize their transfer value with relatively low fees.

Exchange Rate Showdown: Which Service Gives You the Best Value?

Frex wins here, providing the best exchange rate for USD to INR with transparency and no hidden fees, offering more value for your money compared to both Wise and Western Union.

Fees: Wise vs Western Union vs Frex

Wise Transfer Fees

Wise charges approximately $11.72 per $1,000 transfer. The fee is transparent, with no hidden charges, and the pricing is clearly shown upfront. Wise’s fee structure is based on the transfer amount and the payment method, which ensures clarity.

Western Union Transfer Fees

Western Union fees vary significantly based on factors like the transfer amount and payment method. Fees range from $0 to $100, depending on the country, payment method, and how the money is received (cash pickup vs bank deposit). These fees, along with the exchange rate markup, can lead to a higher overall cost for sending money.

Frex Transfer Fees

Frex offers zero (0%) extra fees on all transfers, ensuring you pay the lowest possible cost. With no hidden fees, Frex uses the live mid-market rate (the Google rate) for all transfers, meaning you get the best value with no markup or additional costs.

Fee Breakdown: Which Service Offers the Lowest Cost for Transfers?

Frex offers the lowest cost with zero fees and the best exchange rates. Wise is transparent with fees, but Western Union has higher fees and hidden costs, making it the least cost-effective option.

Speed: Western Union vs Wise vs Frex

Western Union Transfer Speed

Western Union offers the “Money in Minutes” option for instant cash pickup in India, which is ideal for urgent transfers. However, if you’re sending money directly to a bank in India, the transfer may take anywhere from 1 to 5 business days, depending on the destination bank and processing times.

Wise Transfer Speed

Wise offers fast transfers, with most transactions completed the same day or within 24 hours when you transfer money from the United States to India. Bank transfers may take up to 2 business days, but for most users, Wise is still an efficient option for quick digital transfers.

Frex Transfer Speed

Frex stands out with instant transfers within minutes, at no extra charge. Whether you’re sending money to India or elsewhere, Frex guarantees same-day transfers, ensuring that your recipient gets the money quickly, often within minutes of initiation.

Speed Comparison: Which Service Delivers Your Money Fastest?

Frex is the clear winner for speed, offering instant transfers within minutes with no extra charge, including same-day deposits.

Tax: Wise vs Western Union vs Frex

Wise Tax Fees

Wise does not charge any tax fees for personal remittances from the USA to India. However, depending on the amount and purpose of your transfer, gift tax or other taxes may apply. It’s essential to check local tax laws if you’re sending large amounts, as tax reporting may be required in some cases.

Western Union Tax Fees

Western Union also does not charge tax fees for personal transfers. However, similar to Wise, it’s important to note that depending on the transfer amount and the reason for the transfer, local tax regulations may apply. Tax reporting might be required if the transfer is large enough.

Frex Tax Fees

Frex takes a simpler approach, offering no tax fees for personal remittances from the USA to India. This applies to all transfers, making it a straightforward choice for those who want completely hassle-free transfers without worrying about the US remittance tax.

Tax Transparency: Which Service Makes Tax Handling Easy?

Frex leads with no tax fees for personal remittances to India, simplifying the process. In comparison, both Western Union and Wise leave tax compliance to the user, adding extra responsibility.

Security Compliance: Wise vs Western Union vs Frex

Wise Security Compliance

Wise is regulated under the FCA (Financial Conduct Authority) and FinCEN (Financial Crimes Enforcement Network). It complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, ensuring that customer funds are protected. The platform is fully secure with two-factor authentication and encrypted transactions.

Western Union Security Compliance

Western Union is globally regulated by the FCA, FinCEN, and the Central Bank of Ireland. It follows KYC and AML procedures to prevent fraudulent activities. However, the cash pickup service carries a higher fraud risk, as cash transfers can be difficult to reverse, making it a less secure option for some users.

Frex Security Compliance

Frex is trusted, safe, and secure, utilizing 256-bit encryption for all transactions. It also partners with Plaid, offering an additional layer of fraud protection and making the platform highly secure for both senders and recipients. These security measures ensure complete protection throughout the transfer process.

Security Assurance: Which Service Protects Your Money the Best?

Frex leads in security with 256-bit encryption, fraud protection, and Plaid integration, ensuring compliance with FinCEN, FEMA, and FIU India. It offers superior protection compared to Wise and Western Union, especially for secure, compliant transfers.

Customer Support: Wise vs Western Union vs Frex

Wise Customer Support

Wise provides 24/7 customer support through email, phone, and live chat. They have a comprehensive help center on their website and mobile app, making it easy for users to find answers to common questions. The support team is quick to respond, though at times, the resolution of more complex issues may take longer.

Western Union Customer Support

Western Union offers in-person support at agent locations, which can be particularly helpful for users who prefer face-to-face assistance. Additionally, they provide online and phone support available 24/7, ensuring that customers can reach out anytime. However, customers have reported that response times can be longer for certain queries, especially for more complex issues.

Frex Customer Support

Frex features in-app chat with human support available during business hours. The support team provides quick resolutions for issues such as failed or delayed transfers, ensuring users get help without long waits. For a seamless experience, Frex also offers a help center within the app for self-service options.

Customer Support Faceoff: Which Transfer Service Solves Problems Fast?

Frex stands out as the best app to send money to India from USA, offering fast in-app chat and human support during business hours. While Western Union and Wise offer solid support, Frex provides the quickest and most responsive service.

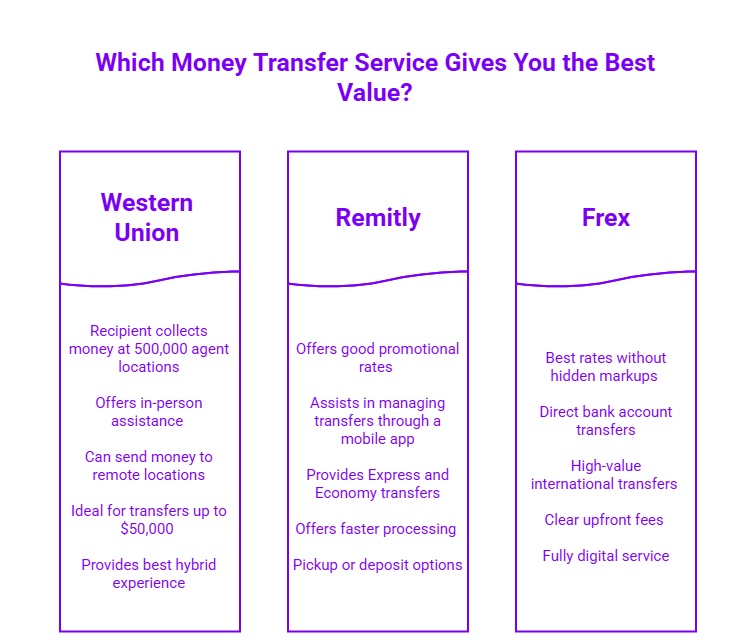

Frex Leads the Pack: Superior Value Over Wise and Western Union

Wise has transparent pricing but slower transfer speeds and limited transfer options. Western Union offers cash pickups but comes with high fees and poor exchange rates. Frex stands out with zero fees, instant transfers, and excellent exchange rates. Here are the main differences and when to choose each service based on your needs.

When to Choose Frex?

If you’re looking for flexibility, zero fees, and instant transfers, Frex is your best bet. Here’s why it stands out:

- No Minimum Transfer Amount: Frex allows transfers as low as $2, offering a low cost option for small transfers without hitting a minimum limit.

- Zero Fees: Frex charges no extra fees on transfers, ensuring the full amount reaches your recipient without hidden costs.

- Instant Transfers at No Extra Charge: Frex guarantees instant international money transfers, often completing them in minutes, making it the fastest service for same-day transfers.

- Competitive Exchange Rates: Frex uses the live mid-market rate with no markup, giving you better rates compared to other services.

- Convenient for All Transfer Sizes: Whether you’re sending a small amount or a large sum, Frex’s flexibility with transaction limits and speed makes it the most versatile service.

Ready for faster, easier transfers? Download the Frex app today and enjoy instant transfers, zero fees, and great exchange rates. Sending money has never been this simple!

When to Choose Wise?

If you value cost transparency and speed, Wise is the ideal choice. Here’s when to go with it:

- Transparent Upfront Fees: Wise offers clear, upfront pricing with no hidden fees, ensuring complete transparency for all Wise payments.

- Real Exchange Rate: Wise uses the mid-market currency conversion rate, ensuring you get the best value for your money when transferring to India.

- Ideal for Bank-to-Bank Transfers: Perfect for those looking to send money to India from USA directly to a recipient’s bank account without worrying about cash pickup.

- Cost-Effective for Frequent Transfers: If you send money regularly, Wise’s low fees for repeat transfers can save you money in the long run.

- Fast Processing: Most transfers with the Wise app are completed within 24 hours, making it a reliable and efficient service for quick digital transfers.

When to Choose Western Union?

Western Union excels when you need cash availability and global reach. Consider it when:

- Instant Cash Pickup: With “Money in Minutes”, Western Union lets your recipient pick up cash almost immediately, which is perfect for urgent international transfers.

- Global Network of Agent Locations: With Western Union locations and physical agent offices in over 200 countries, it’s a better option for recipients who may not have bank accounts or prefer cash.

- Multiple Payment Options: Western Union allows you to pay using cash, credit /debit cards, or bank transfers, providing flexible payment choices.

- Ideal for Emergency Transfers: In time-sensitive situations, Western Union can send money quickly to a recipient who needs access to cash urgently, making it useful for money transfer to India from USA.

- Strong for Cash Transfers: If your recipient needs physical cash, Western Union’s vast network of agents makes it the go-to option for cash pickup.

Conclusion

For NRIs sending money to India, making the right choice can save you time and money. If you’re after speed, go for services offering instant cash pickups or same-day transfers to get your money to loved ones quickly. To ensure you get the best value, choose money transfer providers with transparent fee information and the real exchange rate, with no hidden costs.

If convenience matters most, select services with easy bank-to-bank transfers and clear tracking. Don’t settle for less; by evaluating fees, speed, and flexibility, you’ll find the service that fits your needs and ensures your money reaches home efficiently. Ready to send money hassle-free? Make your transfer today with the right choice!

Frequently Asked Questions

Who offers better exchange rates: Frex, Western Union, or Wise?

Wise offers ₹90.24 per USD using the mid-market rate with no markup. Western Union offers ₹90.68, but applies a markup, reducing the amount your recipient gets. Frex provides ₹90.54, close to the market rate with low fees.

What fees should I expect when sending money with Wise compared to Western Union?

Western Union vs Wise fees differ significantly. Wise charges around $11.72 per $1,000 with transparent pricing, while Western Union’s fees can range from $0 to $100 depending on the payment method and delivery option, often with exchange rate markups.

Are there any limits on the amount you can send with Wise versus Western Union?

Wise allows up to $1 million via wire transfers. Western Union’s limit is $50,000 for verified accounts, but $3,000 for unverified users, with limits varying based on payment type and destination.

Can I send money from Wise to Western Union?

No, Wise does not support direct transfers to Western Union. Wise is primarily a bank-to-bank transfer service, and it does not facilitate cash pickup through Western Union’s network of agent locations for recipients.

Is Wise better than Western Union?

For digital transfers, Wise is often a better choice due to its transparent fees, competitive exchange rates, and quick bank-to-bank transfers. However, if you need cash pickup, Western Union is the preferred option.

How does Frex compare to Wise and Western Union for money transfers?

Frex offers zero fees on all transfers, providing a high exchange rate and instant transfers, making it an excellent choice for those seeking affordable, quick, and transparent transfers compared to both Wise and Western Union.

Is Frex a good choice for sending money to India?

Yes, Frex stands out for its competitive exchange rates, zero fees, and instant transfers, ensuring the best value for NRIs sending money to India without any hidden costs or lengthy transfer times.

How to receive money from Western Union to Wise?

You cannot directly receive money from Western Union to a Wise account. Instead, you’d need to withdraw the money from a Western Union agent location and then transfer it to your Wise account separately.

Can I send money from Western Union to Wise account?

No, you cannot send money directly from Western Union to a Wise account. Wise only allows transfers from bank accounts, debit/credit cards, or other digital payment methods, not from services like Western Union.