Key Highlights

- Wise offers transparent mid-market rates but charges variable fees based on payment method.

- Xoom provides fast delivery and cash pickup options, but includes exchange rate markups.

- Remitly gives promotional rates for new users and flexible speed options like Express and Economy.

- Frex stands out with zero fees, real-time rates, and instant or same-day transfers every time.

- Wise is best for accurate pricing; Xoom for flexible delivery; Remitly for speed choices.

- Frex delivers the highest USD–INR value with no hidden charges and strong compliance standards.

- All four platforms support secure, tax-free personal transfers, but Frex offers the most seamless user experience.

You’ve budgeted, checked your calendar, and now it’s time to send money to your family in India, but figuring out the best app can be surprisingly overwhelming. You compare rates, check delivery times, and calculate fees, only to discover that the final amount received is not what you expected.

Between hidden charges, confusing exchange rates, and unclear processing times, figuring out which app offers real value can be frustrating. Wise, Xoom, and Remitly all promise fast and affordable transfers, yet each one handles costs, speed, and delivery differently. Even small variations can make a noticeable difference when you send regularly.

That’s why we’ve put these popular platforms side by side. This comparison looks at Wise vs Xoom vs Remitly to see how they perform across key areas like exchange rates, transfer fees, speed, and security, helping you make an informed decision before your next transfer.

Wise vs Xoom vs Remitly: Side-by-Side Comparison for 2026

Choosing the right money transfer service can be tricky when each platform claims to offer better rates and faster delivery. Whether you’re sending money for family, business, or bill payments, it’s important to know how each app performs before you make your next transfer.

Here’s a simple side-by-side look at Wise vs Xoom vs Remitly to help you compare everything from Wise USD to INR rates to Remitly USD to INR conversion values, so you can choose the best fit for your needs.

| Factor | Wise | Xoom | Remitly |

|---|---|---|---|

| Exchange Rate | • ₹89.75 with no markup • Based on the real market rate | • ₹89.35 per USD • Includes a markup over mid-market rate | • ₹90.59 for new customers • Includes a markup over the mid-market rate |

| Fees | • Wise fees start at $7.33 via ACH • Up to $67.01 for card payments | • Free for first-time transfers • $0–$45.49 depending on payment method | • Free for the first transfer • $3.99 for transfers below $1,000 |

| Speed | • Typically 1–2 business days • Depends on delivery route and payment option | • Instant for most bank and UPI transfers • Cash pickups are usually available quickly | • Express transfers within minutes • Economy option 3–5 business days |

| Tax | • Personal transfers are tax-free • Subject to U.S. gift tax thresholds | • Personal transfers generally are not taxed • Business transfers may follow separate rules | • Personal transfers are tax-free |

| Transfer Limits | • Up to $1 million via wire transfer • Higher maximum limits for verified users | • Varies by delivery method and verification level • Limits increase with usage | • Up to $100,000 per transfer |

| Security | • Regulated globally • Strong fraud monitoring and encryption | • Backed by PayPal’s compliance network • Meets U.S. regulatory standards | • Licensed in the U.S. • Uses KYC and AML verification |

| Delivery Options | • Supports bank transfers only • No cash pickup or wallet options | • Bank deposit, UPI, mobile wallets • Cash pickups available | • Bank, cash pickup, and mobile wallets • Not all methods are instant |

| Support | • Live chat and help center • No phone support | • Email, help center, and phone support • Availability depends on the region | • 24/7 chat and email support • Delays may occur during peak times |

*Disclaimer: Exchange rates, transfer fees, and delivery options may vary depending on market conditions and platform policies. Always check each provider’s pricing page and terms of use before completing a transaction.

| Why Frex Is the Smarter Alternative to Wise, Xoom, and RemitlyIf comparing Wise vs Xoom vs Remitly feels like a balancing act between fees, delivery time, and exchange rates, Frex makes the choice simple. It offers transparent rates, instant delivery, and zero fees, so what you send is what arrives.Download the Frex app on your iPhone today. |

|---|

Wise vs Xoom vs Remitly vs Frex: Which Money Transfer App Stands Out in 2026?

When you want to transfer money from the United States to India, cost and reliability matter as much as speed. Each platform, Wise, Xoom, and Remitly, promises low fees and competitive rates, but the actual experience can vary depending on your payment method, delivery route, and amount of money sent.

Let’s explore how these services compare across the most important factors:

Exchange Rate: Wise vs Xoom vs Remitly vs Frex

Wise Exchange Rate

Wise offers a transparent conversion rate of ₹89.75 per USD, based on the real exchange rate with no markup. The Wise USD to INR rate reflects the true market value, so senders know exactly how much their recipient’s bank account will receive before confirming the transfer.

Xoom Exchange Rate

Xoom currently offers around ₹89.35 per USD, which includes a slight markup over the mid-market rate. The Xoom USD to INR rate is usually less competitive than Wise’s, especially when sending larger amounts or using card payments.

Remitly Exchange Rate

Remitly provides a rate of ₹90.59 per USD for new customers. While appealing, this includes a markup above the mid-market rate. The Remitly USD to INR conversion can look better upfront, but users should check the final transfer value after applying any transfer fees or additional costs.

Frex Exchange Rate

Frex leads with a strong live rate of ₹91.49 per USD, offering zero markups or hidden charges. Each transfer reflects real-time market pricing, ensuring recipients receive more when converting US dollars to Indian rupee equivalents without deductions.

Which Has the Best Exchange Rate: Wise, Xoom, Remitly, or Frex?

Frex clearly provides the highest value with its real-time, no-markup model, giving users the best exchange rate for USD to INR.

Fees: Wise vs Xoom vs Remitly vs Frex

Wise Transfer Fees

The Wise transfer USD to INR fee starts at about $7.33 for ACH transfers and can go up to $67.01 for card payments. Costs vary based on the payment method, transfer amount, and delivery route.

Xoom Transfer Fees

Xoom’s fees depend on how you pay and how the money is delivered. While it offers a free transfer for new customers, charges range from $0 to $45.49, depending on the payment method and delivery choice.

Remitly Transfer Fees

Remitly usually gives new users a free transfer. After that, the typical charge is around $3.99 for transactions under $1,000. Additional fees may apply depending on the selected delivery method or payment options.

Frex Transfer Fees

Frex keeps things simple by charging zero fees for personal transfers from the United States to India. The full transfer amount reaches the recipient’s bank account, without hidden charges or deductions.

Which App Has the Lowest Transfer Fees: Wise, Xoom, Remitly, or Frex?

Frex is the clear winner with its zero-fee model, ensuring the full amount reaches your family back home.

Speed: Wise vs Remitly vs Xoom vs Frex

Wise Transfer Speed

Wise typically delivers transfers within one to two business days when sending money from the United States. Timing depends on the payment method, the destination country, and how quickly the recipient’s bank processes the transfer.

Xoom Transfer Speed

Xoom is known for fast delivery, with most bank transfers and UPI payments processed instantly. Cash pickup times can vary based on the partner network, but most transactions arrive on the same day.

Remitly Transfer Speed

Remitly provides two options: Express and Economy. Express transfers are completed within minutes, while Economy transfers may take three to five business days, depending on the payment method and delivery route.

Frex Transfer Speed

Frex ensures speed as a standard feature. Transfers are completed instantly or within the same day, regardless of how they’re funded. This makes it one of the most efficient ways to send money to India from the USA

Which Is the Fastest Money Transfer App: Wise, Xoom, Remitly, or Frex?

Frex delivers both speed and consistency without additional fees. For users who prioritize fast and predictable delivery, Frex leads the way.

Tax: Xoom vs Remitly vs Wise vs Frex

Wise Tax Fees

Wise does not charge any tax on personal transfers. Funds sent through Wise are treated as standard international transfers, though users should review local tax rules if sending larger amounts or business-related payments.

Xoom Tax Fees

Xoom does not apply any taxes to personal remittances. Most transfers from the United States to India are tax-free, though business payments may be subject to local regulations.

Remitly Tax Fees

Remitly transfers made for personal use are not taxed. However, users should verify requirements if they are sending high-value or business-related transfers to ensure compliance with any applicable limits.

Frex Tax Fees

Frex supports tax-free transfers for personal use and ensures full compliance with both U.S. and Indian remittance laws. Its straightforward process gives senders peace of mind without hidden deductions.

Which Platform Handles Taxes Best: Wise, Xoom, Remitly, or Frex?

All four platforms support tax-free personal transfers, but Frex stands out for its transparent compliance with evolving U.S. and Indian remittance policies, offering users a secure and stress-free experience.

Curious about tax rules for sending money to India? Don’t miss our guide on how to transfer money from the USA to India without tax for smart, stress-free remittances.

Security: Remitly vs Wise vs Xoom vs Frex

Wise Security Compliance

Wise follows strict financial regulations in multiple countries and uses advanced encryption to protect customer data. Identity verification is required for higher-value transfers, ensuring every transaction remains secure and traceable.

Xoom Security Compliance

Xoom operates under PayPal’s security framework, which includes encryption, firewalls, and fraud prevention systems. Its compliance with U.S. financial regulations adds another layer of protection for users sending international transfers.

Remitly Security Compliance

Remitly is licensed in the United States and uses Know Your Customer and Anti-Money Laundering procedures to verify user identity. It continuously monitors transactions to detect and prevent suspicious activity.

Frex Security Compliance

Frex ensures complete protection through 256-bit encryption and verified bank connections. It adheres to global compliance standards, including FinCEN and FIU regulations, creating a safe environment for users transferring larger amounts.

Which Money Transfer App Is Safest: Wise, Xoom, Remitly, or Frex?

Frex combines modern encryption and compliance with next-generation infrastructure, offering stronger protection and peace of mind for every transfer.

Customer Support: Remitly vs Xoom vs Wise vs Frex

Wise Customer Support

Wise offers support through live chat and an online help center. Users can find detailed guidance for common issues such as transfer delays, fee information, or account-related queries directly within the platform.

Xoom Customer Support

Xoom provides multiple support options, including email, phone, and a help center. Its team assists users with questions about transfer tracking, payment issues, and delivery methods, with availability that varies by region.

Remitly Customer Support

Remitly operates 24/7 chat and email support to assist users worldwide. The service helps with account verification, delivery status, and payment concerns, providing quick responses for both new and returning customers.

Frex Customer Support

Frex offers direct in-app assistance with live human support during business hours. Its integrated chat helps users resolve transfer or account-related issues without needing to leave the app, ensuring quick and simple help when needed.

Which App Offers the Best Customer Support: Wise, Xoom, Remitly, or Frex?

Frex stands out for its seamless in-app experience and quick resolution times, making it the best app to send money to India from the USA.

Wise vs Xoom vs Remitly vs Frex: Which App Gives You the Best Value in 2026?

With so many apps claiming better rates or faster delivery for money transfer to India from the USA, the real question is: which one fits your needs best? It all comes down to what matters most: speed, cost, or convenience.

Here’s how each platform performs and when it makes the most sense to use them.

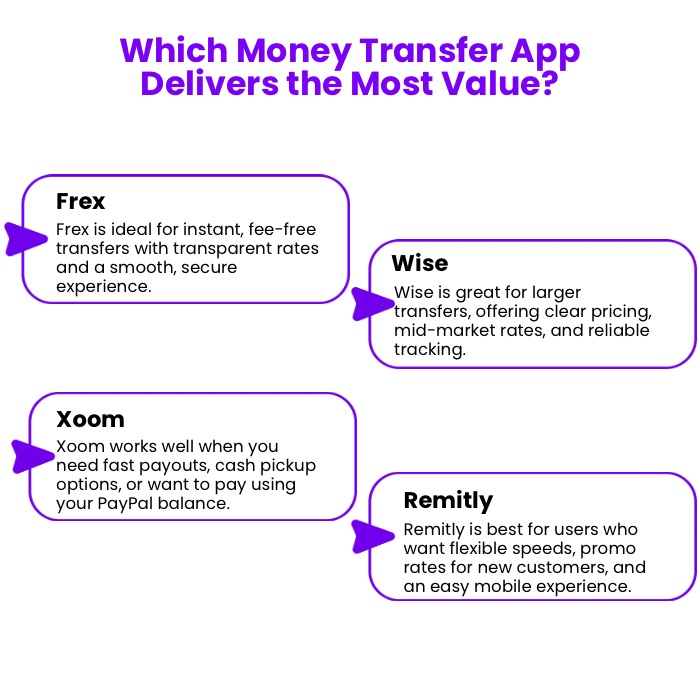

When to Choose Frex?

Frex is ideal if you want the best combination of speed, value, and transparency.

Frex is the right choice when you:

- Want zero fees and instant transfers without restrictions.

- Prefer a transparent experience where every dollar reaches your recipient.

- Need instant delivery with reliable tracking.

- Value ease of use and customer satisfaction.

- Expect secure, high-speed transfers with predictable results.

Download the Frex app on your iPhone today and start sending money confidently.

When to Use Wise?

Wise is best for those who prioritize transparency and fair pricing.

Go with Wise when you:

- Prefer clear and upfront pricing with predictable costs.

- Want to track your transfers in real time.

- Send larger amounts where transparency and accuracy matter.

- Appreciate mid-market exchange rates and simple fee structures.

- Need detailed fee information before confirming your transfer.

When to Pick Xoom?

Xoom remains a solid option if you’re focused on flexible delivery and a wide network of cash pickup locations.

Xoom makes sense if you:

- Need flexible delivery options like bank deposits and cash pickup.

- Rely on your PayPal balance for quick payments.

- Send to recipients who prefer cash pickup locations.

- Prioritizes wide availability across different Indian banks.

- Want fast processing and broad coverage.

When to Opt for Remitly?

Remitly is great for users who want flexible speeds and cost options.

Choose Remitly when you:

- Are a new customer looking for promotional rates on your first transfer.

- Prefer choosing between Express and Economy delivery options.

- Want a trusted global brand for international payments.

- Value a smooth and simple mobile experience.

- Need flexible speed and cost options for each transfer.

In short, Wise offers unmatched transparency, Xoom delivers flexibility, and Remitly provides convenience with variable speeds. But Frex brings it all together: faster delivery, zero fees, and the highest value for every transfer.

Download the Frex app now and experience smarter, fee-free international transfers today.

Conclusion: Make Every Transfer Count

Each app has its own strengths, so the best choice depends on what matters most to you. If you need mid-market rates and transparent pricing, Wise may be the right fit. For flexible delivery options like cash pickup, Xoom could be a better match. Remitly works well if you’re looking for fast transfers and promotional rates. And if you want the highest value with instant delivery and zero fees, Frex brings it all together.

Take a moment to think about your priorities, whether it’s speed, cost, or convenience, and choose the platform that aligns best with your needs.

Frequently Asked Questions

What is the best money transfer service for larger amounts?

For larger transfers, Wise is often preferred because of its transparent mid-market rate and predictable fees. Remitly works well for smaller or promotional transfers.

Remitly or Wise, which is better?

Wise usually works better for consistent long-term transfers due to its clear pricing and accurate rates. Remitly is helpful if you want promotional offers or faster Express delivery. Frex gives a stronger overall value with instant transfers, no fees, and a higher receiving amount for most users.

Is Xoom better than Remitly?

Xoom is great for quick payments and cash pickup options, while Remitly gives more flexible speed choices. Xoom can become costlier because of exchange rate markups. Frex often outperforms both by offering instant delivery, no fees, and strong transparency for everyday senders.

What is the disadvantage of Xoom?

Xoom’s main drawback is its higher total cost due to rate markups and variable fees. This can reduce the final amount received in India. Frex avoids these issues with transparent live rates and zero fees, which helps users keep more of what they send.

Which international money transfer is best?

The best service depends on what you value most, but Frex consistently offers strong rates, instant delivery, and zero fees. It makes sending money simpler for users who want speed and predictable results without worrying about hidden charges or confusing pricing structures.

How does Xoom compare to TransferWise?

In the TransferWise vs Xoom comparison, Xoom is usually faster but often less competitive on exchange rates. Wise offers transparency and real mid-market pricing. Frex combines both speed and value with instant transfers and no fees, making it a stronger everyday choice.

Which service offers the best exchange rates: Wise, Xoom, Remitly, or Frex?

Wise provides the most transparent rate, while Remitly sometimes offers promo-based boosts. Xoom includes a markup that affects the final amount. Frex usually delivers the best practical value with strong live rates and no deductions that reduce what recipients receive.

Which is better for sending money to India: Wise, Xoom, Remitly, or Frex?

Wise offers clarity, Xoom offers speed and cash pickup, and Remitly offers flexible delivery choices. Frex stands out for India transfers because it combines instant delivery, zero fees, and higher real-time rates that improve how much your recipient receives.

How does Xoom handle currency conversion?

Xoom converts funds using its own exchange rate, which includes a small markup. This can affect the final US dollar to Indian rupee Xoom value received. Frex provides a cleaner experience with real-time rates and no added costs for personal transfers.